Consumer lending is the most popular banking product, so banks are trying to present several offers with different terms and conditions in their lineup. In addition to standard conditions, banks are ready to offer preferential conditions for certain categories of borrowers; they differ not only in rates, but also in requirements. One of these categories includes military personnel. Let's consider whether it is possible to get a loan for military personnel under a contract, as well as where and under what conditions.

Lending terms

According to the terms of preferential lending, the identity of the borrower is of paramount importance. That is, if he wants to apply for a consumer loan under the program for military personnel, he must be an employee in the Armed Forces of the Russian Army or the Federal Security Service. By the way, a military pensioner can receive it under these conditions.

Otherwise, the lending conditions do not differ from the standard ones, that is, the potential borrower will need a standard package of documents, including a salary certificate, and work experience, from 6 months to one year, it all depends on the bank’s conditions. In addition, the credit history of the borrower is not the least important.

Please note that military personnel participating in the military mortgage and savings system program can count not only on preferential lending, but also on a mortgage with government support.

Where to get a loan for a military personnel

But, insofar as banks remain a commercial structure, each of them is guided by internal regulations, which means that the essential conditions for preferential lending may vary significantly. Let's consider where it is best to get a loan for contract military personnel, and under what conditions.

Sberbank of Russia

Sberbank is currently the most popular commercial bank among potential borrowers, which in its product line has a specialized offer for the privileged category of the population. There is indeed a consumer loan for military personnel, but only for those who:

- participates in the NIS state program, which is recorded in the unified state register of NIS participants;

- has already obtained or is at the stage of obtaining a mortgage from Sberbank under this program.

In simple words, in order to receive a loan, we will consider its conditions below, you first need to become a member of the NIS; any military serviceman under a contract can do this on his own initiative. Then you need to take out a consumer loan for any needs, including additional payments for the purchased housing.

Loan for military personnel at Sberbank

Now about the conditions. The maximum loan amount is 1 million rubles, if the loan is secured by a guarantee from individuals, and if not secured, then the amount cannot exceed 500 thousand rubles. Loan rates will range from 15.5 and 16.5%, respectively. Maximum term up to 5 years.

Gazprombank

If you have not taken out a mortgage loan under the NIS program, but are taking part in it, then you should contact Gazprombank. There are quite transparent lending conditions here, loan amount from 50 to 500 thousand rubles, rate from 13.25% to 14.5% per year, term up to 36 months. The loan can be issued under the guarantee of individuals or without it, but in the first option the rate will be slightly lower.

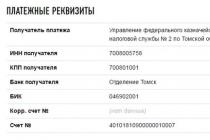

You can submit an application in any convenient way, on the bank’s website or office. The bank will respond no later than 5 business days. After which you need to collect documents and come to the bank in person. Documents will require a passport, income certificate, and confirmation of participation in the NIS.

Bank Zenit

It also provides a consumer lending program for military personnel. But there is no such requirement as participation in the NIS, that is, even a citizen who does not participate in the system can become a borrower. The conditions will be as follows:

- amount from 30 thousand to 3 million rubles;

- rate from 13.5 to 18.5% per year;

- period from 1 to 15 years.

Depending on the loan amount, the borrower may be required to provide a guarantee from individuals. Age requirements from 22 to 45 years old, the upper limit is indicated at the end of the contract.

Please note that in addition to specialized programs, military personnel can obtain loans from banks on general terms.

Consumer loans from other banks

Actually, contract military personnel are one of the most stable and responsible categories of borrower, therefore any commercial bank that does not have a specialized program can issue a consumer loan on general terms. That is, if among the specialized programs you did not find the loan you need according to your parameters, then feel free to contact any other bank.

Loan for military personnel at Gazprombank

In any case, lenders decide to issue loans based on the questionnaire and the documents submitted by the borrowers, which means that military personnel also have the right to take out a consumer loan, for the reason that they are employed citizens with a constant source of income. For example, VTB 24 Bank previously had a lending program for the military, today it does not exist, but the bank still provides loans to this category of borrowers, only on general terms.

So, do they give loans to military personnel? Definitely yes, although most banks still trust NIS participants, although according to this program, public funds can only be used to repay housing loans.

NIS is a savings and mortgage system, the participants of which are active military personnel. They can count on special conditions when applying for both a mortgage and a consumer loan. Read below about how a loan differs for NIS participants and how to apply for it.

Military personnel can obtain not only a mortgage, but also a consumer loan under special conditions.

Features of the loan for NIS participants

Loans are in demand among the military. After all, according to the law, they cannot engage in commercial activities, so their main source of income is wages for service. In this situation, saving up for a significant purchase is very problematic.

For this reason, many banks have developed military lending programs. They attract with reduced rates, but a mandatory requirement is the participation of a military man in the NIS. The borrower can use a consumer loan for any needs, including additional payments or making a down payment on a military mortgage.

But there is a peculiarity: a consumer loan is issued only to those employees who have applied for or have already received housing under the Military Mortgage program. Such loans can be targeted and non-targeted, secured and unsecured. Military personnel who receive their salaries on the card of the creditor bank count on preferential conditions. The advantage of consumer loans for military personnel is that they can be issued for a longer period. So, if a bank issues standard loans for 4-5 years, then a military man can get one for up to 15 years.

What is NIS

NIS is an abbreviated name for the savings and mortgage system. According to the terms of this program, a personal account is opened for each participant. The state transfers a certain amount to it monthly. After 3 years, you can use the money by using it to pay off your military mortgage.

Payments will continue to be added to your account. Thus, it turns out that the loan for real estate is almost completely repaid by the state. However, reviews about military mortgages are contradictory, but this is discussed in detail in another article. Here we will talk about consumer credit.

How to become a member of NIS

The right to participate in the NIS is not granted to all citizens. Can take part:

- Graduates of military educational institutions who received their first officer rank.

- Officers who issued their first contract for military service on January 1, 2005 and were called up from the reserves or on a voluntary basis.

- Midshipmen, as well as warrant officers, whose service period is at least 3 years from January 1, 2005.

- Soldiers, petty officers, sergeants and sailors who entered into a second contract for military service no earlier than January 1, 2005.

To become a participant, a serviceman must submit a report to the commander of the military unit. The document is recorded in the accounting journal. Based on the report, a personal program participant card is created.

Getting a loan

A loan for personal needs in most banks can only be obtained by those who have already begun their participation in the Military Mortgage program. Although there are exceptions. Accordingly, the second loan can be obtained from the same bank. To do this, the borrower must meet the bank's requirements and bring a package of documents.

Requirements for the borrower

Most banks have identical requirements for borrowers:

- The age range for a military personnel is usually 21-45 years.

- Availability of military serviceman status.

- Russian citizenship.

- Residence at the place of permanent residence.

- Work experience at last place of work – at least 6 months. Total experience over the last 5 years – at least 1 year. This clause does not apply to non-working military pensioners.

Required documents

- Passport of a citizen of the Russian Federation.

- Serviceman's ID.

- Certificate from a military unit indicating the borrower's income level.

- Certificate of military service.

- A work record book, according to which the serviceman’s service must be at least 1 year.

After the documents have been collected, you should submit an application form. This can be done both at a bank branch and on the website.

Bank offers

Military personnel can obtain a consumer loan from the same banks that support mortgage lending. Among the largest are Sberbank, Gazprombank, Zenit Bank, Svyaz Bank.

Sberbank

In this bank, military personnel can receive a consumer loan in the amount of 15,000 rubles to 500,000 without a guarantee and up to 1 million rubles with guarantors. The minimum loan amount for Moscow is 45,000 rubles. The loan is issued for a period of 3 months to 5 years, no report on spending purposes is required.

The interest rate is 15.5% if there are guarantors for the loan and 16.5% if there are none. The borrower must be at least 21 years of age. And he must be a member of the NIS and a client of the Military Mortgage.

Gazprombank

A soldier here can get a loan in rubles. In this case, the minimum amount is 50,000 rubles, the limit is 500,000 rubles. A period of up to 3 years is provided for repayment. The interest rate depends on the availability of guarantors and the loan term.

If the loan is issued for a period of up to 1 year, then the rates with and without an order are 13.25% and 14.25%, respectively. If for a period of 2-3 years, then 13.5% and 14.5%. If a serviceman receives a salary on a card from another bank, the annual rate increases by another 0.5%. The borrower must fall within the age range of 25-45 years, have Russian citizenship, be registered or permanently reside in Russia.

Zenith Bank

The loan here can be issued for a period of up to 7 years. The minimum amount is 30,000 rubles, the maximum is 1 million rubles. The annual interest rate is 13.5% if you have personal insurance. If the borrower refuses insurance, the rate increases by 0.5%. The age limit for the borrower is 22-65 years. Even a military personnel who has not taken out a mortgage can get a loan here.

In this article we will look at how to get a loan for a military personnel. We will find out what documents are needed to apply for a consumer loan and what requirements the borrower must meet. We have prepared for you the procedure for submitting an online application and collected reviews about banks.

TOP 5 banks providing loans to military personnel

This table provides a list of banks with offers where you can get a military loan.

In some banks, military personnel can only take out, and in others - only. All the banks presented are commercial organizations, so they differ significantly, but in general they are much better than loans on general terms.

Loan to military personnel at Sberbank

Sberbank has introduced a special consumer loan program for military personnel. It can only be used by participants of the NIS (savings-mortgage system), i.e. those who have already taken out or are receiving a mortgage loan in the context of the Military Mortgage program.

The maximum amount is RUB 500,000. without security and 1,000,000 rub. with loan collateral. Money can be taken for various purposes, including as an additional payment for the purchase of real estate. There is no loan fee.

Loan to military personnel at VTB

They do not issue consumer loans here. Military personnel under contract can obtain a mortgage loan on preferential terms if they are members of the NIS.

They do not issue consumer loans here. Military personnel under contract can obtain a mortgage loan on preferential terms if they are members of the NIS.

You can calculate your mortgage using an online calculator on the bank’s website. The loan term is up to 20 years, but no later than the borrower reaching the age of 45 on the date of final repayment of the loan. The client must make a down payment of 15% of the cost of the purchased property.

At Gazprombank

In this institution, military personnel who are included in the NIS list can take out a consumer loan. Its validity period is relatively short, as is the maximum loan amount. The minimum rate is 13.4%. It may increase by 0.5% for borrowers who do not have bank accounts, including salary accounts.

In this institution, military personnel who are included in the NIS list can take out a consumer loan. Its validity period is relatively short, as is the maximum loan amount. The minimum rate is 13.4%. It may increase by 0.5% for borrowers who do not have bank accounts, including salary accounts.

At Zenit Bank

Clients are offered a military mortgage on favorable terms if they have a NIS participant certificate, which is valid for at least three years. The loan can be obtained for the purchase of an apartment in objects accredited by the bank. There are more than a hundred of them, and they are designed for any budget.

Clients are offered a military mortgage on favorable terms if they have a NIS participant certificate, which is valid for at least three years. The loan can be obtained for the purchase of an apartment in objects accredited by the bank. There are more than a hundred of them, and they are designed for any budget.

Down payment - from 20% of the property value. The loan amount is up to 2.5 million rubles, with the possibility of increasing to 3 million within the framework of the Mortgage+ service. You can repay the loan ahead of schedule, without additional fees or moratoriums, at any convenient time.

In Svyaz-Bank

The bank offers military personnel a non-targeted loan. There is no collateral or commission for issuing a loan, as well as mandatory insurance for the borrower. It is possible to increase the loan amount by attracting a second borrower.

The bank offers military personnel a non-targeted loan. There is no collateral or commission for issuing a loan, as well as mandatory insurance for the borrower. It is possible to increase the loan amount by attracting a second borrower.

How to get a loan for a military personnel?

An application for a consumer or mortgage loan can be submitted in two ways: on the bank’s website or at the office of a financial institution.

In the first case, you need to fill out an application on the service of the selected organization. In the form, indicate the amount and period of use of the money, full name, date of birth, passport information, contact information, social status, monthly income and other data.

Submit your application for review and wait for a call from a bank representative to clarify some questions. After this, you need to visit a branch of a financial institution with a package of documents. A decision on the loan will be made on the spot. If it is approved, then you sign the contract and receive the money in a convenient way.

In the second case, you immediately need to contact the bank, where you need to fill out an application and provide the necessary documents to receive a trouble-free loan. If the application is approved, you will receive the amount after signing the relevant agreement.

Requirements for borrowers

The requirements for military personnel in most banks are approximately the same:

- Age - from 21 to 65 years.

- Military status.

- Citizenship of the Russian Federation.

- Permanent residence in one of the regions of the country.

- Positive

Required documents

The list of required documents depends on the requirements of the bank and the type of loan program you have chosen. Most banks typically require:

- Civil passport with registration in the region where the loan was issued.

- Military ID.

- SNILS or INN to choose from.

- A certificate from the military unit, which confirms the completion of service (it also displays the income of the potential borrower).

- A work record with at least 1 year of work experience.

Additionally, participation in the state NIS program is required, about which a corresponding entry must be made in the register of its participants.

Many banks create special programs for military personnel. In addition to mortgages, military personnel can receive cash in cash for any purpose on individual terms. But loans for the military have their own design features.

Features of obtaining a consumer loan

Loans for military personnel have certain nuances:

- the main requirement of banks is the participation of the military in the NIS (savings-based mortgage system), even when applying for a consumer loan;

- the maximum borrower age has been reduced to 45 years (the age at which most military personnel retire);

- For military pensioners, there is a separate requirement - employment at the time of registration with a small pension amount.

Some banks provide loans to military personnel on the condition that they already have a mortgage. This is what Sberbank does. It issues money only to those who have a mortgage issued under the NIS program.

Few banks are willing to provide loans to contract military personnel and officers. This is due to the fact that it is difficult for a financial organization to obtain complete information about the employer. Phone numbers and addresses of military units are not available to everyone.

Many contract soldiers serve in different cities, which makes it difficult to collect debt in case of delay. For this reason, getting a loan is sometimes quite difficult.

Where can a contract serviceman get a loan?

To get a profitable loan, military personnel should follow some recommendations:

- Maintain payment discipline and repay loans on time to build a positive credit history. You should not assume that defenders of the Motherland will receive “discounts” if they have a negative financial reputation.

- Involve guarantors to increase the chances of approval of the application if the loan amount exceeds 500,000 rubles.

- Provide documents confirming the ownership of property.

Let's consider several offers from banks where contract employees and military unit employees can take out a loan:

In most banks, loans for military personnel are available only for the purchase of housing. For example, VTB does not issue money in cash, but you can get a mortgage.

You can also try to get a loan under the classic consumer lending program. The interest rate will be higher than for special programs, but if you need money urgently, then this is a suitable option.

A loan for military personnel is a topical topic of our time that is of interest to many citizens in military service. The most popular financial product is still the NIS mortgage. But credit organizations offer military personnel other loans on favorable terms. We will consider which ones later in our article.

Where is it possible to get a mortgage for a military man?

A military person can take out a mortgage loan from any banking organization (among the largest) in Russia. NIS allows military personnel to receive funds from the state to purchase housing. Those taking part in the program open a savings account. Every year, contributions are credited to it, which are the cumulative part of the targeted housing loan.

The size of these payments will be approximately 270,000 rubles per citizen. The military will be able to use this money to purchase residential premises only 3 years after the account is opened. The missing part of the amount is paid by the military themselves.

There are several mortgage programs for the military

If a person decides to leave the service, he will have to service the loan entirely himself.

The banking organization also has the right to send a demand for early repayment of the mortgage debt. The rates on the loans in question for military personnel are usually lower than the average rate on AHML (about 13% per annum in January).

Consumer loan and debit card product on preferential terms

Some credit institutions allow military personnel to take out consumer loans, as well as debit card products on preferential terms. These offers, although not represented in large numbers, are still present in the banking industry.

The problem is that almost all financial institutions do not consider military clients as a separate (special) category. As a rule, the conditions for such citizens are identical to those of other public sector employees.

Features of providing a preferential loan per million

Banking organizations that provide consumer loans to military personnel on preferential terms are:

- Sberbank.

- VTB 24.

- Rosselkhozbank.

If we talk about Sberbank, it allows you to issue such a loan for a period of three to 60 months. The maximum loan amount is 1,000,000 rubles.

But, in order to receive more than half a million rubles, the borrower will be forced to attract guarantors - financially wealthy citizens. Interest on the loan is 15.5% per annum in rubles (if there is collateral) and 16.5% per annum in rubles (if there is no collateral).

Mortgage from Sberbank

Important point: obtaining a loan on these terms is possible exclusively for military personnel - participants in the “military mortgage” program. According to representatives of Sberbank, the term of such a loan is up to 20 years, the maximum amount is 2,000,000 rubles. The down payment must be 20% or more of the price of the residential premises.

It is worth remembering that a banking organization that issues two loans to one citizen at the same time does not particularly risk anything, because the Russian Federation will repay the housing loan, and not the serviceman himself. As a rule, a loan to military personnel under a contract from Sberbank is issued for an additional payment for the purchased residential premises (or for repair work - when purchasing an apartment without finishing work).

Loans to military personnel on preferential terms

Banking organization VTB24 also provides special loan products for military personnel– but exclusively within the framework of salary projects. These are special offers on car loans, issuance of corresponding cards and cash loans. Clients can focus on the following indicators:

- standard rates – 16.5% per annum (loans from 400,000 to 3,000,000);

- 18-25% - if the loan amount is from 100,000 to 399,000 rubles.

Rosselkhozbank's proposal is as follows: loan in the amount of up to 2,000,000 rubles, rate 13% per annum. That is, the rate is 1.5-2% lower than for ordinary clients of a banking organization.

A standard loan (if there is no collateral) is up to 750,000 rubles, the time period is 5 years, the client of a banking institution has the opportunity to take it at a rate of about 20% per annum. If the loan has collateral, the amount increases to 1,000,000 rubles. The time period is the same, the rate is 15.5%.

With the help of a special program you can become the owner of your home

What other banks offer preferential loans to military personnel?

The banking organization Zenit also offers loans for military personnel.. With its help, it is possible to obtain a loan ranging from 30,000 to 3,000,000 rubles. The time period is from one year to 15 years, the interest rate is from 13.6 to 18.6 percent per annum. When compared with a standard loan from this financial institution, the picture looks like this: the rate is 13.6–20.6 percent.

This program can be used by Russian citizens who are in military or similar contract service in a variety of government organizations.

Svyaz-Bank also offers an identical service.. The latter began issuing various loans to the military since 2016. The program can be used by both NIS participants and ordinary military personnel serving under a contract (the only exception is “conscripts”), whose age ranges from 21 to 65 years.

The requirements are as follows:

- loan term – up to 7 years;

- you can take up to 3,000,000 rubles;

- rate 15% per annum.

There is no need to bring guarantors.

Features of using the “Russian Army” card

These card products are issued by Gazprombank and VTB24. But they can be issued only if the military man is a user of the services of a financial organization as part of a salary project.

Gazprombank and Voentorg JSC are releasing a card product “Russian Army”. It has three varieties (it all depends on which payment system) - Visa, MasterCard and Mir. This card can be issued to both military personnel and civilian personnel of the Armed Forces.

Special offers for military personnel also apply to other types of loans

Tariff plans for servicing this card product are, in general, identical to other cards of the banking organization. The main nuance of the card in question is the following - promotions and monthly cashback when purchasing products in stores controlled by Voentorg. You can use this service after registering the card owner in a special program. A link to it is provided by the portal of the financial institution Gazprombank.

The military has the opportunity to take advantage of other favorable conditions for various loans (without involving banking organizations). Any financial institution will consider a military man an ideal client, since he has a stable income (high salary). That is, by considering the application of such a person, the bank can make him the most advantageous offer (compared to offers for other clients).

Despite this, experts recommend paying attention not only to the largest banking organizations - small local participants in the lending market often also have good offers. This point is especially relevant given the high mobility of military personnel, who often have to move from place to place while performing their official duties.

How to avoid mistakes when opening an account

Before taking out a loan or card product from a specific banking organization, be sure to review its entire line of products to select the most optimal and favorable conditions for your situation.

Credit organizations treat military citizens with sympathy: they have a stable salary, and in the future they will have a solid pension. The most useful financial instrument for the military is a deposit, as it helps to protect existing funds. When choosing a deposit, be sure to take into account a variety of factors. The banking organization must have a solid reputation (for example, be in the top 10 in the country), and the profit rate should not raise doubts or concerns. Thus, today we told you what a preferential loan for the military could be.