Clients evaluate the quality of banks according to several parameters, one of which is the convenience of withdrawing funds. OTP Bank has 1,400 own branches and about 4 thousand ATM devices (ATMs), due to which cash withdrawals from OTP Bank should not, in principle, cause the slightest difficulty at any time of the day or night. Also, partnership agreements allow cardholders of this bank to be served at preferential rates at ATMs of other financial institutions without additional commission.

Withdrawal of funds through the cashier

A huge number of clients who receive wages to a bank account or card, as well as those who use Internet services and OTP Bank "plastic" for settlements, payment for goods and services, are interested in the issue of cashing out money without additional costs. No less such questions are of interest to Russians who have.

It is clear that not every client can afford to receive their own hard-earned money even with a minimum commission. Today, most banks include in the tariff packages the service of interest-free debiting from accounts when issuing money. For customers who do not want or cannot master the technique of working with an ATM, there is a simple alternative way - withdrawing cash from an OTP Bank card directly at the cash desk.

To do this, you just need to go to the nearest branch with a passport and a card, where there is an operating cash desk. In it, a lot of services are available to the client, including the withdrawal of cash. Bank employees will quickly issue and organize the issuance of the amount of cash requested by the client.

In addition, each of these branches has ATM devices that allow you to withdraw cash from OTP Bank without commission. In many branches there are also special self-service zones, round-the-clock access to which is provided to customers with an OTP Bank plastic card.

Withdrawal of funds via ATM

You can cash out funds stored on a plastic card at any OTP Bank ATM. The procedure is the most common and is no different from receiving money in any other bank, only the commission for cash withdrawal in OTP is not taken at all. It is not even provided for the removal of credit funds: money can be received both from debit and from.

Until 2020, the bank was part of the United Settlement System (ORS), which includes financial institutions with a total number of ATMs of about 45,000. The ODR ceased to operate, but the contractual ties between the partners remained. In addition, the National Payment Card System (NSPK) includes more than 100 partners of OTP Bank.

According to the agreements, banks serve clients of partners on the same terms as their own. In other words, there is no commission at most ATMs either. But for withdrawing cash from an OTP account at other ATMs, a commission may be charged. This is 1% (minimum 100 rubles) when withdrawing your own and 3.9% (minimum 350 rubles) when withdrawing credit resources.

As noted on the official website, since April last year, the “All at once” card has been offered for regular and reliable customers, which guarantees cash withdrawal without commission at any ATM. This applies, however, only to their own funds.

And recently OTP Bank has released a new product - "Clear Credit Card". Such a payment instrument makes it possible to carry out absolutely free cash withdrawals from an OTP bank credit card in any ATM. It is worth noting that even repaying a loan through partner ATMs is free of commission here.

Transfers through QIWI and Yandex.Money wallets

Internet banking has made it much easier for customers to communicate with the bank. Funds from OTP Bank accounts and cards can now be withdrawn through electronic wallets, including QIWI and Yandex.Money without commission. In this regard, it is very useful to ask what OTP Smart is and how it works.

To top up your e-wallet you need:

- In the payment for services section, indicate the type of payment - "Electronic money", and in the "Provider" field, select the required one.

- Then fill in all the fields and click the "Run" button.

The money will be transferred quickly. In any case, through QIWI this transaction is carried out almost instantly.

Relatively recently, a commission percentage was introduced for cash withdrawals at OTP, if the funds were credited to the account in a non-cash way. That is, if the funds came to the account from electronic wallets, then the bank will take the 0.5% due to it when it comes time to withdraw the money. At the same time, the commission for standard incoming transfers to the current account has been canceled.

OTP Smart: Video

Most clients who receive wages to a bank account or simply replenish the card periodically to pay for certain services are interested in the issue of withdrawing money without paying additional charges.

After all, not everyone wants to pay extra for receiving their own money.

Therefore, most banks have long changed their policy towards their customers and most of the tariff packages include the service of interest-free withdrawal of money from debit cards.

Withdrawing money through the operating cash desk

For customers who cannot cope with the development of an ATM, there is an excellent option where you can withdraw money from an OTP bank card without a commission - contact the nearest bank branch.

Each of the branches has an operating cash desk, where the client can make a payment using the specified details, withdraw or deposit money into the account, or pay for various services.

It is enough to have only a card and a passport with you for identification.

Also, in each of the branches there are ATMs that customers can use if there are queues at the cash desk.

For the convenience of customers, some branches have special self-service areas that are available even after the bank closes. Access to them is carried out using a plastic card of the client of OTP Bank.

Withdrawal of funds through an OTP ATM

You can cash out money from a plastic card at any of the ATMs of OTP Bank without commission.

Due to its wide customer service area, their number is growing every day and you can get your money at any convenient time in almost any city in Russia.

A large number of ATMs allows you to reduce the queue at the operating cash desk of a bank branch, because people try to look for the nearest ATMs and cash out their money there.

Most ATMs do not have additional fees for withdrawing their money, but it may be charged in cases where credit funds are withdrawn.

In this case, the standard withdrawal interest rate is charged (may vary depending on the tariff plan), which is 3.9% of the withdrawal amount. But at the same time, you will have to pay at least 350 rubles of commission for each operation.

Location of ATMs

To make it convenient for customers to search for ATMs, a special service has been created that will show all terminals, ATMs and branches of OTP Bank on an up-to-date map of the city.

To use it, you will need to go to the official website of the bank and select the "ATMs and branches" section from the main menu. But before that, it is very important that the site correctly determines your location. The city that was automatically determined by the site will be displayed next to the button.

For some reason, it does not always match the real one, and if this happens, then just click on the name of the city and select the one in which you are located from the list.

After that, click on the button and an up-to-date map of the city will open with marked ATMs, branches and self-service terminals.

The service also has a special indicator that will show the current workload of the branches. This helps many customers evaluate their time and know exactly whether to contact the bank at the moment.

Can I withdraw money from other ATMs?

Yes, you can cash out your funds through other ATMs, only in this case the client will be charged an additional fee for using the services of a third-party bank. But to solve this problem, banks enter into partnership agreements with each other.

According to such documents, the bank must serve the client of the partner bank on the same terms as its client.

We can say that you can cash out money from your plastic card at a partner's ATM under the same conditions as when using a standard OTP ATM.

Since OTP has joined the United Settlement System, you can withdraw money without paying additional interest at any ATM that is marked with a special sign indicating that the ATM belongs to this group.

Usually they are located in large shopping centers, airports, hotels and other similar places.

But even in addition to cooperation within the United Settlement System, OTP Bank has signed partnership agreements with such banks as Avangard and Uniastrum. The current list of ATMs of OTP Bank partners without commission can be found on the official website or from a consultant at a bank branch.

It is worth noting that you can even repay credit obligations through partner ATMs without additional fees.

This can be done either by transferring from another card, or simply by depositing cash. Only in this case, the ATM must be equipped with bill acceptors.

Check out the offers of banks

| Card with cashback in Rosbank | Issue a card |

More about the map

- Cashback up to 7% - for selected categories;

- Cashback 1% - for all purchases;

- Bonuses, discounts on goods and services from VISA;;

- Internet banking - free of charge;

- Mobile banking - free of charge;

- Up to 4 different currencies on 1 card.

| Card from Unicredit Bank | Issue a card |

More about the map

- Up to 5% cashback;

- Cash withdrawal without commission at partner ATMs;

- Internet banking - free of charge;

- Mobile banking is free.

| Card from Vostochny Bank | Issue a card |

More about the map

- Up to 7% cashback;

- Cash withdrawal without commission at partner ATMs;

- Card service - free of charge;

- Internet banking - free of charge;

- Mobile banking is free.

| Card from Home Credit Bank | Issue a card |

More about the map

- Up to 10% cashback from partners;

- Up to 7% per annum on the account balance;

- Withdrawing funds from ATMs without commission (up to 5 times a month);

- Apple Pay, Google Pay and Samsung Pay technology;

- Free internet banking;

- Free mobile banking.

| Debit card from Alfa Bank |

More and more goods and services can be paid for by bank transfer. However, cash still has not lost its relevance. They may be needed at any time. In this case, you can withdraw money from a plastic card: debit or credit. Let's find out how to cash out funds from an OTP bank card without a commission.

To withdraw cash, you must:

- Have money on the “plastic” account (for a credit card - have a limit);

- Use the services of OTP Bank or its partner (including the use of ATMs).

When withdrawing cash from an OTP credit card, no commission is charged either. However, after that, the grace period ends, if it was still in effect. Additionally, an increased rate is set on borrowed funds. Its value is indicated in the agreement that was concluded with the bank during the execution of the "plastic". Thus, the interest rate may increase from 24% (personal) or 29.9% (standard) to 39.9%. Therefore, it is unprofitable to withdraw cash from a credit card.

Where can I withdraw funds

Ways to withdraw money without commission:

- At the cash desk or at an OTP ATM;

- At an ATM of a partner bank.

It is not possible to cash out funds at the cash desks of partner banks. This can only be done at their ATMs.

Restrictions and limits

Banking organizations set certain restrictions on cash withdrawals. Their size depends on the type of card. In the table below, we will consider the limits set for various OTP plastic cards.

The "Instant" card is also issued in foreign currencies: in US dollars and euros. You can withdraw up to $1,500 and €1,300 from plastic per day, and up to $8,500 and €6,500 per month.

What difficulties may arise

Holders of OTP credit cards who withdraw cash from them often face the following problem: an increased interest rate is imposed on borrowed funds. Unlike credit cards issued by other financial institutions, there is no commission for withdrawing cash from an OTP card. But the interest on the loan increases to 39.9% per annum.

Other banks usually charge a commission of up to 4.9% of the amount (but not less than a certain value), but the annual rate remains the same. This suggests that when withdrawing large amounts, it is more profitable to use the products of other banks, since they will charge a lower percentage. If you withdraw small amounts, then a credit card from an OTP bank is more profitable, since when withdrawing 1000 rubles. do not have to pay a commission of 300-400 rubles. And if you deposit money into the account after 1 month, you will have to overpay no more than 33-35 rubles.

Debit card holders sometimes face the fact that ATMs of partner banks do not want to give them money without a commission. But this partnership is only extended to credit cards. Therefore, when withdrawing cash from a debit "plastic" at an ATM of a third-party bank, you will have to pay the commission established by it. The way out is to withdraw funds only at OTP cash desks or ATMs, but they are not available in every city.

Partner banks

To cash out finances without paying a commission fee, use ATMs of partner banks. These include:

- Sberbank;

- Raiffeisenbank;

- Vanguard;

- Alfa Bank.

You can withdraw cash from ATMs of partner banks not only in Russia, but also abroad. So you can go on vacation and shop with your card, and if necessary, cash out without any overpayments.

Did you know that you can use credit funds without paying interest? Below we describe in detail how this can be done.

Activate the card for free now, even if you don't need a loan. While you do not use the card, you do not pay anything - no commissions, no interest. But when you need money, you can get it at any time!

GET TO KNOW THE MAP

How and why to activate the card?

For security reasons, your card has not yet been activated - you cannot make purchases with it. Call 8-800-200-70-02 (the call within Russia is free) and follow the operator's instructions - your credit card will be activated, after which you will be prompted to create a PIN code. Card activation is free - no interest is charged and no commissions are charged if you do not use credit funds.

8-800-200-70-02

free card activation

How to get a PIN code?

Immediately after activating the card by phone, stay on the line, you will be asked to come up with your own PIN code or create it automatically. The PIN code is needed to confirm some card transactions, such as cash withdrawals from ATMs. You can also get a PIN later by calling 8-800-200-70-01 (toll-free within Russia).

8-800-200-70-01

free PIN creation

What information is on the map?

- Card number

- Card expiry date. You can pay with the card until the end of its validity period (until the last day of the month and year indicated on it). Upon expiration, the card may be reissued.

- Name and surname of the cardholder

- Payment system logo

- Magnetic strip. Protect from damage and demagnetization!

- Place for the cardholder's signature. Put your signature here - the card is invalid without it!

- CVC-code (CVV-code) - a three-digit payment confirmation code. It is used as a security element when paying via the Internet, by mail or by phone.

How to pay by card in a store or online?

When paying by card, no commission is taken from the buyer - exactly the amount of the check is debited from the card. Cards of payment systems VISA and MasterCard are accepted for payment all over the world. It is more profitable to pay by card, rather than withdrawing cash - the interest on the loan will be lower. And for non-cash purchases there is a grace period of up to 55 days, when interest on the loan is not charged.

Payment by card in a store, hotel, gas station, etc.

You will need to give the card to the cashier or swipe it yourself through the payment terminal. The terminal may request a PIN code. It will take less than a minute, and you will not need to count the required amount and wait for change!

Payment by card in a cafe or restaurant

If the cafe accepts cards, then after receiving the bill, you simply give the card to the waiter, and he performs the operation. It may also need to be verified with a PIN.

Payment by card on the Internet

In a special form of payment on the site where you buy the goods, you need to enter the card details:

The amount that will be indicated by the site will be debited. Be careful when paying by card via the Internet!

How to withdraw cash?

You can withdraw cash in two ways:

- At any ATM (in Russia and abroad), where you will see the VISA or MasterCard logo. To withdraw cash from an ATM, you must enter a PIN code.

- At the cash desks of banks. You will need to have your card and passport with you.

When withdrawing cash, a commission is charged - see its amount in the tariffs of OTP Bank for servicing individuals. Also, a third-party bank, for example, abroad, can also charge a commission when withdrawing funds. You should also ask about this in advance at the bank where you plan to withdraw money.

The grace period does not apply to cash withdrawals.

How to find out the amount of the debt, the date of the minimum payment and the end of the grace period? How to view card transactions?

Our internet bank, mobile bank and SMS bank are at your service. You can read more about them in the Online Services section.

Internet bank "OTPdirect" |

|

Mobile bank "OTPdirect" |

|

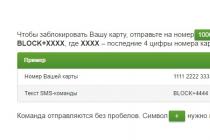

SMS-bank |

|

Bank Help Desk |

|

Monthly invoice |

|

Branch of OTP Bank |

IMPORTANT INFORMATION

What is a credit limit? What is my limit?

The credit limit is the maximum amount that the bank can lend to you. You pay by card and make purchases using your credit limit. As the money spent and accrued interest are returned to the bank, your credit limit is restored, and you can spend the funds again.

You can find out your credit limit, how much of it you have spent and how much now, in the Internet bank, in the OTPdirect mobile application or by calling the free help desk number: 8-800-200-70-01.

pdf Credit card termsWhat is the percentage for cash withdrawals and non-cash transactions? How is it considered?

The main purpose of a credit card is cashless payment for purchases and services. That is, it is a payment for goods and services with a credit card, and not with cash. However, you can withdraw funds from your credit card at ATMs of any banks that accept VISA/MasterCard cards. Remember that the interest on a loan when withdrawing cash from a card is usually higher than the interest charged on non-cash payments. In addition, a fee may be charged when withdrawing funds from the card.

An important nuance: when you pay with a credit card, you can use the grace period for 55 days and not pay interest to the bank, and the grace period does not apply to cash withdrawals.

You can find the amount of accrued interest and fees charged in the tariffs for your card, as well as in the tariffs of OTP Bank for servicing individuals.

What is a grace period for loans?

OTP Bank credit cards have a grace period of up to 55 days. If you repay the debt before the end of the grace period, then the bank will not charge interest on the loan for purchases paid by the card. To take advantage of the grace period, follow a simple scheme:

- Make cashless purchases with a card

- Get an invoice or go to "OTPdirect"

- Pay the entire amount that is indicated in the "Grace period of credit" section before the date indicated there

- Don't pay interest on loans!

The grace period is valid only for non-cash purchases, i.e. paid by card in shops, restaurants, etc. The grace period does not apply to other transactions, including cash withdrawals.

What is the minimum payment?

The monthly minimum payment is the minimum amount that must be paid to repay a loan if you have credit card debt. You can repay the loan by making minimum payments or a large amount at your discretion. The amount of payment in rubles changes every month depending on the amount of the total debt. How the minimum payment is calculated is specified in your rates. You can choose to use the grace period or pay off the debt in installments.

REPAYMENT OF THE LOAN

How and how much to pay?

If you have not used the card yet (i.e. you have no debt), then you will not have any obligations to the bank. Commissions for using the card, SMS-informing are not charged.

If you have already used credit funds, then you will need to repay the debt in a timely manner:

- make payments not less than the minimum. The exact amount of the payment will be indicated on the invoice every month.

- the money must be in your account no later than the date set by the statement.

If you have any questions about the repayment procedure, call the help desk and the bank employees will tell you everything in detail.

OTP Bank occupies a leading position in Russia. This is due to a loyal policy and profitable banking products designed for legal entities and individuals. The OTP plastic card, which opens up wide opportunities for the owner, is popular. In particular, you can withdraw money without commission not only at OTP ATMs, but also at the machines of partner banks. With which organizations the ULP is "friends" and what are the features of cooperation, we will figure it out in this article.

Essence of partnership

In the process of carrying out their activities, banks acquire partners. The benefit of "friendly" relations lies in the fact that the organization significantly saves its own and client funds. She does not need to buy equipment, set up software and carry out collection of ATMs. It is enough to sign an agreement with another bank, and customers will be able to withdraw funds at third-party ATMs with a commission of 0%. "Friendship" is beneficial for the partner. He is expanding his customer base and profiting from the transactions that go through his equipment.

There are other types of partnerships as well. One of its popular forms is to reduce the cost of interbank card-to-card transfers. For clients making such transactions, a loyal tariff is introduced. A credit partnership is possible. It manifests itself in the fact that the agent recommends his partner to clients and invites them to arrange other types of loans in it. For example, mortgage or automobile.

OTP conducts partnership only at the level of withdrawals without commission.

Partner banks

Until 2016, OTP was part of the URS (United Settlement System). After its collapse, the bank continued to maintain partnerships with other ORS organizations. Together they joined the new NSPK payment system. Today it consists of more than 100 organizations.

| Name | Peculiarities |

|---|---|

| Sberbank | It is the largest bank in Russia. It also has branches in Central and Eastern Europe. The organization is controlled by the Central Bank of Russia, which owns more than 50% of the shares. Sberbank offers customers a wide range of products designed for different income levels and for all categories of citizens. |

| Alfa Bank | The organization is private. According to Forbes, it ranks 7th in the reliability rating among all banks in the Russian Federation. The main office is located in Moscow, but there are branches in many CIS countries. |

| Vanguard | It is a universal commercial bank. It is aimed not only at frequent customers, but also at corporate ones. Avangard serves more than 1 million customers and offers, in addition to standard products, services that are unique on the Russian market. |

| VTB | VTB is a commercial bank, in whose management the state takes an active part. He owns over 60% of the shares. The organization has a wide network of subsidiaries that are part of the VTB Group. |

| Raiffeisenbank | It was founded in 1996. Provides a wide range of services to the public. Also serves corporate clients. It has 52 branches and 1 representative office. |

Withdrawals from ATMs

You can find the location of the partner bank on the official website of OTP. To do this, follow the instructions:

- Open the "Branches and ATMs" section.

- Enter the desired address in the field.

- Click the "Find" button.

The site will offer a list of suitable options and mark it on the map so that it is easy for the client to reach their destination.

While in another country, you can withdraw cash from partner ATMs. They operate on the territory of the CIS countries and Europe.

Instruction

To withdraw funds, a plastic card must be inserted into the reader. Next you need to follow the instructions:

- Enter a unique password.

- Select the Cash Out option.

- Enter the amount.

The machine will dispense money. Don't forget to take your check. It contains information about the transaction. Including the amount of the commission. In partner ATMs it is 0%.

Cash withdrawal

It is not possible to cash out funds through the cash desk of another bank. Organizations serve exclusively their customers. Therefore, to conduct a transaction, you will have to contact OTP Bank. You must have a Russian passport with you. If the amount is large, then it must be ordered in advance. They will be at the checkout the next day.

Banking partnerships are beneficial for everyone. The bank does not spend funds, the partner expands the client network, and the clients themselves have the opportunity to quickly and profitably withdraw money.