Social mortgage For low-income families, as one of the types of government support, is designed to help citizens with low incomes acquire decent housing. As such banking product There is no funding to finance the purchase of an apartment for this category of people. However, a low-income family can take part in one of the real estate acquisition programs on preferential terms.

In a broad sense, social mortgage is Housing loan, issued in banking organization on preferential terms and under a guarantee from the state. In this case we're talking about on cooperation between the direct borrower in the form of a low-income family, the state and a financial institution.

But it should be understood that there is no specific banking product for this category of families. In this case, we are talking about several projects, within the framework of one of which citizens with a small income can take advantage of support from the state and receive a loan on the most favorable terms for them.

In particular, 3 options for assistance are offered:

- issuance of a certain amount of funds aimed at repaying part of mortgage loan;

- payment of interest on housing loan from the country’s budget within a specified time period;

- obtaining a loan on preferential terms, in particular, at a reduced interest rate.

The resolution of many issues regarding the social mortgage program falls on the shoulders of regional authorities. This applies to both the selection of a project for its implementation in a specific locality, and the conditions for its implementation.

According to Federal Law No. 178-FZ, families and citizens recognized as low-income have the right to all kinds of state support. Such a family is understood as a unit of society, the level of income and profit of which in total does not exceed or equal to the level living wage, installed in the region of residence.

According to Federal Law No. 178-FZ, families and citizens recognized as low-income have the right to all kinds of state support. Such a family is understood as a unit of society, the level of income and profit of which in total does not exceed or equal to the level living wage, installed in the region of residence.

For 2020, the average value fluctuates around 10 thousand rubles. The fact that with such earnings it will not be possible to get a loan is beyond doubt.

Because the conclusion mortgage agreement on favorable terms for low-income families occurs with the participation of funds state budget, candidates are required to meet a number of criteria. A series of checks on the accuracy of the information provided will likely follow. The entire procedure should be as transparent as possible in order to avoid fraudulent activities on the part of those wishing to take out a mortgage.

First of all, you will need to obtain the status of “low-income family”. This must be confirmed and documented.

The procedure involves calculating official income, including any social benefits, scholarships, and pensions. The result obtained is divided by the number of family members, as well as disabled citizens and children in the family. If the final amount is below the subsistence level, the family is recognized as in need of social support from the state.

Another factor that receives attention is heavy housing situation. If own apartment not at all, or the area of real estate per person is less than the established norm, then the need for urgent improvement of living conditions is verified. This point should also be documented, for which you need to contact the city’s land department and get in line to receive a subsidy.

Social credit programs

As already mentioned, there is no banking product aimed at mortgage lending to the poor. However, there are a number of programs under which a needy family can receive not only subsidized assistance, but also more favorable loan conditions.

The best options are:

- Project for obtaining a targeted loan for a young family. The main condition is the age of the applicants - no older than 35 years. The benefit in this case is expressed in the provision of a subsidy to pay part of the mortgage. 35% of the cost of housing if there are no children and 40% if there are any. The minimum interest rate is 8.6%.

- Providing housing for citizens standing in line. In this case, the family receives a subsidy to pay part of the loan, or is given a mortgage on real estate sold by the local municipality. The program only works in those regions where they have their own housing stock.

Upon registration targeted loan It is not prohibited to use maternal capital funds if the family has the right to a certificate. As well as other required subsidies and benefits.

Where to contact

Mortgage registration takes place in banks that are participants in these programs. The most popular are Sberbank, as well as AHML (Agency for Housing Mortgage Lending).

Mortgage registration takes place in banks that are participants in these programs. The most popular are Sberbank, as well as AHML (Agency for Housing Mortgage Lending).

Thus, AHML offers:

- rate - 9.9%;

- down payment - 10% of the cost of the home;

- the amount of subsidy from the state is 20%.

For comparison, at Sberbank the interest rate can reach 11.75%. It all depends on the chosen program.

It is important to remember that each region develops its own conditions for designated projects. You can clarify points of interest by contacting the local administration directly.

Features of preferential mortgages

Regardless of the chosen program and the conditions for obtaining a targeted loan, the project to provide social mortgages to the poor has some subtleties. A potential borrower should be aware of the following features:

- The acquisition of real estate occurs with the involvement of finance from a specific credit institution.

- Cash they do not cash out, the client does not receive the amount in hand. It does not matter whether we are talking about a subsidy from the state or loan funds. All operations are carried out in non-cash. That is, if part of the mortgage is paid from the budget or government assistance is expressed in the payment of interest, the money is transferred to the bank account within the specified time frame. Direct transfer of the amount equal value apartment to the seller is also carried out by transferring funds from the lender’s account to the account former owner real estate.

- The apartment acts as collateral.

- Title is transferred to the buyer upon signing the purchase and sale agreement. The new owner has the opportunity to use the square meters at his own discretion.

- Until the mortgage is repaid, an encumbrance is placed on the apartment. That is, the owner will not be able to sell it, exchange it, or give it away.

It is necessary to understand that assistance and guarantees from the state do not cancel the borrower’s obligations to repay the mortgage loan. Support for low-income families is expressed only in facilitating the conditions of the home purchase program with the help of borrowed funds.

Mortgage lending to low-income families is carried out within the framework of various state support programs. The conditions for obtaining a targeted loan in this case will be more favorable than for persons with good income. More specifically, assistance is expressed in subsidizing part of the loan and a reduced interest rate. However, do not forget that when approving an application, the stability of the family’s income and the applicant’s good credit history will be taken into account in one way or another.

A lawyer is ready to answer your questions.

Low-income families are those families whose income does not reach the subsistence level. installed in the region. This indicator is calculated in this way: all family income for three months is summed up, divided by 3 (by the number of months) and then the result must be divided by the number of family members.

As a result, the average per capita income is determined, which is compared with the subsistence level established for a given period. If the cost of living exceeds the average per capita income, then the family has the right to receive the corresponding status.

Important! Only those families that find themselves in a difficult life situation (problematic financial situation) through no fault of their own, but due to unforeseen circumstances that are impossible to influence independently, can be recognized as poor.

Do they give loans and what programs can I take part in?

For some categories of citizens, mortgages are available on preferential terms., that is, social (read about social and preferential mortgages). Low-income families also have this opportunity, but this status must be obtained officially.

Low-income citizens can take part in the following programs to obtain a mortgage.

Social mortgage for young families

To implement this program, subsidies are allocated to those young people who are under 35 years old and must stand in line for an apartment. Wherein young families with children can receive 40% of government support, well, childless - 35%. Read more about mortgages for a young family, and what benefits there are this loan at the birth of a child, you will find out in.

Lending to young professionals

The program does not yet work in all regions of Russia. According to its terms, the following can take advantage of the offer:

- Scientists.

- Persons who agree to move to rural areas.

- Those who have worked in construction teams for a certain number of hours (150 or more).

The following program only works in those regions that have their own housing stock.

Support for citizens queuing for an apartment

This program provides assistance in the form of:

- Providing subsidies to repay a mortgage loan.

- Issuing a loan for social housing, which the municipality sells at reduced prices.

Requirements

In order to be able to qualify for a social mortgage, you must meet the following criteria:

- Live in the same apartment with another family (or other families).

- Own no housing at all.

- Be registered in a dormitory or communal apartment.

- Live in premises that do not comply with SNiPs and area standards.

Who offers these loans?

A number of banks offer social mortgages, that is, a loan issued on preferential terms:

A detailed list of banks that offer social mortgages, as well as all the details of obtaining this mortgage lending you will find in .

Sberbank offers and conditions

Sberbank offers mortgages to low-income families under the following conditions:

- For young families, the interest rate will be from 11 to 12%, the down payment is set at 20%, and a loan is issued for a period of up to 30 years. When children are born (second and subsequent ones), it becomes possible to repay part of the loan with maternity capital.

- For military personnel, it is possible to obtain a loan of 2 million rubles at 11.75% for a maximum of 20 years.

- The potential borrower is on the waiting list to receive an apartment.

- There are less than 18 per resident square meters area.

- The applicant has three or more children or is disabled (read about social mortgages for disabled people).

- One of the family members is a healthcare worker, teacher, combat veteran, government employee, etc.

Procedure - how to get a mortgage loan?

What should you pay attention to?

It would be wisest not to contact the first bank you come across that offers a preferential mortgage loan program, but to carefully read all similar offers from other banks. Everyone has it large bank has its own official website, where all the necessary information is posted.

It would be wisest not to contact the first bank you come across that offers a preferential mortgage loan program, but to carefully read all similar offers from other banks. Everyone has it large bank has its own official website, where all the necessary information is posted.

It will be possible to decide on the choice of bank only after studying and comparing, be sure to pay attention to:

- Interest rates.

- Size down payment.

- Required forms of proof of experience and income.

Attention! If the bank where the potential borrower receives a salary also offers various preferential programs, then the easiest way would be to contact this bank.

Collection of necessary documents

To a government agency to receive benefits

- Passports and birth certificates (children) for each family member (plus copies).

- Marriage certificate (along with a copy).

- Certificate of family composition (issued by the housing department).

- Income certificates ( wage, scholarship, benefits, pension and other types of income).

- A document confirming the family's need for improvement living conditions. It can be:

- an extract confirming the absence of ownership of any housing (issued by Rosreestr);

- a certificate confirming cramped living conditions (one person has less square meters of apartment area than established by law);

- act on the unsatisfactory condition of a house or apartment (drawn up by the Housing Inspectorate).

To the bank

Contacting your local administration

After the status of a low-income family has been officially confirmed (by the authorities social protection population) You must submit a set of documents and an application to the local municipality. It is best to do this in the first half of the year, because lists of those wishing to take advantage of government support are formed in advance.

The application should write that the family needs to improve their living conditions, indicating the reason for the need and asking for registration. Also write that there are no objections to the verification by self-government bodies of all the information specified in the application and questionnaire (attached to the application).

We wrote in more detail about how to obtain and properly arrange a social mortgage.

Underwater rocks

It is worth paying attention to the following points:

- In case of non-payment of payments public funds will be confiscated, and it is impossible to get them again.

- It is very important to calculate initially real opportunity making monthly payments to avoid future negative consequences.

- There should be no insurance commissions in the contract, since the state acts as a guarantor.

As a result, we can conclude that families who do not have the opportunity to buy housing on their own can successfully take advantage of government support (you can read about how to use a mortgage with government support, including for young families). For low-income families, special conditions are provided, that is, various forms of providing benefits from the state and from the bank. Due to their social status, they can repay the loan on special terms.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

One of the main concerns of the state is to provide people with their own housing. Unfortunately, there is no social mortgage as such for low-income families. Citizens with low incomes are invited to join one of the available programs.

Let's consider what conditions for purchasing an apartment or house are offered to low-income families in 2020.

Definition of social mortgage

A social loan is one provided on preferential terms under state guarantees.

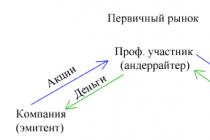

That is, this is a form of triple cooperation:

- power, more specifically, its executive branch;

- financial institutions of various forms of ownership;

- citizens.

The state provides the following types of support to families who are unable to pay the loan on their own:

- repayment of part of the interest rate from budget funds;

- allocation of a subsidy, which is used by the citizen only to pay off the loan;

- providing a preferential loan for the purchase of social housing.

Characteristics of social mortgage lending

The general features of social mortgage lending are:

- people buy real estate with borrowed funds;

- money is not handed over to them. They go directly to the seller;

- the right of ownership is acquired by a citizen from the date of signing the purchase and sale agreement, the owner uses the property at his own discretion;

- the apartment acts as collateral for the loan;

- a citizen gets rid of the encumbrance after full repayment of the debt; before that he does not have the right:

- sell an apartment;

- give it away;

- use as collateral;

- In case of regular non-payment, the bank has the right to return the money through the sale of the collateral property.

Who is issued a social mortgage for the poor?

Spending of budget funds is strictly controlled. The law prohibits providing assistance to people provided with normal living conditions.

Spending of budget funds is strictly controlled. The law prohibits providing assistance to people provided with normal living conditions.

This means that there are criteria for participation in programs. They are slightly different from each other. However, common features can be identified.

People can get a social mortgage:

- huddling together with other families in the same apartment;

- do not own living space;

- registered in a communal apartment or dormitory (periods of study or seasonal work are not considered);

- living in premises that do not comply with:

- area standards (set by each federal subject separately);

- sanitary and technical requirements(recorded in Housing Code RF).

Types of government programs suitable for low-income families

The country implements activities limited to categories of citizen participants. However, there is a big project aimed at all Russians.

This is the program “Affordable and comfortable housing for Russian citizens.”

The project includes various subprograms of federal and regional significance.

They should cover the main population groups, ideally everyone.

Social mortgage for young families

This program is implemented by providing subsidies to citizens who have not celebrated their 35th anniversary. In this case, children are important in the family, and one parent is allowed. The applicant is required to stand in line for an apartment.

The percentage of state support is distributed as follows:

- families with children can count on 40%;

- while childless - by 35%.

The budget pays for square meters calculated according to standards on average of 18 square meters. m per person.

Lending to the military

This program is designed to provide housing for military personnel and their families. Budget money goes to special accounts and accumulates there.

This program is designed to provide housing for military personnel and their families. Budget money goes to special accounts and accumulates there.

The applicant spends them only on purchasing housing at his own discretion.

Military personnel can purchase real estate in any corner of the country. But they are subject to stricter banking conditions. In particular, the age is limited to the borrower being 45 years old at the time of repayment of the mortgage.

Lending to young professionals

The program operates in some regions of the Russian Federation. Mortgages are provided to persons:

- willing to move to the countryside;

- scientists up to a certain age;

- those who worked 150 hours in construction teams and others.

Specific criteria should be clarified with the regional authorities.

Support for people on waiting lists for housing

This program is aimed at meeting the needs of individuals who have long expressed their needs. Help is provided in the form of:

- subsidies for mortgage repayment;

- lending to social housing sold by the municipality at reduced prices.

Maternal capital

Families from the state receive a certificate for the established sum of money after the birth of the second and subsequent children.

Families from the state receive a certificate for the established sum of money after the birth of the second and subsequent children.

It is allowed to be deposited into a banking institution as:

- down payment;

- repayment of the principal amount of the mortgage.

Mortgage AHML

Mortgage agency housing lending represents government structure, engaged in allocating funds to the population for the acquisition of square meters of property.

The agency offers preferential conditions that are more suitable for low-income families:

- reduced lending rate;

- minimum down payment;

- social housing at prices below market prices.

Advantageous offers from financial institutions

| Bank | Name of the loan program | Bid | Sum | Term | An initial fee |

| Bank of Moscow | Maternal capital | 14,95% | from 500 thousand rubles. | up to 50 years | Maternal capital |

| Rosselkhozbank | Maternal capital | 11,9 - 14,5% | 3 thousand - 600 thousand rubles. | up to 25 years | No |

| Young family | 11,9 - 14,5% | 3 thousand - 600 thousand rubles. | up to 25 years | 10% | |

| Sberbank | Military mortgage | 11,75% | up to 2,050,000 rubles. | up to 20 years* | 20% |

| Purchase of housing under construction | 10,4 - 10,9% | 45 thousand - 15 million rubles. | up to 30 years old | from 15% | |

| VTB 24 | Mortgage for the military | 12,1 - 13,1% | up to 2 million rubles | up to 14 years old* | 20% |

| AK Bars | Providing housing for young families | 14,5% | from 100 thousand rubles | 1-20 years | from 10% |

| Snezhinsky Bank | Young scientists | 10 −10,5% | from 300 thousand rubles. | up to 25 years old. | 10% |

* The loan is provided on the condition that the serviceman repays it before reaching 45 years of age.

Conditions credit institutions depends on key rate Central Bank, therefore may change.

The procedure for applying for state assistance

Although all programs are different, there are general rules providing access to them for citizens.

Although all programs are different, there are general rules providing access to them for citizens.

The procedure can be schematically represented as follows:

- Explore all available offers. Compare conditions.

- See if the family falls under the specific conditions of the program.

- Find out which banking institutions in the region they work with the budget.

- Read the terms of the loan. Special attention pay attention to nuances, for example, whether it is allowed to contribute maternal money as a mortgage payment.

- Find out what documents are required to be submitted to the government agency and credit institution.

- Collect papers.

- Contact your local administration (another institution involved in the mortgage program) with an application. This must be done in the first half of the year, since the queue of applicants for state support is formed in advance.

- Wait for the government agency to approve the application.

- Receive a certificate or open an account.

- Contact desired bank for a mortgage.

- Buy the desired housing (house or apartment).

- Pay your share carefully.

Last changes

In April 2019, a law on “mortgage holidays” was issued, according to which borrowers who find themselves in difficult life situations can be provided Grace period: 6 months within which these persons will be able to suspend loan payments or reduce their size.

These rules will apply to people who have lost their jobs, received 1-2 groups of disability, or lost their breadwinner. They will also apply to existing credit relationships.

Our experts monitor all changes in legislation to provide you with reliable information.

Subscribe to our updates!

March 6, 2017, 11:36 Oct 10, 2019 23:33

Social mortgage is a complex of federal and regional programs, which is aimed at improving the living conditions of socially vulnerable segments of the population. Let's figure out who can count on government help and how to get it.

Types of assistance to borrowers under social mortgage programs

Social mortgages are provided to low-income citizens within the framework of state program“Housing”, as well as programs operating at the regional level. What options state aid may be provided:

- preferential interest rate - the state compensates part of the interest on the loan;

- partial compensation for the cost of purchased housing - a subsidy that is paid on the basis of a housing certificate or other document;

- home sales from regional fund at a reduced price.

In each region, the conditions of social mortgage programs may differ. But there is a general rule - assistance is allocated only to those citizens who need to improve their living conditions. For example, the area of the existing apartment is less than the established norm, or there is no own housing.

Social mortgages are aimed only at low-income categories of the population. Young families, workers can take part in the programs budgetary institutions, Young professionals.

Mortgage for young families

Families in which both spouses are under 35 years of age, including families where children are raised by one parent, can participate in the preferential program.

The assistance consists of providing a subsidy in the amount of 30% of the cost of the apartment purchased with a mortgage. If there is at least one child in the family, the subsidy amount increases to 35%. At the regional level, payments can be increased if these costs are included in the budget.

A young family can use the subsidy to make a down payment or pay part of the principal and interest on an existing mortgage loan.

According to the rules of the program, a young family must register as in need of improved housing conditions, and also have an income sufficient to repay the bank loan.

Size social benefits depends on the area of the purchased apartment and average cost one square meter of real estate in the region. A family consisting of two people will receive a subsidy for the purchase of housing with total area no more than 42 sq.m. If there are more than two family members, then the area will be calculated based on 18 square meters. m per person.

A family can buy a larger apartment, but the payment amount will not change. The difference will need to be paid either from own funds, or by increasing the loan amount.

The subsidy can be allocated to a family only once. Repeated applications for payment are prohibited. In addition, under the terms of the program, assistance is provided only to citizens Russian Federation. If one of the family members does not have Russian citizenship, he will not be taken into account when calculating the area of the purchased apartment and the payment amount.

Social mortgage programs for public sector workers

The state program “Housing” also provides for the provision of mortgage loans on preferential terms to employees of budgetary organizations. Who can get help:

- State and municipal teachers educational organizations general and secondary education. Experience requirements are established at the regional level pedagogical activity, teacher qualifications and age restrictions.

- Doctors of state and municipal health care institutions, as well as institutions social services. The programs contain a list of specialties of medical workers who are eligible for benefits, as well as special conditions for those who work in rural areas.

- Young scientists and specialists carrying out professional activity in government institutions. Selection criteria are also established for them: academic degree, work experience, age, topic of scientific research. In addition, the programs may provide benefits for young professionals who are ready to move to rural areas.

For young professionals the age limit is 35 years, for all others preferential categories they can vary between 40-45 years.

When receiving benefits for the purchase of an apartment with a mortgage, employees undertake the obligation to work in budgetary organizations at least 5-10 years. If this requirement is not met, the employee must return the funds received from the state.

Stages of obtaining a social mortgage

- To participate in the social mortgage program, a citizen must contact regional structure involved in the implementation of the project. IN mandatory list documents for providing assistance include an identity card, a copy of the work book certified by the personnel department, certificates of marriage or divorce and birth of children, a certificate of family composition. If a positive decision is made, the applicant will be issued a certificate of entitlement to receive government assistance.

- The participant must Apply to the bank for a mortgage loan. Receiving a certificate does not guarantee that the bank will approve the loan. They may refuse if there is a bad credit history, insufficient income and other factors that will indicate the low solvency of the borrower.

- Having received the bank's approval, the borrower must find an apartment that meets your requirements benefit program , and conduct an independent assessment. The object undergoes the approval procedure not only in the bank, but also in the regional authority allocating funds.

What it is

Social mortgage mortgage for low-income families is credit product, which is issued on preferential terms and is accompanied by government support. It is the product of:

- authorities;

- banking institutions;

- citizens.

Government agencies provide support to those families who are unable to repay the entire loan on their own by providing them with financial assistance. Subsidies are also provided for payment and the interest rate is reduced. Regions can help credited citizens independently, for example, by allocating apartments from municipal property for sale to the poor.

Features of the loan

Social mortgages for the poor have certain characteristics, for example, real estate is purchased using funds from the bank and the authorities, but they are not given to the citizen, but are immediately used for repayment financial institution. A person receives ownership rights immediately after the execution of a purchase and sale agreement, having the opportunity to dispose of the property.

In this case, the apartment is collateral, so restrictions are imposed on it. They relate to the inability to sell it, donate it, or provide it as collateral to obtain another loan. If the loan is not repaid by the citizen, the bank has the right to sell the apartment or house, thereby repaying the debt. It doesn't even save you from this governmental support, since it does not cancel the obligation to pay the creditor.

The area of housing purchased on credit should not be more than 18 square meters per person, this is dictated by sanitary standards. Also, at the time of repayment of the loan, the person must be no more than 70 years old, and the income must be sufficient for monthly payments. If servicing the loan will require more than 50% of the profit, the application potential borrower will be rejected because the law does not allow transactions on such conditions.

Who can qualify for a mortgage

Budget expenditure is tracked by top level, and the legislation does not allow assistance to be provided to those citizens who already live in comfortable conditions or have sufficient income. By general rules, social mortgages for low-income people can be obtained:

- the population who lives in an apartment with other people;

- when the property does not have any other residential property;

- registered in public housing (this is communal apartments or dormitories);

- when living in premises that do not meet space standards and technical requirements.

Government programs

The country is implementing housing support measures for citizens that correspond to the categories. But there is one big project called “Affordable and comfortable housing for Russian citizens,” and other proposals are already included in it. They can be like this:

- social credit for young families - citizens must be no more than 35 years old and be on the waiting list for housing. If there are no children, the level of government subsidies will reach 35% of the cost of housing, and if there are children, up to 40%;

- for the military - the state accrues monthly payments to each career employee from federal budget he can spend such savings on housing, but loans are issued only up to the age of 45 at the time of full repayment;

- for young specialists (for teachers and doctors) - this offer only works in some regions of the federation;

- for those already included in the housing queue;

- maternity capital - issued to families in which the second and each subsequent child was born;

- AHML is an institution government agency, which allocates money to citizens for their own living space, users receive a reduced interest rate and a small down payment.

Low-income mortgages under each program are available to people who meet the conditions, but this requires documentation.

Socipoteka in different cities

Throughout Russia, the conditions for obtaining a preferential loan differ. In Moscow, you must first become officially poor, which implies an income level below the subsistence level. There are two schemes in operation in the capital:

- The city orders apartments, after which they are sold at cost.

- Citizens are given subsidies based on the down payment, but housing is purchased at market prices.

In St. Petersburg, there is a system in which people are provided with social benefits based on the number of family members, and also adjusted depending on the period of inclusion in the queue. It is equal to a third of the price of housing that a person buys. If we are talking about budget employees, then with five years of experience they can buy housing at cost, and at the same time they are given an installment plan for 10 years, without interest. IN Last year repayment, if papers on permanent work throughout the entire period in budgetary organizations are provided, citizens are given another payment in the amount of 20% of the value of the property.

Tatarstan offers social mortgages for the poor, which are supported by the state fund of the local president. The agreements indicate that a starting price must be paid, since housing is being built according to city orders. As a result, 45% of apartments are given to budget employees, the same amount to employees of enterprises that finance the program together with the state. The remaining 10% is given to those moving from dilapidated housing. At the birth of a child during lending, the family can reduce the size of the loan by the price of 18 square meters. meters, but there should be no unemployed in it.

If you look at the offers of banks, then interest rates will be different, as will the amount of lending with the target audience. Sberbank's social mortgage of 2018 is one of best options, but at the birth of children it is possible to set the percentage at 6%.

|

Bank's name |

Program |

Max. loan term, years |

Interest rate |

Loan amount, rub. |

|

Bank of Moscow |

Mat. capital |

from half a million |

||

|

Rosselkhozbank |

up to 600 thousand |

|||

|

Sberbank |

Military mortgage |

|||

|

For young families |

from 100 thousand |

|||

|

Snezhinsky Bank |

For young scientists |

not less than 300,000 |

Required documents

When a mortgage is issued for low-income families, additional paperwork must be provided. Their list includes the borrower’s passport, who must be a citizen of the Russian Federation, a certificate of income issued from the place of work, or made according to the bank’s form. Still required employment history, since no loan is given to the unemployed and income is required. In addition, they may request:

- certificate of participant in the state program;

- paper on family composition;

- SNILS;

- military ID;

- pensioner's certificate.

- a document confirming low-income status (usually a certificate from a regional or local social protection authority);

- passport of the applicant and spouse, if available;

- a document on the priority list of persons applying for state assistance to improve housing conditions;

- application form for a preferential loan;

- certificate of family composition;

- marriage/divorce certificate;

- children's birth certificates;

- a document from the Registration Chamber confirming that the client does not have any residential real estate.

Usually it is necessary to include a person in the list of participants in state programs, for which he must contact the housing department of the local administration. The bank can tell you how to formalize this correctly and where to request it so that there are no difficulties with registration.

Registration procedure

Mortgages for low-income families in Sberbank in 2018 are issued in the same way as in any other. First, you should study the offers and conditions, taking into account the requirements. In the case of Sberbank, you can participate in any of them, but additionally you will need consultation with specialists.

Having learned the list of documents, you need to collect them, and then go to the local housing department, writing an application there. If it is approved, you should receive a certificate and open an account, then submit the papers to the bank and buy a home. It will be useful to find out if there is an opportunity to buy social real estate in the region, because it is cheaper, and mortgages for low-income families in 2018 will be more profitable.

Pros of a mortgage

Mortgages for low-income families are a list of offers that make it possible to purchase your own home. Among their positive aspects:

- low percentage compared to standard offers;

- the state budget compensates part of the interest on the loan, as well as its body;

- the price of real estate is significantly lower;

- There is no need to pay a state fee for obtaining a loan for the poor.

Requirements for mortgage recipients for low-income families are established by regions, but general rules are approved at the federal level. Even by social programs After purchasing real estate, you can return income tax.

Conclusion

Social mortgages for low-income people are intended not only for them, but also for people who work in public positions, including serving in the army. Many Russian banks provide it, of which Sberbank is the largest, but you must meet certain criteria. According to support programs, low interest, and sometimes there is no down payment because it is paid by the state. Otherwise, these are standard loans, and for non-payment, the property can be taken away and sold to pay off the debt.