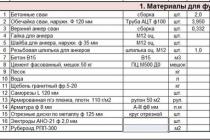

Review of useful services of the site Nalog.ru (www.nalog.ru).

Personal account of the taxpayer (individual) 1: find out your debt

What needs to be entered? TIN, Last name, First name, Region.

What information will I receive?"Taxpayer's Personal Account" provides users with the ability to search for information on debts for property, transport, land taxes, personal income tax and print a fine receipt to Sberbank. Information obtained using this service does not constitute a tax secret. Find out debt and taxes by TIN

Personal account of the taxpayer (individual) 2 (advanced)

What needs to be entered? It is enough to enter ONE of the fields: Name (simply Yandex, Gazprom, etc.) and/or OGRN\GRN\TIN and/or Address and/or Region and/or Date of registration.

What information will I receive?

- Name of the legal entity;

- Address (location) of the legal entity;

- OGRN;

- Information about the state registration of the organization;

- Date of making an entry in the Unified State Register of Legal Entities (registration of a legal entity);

- The name of the registration authority that made the entry (Tax);

- Address of the registration authority;

- Information on amendments to the Unified State Register of Legal Entities;

- Information on state registration of changes made to the constituent documents of legal entities;

- Information about licenses, registration as insurers in funds, information about registration.

Also recently, on the same tax website, information from the EGRIP (OGRNIP, OKVED, etc.) appeared on all individual entrepreneurs.

Search by: OGRNIP / TIN or full name and region of residence (patronymic name is not required)

The site has a complete database of organizations and individual entrepreneurs of the Russian Federation. .

Determination of the details of the IFTS (tax)

What needs to be entered?

What information will I receive? Tax office name, address, phone number, OKPO code.

Payment order or receipt.

What needs to be entered?

- IFTS code:

- Municipality:

- Type of payment:

- Payment type:

- Tax group:

- Tax:

- Status of the person who issued the payment document:

- Payment basis:

- Taxable period:

- Date of signature of the declaration by the taxpayer:

- Order of payment:

- Name:

- Payer's bank:

- Account No:

- Sum:

What will I get? Payment to a bank or a receipt for a savings bank.

An individual entrepreneur can pay everything through Sberbank with receipts - any taxes and insurance payments (PFR, FSS, medical insurance). Save your receipt!!!

How to find out your TIN

What needs to be entered? IFTS code. These are the first 4 digits of your TIN.

- Surname:

- Middle name:

- Date of Birth:

- Type of identity document:

- Series and document number:

- Document issue date:

What information will I receive? Your TIN number (find out the TIN of an individual).

By address, determine OKATO, OKTMO, index, etc.

In the process of entering information, a drop-down list will appear containing information about the first 10 addresses corresponding to the entered parameters.

Information input:

- it is desirable to start in the following order: street locality city region;

- exercise through gaps;

- use only the name of address objects;

If you did not find the required address in the drop-down list, enter the name of the address element of a higher level, for example, city, region.

What needs to be entered?

- street

- city

- Enough street and city

What will I get?

Sign up for an appointment with the tax office

In the event that the employee who receives the selected service is busy, it is allowed to start the appointment later than the selected time, while the taxpayer is guaranteed an appointment within half an hour.

If the taxpayer is more than 10 minutes late, the taxpayer loses the right to priority service and is served on a first-come, first-served basis.

Priority service by appointment is subject to:

compliance of the data of the presented identity document with the data specified when registering online.

applying for the service selected when booking online.

To receive the selected service in the IFTS hall, you need to receive an electronic queue ticket before the appointed time. To do this, enter the "PIN-code" specified in the current ticket in the electronic queue terminal and receive a printed ticket of the electronic queue.

IP personal account

On the site tax.ru there is a personal account for individual entrepreneurs, where you can find out about the payment of taxes by individual entrepreneurs of debt, fines and penalties.

There are also for tax accounting on the simplified tax system and UTII. For employees: generate payments, 4-FSS, Unified settlement, submit any reports via the Internet, etc. For newly created individual entrepreneurs now (free of charge).

Personal account LLC (legal entities)

There is an office for legal entities (LLC) on the tax website, where you can find out about tax payments, fines and checks.

Recently, all taxpayers of the Russian Federation have received the website of the Federal Tax Service of Russia www.nalog.ru, which is officially developed for the Federal Tax Service and contains a huge amount of information, information and legislative acts necessary for various types of economic activity.

The site of the Federal Tax Service of Russia www.nalog.ru is designed to simplify the system of communication between clients and the tax office, thereby saving time for users and the tax service itself.

Website

Website design

Absolutely every interested user or outsider can visit the official resource of the tax service to get acquainted with the new service. By clicking on the link to the website of the Federal Tax Service of Russia www.nalog.ru, the client will be taken to the main page, which includes all the basic information about the tax service and its activities.

For the reliability of the data, the user will need to select his region of residence from the provided list of cities. At the top of the page, the client will also be able to:

- go to the pages of the bodies that control the Federal Tax Service;

- open the video assistant, a kind of site guide;

- view legislative documents of the inspection;

- change the scale of displaying information;

- switch languages from Russian to English or vice versa;

- visit the official communities of the service in social networks;

- open a section with information about the Federal Tax Service;

- view contacts and inquiries.

What does the site look like

What does the site look like The site of the Federal Tax Service of Russia www.nalog.ru still provides an opportunity to view news in this area and fill out a questionnaire about the quality of service on this resource.

How does the site look?

Access to the resource www.nalog.ru of the Federal Tax Service of Russia is absolutely free, free of charge and available to everyone at the given address. When the user clicks on the link, he will see the main page of the service, which immediately impresses with its dynamism and design.

For the convenience of customers in the top ribbon, you can select the region of residence, change the scale of displaying information on the page, choose between Russian and English. Here it is also possible to go to higher authorities, revise legislative documents and visit the official communities of the www.nalog.ru resource of the Federal Tax Service of Russia in such social networks:

- Facebook;

- Twitter;

- in contact with.

A lot of space on the page is also occupied by the news block, which contains news from the Federal Tax Service itself, as well as information about the inspection in the media.

www.nalog.ru

www.nalog.ru At the top of the page, the user can go to the tab with information about the Federal Tax Service, as well as to the contacts and appeals section.

It is also interesting that the site developers offer official users and site guests to take a survey by clicking on the “Your opinion” button and filling in the following fields:

- the status to which the visitor belongs - whether he is a sole trader or legal entity, a private entrepreneur, a journalist or a client who is associated with the tax office;

- the purpose of accessing the nalog.ru website of the Federal Tax Service of Russia is to find a solution to the problem, use the necessary service, view the news and the website, another purpose;

- the client is offered to evaluate the design of the site nalog.ru of the Federal Tax Service of Russia - on a scale from good to very bad;

- determine the ease of location of information on the resource - according to a similar system;

- indicate whether the client has found a solution to the problem;

- formulate a problem that interested the user;

- submit wishes and recommendations for the operation of the site;

- optionally provide a telephone or e-mail feedback;

- enter the security code and submit the form.

Questions on the site

Questions on the site In general, the main page of the website www.nalog.ru of the Federal Tax Service of Russia is multifunctional and contains a huge amount of information. The portal is clear and easy to use.

Website functionality

Of course, most of the visitors to the website of the Federal Tax Service of Russia www.nalog.ru are interested, that is, clients of the tax service who regularly use the services of the resource. These users include:

- legal entities (LE);

- individual entrepreneurs (IP);

- individuals (FL).

For these categories of clients, personal accounts are provided, which can be accessed by going through the registration procedure. Also, all types of taxpayers can study in detail the features of the type of activity and legislative documents that operate in this area.

From the main page of the resource, the user can go to any section of interest to him by simply pressing a button.

Any citizen who simply wants to get acquainted with the resource or find the necessary legislative document can also go to the site and solve their problem.

Sections

Sections All types of taxpayers can register on the site and get a personal account with advanced features that will greatly simplify the user's work and the process of communication with the Federal Tax Service of the country.

The website www.nalog.ru of the Federal Tax Service of Russia also provides an opportunity to use electronic services:

- register an individual entrepreneur or legal entity - go through the registration process by filling in the requested data;

- get acquainted with the risks for business - get a certificate about the organization of interest;

- Unified register of small and medium-sized businesses - visit the database;

- Frequently Asked Questions - get acquainted with the most common questions and answers to them;

- find out TIN - check your individual number;

- pay taxes - pay a tax or debt via the Internet;

- sign up for an official admission to the service;

- complaints decisions.

Electronic Services

Electronic Services

Electronic Services In addition, electronic services operate on the website of the Federal Tax Service of Russia www.nalog.ru, which greatly simplifies the work of clients and inspections:

- the process of registration of legal entities and individual entrepreneurs;

- familiarize yourself with the risks of your own business;

- visit the register of medium and small businesses;

- review popular questions and answers to them;

- order or recall your TIN;

- pay tax bills;

- make an appointment with the tax office;

- view inspection decisions on specific complaints.

Tax Information

A user who is interested in taxes can also view the taxation point in the Russian Federation on the main page, which includes the following active links:

- ceremonial fees and taxes;

- legislative base of the inspection;

- real estate tax according to the cadastral value;

- regulation of disputes in pre-trial mode;

- litigation;

- insurance;

- providing reports;

- inspection control;

- tax debts;

- bankruptcy process;

- pricing process;

- cases of bankruptcy;

- a group of consolidated tax payers;

- taxes for those who work abroad;

- disposal tax;

- trade tax;

- product labeling process.

Taxation in the Russian Federation

Taxation in the Russian Federation For all the items provided, the user can get detailed information by clicking on the question of interest.

Registration of a personal account for an individual entrepreneur

In order for an individual entrepreneur to use the huge functionality provided by the tax service, he needs to go through the registration process on the website of the Federal Tax Service of Russia www.nalog.ru, after which he will become the full owner of his own profile.

To begin with, the client needs to follow the link for registration of legal entities and individual entrepreneurs on the main page of the site, which is located in the electronic services section. Further on the page, registration options for individual entrepreneurs and legal entities will be presented, after the client selects the tab for entrepreneurs, a window will open in front of him for this type of client with the following options:

Registration of an individual entrepreneur

Registration of an individual entrepreneur - initial registration of IP;

- making changes about the entrepreneur;

- termination of the enterprise.

Of course, the last two points are provided for already authorized clients of the system on the website of the Federal Tax Service of Russia www.nalog.ru.

After the user opens the registration window, he will be required to enter the following data:

- email address;

- re-entering the address;

- secret password;

- repeat password;

- surname;

- patronymic;

- code with security picture numbers.

Next, the user will have to carefully check the correctness of the entered data and click the button to continue registration. At the same time, the client will receive an email containing a link to activate the account, by clicking on which he will complete the registration process.

Each individual entrepreneur who has completed the registration procedure on the website www.nalog.ru of the Federal Tax Service of Russia will also receive their own account, which can be accessed in the following ways:

- when entering the TIN and password;

- using the signature key in electronic form;

- through Rutoken EDS 2.0;

- using Jacarta.

IP personal account

IP personal account  Sign in

Sign in An individual entrepreneur can carry out such actions on the website www.nalog.ru of the Federal Tax Service of Russia if he has his own account:

- receive electronic statements from USRIP;

- make changes to your own business;

- send requests, applications to the tax service;

- send complaints about violations or inaction of officials;

- receive information about the data sent to the inspection;

- view payments, debts and overpayments for taxes;

- clarify information about disputed payments;

- receive information about individual taxation systems;

- choose the right taxation system;

- view settlement transactions with the state budget;

- request and receive settlement statements and acts;

- use the SME Corporation resource for individual entrepreneurs;

- choose the type of business, draw up a business plan, find premises and organize other necessary matters.

Login to your personal profile

The official owner of a personal account on the website of the Federal Tax Service of Russia www.nalog.ru can enter it at any moment and use its functions. To do this, on the main page of the resource, the client needs to click the button to enter the personal account in the section for individual entrepreneurs. To enter, the user will need to fill out:

- login method - via E-mail and password, personal account for FL, certificate or through the public services portal;

- email address;

- secret password.

Authorization on the site

Authorization on the site When you click the login button, an individual entrepreneur gets to his profile. To ensure that the authorization process in the system does not take much time, the client can check the box so that his email address is filled.

Lost data recovery

In the event that a private entrepreneur for some reason has lost the security password from the office, he can renew it. To do this, the client needs to click the button about a forgotten password in the authorization field and fill in the fields:

- email address provided during registration;

- numbers from a secret picture.

Remember password

Remember password If the email address is entered correctly, then it will receive a letter from the support service with further instructions for resuming access to the account.

Own profile for an individual

Any taxpayer who is a private individual can register on the website www.nalog.ru of the Federal Tax Service of Russia and have access to a personal profile that gives the user the following opportunities:

- exercise control over accounts;

- have reliable information about vehicles, the amounts of existing taxes, their payment, the amount of overpayment and debts to the state;

- pay taxes or debts through partner banks;

- receive messages from the inspection and receipts, as well as print them;

- the possibility of contacting the service without visiting it;

- download software for filing a declaration;

- monitor the status of the verification of the declaration.

An individual can get access to a personal account and its functionality only in three cases:

- through the profile in the ESIA - according to the access details of this system. The authorization process is possible only for customers who have applied to receive data;

- using a registration card that contains a password and login - it is possible to become the owner of the card in any department of the service. The client must have a passport, and if he is under 14, then the procedure is performed with legal representatives with a birth certificate;

- using a signature in electronic form, which is qualified and issued by a special authority. The signature can be stored on any medium and used only through a special program.

Office for legal entities

Cabinet

Cabinet All legal entities that have gained access to their personal account on www.nalog.ru of the Federal Tax Service of Russia can:

- find out information about debts, debt amounts, overpayments, next payments;

- send requests about taxes, debts, fines, interest;

- receive an electronic statement about yourself from the USRN;

- send the necessary reports, documentation;

- send documents for the purpose of registering a legal entity or making changes to the Unified State Register of Legal Entities.

Cabinet Features

Cabinet Features Technical Support

Through the main page of the website of the Federal Tax Service of Russia www.nalog.ru, the user can go to the section with contacts and appeals, which has a tab with the most frequently asked questions. This section contains a list of popular questions and problems among customers, as well as answers to them.

The client will have to select the subject of the question from the list, the subcategory to which he belongs, indicate the region where the enterprise is located, and formulate the text of the appeal. Next, the system will find the right question among the existing ones and give options for solving the problem. If there is no question of interest to the client among the above points, then he can write a detailed letter and send it to the tax office. After solving the issue, the technical service will provide its answer to the specified e-mail. Also, the user can make an appointment for a personal appointment with the inspection to solve his problem.

Frequently asked Questions

Frequently asked Questions Absolutely all taxpayers appreciated the appearance of the official website www.nalog.ru of the Federal Tax Service, which offers the user a wide range of services and information about the types of activities of various kinds and about all existing state taxes. With the advent of this resource, clients have a lot of new opportunities, and the time to communicate with the tax office has been significantly reduced.

The Federal Tax Service (FTS of Russia) is a federal executive body, the full information about which is available on its official website.

The official website of the service has two versions: Russian and English. In addition, there is also a version for visually impaired users. The corresponding choice can be made in the upper right corner of the web resource.

The Federal Tax Service of Russia official website allows you to familiarize yourself with materials addressed to individuals, individual entrepreneurs and legal entities. Relevant links can be found at the top of the resource. Here you can also find information on how to get a personal account and what opportunities it opens up.

The official website of the Federal Tax Service also allows you to get acquainted with general information, to which the tab "About the Federal Tax Service of Russia" will help you go. So, here you can find information about the structure, functions, history, activities of the service and other useful information. Here you can also get acquainted with the contacts of the Federal Tax Service, the database of documents, the interaction of the service with other institutions and organizations.

The official website of the Federal Tax Service of Russia is also a set of services that can be used directly on the web resource. To get acquainted with their full list, it is enough to use the "All Services" tab, presented on the main page of the site. Here you can also access the most popular electronic services.

Also, the official website of the Federal Tax Service has news of the service and media materials about the Federal Tax Service. In addition, the main page contains materials related to taxation in Russia and other functions of the Federal Tax Service.

It is worth paying attention to the lower part of the official website of the Federal Tax Service, where, among other things, there are links to open data, videos, documents, vacancies and a forum.

The official website of the Federal Tax Service of Russia also has links to the pages of the service in various social networks, such as Facebook, Twitter and VKontakte.

You can also express your opinion about the operation of the site using the appropriate tab on the right side of the web resource, where you will need to answer questions related to working with the official website of the Federal Tax Service.

Determination of the details of the Federal Tax Service Inspectorate, the state registration authority of legal entities and / or individual entrepreneurs serving this address.

The service allows the taxpayer to find out the number of his tax office at his address.

service.nalog.ru/addrno.do

Federal Information Address System

The Federal Address Information System (FIAS) contains reliable uniform and structured address information on the territory of the Russian Federation, available for use by public authorities, local governments, individuals and legal entities.

The system was developed in accordance with the Decree of the Government of the Russian Federation of June 10, 2011 No. 1011-r. Information from FIAS is presented on the basis of the administrative-territorial division of the subjects of the Russian Federation and on the basis of the municipal division.

The address information contained in FIAS is open and provided free of charge.

fias.nalog.ru

Registration of an individual with a tax authority

Registration of an individual with a tax authority on the territory of the Russian Federation.

The service allows:

- fill out an application of an individual for registration with a tax authority on the territory of the Russian Federation;

- register and send the completed application to the tax authority;

- receive information about the status of processing the application in the tax authority on the website and by e-mail (if you indicate it in the application in the section "Contact details of the applicant");

- print the completed application.

service.nalog.ru/zpufl/

Personal account of the taxpayer for individuals

The Internet service "Personal Account of the Taxpayer for Individuals" allows the taxpayer to:

- receive up-to-date information on tax debts to the budget, on the amounts of accrued and paid tax payments, on the presence of overpayments, on objects of movable and immovable property;

- control the state of settlements with the budget;

- receive and print tax notices and tax receipts;

- receive tax notices;

- pay tax debts and tax payments;

- apply to the tax authorities without a personal visit to the tax office.

service.nalog.ru/lk/

The Know Your Debt service provides users with the ability to search for information about debts for property, transport, land taxes, personal income tax (only for individuals, citizens of the Russian Federation) and print a payment document (notice) in the form No. PD (tax) . We also draw your attention to the fact that the information obtained using this service does not constitute a tax secret.

service.nalog.ru/debt/

Information about legal entities and individual entrepreneurs in respect of which documents for state registration are submitted

Information about legal entities and individual entrepreneurs in respect of which documents for state registration are submitted, including for state registration of changes made to the constituent documents of a legal entity, and changes to information about a legal entity contained in the Unified State Register of Legal Entities.

service.nalog.ru:8080/uwsfind.do

Messages of legal entities published in the journal "State Registration Bulletin"

Messages of legal entities published in the journal "Bulletin of State Registration" on the adoption of decisions on liquidation, on reorganization, on reducing the authorized capital, on the acquisition by a limited liability company of 20% of the authorized capital of another company, as well as other messages of legal entities that they are obliged to publish in accordance with the legislation of the Russian Federation.

search.vestnik-gosreg.ru/vgr/

Information published in the journal "State Registration Bulletin" on the decisions taken by the registering authorities

search.vestnik-gosreg.ru/fz83/

Submission of electronic documents to the Federal Tax Service of Russia for state registration

The Federal Tax Service provides an opportunity for legal entities and individuals registered or registered as an individual entrepreneur to submit documents for state registration in electronic form via the Internet.

The Federal Tax Service of the Russian Federation has several online representations that help individuals and legal entities to fully receive reliable information in a timely manner online. You can access the tax website using a computer, tablet or mobile phone.

The modern tax authorities are developing an official website for various purposes; individuals and legal entities, as well as individual entrepreneurs, can use it. The given vector for digital promotion in the public sector is carried out ahead of schedule. Many have already appreciated all the services and functions with which you can work remotely without visiting the tax office.

Tax official website - Federal Tax Service of Russia

The official website of the tax FTS of Russia is available 24/7 on the Internet at: www.nalog.ru(TAX RU) is the only representative office of the IFTS, which is wholly owned and controlled by the state.

It is worth noting the high growth in the popularity of the resource, which is associated with the provision of services in demand for the population remotely. It's now much easier to keep track of basic information about paying taxes, insurance premiums, and getting first-hand information about other options available online.

Main projects:

- Tax ru is a general, informational, main portal.

- LKFL (old version) and LKFL2.nalog.ru (new cabinet) for FL.

- LKUL.nalog.ru - for legal entities.

- LKIP.nalog.ru - for individual entrepreneurs.

WWW NALOG RU (TAX RU): electronic services

This is the central project, by visiting which you can determine further actions. Immediately after entering the site, it is recommended to personalize the settings for the region of location, you can select it at the top left of the main navigation menu.

Here you can read news not only taken from the media, but also from the original source about upcoming changes in taxation, the procedure for registering or liquidating legal entities, as well as a lot of additional information for work.

The main list of services that can be used remotely:

- Registration of legal entities and individual entrepreneurs. Allows you to get acquainted with the full list of documents that are necessary for the registration and registration of an LLC or individual entrepreneur, as well as a guide to the main codes of foreign economic activity.

- . The service allows you to find out a personal identification tax number from your passport in 1-2 minutes without visiting the Federal Tax Service. All you need to enter is your full name, date of birth, as well as a series with a passport number and date of issue.

- Business risks: check yourself and your counterparty. Be confident in the solvency of the supplier or the reliability of the contractor.

- Pay taxes. The name speaks for itself, here you can pay all taxes for both an individual and a legal entity.

- The unified register of small and medium-sized businesses - provides access by TIN to the main entries in the register of individual entrepreneurs and LLCs.

- Online registration for admission to the inspection. A very convenient option, without leaving your home, will help you make an appointment with the right department and a specific specialist at a convenient date and time.

- Frequently Asked Questions. Most of the questions can be answered in this section.

- Labeling of goods in accordance with state standards.

- Definition of OKATO, OKTMO at the address (street, city or index).

- Formation of payment orders and online filling of documents for the payment of tax.

- Clarification of tax details for your TIN. As a result of the request, you will find out the correct name of the unit, where it is located, and also see the main contact information and OKPO code.

Additional functions provided by the Federal Tax Service:

- State registration of individual entrepreneurs and legal entities.

- Register of entrepreneurs and legal entities. A single database of legal entities in the form of a register. To check, just enter the full name of the company or TIN.

- Statistical and analytical materials.

- Registration of cash registers and registration of online cash registers.

- The tax code and other legislative documents in the modern edition. All documents are constantly updated and revisions of materials are published in this section.

- tax calendar. Quickly coordinates the deadlines for the submission of tax returns and other events according to relevant dates.

- Contact information and definition of the displayed version of the site by city. At the first visit, the project offers to select the user's location automatically to provide information in accordance with the region of presence.

How to find the right tax office website

There are several sites that perform certain functions and are designed for different purposes of use. For example, there are NALOG RU, EGRUL.NALOG.RU, LKIP.NALOG.RU and LKUL.NALOG.RU. Let's take a closer look at each of them.

LKFL.NALOG.RU (old version)

Hotline

In order to timely resolve issues that have arisen and receive highly qualified support from an employee of the Federal Tax Service, a multi-channel telephone for free calls within the Russian Federation has been created - 8800-222-22-22.

Please note that after connecting, on the back of the call there will be a greeting from the automatic robot with tips for choosing thematic sections. If the question requires live communication, it is necessary to wait for a connection with the operator, which can take 10-30 minutes or more due to the heavy line load.