How secure are contactless bank cards?

Sberbank gave me a modern contactless card instead of an old plastic card. Which you can simply bring to the terminal to pay for a purchase, and the money will flow out by itself - without any PIN codes. Is it possible to refuse? – I asked. “You can’t,” the bank manager replied. Without suspecting me of being a journalist, she shared how money is “stolen” from their cards and what protection the bank offers against this.

Wallet or handbag?

Sberbank exchanges your old plastic cards for new ones - they have a built-in radio chip. The contactless payment technology for Visa cards is called PayWave, for Mastercard – PayPass. The essence is the same: you don’t have to insert the card into the terminal when paying for a purchase, but simply present it. In this case, RFID technology is used (when the plastic card and the terminal exchange radio signals). If the purchase amount is less than 1000 rubles, then the system does not ask for a PIN code - it simply debits the money from the account. Is it possible to refuse this miracle of technology? – I asked the manager of additional office No. 9055/1823 Maria. Maria looked important. She looked at me as if I were a technically backward citizen and said that it was impossible to refuse to use a contactless chip. It is also impossible to receive a card without a radio tag. And it’s not even possible to reduce the amount of “contactless and uncontrolled” debiting of funds (without entering a PIN code).

The answer surprised me greatly, and I turned on the recorder just in case. At the same time, I decided to ask Maria what I had long been meaning to ask from Sberbank, but was embarrassed. How secure is this wonderful PayPass/PayWave system?

When paying, the card “doesn’t even need to be taken out of your wallet,” it’s written on the Sberbank website. I'm wondering: does it work from a purse? And if so, then anyone who pressed their mobile terminal against my card (which is in my purse) on the bus will be able to use my account (within 1000 rubles)?

– No, it won’t work through the bag,” Maria said after thinking. – You have to press very, very tightly! When I apply it myself, if I apply the card crookedly, it doesn’t work. Even in the subway, I don’t always manage to pay, although I really push it like that,” the manager showed how to do it with her hands.

– Why then are metal cases needed, on which it is written that they are designed to protect cards from unauthorized withdrawal of money?

“Perhaps they are needed to protect against portable skimming designed for the PayPass and PayWave system,” said Maria.

(Remark in parentheses: skimmers are devices for stealing money from cards.) How do they work? – I asked.

– I’ve never seen it! But there are skimmings that scammers install directly on ATM terminals. And taxi drivers have these small ones... When you insert the card right there... I think it should be something like that. But you also need to give it a good shot! – Maria explained a little confusingly, but confidently.

- So what should we do? How to defend yourself? – I screamed in fright.

“Sberbank may offer you financial protection against fraudulent activities,” Maria said.

According to her, financial protection insures against “skimming thefts”, “thefts when card data is intercepted in public places.”

– For example, employees of public enterprises - cafes, hotels - read the card number, remember the three digits and make purchases on the Internet. As a rule, it is employees who steal card data! But if someone steals your card itself, he can go to the store and pay for purchases up to a thousand rubles. He will perform three operations like this, and the fourth time he will need a PIN code. It also happens that people stand in line to withdraw money, but their PIN codes are spied on and their cards are stolen! – the manager decided to be frank with me.

According to her, “financial protection” from Sberbank can save you from all these outrages (and much more) for only 990 rubles a year. I promised to think about it and said goodbye. But questions remain. If I don’t pay Sberbank 990 rubles for “financial protection”, does that mean my finances will be protected less than those of those who paid?

And it’s still unclear about the wallet and handbag. If you can pay without taking the card out of your wallet, then why can’t you pay without taking the card out of your purse?

Tormented by these questions, I put my contactless miracle of technology deeper into the pocket of my purse (I have one) and went to look for answers from other specialists.

Central Bank of the Russian Federation: shield with foil

My doubts turned out to be not unfounded. Contactless cards turned out to be rather defenseless creatures. Although MasterCard, Visa, as well as Sberbank, assure that using them is no more dangerous than other technologies for non-cash payments. But the Central Bank of the Russian Federation warns Russians.

“In crowded places (crowded public transport, markets, shops), an attacker places a contactless reader or POS terminal against clothing pockets or the sides of bags and steals money from cards from unsuspecting victims. An attacker only needs to bring the reader closer to the card at a distance of 5–20 centimeters to make a write-off. Fraudsters can also record the information received on clone cards for further theft of funds from real bank cards,” this is information from the official website of the Bank of Russia.

There are also recipes on how to defend yourself.

“Use special shielded wallets (the card is placed in a compartment shielded with foil). Make sure that the confirmation of writing off an amount of more than 1000 rubles is a request for a PIN code, and not a receipt signature. If you do not plan to pay contactlessly for purchases worth more than 1,000 rubles, it is recommended (if the issuing bank has such an opportunity) to set an individual spending limit on the card and limit the size of possible transactions,” the Central Bank recommends.

Experts from the Center for Monitoring and Response to Computer Attacks in the Credit and Financial Sphere of the Central Bank of the Russian Federation (FinCERT) said that the most popular method of theft in the Russian Federation is still skimming, in which information about a bank card is stolen using a special device.

The hacker “reader” only needs to be brought within 20 cm of the card with the RFID chip to read the information. A type of skimming is shimming and Black Box - hacking and installation of malicious software into ATMs.

According to the website of the Central Bank of the Russian Federation, FinCERT “has recorded isolated cases of the use of devices capable of reading information from payment card chips. A technical study of these devices is currently being carried out... Using the information received by attackers to create a copy of a payment card is possible, but difficult.”

According to the Zecurion analytical center, in 2017 the number of money thefts from bank cards in Russia may increase by 30% compared to the previous year.

I'll go buy some chocolate for my bank card. I'll eat the chocolate and put my plastic in foil.

Elena Rotkevich

Sberbank comments

We asked the press service of the North-West Bank of PJSC Sberbank to answer two of our questions. We received answers to more questions.

– Are payments made using cards with PayWave/PayPass safe? What to do to protect such a card from intruders?

– The possibility of contactless payment itself does not provide any advantages to scammers: they cannot write off money without your knowledge. You just need to follow basic security rules, and we recommend that you activate the Mobile Banking service.

Answers to possible questions:

– Can fraudsters write off money with a reader, discreetly pressing it against my pocket, for example, in transport, in a store line or in a street crowd?

– A POS terminal “like in a store” cannot be bought by a person on the street. All such devices are registered by retail outlets, money is transferred through terminals to accounts that always have owners - with passport data, tax identification number, etc. If some entrepreneur goes into transport with his terminal to make false sales, he will be immediately identified after the first statement of the victim

The terminal is activated for payment in just a few seconds. During this time, it is very difficult to understand where the wallet is and to approach it within a distance of no more than 4 cm (this is the radius of action of the terminal waves).

If a fraudster made a POS terminal with his own hands and learned to instantly find suitable wallets in a crowd, he would need to accept non-cash payments to some account. There are no anonymous accounts in Russia, which means that a fraudster would not be able to receive money without “exposing” someone’s name.

– If you touch the terminal twice, will the money be debited both times?

- No. The terminal is activated when the cashier enters the amount. This only applies to one payment, and only for a few seconds. As a rule, we hear a sound signal and see a contactless payment icon on the terminal. If you touch the terminal a second time, and the cashier did not enter the amount of the new purchase, the terminal will not “beep” and the operation will not go through.

– If the card is stolen, can the thieves spend all the money?

- Yes. They will not be able to receive cash from your card and will only be able to make small purchases. But in order to track any attempt to pay for something with your card, be sure to activate the Mobile Banking service, with which you will receive SMS notifications about all transactions. If you see that an amount that you did not spend has been debited from your card, immediately call the Sberbank contact center at 900 and block the card.

– Will money be debited from my card for someone else’s purchase if a person pays in a store, and I stand in line very close, right behind him?

- No. To carry out the operation, the card must be right at the terminal, at a distance of no more than 4 cm. It is unlikely that the person in line in front of you will stand so close to you.

– Which card will money be debited from if you touch the terminal with your wallet, and it contains a credit and debit card (both contactless)?

– If there is more than one contactless card in the terminal’s coverage area, the payment will not go through, and the terminal will display the message “Attach one card.” Only you can choose which card to pay from; the terminal will not do it for you.

– Is it possible to reduce the payment limit on these cards without entering a PIN code below 1000 rubles?

– The limit cannot be reduced.

Sberbank was one of the first in our country to actively introduce contactless card payment technology and offer clients a new type of plastic. It can be noted that this is a relatively new offer on the Russian banking products market. Today the bank issues two types of such cards: MasterCard PayPass and Visa payWave. More and more payment machines with special reading devices are also appearing in retail outlets. If the point of sale or terminal is not equipped with a special device, then payment is made using the usual method: insert the card into the terminal, enter the PIN code and confirm the payment.

To receive an innovative product that does not require entering a PIN code, the account holder needs to contact Sberbank and go through a simple registration procedure: provide identification documents and fill out an application.

Sberbank contactless cards look like ordinary Visa or MasterCard, differing from them only in a special icon located next to the logo. This is an icon depicting diverging waves (similar to the Wi-fi icon).

You can pay for purchases with a contactless card in every terminal that is marked with the same symbol. With MasterCard PayPass and Visa payWave, you can pay with one touch for goods and services in chain supermarkets and smaller stores, in some types of public transport, and in catering establishments.

The functions of contactless cards are no different from the usual set of debit cards. This:

- write-off and replenishment in cash and non-cash;

- money transfers and transfers of funds from one owner’s account to another;

- account management using the “mobile banking” and “online personal account” services.

How it works

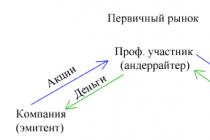

The principle of operation of a contactless card is simple, like everything ingenious. An ordinary Visa is supplemented with a special chip, which has a built-in radio antenna (FRID). Payment information is processed by a terminal equipped to receive radio signals and transmitted to the bank.

The principle of operation of a contactless card is simple, like everything ingenious. An ordinary Visa is supplemented with a special chip, which has a built-in radio antenna (FRID). Payment information is processed by a terminal equipped to receive radio signals and transmitted to the bank.

Thus, in contactless payments there is practically no danger of losing money: Internet technologies have been repeatedly tested and have been working for years, so errors when writing off funds are excluded. The plastic itself interacts less frequently with the terminal and is less subject to mechanical stress, so the risk of premature demagnetization of the card is significantly reduced.

As a security measure for storing funds on a contactless card, the developers have set a limit for quick write-offs: if the amount of a one-time payment exceeds 1,000 rubles, the owner will have to enter a PIN code or sign a receipt (slip) offered by the seller.

It is the ease of use of contactless cards that has brought them widespread popularity. To make a payment, you don’t even need to take the card out of your wallet: just store the payment instrument in the external pocket (so that small change and metal fittings do not interfere with signal transmission).

Payment for purchases is carried out in just three steps:

- make sure that the amount to be written off is accurate;

- For two to three seconds, bring the card to the terminal: with the front or back side (you don’t have to touch the device, but hold the card at a distance of 2 or 3 cm);

- the terminal will notify you of the correct debiting of funds with a sound signal and the inscription “Approved”.

There is no need to be afraid that due to an incorrect movement the scanner will write off the money twice: after the transaction has completed, the terminal considers the operation completed and turns off.

Mobile payments

Payments using the phone are a relatively new, but no longer exotic method of financial management. Developers predict a great future for mobile payments, because a telephone is probably the only thing that a modern person does not part with day or night.

But before connecting contactless payment from a Sberbank account to the phone, the user needs to make sure that the mobile device supports NFC (near field communication) technologies. In addition, you will need a special application.

Android smartphones

The Android Pay™ application is installed on devices running the Android operating system version 4.4 and higher. You can connect mobile payment applications through the Sberbank Online service (the service is free). You just need to find the required account number. In the card information tab there is also the line “Add to Android Pay”.

Another way is to download the application to your smartphone and add the number of the desired card to it. This operation is absolutely safe: the card data is only needed for installation; subsequently, the card number is not stored in the phone.

iPhone on iOS platform

Another mobile system has been developed for iPhone - Apple Pay. Full support for the system is designed for models starting with iPhone 6. Earlier versions do not have full functionality available. The system is connected through the Wallet application, which is provided on the iPhone with factory settings. Five or six clicks - and you can use your phone instead of a bank card. The principle of operation is the same: just touch your phone to the terminal to make a transaction.

Payment for purchases via bracelet

A bracelet for contactless payment is not only a useful tool, but also a beautiful accessory. A mini-card, resembling an ordinary SIM card, is inserted into the bracelet and linked to any card number of the owner.

A bracelet for contactless payment is not only a useful tool, but also a beautiful accessory. A mini-card, resembling an ordinary SIM card, is inserted into the bracelet and linked to any card number of the owner.

How to disable

There are two simple ways to disable contactless payment from a Sberbank card.

The first is to remove the application itself from the mobile device. Without it, you cannot buy using your phone.

The second is to simply turn off the short-range wireless function on your device. To do this, you need to open “Settings”, find the “wireless networks” section and move the slider that disables the NFC module. Why is this method preferable? Because if the owner wants to use contactless payments again, he will have to download the application again and link the card number to the mobile device. And you can turn on wireless communication in a couple of clicks.

For obvious reasons, it is impossible to disable contactless payment directly on a plastic card: it is impossible to remove the built-in chip without damaging the card.

Although Sberbank’s contactless payments are attractive due to their undeniable advantages, they also have a number of disadvantages. The disadvantages include:

- insufficient distribution of terminals capable of receiving a radio signal from a card (this mainly applies to small settlements);

- the likelihood of losing funds up to 1000 rubles if the card is lost;

- the ability for attackers to write off money from a card using special RFID readers at close range.

Good news for public sector employees will be the news that the Mir card, which is serviced using domestic systems, is also, following the others, switching to Sberbank contactless payments. This innovation is convenient, including for pensioners, as it eliminates the need for older people to remember and enter a PIN code on small terminal buttons when paying for daily purchases.

Contactless payment technology is a new product that allows you to make purchases with one touch. Sberbank was one of the first to actively implement the innovation in May 2017, and to date, the volume of payment instruments with a built-in NFC chip exceeds 15 million (which is 11% of the total number of cards issued by the credit institution).

The Bank also continues to modernize its POS terminal network, making them suitable for new technology.

The organization's management notes that thanks to the use of Sberbank contactless cards, their owners will reduce the amount of time spent on standard payment for purchases. It is now expected that new cards issued by the institution will be contactless.

Features of contactless technology

The Sberbank contactless bank card is in a sense a standard card, but it has special technology built into it. With its help, you can make quick purchases, the amount of which does not exceed 1000 rubles (otherwise you need to enter a secret code).

The plastic contains an NFC chip (Near Field Communication, translated as “near field communication”), it transmits information about the completed payment to the bank via radio channels.

To actively use this innovation, you need to have a device that can receive radio signals. Therefore, you can pay using an NFC card only in places where POS terminals are installed.

Features of the procedure

Payment with a contactless card has a distinctive feature: to make a purchase, you do not need to insert the card into an outdated terminal and enter a PIN code; you just need to touch it to the reader.

Step-by-step instructions for the payment procedure:

- Please check that the displayed amount is correct.

- Touch the card to the POS reader.

- Wait until the message “Approved” is displayed on the screen and a characteristic sound signal is heard.

- Remove the card.

Today you can pay contactlessly for purchases in any shopping center, fitness club, supermarket, cafe or restaurant. And in a number of large Russian cities, you can use this card to pay for a travel ticket by installing the Troika application, which is available on both Android and IPhone.

Main advantages of contactless technology

Sberbank's NFC card is rapidly gaining popularity in the Russian market due to a number of significant advantages.

Among them:

- Comfort. It is convenient to use cards because there is no need to insert them into terminals; you just need to attach them to a special device. It is noteworthy that you don’t even have to take them out of your wallet or business card holder. This helps when paying payments when your hands are full of all kinds of packages.

- Simplicity. Now there is no need to remember PIN codes and constantly enter them. To make a purchase, you just need to take your card with you and apply it to the terminal.

- Instant payment processing. Any monetary transactions take place very quickly, without taking away precious time from the debit card owner.

- Reducing technical errors. Contactless technology keeps you safe: Since the plastic no longer has direct contact with the terminals, the possibility of demagnetization of the black magnetic stripe is reduced. Service life increases.

- Safety. By making a one-touch payment, you can protect your card details from illegal photo and swipe devices used by fraudsters.

Main disadvantages

Although contactless cards have a number of undeniable advantages, they also have disadvantages:

- Impossibility of use. Creating maps is not difficult, but not all terminals are able to support them. This is the main circumstance preventing the mass distribution of contactless programs and technologies.

- Limit. To protect customers, special payment restrictions have been introduced, beyond which you cannot pay with a card. This is due to the fact that the system cannot guarantee absolute protection from hackers and intruders. There have been precedents when fraudsters used homemade RFID readers to steal money from people. Therefore, this protective option cannot be disabled.

If attackers manage to steal a means of payment, they will be able to safely make purchases not exceeding 1,000 rubles, since this does not require a secret code.

What does a contactless card look like?

In appearance, the card is no different from ordinary types; it can be identified by the presence of logos and symbols.

For example, the universal logo of MasterCard and Visa contactless payment cards is a wave icon, similar to an inverted Wifi icon.

The front side contains the following information:

- FULL NAME. owner.

- Validity.

- Distinctive sign.

On the reverse side, like a contact card, the CVV code is displayed.

What does it have:

- Possibility of storing funds.

- Possibility of debiting and replenishing current accounts.

- Possibility of payment for purchases.

- Possibility of money transfers.

- Management of monetary assets through special Internet services and Sberbank programs.

Which Sberbank “plastic” supports the technology?

Now Sberbank is re-issuing and offering new clients to become the owner of a Mastercard or Visa contactless payment card. Also, not so long ago, an alternative appeared to pay using the Sberbank Mir contactless card, which are also equipped with this technology..

There are the following types of Visa cards:

- Visa Classic. The classic visa has a basic set of options, the cost of the first year of use is 900 rubles, then it decreases to 600 rubles.

- There are two types of Visa Gold from Aeroflot: debit and credit. Its peculiarity is the ability to receive bonus miles, which can later be used to pay when purchasing airline tickets from Aeroflot and SkyTeam. You can apply for it at any bank branch, and one thousand welcome miles will be immediately credited to your account. Maintenance costs 3,500 rubles/year. Owners of these cards also have access to a variety of discount programs from the World of Privileges. The credit limit is 600 thousand rubles.

- Visa Platinum. Opens access to Sberbank Premier services and provides many pleasant bonuses.

- "Gift a life". As part of this program, a fixed share of purchases made is transferred to a charitable account of an organization that provides financial assistance and support to children with cancer. Annual maintenance is 15 thousand rubles for the first calendar year, then reduced to 10 thousand rubles per year. The cardholder enjoys any benefits and bonuses: enhanced protection against fraudsters, an insurance program, an increase in the warranty period, support abroad and other privileges.

Offers from Mastercard:

- MasterCard Classic is a classic debit card. Has a list of standard options. Use will cost 900 rubles for the first calendar year, then decreases to 600 rubles.

- MasterCard Premier - provides full access to Sberbank Premier services. It is noteworthy that one person can issue no more than 5 means of payment for himself or loved ones.

You can exchange, issue or replace contactless payment methods today at a Sberbank branch convenient for you. You only need to submit the appropriate application in advance, which can be done in writing at a banking institution or sent an application online via the Internet.

If you are the owner of an ordinary contact bank card, you can also contact the branch with a request to replace it with a contactless one. In this case, the personal account remains unchanged.

Is it possible to disable contactless payment?

Despite the fact that contactless payment is gaining popularity, many are suspicious of this innovation. Which is justified due to the high level of various banking crimes. For your own peace of mind, you can disable contactless payment on your card, but you should make sure whether this is necessary.

There are two ways to disable the contactless payment feature:

- Removing the corresponding application on the phone (the official Sberbank program, available on IOS and Android).

- Disabling the NFC chip in the phone settings. To do this, you need to open the “Wireless Networks” section in the settings and switch the module to the off state.

Both of these options will eliminate the need for contactless payment. It is noteworthy that after deleting the application from the gadget, you do not need to disable the NFC module. Contactless payment will already be deactivated.

You can activate contactless payment at any time. To do this, you do not need to contact the bank for help, just reinstall and configure the application or put the module into operation mode.

Contactless payment via smartphone

Another innovative offer from Sberbank for its clients is the ability to make payments using a smartphone. Thanks to this innovation, there is no need to take an outdated plastic card everywhere. The role of payment instrument will be performed by the telephone. To carry out transactions, the same NFC technology is used, which is based on the principles of radio communication with a certain coverage area.

To pay bills by phone you need to:

- The gadget had an NFC chip;

- A special application was installed;

- Reading devices were installed at the payment point.

The algorithm for carrying out the procedure is as follows: bring the smartphone to the device and wait until the transaction is completed. As a rule, the exchange of information between the bank and the terminal takes place instantly, it does not take more than 1-2 seconds.

You can find out whether your smartphone supports NFC technology yourself. Check its case or battery: if they show the NFC icon (wave icon), then the technology is supported. Also, you can “dig” into the settings and determine.

The following contactless systems are currently operating in Russia:

- Samsung Pay. This system is supported by 6 phone models, which is an absolute record (other developers cannot boast of such an abundance of counterparties). The pricing policy of companies supporting this technology is quite affordable; smartphones can be purchased at a reasonable cost. Also, the application has an image of a magnetic strip, which makes it possible to use it in standard terminals.

- Apple Pay. Sberbank is the first and only Russian bank cooperating with Apple. The application is supported exclusively by original flagship smartphones, starting with the sixth version (Apple iPhone 6). No more than 4 devices can be linked to the system; a scanned fingerprint is required for operation.

- Android Pay – this payment system is developed by Google and is built into Android-based gadgets. Among the advantages are: a wide variety of partner banks; automatic linking of savings and discount cards; opportunity to participate in bonus programs.

All systems are similar in functionality, methods of conducting transactions and security systems. The setup algorithm is the same: you need to install the application corresponding to the phone model; switch the NFC module in the settings to active mode.

Contactless payment via cards or smartphones still seems incredible and untrustworthy. A certain proportion of Russians are skeptical about innovative technology, but this mistrust is gradually subsiding, and perhaps in the near future this payment method will become firmly established in everyday life.

Theft of money from cards has always been a common type of fraud. But with the advent of contactless payment cards, it has become even easier for criminals to steal other people's funds. If you are the owner of contactless Visa PayWave or MasterCard PayPass cards, then you are at risk when your money can be withdrawn from your account very quickly and unnoticed.

Contactless cards: convenience of payments and increased risks

Banks offered their clients new cards equipped with contactless payment technology - Visa PayWave and MasterCard PayPass. The purpose of their issuance is to facilitate payments and reduce the time spent on financial transactions. These cards are different in that there is no need to swipe them through the terminal. You just need to bring them to the reader and the money will be written off. There is no need to even take the card out of your wallet. When paying for goods or services worth up to 1000 rubles, you do not need to enter a PIN code. You just need to present the card to the reader. Paying with them has become fast and convenient.

But it is precisely the fact that money can be debited from a card remotely using a special device and without the need to enter a PIN code or sign, which has made them easy prey for scammers. The Zecurion company estimates that in the first quarter of 2016 alone, about 1 million rubles were stolen from such cards.

Did you like the Video?! Subscribe to our channel!

How does theft happen?

To withdraw money from a contactless payment card, a fraudster just needs to purchase or make his own special reading device and bring it closer to the victim at a distance of up to 20 cm. Even at this distance, the device reads the data from the card.

Contactless cards are equipped with special RFID chips, and devices that allow you to obtain information from them are called RFID readers. The fraudster just needs to bring it as close to the card as possible. So that the victim does not notice anything, thefts usually occur in crowded places - public transport, a market, a crowd of spectators at a concert, etc. The criminal simply places the device near the person's pockets or bag without him noticing. There is no need to even bring it too close - 10-20 cm is enough. A few seconds, and all the data is in his hands.

The criminal either uses them to make payments through online stores that do not require entering a password or CVV code. However, there is a restriction for contactless card holders - the transaction amount should not exceed 1000 rubles, only in this case there is no need to enter security data. But there are no restrictions on the number of transactions, so the fraudster can carry out several of them until he has used all the available funds on the victim’s card.

Also, some criminals produce “white cards” on which a magnetic strip is applied with the victim’s card data. Then they withdraw money from an ATM.

Some statistics

According to statements by the information security company Zecurion, more than 2 million rubles were stolen from contactless cards of Russian citizens in 2015. As the number of users of such cards increases, money thefts will correspondingly increase. Zecurion experts predict that at least 2.5 million rubles will be stolen in 2016; by 2017, this figure could reach 5 million rubles.

How to protect yourself

It is almost impossible for the owner of a contactless payment card to protect himself from a fraudster, since in the crowd in which the criminal operates, it is very difficult to notice him, especially considering the fact that he uses the reader secretly. Therefore, you can find out about the theft of money only after it has been written off from the card. But there are ways that help reduce the risk of theft of funds:

- The maximum amount that can be debited from the card without having to enter a PIN code is 1000 rubles. However, it is possible to write an application to the bank to reduce it. This will allow you to lose a smaller amount of money in case a thief manages to steal your card data.

- It is recommended to enable SMS notification of any transactions made from the card. This will allow you to detect theft in time and block the card. Despite the fact that there is a limit of 1,000 rubles for conducting transactions with a contactless card, the fraudster can make several payments. By activating SMS notification, you will be able to find out about the theft of funds after the first transaction and prevent all the money from being written off from the card.

- Be careful and attentive in transport.

There are also wallets and cases on the market that claim to protect your card from being swiped, but no studies have been conducted on whether they can actually prevent theft or not. Therefore, there is no need to rush to buy them.

Once again talking about technological innovations and interesting solutions in the banking product line, one cannot fail to mention the services and convenient services sold by Sberbank. This article will talk about contactless Visa PayWave and MasterCard PayPass cards.

What is a contactless card

Contactless cards appeared quite a long time ago, their introduction dated back to 2002, but the trend in the market of domestic banking products is quite new. As one of the innovators, Sberbank is participating in the implementation of this technology.

A contactless card is a regular plastic bank card with a embedded chip with a radio ribbon (FRID). This technology is relevant when paying for fairly large purchases over a thousand rubles.

Banks offering the best credit cards

| Bank | Peculiarities | Application method |

| No failures | ||

| Instant application processing | ||

| 100 days without interest |

Using a POS terminal, the information read from the card is transmitted via a radio channel to the bank. Also, one of the advantages of the technology is that there is no need to enter a PIN code from a bank card or use a dispenser to read the card.

ATTENTION: if the store cannot provide a POS terminal for reading information from the chip, then in this case the contactless card can be used as a regular one.

To ensure the safety of users of contactless cards, Sberbank sets a limit of 1000 rubles for withdrawing money when making a purchase and using payment using a chip. That is, you can pay for a purchase worth over a thousand, but you will need to enter a PIN code.

How to use a contactless card

Now let's figure out how to use a contactless card.

- First of all, you need to make sure that the amount specified for the purchase at the checkout is accurate.

- Next, you bring the contactless card to a special device (POS terminal) and hold it near it for a few seconds. You can also attach the card directly to the screen.

- After the radio signal is read, a payment notification will be displayed on the terminal display. If your amount to pay for the goods exceeds a thousand rubles, you will need to enter a PIN code.

What is typical is that the radio signal from a bank card can be read by the terminal even when it is in a wallet or business card holder.

This technology for contactless payment for purchases has been introduced in large cities, in hypermarkets, shopping centers, etc.

And in Moscow, using a similar card, you can pay for travel in the Troika application. Using this application you can pay for travel on public transport.

Contactless cards from Sberbank

Externally, it is quite difficult to distinguish a contactless card from a simple plastic one, because the basic standards of appearance are characteristic of all types of cards. This includes the presence of details on the card:

- Owner's name.

- Card expiry date.

- and etc.

The main difference is a special sign.

In addition to the possibility of contactless payment, the rest of the functionality of this bank card is quite standard:

- You can pay for various purchases and bills both in stores and online.

- A fairly convenient compact means of storing funds.

- Used all over the world.

- Using special mobile applications, you can manage your finances remotely.

Currently, Sberbank offers its clients contactless bank cards from the VISA and Mastercard payment systems.

Additional Information:

Visa PayWave cards: types and features

Now let's look at the types and features of contactless bank cards.

- Aeroflot Visa Gold Debit Card: like its regular counterpart, this card allows you to accumulate additional bonus points or miles for program participants from Sberbank, and use them to pay for tickets at Aeroflot and its branches. Servicing this card costs about 3,500 rubles per year. You can find out more about the features of this card.

- If you are the owner Visa Gold credit card Aeroflot, then you should know that the total credit limit on this card is about 600 thousand rubles. But the loan rate will be in the range of 25.9-33.9% per annum. The cost of servicing this card per year is the same as that of a debit card, and is about 3,500 thousand per year. This card also allows you to accumulate bonus miles.

- As for classic type contactless bank card visa paywave, then everything is also standard here. Starting from the range of services and ending with the cost of annual service, which is 900 rubles in the first year of service and 600 rubles in subsequent years. If additional cards are issued, they also have the ability to make contactless payment for services.

- Another type - Visa Platinum Premier. The peculiarity of this card is a wider range of services and other additional privileges that are provided to its owners. The card will be available to you if you purchase a package of services from Sberbank “Sberbank Premier”.

- Another interesting card from Sberbank is . A special feature of this card is the opportunity to help children fight incurable diseases. When paying for purchases using “Visa platinum Give Life”, a certain amount (a small percentage) is transferred to a charitable foundation. The cost of servicing the card is 15,000 rubles per year, in subsequent years - from 10,000. More details about the capabilities of this card and its advantages can be found on the official website of Sberbank.

Types and features of Mastercard PayPass card

Now let's go over the types and features of contactless cards from the Mastercard system.

- WorldMasterCardBlackEdition Premier: This card is characterized by the fact that it has functionality similar in basic capabilities to the visa platinum Premier.

- If you subscribe to the Sberbank Premier service package, you can issue up to 5 premium cards for yourself and your loved ones.

- As for the contactless classic Mastercard, the range of services for it is also standard, the cost of annual service is 900 rubles and is otherwise similar visa classic.

Advantages of contactless bank cards

At the beginning of the article, we wrote that the technology that makes it possible to make contactless payment for purchases is quite new, but is rapidly gaining popularity among domestic banking clients. This is due to the fact that it allows you to save a lot of time without having to linger at the checkout with purchases.

- Fast payment for purchases in the store. Since the radio signal from the card to confirm the purchase is sent instantly, there is no need to wait for confirmation of the transaction through standard communication channels.

- The card is very easy to use. There is no need to insert it into the reader and enter a PIN code. You just need to bring your card to the payment terminal and the transaction will happen automatically.

- The service life of such a card is longer than that of a regular one. This is explained by the fact that there is no physical contact with the reader, and damage and demagnetization of the magnetic strip are eliminated.

- The card has higher security compared to a regular card, since when making a payment, you do not let it out of your hands, which reduces the risk of falling into the hands of an attacker.

Disadvantages of contactless bank cards

Now let's go over the main disadvantages that this progressive technology has not avoided.

- The main, but not least, disadvantage is the relatively high cost of installing special signal readers from such bank cards. Not every store can afford this, even despite the convenience of customers. In this regard, contactless payment technology has become widespread only in large cities and large shopping centers. At the same time, technology is developing, which will eventually lead to cheaper equipment.

- Fraudsters have also not ignored the technology, and are making special fake RFID readers, which allows them to steal money from contactless bank cards. However, to protect your credit cards, banks recommend using special cases that shield the radio signal.

- If you are a resident of a large metropolis, then the established limit of 1000 rubles for a one-time purchase payment may leave you with a negative impression. Because in this regard, you will have to enter a PIN code. But for the sake of safety, this inconvenience should not cause a storm of negative emotions, because the safety of money is more important.

I like 86 I don't like 66