At the very beginning of working on Forex, along with training, a novice trader needs to decide on a time interval. First of all, the optimal forex trading time depends on the chosen strategy. Whether it will be aggressive trading (scalping), intraday trading online or using pending orders, this will be determined by the trader himself. But before that, a beginner in the Forex market must know what trading sessions there are and how currency pairs behave at different times of the day.

Forex trading time

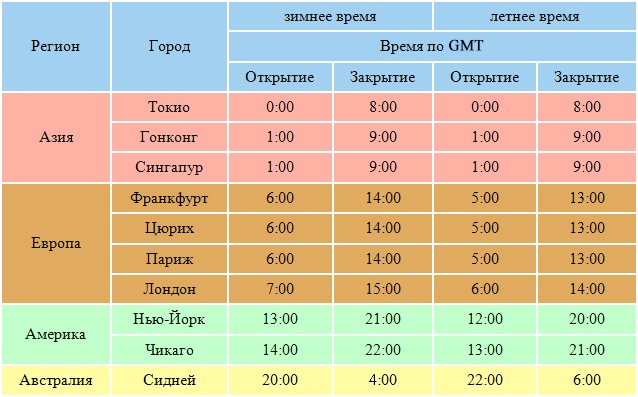

On Internet portals you can often see that analytics or news are published on time Greenwich GMT. This is a standard value and the start of trading is tied to this exact time. But in order not to get confused in the Forex broker’s terminal, in the “beginning of trading sessions” column there is a function where the trader indicates the time of his time zone (Fig. 1). For example, in Moscow the time is GMT+3, which means that if the trading session in London opens at their local time at 8:00, then in Moscow the time is GMT+3, that is, 8 + 3 = 11 o’clock in the afternoon, and so on. This can be clearly seen in the figure below. The trader must determine for himself what time he will trade, Greenwich Mean Time, Moscow or local time, depending on his personal wishes. Why you need to know the start time of Forex trading, depending on the trading session, is described below.

Fig.1. Start and end times of Forex trading on world trading platforms

Total on Forex four trading sessions and they are named depending on their geographical location. This Pacific trading session , where the main trading floors are in Wellington (New Zealand) and Sydney (Australia). Further Asian session -Tokyo, Hong Kong, Singapore. After European session (Zurich, Paris, London) and American (New York, Chicago). The start time of each session is visible in the schedule that most Forex brokers have. Trading begins at 00:01 Moscow time (local start time 22:00), on Monday during the Pacific trading session. Ends at 01:00 Moscow time. Saturday with the close of trading on Chicago trading floors.

Rice. 2. Crossing trading sessions

Movement of a currency pair depending on the session

To begin with, a trader must understand that the end of one session does not mean the beginning of a second. Forex trading sessions overlap in time (overlap each other) and it is at this time that volatility in the market increases.

Time of low and medium volatility

During the Pacific session, the movement of currency pairs is almost minimal. Intensity of movement of the main currency pairs EUR/USD, GBP/USD, USD/JPY at this time is close to zero (low). Trade is mainly carried out in the New Zealand and Australian dollars, since it is at this time that economic news for these countries comes out. Then, late at night in Moscow, trading begins on sites in Tokyo, Singapore, and Hong Kong (Asian session). These are quite large trading platforms and there are quite large players in the foreign exchange market. Forex trading time in the range from 03:00 to 06:00 MSK is characterized by the movement of average volatility. If someone trades the USD/JPY pair, then it is at this time that important economic news comes out in Japan, which determines the movement of this pair.

Best Forex Brokers

Alpari is the undisputed leader in the Forex market and today the best broker for traders from Russia and the CIS countries. The main advantage of the broker is reliability, confirmed by 17 years of work. Alpari gives traders the opportunity to earn and withdraw profits.

Roboforex is an international broker of the highest level with CySEC and IFCS licenses. On the market since 2009. Provides a range of innovative tools and platforms for both traders and investors. It is famous for its excellent bonus program, which includes a free $30 for beginners.

Optimal Forex time for intraday trading

When the European session begins, but the Asian session has not yet ended, increased volatility is observed on Forex 10:00 - 12 (13:00 MSK). This is also due to the fact that at the beginning of trading in Europe, important economic news in the Eurozone comes out. After the release of this news, the market awaits the opening of trading in the United States. The intersection of the European session and the North American session is considered the best time for traders who trade using the scalping strategy, as well as for those who trade the main currency pairs EUR/USD, GBP/USD, USD/JPY. This time is from 15:00 (opening of trading in New York) to 19 (20):00, when trading floors in continental Europe and London close. After Europe closes, trading intensity decreases, and after Chicago closes, the intensity almost disappears.

Best regards, Alexander Ivanov

Knowing the schedule of trading sessions on Forex means being able to rationally distribute your efforts and effectively use opportunities and time. Trading sessions are periods of time when banks are open and actively trading. As you know, Forex trading hours are not limited and it operates around the clock. When evening comes in one point of the world and trading there closes, morning comes in another point and the local foreign exchange market begins to work. Sessions follow each other or partially overlap one another, so traders can trade at a time convenient for them. By logging into Forex at any time, you will find it in working order, except for Saturday and Sunday, when the stock exchanges in all countries have a day off. Forex also does not work on holidays, such as Christmas, New Year and Easter.

Knowing the schedule of Forex trading sessions is also useful because currencies behave differently in different sessions. Thus, the yen usually “comes to life” and begins to move actively during the Asian session, and trading in the euro intensifies during the European session. The rest of the time, sharp price movements are uncharacteristic for these currencies. The most “aggressive” of all - the American session - can greatly reduce or, conversely, strengthen its “native” dollar.

Due to the fact that the foreign exchange market involves so many countries from different time zones on Earth, Forex trading hours were previously usually calculated in Greenwich Mean Time (GMT) to eliminate confusion. Currently, the GMT standard is considered obsolete and UTC - Coordinated Universal Time is used instead. Server time in RoboForex differs from UTC by 2 hours (UTC+2). In the summer, due to the transition to daylight saving time, this indicator becomes equal to UTC+3.

Forex trading sessions schedule - Forex opening hours. Time zone UTC+2 (Eastern European Time, EET):

| Region | City | Opening | Closing |

|---|---|---|---|

| ASIAN (Asia) | Tokyo | 2:00 | 10:00 |

| Hong Kong | 3:00 | 11:00 | |

| Singapore | 2:00 | 10:00 | |

| EUROPEAN (Europe) | Frankfurt | 8:00 | 16:00 |

| London | 9:00 | 17:00 | |

| AMERICAN (America) | NY | 15:00 | 23:00 |

| Chicago | 16:00 | 24:00 | |

| PACIFIC | Wellington | 22:00 | 6:00 |

| Sydney | 22:00 | 6:00 |

Each regional Forex market has its own characteristics.

Asian market - Forex opening hours

During this trading session, the most active transactions are in the exchange market of American dollar to yen (USDJPY), euro to yen (EURJPY), euro to dollar (EURUSD) and Australian dollar to American dollar (AUDUSD).

European market - Forex trading hours

The trading schedule in Europe is much different from that in Asia due to the difference in time zones. Frankfurt opens at 8:00 CET, London at 9:00. At this time, trading is held in European financial centers. The volatility of the most popular currency pairs increases significantly after the start of the Forex trading session on the London market. Trading activity decreases somewhat towards lunch, but in the evening players are again actively making transactions. Changes in rates during the European trading session can be significant, since the bulk of funds are concentrated in Europe.

American market - Forex opening hours

The busiest Forex transactions begin with the opening of the New York session. During this Forex trading period, US banks begin their trading activities, and European dealers also return after their lunch break. The influence of European and American banks is approximately the same, so there are no significant changes compared to the European trading session on Forex. However, after the European market shuts down, volatility may increase. This is often observed on Friday evenings, before the weekend. The American session is more aggressive in trading than others.

Directly in front of you is a multifunctional living online price chart. You can view any tickers of all stock exchanges in the world. You can see asset quotes in real time. If you do not know a specific ticker, enter the company name instead, you will get a list with possible options.

Also available on the chart is setting a time interval, installing your own indicators, setting up different types of displays, as well as using other features of the live chart.

In the upper right corner you can see the inscriptions delayed And closed.

- delayed (detainees) is the time of pre-market or after-market, when orders are accepted by the exchange, prices for new contracts between buyers and sellers are established.

- closed (closed) - this means that trading is currently closed. This is due to the fact that the exchange is currently closed (after hours or weekends).

Live price chart online displays quotes according to Moscow time. (If you don't see the graphs, please refresh the page). Below you will find detailed instructions on how to manage your price chart online.

Live price chart

Chart settings instructions

Asset selection

By default, the charts show Amazon shares and the EUR/USD currency pair. These assets are selected as an example, but you can specify the asset you need. If you want to select other assets, then you need to delete the current ticker in a special field, and an extensive menu with all assets will immediately open in front of you, divided into categories -, and others. If you know the ticker of the desired asset, then you should simply enter it in the field. For example, the Google ticker is written as GOOG. If you don't know the ticker symbol, then you can enter just the company name and the smart search will give you options to choose from.

Chart time interval

Chart time interval

Don't forget that the online price chart has different time intervals. Following the selection of the desired asset will be a unit. This is the time frame setting, which is equal to one minute. You can set the chart to an hourly or daily interval, where each candle or bar will be equal to the value of the interval. Viewing different intervals can be useful in technical analysis, identifying trends, drawing support and resistance lines, and setting up indicators.

Indicators on a live chart

Indicators on a live chart

In the chart menu, in the center, there is an INDICATORS button. Clicking on it will open a menu of indicators. Some indicators can be a real godsend for you. are able to reflect the current market mood and predict the future price direction. There are many types of indicators that display trends, volumes, volatility, overbought or oversold assets. Current charts have the ability to include many indicators at the same time.

Types of charts

Types of charts

Also in the menu settings of the live online price chart there are buttons with settings for displaying the price line, for example - bars, Japanese candles, line chart and other price display options. These tools can be part of technical analysis. By default, the charts are turned on, which show maximum information and are of great importance in technical analysis. But besides them, you can choose other types of price display, for example, Renko or Kagi. It is worth saying that the most convenient charts remain 2 types - Japanese candlesticks and a simple linear view or Area. Two extremes of display - from maximum information to minimum.

Settings for professionals

Settings for professionals

On the left there is a strip with tools for constructing technical analysis on the chart manually. These tools are for advanced traders who want to build additional support and resistance levels and build their own calculations without using indicators. These methods are suitable only for those who are very well versed in technical analysis or have their own strategies.

Popular stock tickers:

Apple - AAPL

Google - GOOG

Facebook - FB

Cisco Systems - CSCO

Intel Corporation - INTC

Deutsche Bank - DBK

Barclays - BARC

British Petroleum–BP

Coca Cola Company - KO

Amazon.com - AMZN

Microsoft - MSFT

Sberbank of Russia - SBER3

Bank of America - BAC

JPMorgan Chase - JPM

McDonalds – MCD

Twitter – TWTR

Walt Disney–DIS

Daimler AG – DAIGn

Gazprom – GAZP

Rosneft – ROSN

Renault - RENA

Toyota Motor - TM

If you find an error, please highlight a piece of text and click Ctrl+Enter! Thank you very much for your help, it is very important for us and our readers!

Forex opening hours allow traders to trade at any time of the day. Currency transactions are carried out 24 hours from Monday to Friday. Saturday, Sunday and national holidays are non-working days.

Differences between stock exchange and over-the-counter exchange

The international financial market "Forex" opened in 1976, when states began free exchange of currencies in connection with the abolition of the "gold standard". The over-the-counter market ensured the movement of capital between countries and contributed to the preservation of the economy.

Participants in the foreign exchange market say “Forex exchange”. But this is an incorrect name for the item; the differences are presented in the table.

Participants in the foreign exchange market say “Forex exchange”. But this is an incorrect name for the item; the differences are presented in the table.

Entity | Interbank over-the-counter currency exchange |

Centralized site | Does not have a single platform |

State legislative regulation of stock, currency, futures, commodity, options markets. | There is no government regulation, the currency is traded at free prices |

There is a market order book, showing open interest and trading volumes | No information provided |

Trading takes place through a broker. The broker is interested in the number of transactions. The broker and exchange receive commissions on each transaction. The broker's interest is for the client to work on the stock exchange for as long as possible. | Relationships are built between the client and the dealing center. The center works as an exchange office; whatever price it wants, that’s what it will set. Interested in the client's loss. |

If the decision to trade currency is finally made, then you should establish relationships with licensed brokers who have access to legal trading platforms in Russia and the world - the Moscow Exchange, NASDAQ or NYSE.

Working hours of world exchanges

To create a Forex trading schedule for your own trading, you should know the schedule of currency exchanges in North America, Europe and Asia. It should be borne in mind that national holidays are non-working days only in the country where they are established. For example, Catholic Christmas is a working day for stock exchanges in the Muslim world.

The Asia-Pacific region's sites begin the day. For all exchanges, Forex operating hours are indicated in Moscow time.

- Sydney is open from 1am to 9am.

- Tokyo - from 3 am to 11 am.

- London starts at 10am and trades until 6pm.

- North American stock exchanges are the last to open in the day. The start of operations in New York is 4 o'clock in the afternoon, the end of trading is at midnight. In Chicago, the schedule is shifted by an hour: opening at 5 pm, closing at 1 am.

Optimization of trader activities

Knowledge of the operating mode of centralized trading platforms will allow you to optimize your working day and increase the effectiveness of your trade. Let's consider the operating hours of the world Forex exchanges in a complex.

- Sydney and Tokyo overlap from 3am to 9am.

- London and Tokyo operate simultaneously from 10 to 11 am.

- London and New York coincide in the evening from 16 to 18 hours.

- London and Chicago trade synchronously from 17 to 18 pm.

Forex trading hours Moscow time during crossing hours are the most productive for a trader. These intervals are characterized by a large number of participants and high daily transaction volumes. The largest currency transactions are made during the specified periods. The risk of making an unsuccessful trade is lower, and the chance of making a profit is higher.

Forex trading hours Moscow time during crossing hours are the most productive for a trader. These intervals are characterized by a large number of participants and high daily transaction volumes. The largest currency transactions are made during the specified periods. The risk of making an unsuccessful trade is lower, and the chance of making a profit is higher.

A foreign exchange trader would love to have a Forex Clock on his computer desktop. They show how much is left before the start and end of trading on world exchanges trading currency pairs, and also display a banner on the screen about the closing and opening that has occurred.

News to help traders

Each day of the working week in the foreign exchange market has its own characteristics. The start of Forex trading on Monday in terms of volume, volatility and starting price is largely determined by the news background of the weekend.

A trader needs to know the release schedule of news about global events in the world for each region where exchanges are located. You should focus on the current trading charts an hour before the news announcement and an hour after the news release. Terrorist acts and local military actions, speeches by the head of the Federal Reserve System - these events have a strong impact on exchange rates, as they significantly affect the economy.

A trader needs to know the release schedule of news about global events in the world for each region where exchanges are located. You should focus on the current trading charts an hour before the news announcement and an hour after the news release. Terrorist acts and local military actions, speeches by the head of the Federal Reserve System - these events have a strong impact on exchange rates, as they significantly affect the economy.

The hottest battles in the foreign exchange sector occur between 4 pm and 6 pm, when the exchanges of London and New York trade synchronously. Even a novice trader, if he carefully plays with small amounts, can make a profit during this period.

Holidays - for relaxation

Competent traders who have experienced financial ups and downs and have over 20 years of experience trading currencies, remind you to be careful when trading on holidays, since on holiday days there are a small number of participants and low trading volumes.

When choosing Forex, you need to start from the type of currency pair that the trader is trading. If your area of interest is the yen, then welcome to the Tokyo Stock Exchange. It is convenient to trade pairs "Australian dollar - yen", "euro - yen", "dollar - yen". On the charts you can see that the euro falls before the opening of the Shanghai Stock Exchange, and then begins to rise. The reason lies on the surface - with China they pay for exports in dollars, but they have to buy euros. It is rare, but there are cases of purchases of dollars by China.

When choosing Forex, you need to start from the type of currency pair that the trader is trading. If your area of interest is the yen, then welcome to the Tokyo Stock Exchange. It is convenient to trade pairs "Australian dollar - yen", "euro - yen", "dollar - yen". On the charts you can see that the euro falls before the opening of the Shanghai Stock Exchange, and then begins to rise. The reason lies on the surface - with China they pay for exports in dollars, but they have to buy euros. It is rare, but there are cases of purchases of dollars by China.

So, a trader should have within his reach:

- operating modes of world exchanges;

- period of release of news blocks;

- calendar of events for the year: Federal Reserve meetings, tax payments, etc.

Compliance of schedules and mode

But it’s not enough to know Forex trading hours and a summary of political and economic news. The graphs should be examined to identify patterns. Each exchange has its own characteristics, each currency has its own periods of growth and depreciation.

An observant trader will note that on the exchanges listed above there is a period of silence - from 6 to 9 am Moscow time, when there are few participants and volumes are small. This is objectively explainable: Asia has finished trading, but Europe has not yet started.

The battle resumes at 9 o'clock and lasts until one o'clock in the afternoon. During these hours, news from continental Europe and Great Britain comes out.

The peak hour for foreign exchange trading is between 4 and 6 p.m., when North American exchanges, large funds, banks and wealthy traders enter the fray. On the chart of the dollar and euro in the specified period, there is high volatility and growth of the dollar, while the euro usually falls.

The peak hour for foreign exchange trading is between 4 and 6 p.m., when North American exchanges, large funds, banks and wealthy traders enter the fray. On the chart of the dollar and euro in the specified period, there is high volatility and growth of the dollar, while the euro usually falls.

But you should always remember the risks and make transactions carefully.

Trading and emotions

Here it is appropriate to recall the psychology of trading. Forex trading hours, as stated above, are 24 hours a day. But the trader needs to control the length of time he spends at the computer. It is enough to devote one hour a day to studying the rules of trading. Two hours to get acquainted with the news flow. Half an hour for a deal. You shouldn't turn into a slave of Forex. In life there is not only the foreign exchange market.

Speculation on Forex is not a completely correct strategy. Fundamental analysis helps determine currency movements. A long-term game will bear greater fruit than speculation.

If the game doesn't go well, you shouldn't win back. An unsuccessful trade should be analyzed, think about the correct choice of instrument for trading, and check the planned entry points again. And then it will not be the hours of Forex availability that will manage the trader’s capital, but the trader will manage time.

The foreign exchange market has no break between lunch and sleep, so we have to talk about a 5-day working day. Theoretically, you can trade either early in the morning or at 3 am, but the volatility at these hours will be different. So trading time must be taken into account when choosing currency pairs and choosing a trading strategy.

However, Forex trading times still require breaks - on Saturday and Sunday, the vast majority of trading participants stop their activities. Transactions can be concluded on weekends, but this is the prerogative of large players; this opportunity is not available to an ordinary trader. This is what explains the gaps after the weekend.

Also, trading is not conducted on holidays, such as New Year or Christmas. Although there are exceptions to this rule, financial institutions in Muslim countries can enter into transactions. But the volumes are minuscule compared to the volumes of a regular trading day.

How to take into account trading time in Forex?

There are several main trading sessions in the world:

European (most transactions are concluded in several powerful financial centers). Working hours in cities such as London (working hours 06:00 - 14:00 GMT), as well as Paris, Frankfurt am Main and Zurich (working hours the same 5:00-13:00 GMT) are taken into account;

- Asian session (Singapore and Hong Kong, working hours 01:00-09:00), as well as Tokyo (00:00-08:00);

- those who like to trade commodity currencies should also take into account the opening hours of Wellington 00:00-08:00 (New Zealand), as well as Sydney 01:00-09:00 (Australia);

- The American session falls on the periods 20:00-05:00 (Los Angeles), 17:00-03:00 (Chicago), and New York 16:00-02:00.

If you compare the opening hours of these financial centers, you will see that there is not a single hour of silence throughout the day, which is why they talk about a five-day working week in the market. But this does not mean at all that the trading system will give signals to enter the market at any time of the day.

Forex trading time is usually taken into account at the stage of drawing up a trading system. For example, if the main pair is EUR/USD, then the American and European sessions will be of great importance.

When is the best time to trade?

Trading volumes are distributed extremely unevenly across the listed sessions. When London financial institutions come into play, they can enter into transactions whose total volume can easily amount to up to 30% of the total daily volume.

The same surge can be observed when trading begins in the United States. The influence of transactions concluded by American banks and exchanges increases due to the fact that the beginning of trading quite often coincides with the release of important statistics for the United States and the eurozone. It is at the start of the American session that a surge in the market is often observed.

Some of the most popular currencies on the market are USD, EUR, GBP, JPY. But it is foolish to expect that the Asian session will greatly affect, for example, the GBP/USD pair, so you need to take into account which trading session and which pairs are most affected:

- pairs involving USD, EUR, GBP show good movement during the American and European sessions;

- the Asian session affects pairs involving JPY, but strong movements cannot be guaranteed;

- As for Australia and Oceania, this trade can only affect pairs with the New Zealand and Australian dollars, but this influence is small.

Accounting for session time in trading

Forex trading times are indicated in Greenwich Mean Time, but the trading terminal indicates a different time. So you need to be able to translate it, that is, calculate the difference between local time and GMT time.

In order to ensure that there are no mistakes during translation, you can use an indicator that will highlight the operating hours of different zones on the chart; there is also a special clock that displays the operating hours of sessions.

You can also change the terminal time manually, for this you need:

- in the terminal itself, the broker’s time is indicated in the upper left corner;

- the website http://wwp.greenwichmeantime.com/ shows Greenwich time (you just need to switch it to display mode in 24h format);

- the difference between these values will be equal to the required correction.

Most trading systems involve trading on the most common trading pairs (EUR/USD, GBP/USD, USD/JPY), so the American and European sessions are decisive. Moreover, they account for more than half of the daily turnover.

For European traders, the day begins with the European session, followed by a break in work around noon. There is some lull in the market at this time. Another surge occurs in the afternoon, when the Americans get involved.

There are also more exotic trading techniques. For example, some advisors are initially developed for trading at times when large players do not participate in trading, that is, the risk of impulse movement is reduced to nothing. In this case, trading is usually carried out at night on cross-country markets.

Summarizing

Forex trading time is an important parameter, and it should definitely be taken into account when building a trading system. Since the euro and dollar can be considered the most popular currencies, it is the European and American sessions that are considered the most important. But you shouldn’t forget about the rest; the main thing is to take into account what kind of currency is used. Source:

Social buttons for JoomlaPopular:

- 11/14/2013 06:32 | Reversal indicator - determine the end of the trend 54613

- 04/02/2015 10:04 | The VSA indicator reads the market like an open book 51913

- 09.23.2014 11:08 | The Forex advisor designer will allow you to create any trading robot 47900

- 12/13/2013 01:48 | Intraday trading - hourly forex strategy 39984