Many people who have at least once applied for a bank loan are aware of the problem of imposing insurance services. Employees of financial institutions directly say that a loan will not be issued to a person without valid insurance. The Government of the Russian Federation drew attention to this situation, and now the termination of a life insurance contract on a loan is no longer an extraordinary case.

You can learn from this material about what has changed in this area and how a citizen can return the money paid to the insurance company under a signed contract.

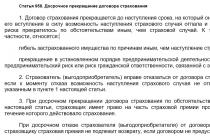

Issues of early termination of an insurance contract are regulated by Article 958 of the Civil Code of the Russian Federation.

Article 958 of the Civil Code of the Russian Federation

Article 958 of the Civil Code of the Russian Federation How to refuse life insurance services

The borrower should understand that he signs two independent agreements - with the bank and with the insurance company. And all communications regarding different contacts should be addressed to the appropriate organizations.

Today, the Directive of the Bank of Russia No. 3854-U dated November 20, 2015 is in force. This document establishes mandatory requirements for the return of the insurance premium upon termination of the contract at the initiative of the policyholder. It has been established that if, within the first 5 working days after signing the contract, a citizen declares his refusal to enter into the relevant agreement, then the company is obliged to return the entire insurance premium to him. This period may be extended at the discretion of the parties.

In the event that the contract has already begun to operate at the time of termination, the refundable amount may be reduced in proportion to the number of days during which the life insurance service was provided.

A citizen can submit an application independently through the office, or send it by registered mail. When submitting in person, the applicant must have a second copy of the document, on which the insurance company employee will put the entry number.

The application is drawn up in free form and must contain the following information:

- FULL NAME. and passport details of the policyholder;

- Contract details;

- Request to consider the agreement terminated;

- Request to return the corresponding part of the insurance premium;

- Desired method of refund (cash or transfer to a bank account).

Note! The insurance company must receive the borrower's application within 5 business days from the date of signing the contract.

In order not to miss this deadline due to the special work of the post office, it is advisable to resort to the services of one of the courier services. The document will be delivered within one business day, and the sender will receive a copy of the receipt confirming receipt of the correspondence by the addressee.

If the insurance company employees refuse to accept the application from the citizen himself or from the courier, then this fact should be recorded in the complaint book or using video recording. In accordance with the provisions of Article 165.1 of the Civil Code, the message will be considered delivered.

Within 10 days from the date of receipt of the message from the borrower, the insurance company is obliged to transfer to him the insurance premium, in whole or in part.

If the money was not returned and the insurance company did not respond in writing to the citizen’s application, then the Bank of Russia should be informed about the current situation. The regulator will take effective measures against the organization that has violated the law.

How to terminate a life insurance contract after 5 working days

There are cases when the need for life insurance disappears much later than the expiration of the five-day period from the date of signing the contract. For example, obligations to the bank are repaid ahead of schedule, and insurance services are no longer required.

In such a situation, the natural desire of a citizen is to return the unused portion of the insurance premium.

The application will be accepted for consideration, but the insurance premium will not be returned, because there is no such clause in the contract. As a result, the citizen will be left without money and without insurance.

There is only one way left - termination of the contract and return of the premium in court. To do this, you must file a claim in the district court at the location of the insurance company. The document should reflect the following information:

- Name and location of the court;

- FULL NAME. and the plaintiff’s residential address;

- Name and location of the defendant;

- Information about the loan agreement: document details, name of the bank with which it was signed, loan amount and purpose of receipt;

- Information about the insurance contract: details, name of the insurance company, amount of the insurance premium, validity period;

- Justification that the issuance of the loan was conditional on the signing of a life insurance contract;

- Reference to Article 16 of the Law “On Protection of Consumer Rights”, which prohibits the sale of goods, work or services under the condition of purchasing other goods, work or services;

- We request, in accordance with the provisions of Articles 131 and 132 of the Code of Civil Procedure of the Russian Federation, to declare the insurance contract invalid and to recover from the defendant:

- Insurance premium;

- Costs for legal services;

- Interest on the use of someone else's money.

The following must be attached to the claim:

- A copy of the claim for the defendant;

- Copies of contracts;

- Receipt for payment of state duty.

Note! Many citizens claim in court that they were forced to enter into an insurance contract because they needed a loan. However, the loan agreement does not contain any reference to mandatory life insurance for the borrower.

Moreover, the policyholder read the text of the agreement, signed it with his own hand and transferred the appropriate fee to the company for its services. Everything suggests that he understood the meaning of his actions, and there was no pressure from outside.

Banks have the right to protect their property interests. Therefore, taking out insurance directly at the office of the relevant financial institution does not indicate coercion. Representatives of the lender only receive information about where their client is insured.

If the plaintiff refers to the fact that the insurance contract was not signed voluntarily, then he needs to prove this. The best evidence will be the testimony of the bank employee who issued the corresponding loan for the borrower. As a rule, an employee of a financial institution does not confirm such statements of the plaintiff in court, and the decision is made in favor of the insurance company.

Decisions to terminate a life insurance contract and return the insurance premium are still made. This can be counted on if the plaintiff has repaid his obligations to the bank ahead of schedule, and the text of the agreement meets the following conditions:

- The contract is not tied to the term of the loan agreement;

- The amount of the insurance payment is related to the balance of the loan payment. If the loan is fully repaid, then the amount that the policyholder can receive will be equal to 0.

Note! In the described situation, the borrower can claim a refund of the insurance payment in accordance with the remaining term of the contract.

However, since 2015, such provisions have been completely excluded from the standard forms of insurance contracts that are offered to citizens when receiving bank loans.

Citizens should contact banks to obtain a loan without first signing a life insurance contract. If a financial institution refuses to issue a loan, then you should sign an insurance contract and terminate it immediately after the loan is issued.

Termination of the agreement upon early repayment of the loan

The conditions for early termination of the contract are specified in the contract itself, and this determines whether a refund is possible. Insurers often consider the insurance contract as an independent contract, and not tied to the loan agreement, and refuse to return the money. In this case, you need to carefully read the insurance contract and if there is a link to the loan agreement, there is a chance of winning the case in court.

According to the legislation of the Russian Federation, any contract of life insurance of a client or collateral for a loan can be terminated early. We will figure out how to write an application for early termination of a contract, what documents are needed for this in 2018, and what rules apply to Ingosstrakh, PPF, ERGO and other insurance companies.

The inclusion of an insurance agreement in the standard package of loan agreement terms is standard practice in most banks, for example, in Russian Standard Bank, Sberbank or VTB-24.

Often this service is provided by an insurance company that is a subsidiary of the bank, for example, for Alfa-Bank it is the Alfa-Insurance company. The practice of forcing insurance is not legal, but it is almost impossible to avoid it and get a loan.

One of the options for returning at least part of the money spent is early termination of the contract. Also, termination of the contract may be required if, during the process of applying for a loan, the borrower decided to refuse to cooperate with the bank or was refused a loan. If the contract has already begun to take effect during this time, it will have to be terminated.

Important! It is worth understanding that the bank and the insurance organization are different structures and are responsible for different operations. Therefore, with all questions related to insurance, you should contact the office of the insurance company. Bank employees are not authorized to perform any actions or accept documents regarding insurance issues.

Thus, two cases of termination of insurance contracts can be distinguished:

- Termination of the contract immediately after conclusion;

- Termination of a contract after it has been in force for some time.

Almost all insurance contracts are terminated according to one of these two procedures, no matter whether it is a compulsory motor liability insurance contract or a life insurance contract. Let's look at these cases in more detail.

Grounds for termination of the contract

In order to be able to terminate the insurance contract, the client of the insurance company must have sufficient grounds for this. The legislation of our country (Article No. 958 of the Civil Code of the Russian Federation) provides for several such reasons. The most common reasons for filing an application are:

- Changing life situation. These are all cases when the client decides not to take a loan or is refused a loan by the bank. Naturally, there is no need for life or property insurance;

- Fulfillment of obligations under the loan agreement. From this moment on, the safety of the property that has become the property of the borrower, or his life and health, becomes the complete prerogative of the client. By law, no one can oblige him to take out insurance. Therefore, the client has the right to terminate the contract and receive back the payment for the unused period;

- Violation of the terms of the contract by one of the parties. Most often, this clause is the basis for termination of the contract by the insurance company. But in some cases, the insured person can also take advantage of this reason;

- Concealment by the insurance company of important information about the insurance service, for example, the presence in the contract of non-obvious payments, additional commissions or other conditions that increase the cost of services.

If one of these grounds exists, the process of terminating the contract occurs quite quickly and does not require costs. However, it is worth taking care to have written evidence. For example, if you repay a loan early, it will be enough to obtain a loan repayment certificate from the bank.

Important! Before starting the termination procedure, you should carefully study the text of the contract. If the contract contains references to the fact that it cannot be terminated early, contacting the insurance company is useless.

If the borrower decides to terminate the insurance contract immediately after conclusion, it is important to act quickly. Directive of the Bank of Russia No. 3854-U dated November 20, 2015 sets a five-day period for such action. If the client notifies the bank within this time, he may qualify for a full return of the money deposited under the agreement.

Attention! If more time has passed since the conclusion of the contract, the refunded amount will be less, in proportion to the ratio of the elapsed time to the total validity of the contract. However, the client can ask for a full refund if he can prove that he could not submit the application within five days for objective reasons.

In order not to depend on the speed of delivery of documents by mail, it is better to find an opportunity to submit documents in person. If you need to send them to another city, it is better to use courier delivery services.

How to draw up an application for early termination of an insurance contract?

To terminate a life insurance contract early, you will need to prepare documents according to the list:

- Russian passport or other document for identification;

- Insurance contract to be terminated;

- Loan agreement. If insurance is not part of the lending transaction, then this agreement is not needed;

- Evidence (in writing) of the existence of grounds for termination of the insurance contract.

If insurance for another purpose, for example, MTPL, is terminated, the package of documents may expand. Documents for the car will be added to it. In addition, you will need to return the insurance policy and payment receipt to the company, so you need to add them to the documents as well. It will be useful to make photocopies of these documents. They may come in handy if you have to demand a refund through legal means.

Attention! If it is not the insured himself who will be terminating the contracts, but his authorized representative, the package of documents will need to include a power of attorney certified by a notary.

After the package of documents has been collected, the insured person submits it to the insurance company (preferably to the same branch where the contract was concluded). After writing the application, the procedure for reviewing the submitted package of documents is carried out and money is transferred to the details specified in the application.

You can find a sample of filling out an application for early termination of an insurance contract on the websites of insurance companies. Both VSK, Sberbank Life Insurance, and Renaissance Insurance use the same application form.

However, the legislation does not provide a specific model. The application can be drawn up by hand or entered into a ready-made form posted on the website.

Application form for termination of the insurance contract

A typical application form usually contains the following data blocks:

- Information about the insurer;

- Information about the insured person who submits the application;

- Information about the insurance policy (its number, date of issue, etc.);

- Grounds for termination of the contract;

- Application for receipt of unspent money under the agreement;

- Information about the method by which it is planned to receive the refunded money (bank account number and its details);

- If necessary, additional comments clarifying the essence of the matter;

- List of attached documents.

A properly completed application form is the basis for consideration of the issue of returning money to the insurance company. It must be registered accordingly. It is customary to give the client a receipt of acceptance of the application or a second copy with a registration stamp and a handwritten signature of the employee who accepted the application.

A correctly completed application is processed quickly, and if there are grounds for terminating the contract, the remaining funds are returned to the client’s account without any problems.

You can learn how to terminate an insurance contract early from the video.

Insurance is an agreement drawn up on a voluntary basis for the provision of services between a potential client (policyholder) and an insurance organization (insurer). Like any other official document with legal force, an insurance contract must comply with the norms of the legislative framework of the Russian Federation in order to provide protection to clients of insurance companies.

What documents are attached?

In order for the issue to be considered at the meeting, the initiating party must attach to the application for early termination of the insurance contract an original identification card and a package of necessary documents certifying the fact of registration of insurance - the original and a duplicate of the insurance contract and the policy. It will also be a plus to provide documentary evidence of the reasons for which termination is required.

provides for cases in which the insurer has the right to contact the insurance institution not independently, but through an authorized representative. The authorized representative is also required to provide a passport of a Russian citizen and the original of a notarized general power of attorney, which must clearly indicate the right to submit an application for termination of the insurance contract from an official representative.

Submission and review period

“On standard norms for the conditions and procedure for the implementation of special types of voluntary insurance” dated November 25, 2015, a certain temporary period was introduced during which the client has the right to refuse insurance with a full refund of all monetary compensation. The corresponding time period will be called the “cooling period”. To use the established cooling period, the insurer must contact the main administrative office of the insurance organization with an application to terminate the contract. If there is no representative office of the insurance organization in your regional region, a written application for termination and the initials of the account must be sent by registered mail with acknowledgment of receipt to the address of the main administrative office of the insurer. In this case, the date of termination of the contract will not be considered the date of receipt of the application, but the date of sending the registered letter.

List of required documents:

- application in duplicate for refusal;

- original and photocopy of the insurance contract;

- check for payment of insurance benefits;

- identification.

According to generally accepted rules, the period for consideration of an application for early termination of an insurance contract is 14 days from the date of its official conclusion. However, the amount of the insurance benefit returned to the policyholder will directly depend on the period of termination, therefore it matters on what day the application was submitted - on the first, third or last. The funds are returned in direct proportion to the time period from the start of the agreement. A full refund of the insurance premium will be made upon application during the cooling-off period or even before the legislative validity of the insurance document.

Despite the fact that the insurance contract is officially terminated at the organization's office, the banking institution must be notified in writing of the termination of contractual obligations to prevent the collection of funds from the consumer. It is worth noting that upon termination of the insurance contract, the bank legally has the right to automatically cancel the loan agreement, or increase the loan interest.

Currently, movable and immovable property, human health and life are insured against damage. Citizens can also protect themselves from accidents through insurance. A life insurance contract is most often used when taking out a loan. Thus, banking institutions want to protect themselves from non-payment of debt by the borrower in the event of an insured event, namely, death or disability of group I. How to terminate an insurance contract (similar to terminating a loan agreement) and in what cases this will be possible, we will consider in more detail.

Deadlines

According to civil law, a citizen who has executed an insurance contract has the opportunity to terminate the above agreement and return part of the unused funds in proportion to the remaining period if:

- the likelihood of an insured event has disappeared;

- the presence of the insured risk has disappeared according to factors that do not affect the insured event. The above factors are considered to be the loss of the insured property or the bankruptcy of the insurer.

You can terminate the insurance contract early, without waiting for its expiration. However, if this special opportunity is not provided for in the agreement itself, then it will be impossible to return funds for the unused period.

Many policyholders expressed dissatisfaction with the imposition of an insurance contract when taking out a loan, and in connection with this fact, the Central Bank introduced the concept of a “cooling off period”, starting in November 2015, when it is legally permitted to terminate the agreement.

Cooling period- this is a five-day period from which the calculation of the conclusion of an insurance contract begins and which is given to an individual (the policyholder) to terminate the existing agreement. The procedure is carried out unilaterally and with little or no financial losses if the insured event does not occur.

The insurer carries out partial refund to the policyholder who decides to terminate the agreement early if the insurance contract is valid for several months. The calculation of payments depends on the time that has passed since the conclusion of the document.

Something to remember! After the “cooling off period”, terminate the insurance contract The opportunity will only arise if the above document has the appropriate criterion.

How to terminate a life insurance contract?

Taking out a life insurance policy is most often an additional service when taking out a loan from a banking institution and is considered a voluntary procedure. You can terminate a contract with an insurance company by following the step-by-step algorithm of actions:

- collection and preparation of necessary documentation;

- contacting the insurance company with a written application;

- consideration of the application within a ten-day period by the insurance company;

- final termination of the insurance contract and calculation of payments.

Transfer of funds is made within a period not exceeding ten days. The following list of documents should be attached to the application:

- identification document of the applicant-insurant - original and photocopy;

- duplicate and original of the life insurance contract;

- papers confirming the legality of the reasons for canceling the agreement.

The existing agreement between the policyholder and the insurer can be terminated during the “cooling off period” or during another period if this condition is specified in the agreement.

By loan

When taking out a loan, employees of a banking institution are often imposed an additional obligation to draw up a life insurance contract. In case of early termination of a loan life insurance contract the credit institution must also be notified.

To terminate an agreement unilaterally, you should take into account the type of signing of the document. Employees at a banking institution offer their clients the following ways to obtain an insurance policy:

- registration of an individual insurance policy;

- joining a collective insurance program.

In the latter case, there is a signed agreement between the bank and the insurance company. The borrower is included in this document and is considered insured from that moment on. The insurance payment is the payment of the corresponding commission to the credit institution for carrying out the operation of joining the above program. In this case, it is not possible to terminate the agreement during the cooling-off period..

The main condition for the possibility of terminating the agreement is the presence of such a condition in the concluded agreement. The amount of funds returned may not be 100 percent, since the banking institution has the right to collect personal income tax from individuals.

Upon voluntary registration of insurance

According to generally accepted rules, you can terminate an agreement with an insurance company within a five-day period, which is called the “cooling off period.” Refunds are made in full if the insured event does not occur within a given period of time.

After 5 days, the policyholder should refer to the contents of the existing insurance contract. If the return of finances upon early termination is a stated clause, then the money can be returned, but not in full. To terminate the agreement, you must submit a written application to the insurance company.

Transfer of funds is carried out in proportion to unused time with deduction of business management costs. The above costs can range from 25 to 90%. Insurance rules sometimes provide that a deduction from the amount due after cancellation is equal to the amount of payments made.

We will consider below how an application is drawn up to terminate an insurance contract.

Statement

You can terminate an agreement with an insurance company by drawing up an application. The signed document is submitted in person to the company or sent by registered mail. A written appeal is drawn up in two copies - one remains with the applicant, the other with the insurance company.

The standard application form must contain the following information:

- recording the name of the insurance organization without abbreviations;

- information about the policyholder - full name, place of registration, passport details;

- indication of information about the life insurance contract - insurance policy number, date of signing and date of expiration of the document;

- a description of the reason why the policyholder wishes to terminate the agreement;

- expressing a request to terminate the agreement and return funds for the unused period;

- fixing the method of making financial payments - in cash or non-cash, by transfer to a bank account;

- date and signature.

You can download a sample application for termination of a life insurance contract link .

Refund

If the policyholder wants to refuse the life insurance service and terminate the contract, then he can use the so-called “cooling off period” for a period of five days from the moment of service registration. By law, the insurance organization is required to comply with the above regulations.

Something to remember!According to the order of the Central Bank, from January 1, 2018, the five-day period will be extended by two weeks.

If the decision to terminate the life insurance contract was made at the very beginning of its validity, then the refund is made in full. The main condition is that no insured event occurs during this period.

After the specified 5 days, the refund occurs in proportion to the unrealized insurance time. Consider the following situation:

An individual has signed a life insurance contract with a validity period of 20 years. After a five-year period, the citizen decides to terminate the agreement. 70% of paid fees are refundable.

The transfer is made within a maximum of 10 days after consideration of the application and a positive decision.

What to do if the insurance company refuses to terminate the contract?

Terminating an insurance contract is not easy. The insurance organization may refuse in the following cases:

- the application for termination of the agreement was drawn up with errors;

- the corresponding condition is not recorded in the document;

- an insured event occurred.

In some cases, the insurance company's refusal to terminate the agreement has no legal basis. In this case, you can file a corresponding claim with the Central Bank of Russia or resolve the problem in court.

The statement of claim is sent to the arbitration court with a formulated request to terminate the life insurance contract. If you take out a loan, after a month you can achieve a 100% return of funds. If more time has passed, then you can only achieve a 50% refund. Within a month after accepting the application for consideration, the court makes a positive decision to terminate the insurance contract and obliges the insurance organization to make a payment.

You can download a sample statement of claim for termination of a life insurance contract.

Thanks to the innovations of the Bank of Russia termination of a life insurance contract on a loan in certain situations it is carried out quickly and in favor of the borrower. Promoting programs with low rates and compulsory insurance is a marketing move by banks. Higher interest without insurance is often the best deal. What to do if the client unknowingly or under duress agreed to additional services?

Thanks to the innovations of the Bank of Russia termination of a life insurance contract on a loan in certain situations it is carried out quickly and in favor of the borrower. Promoting programs with low rates and compulsory insurance is a marketing move by banks. Higher interest without insurance is often the best deal. What to do if the client unknowingly or under duress agreed to additional services?

Legislation on loan insurance

The Civil Code of the Russian Federation (Article 958) defines the right of clients of insurance companies to return insurance if an insured event does not occur and the company’s risk has decreased. Article 958 also determines the possibility of canceling the contract at the request of the policyholder. In this case, the client will not be able to return the paid insurance premium unless it is specified in the agreement.

Amendments made to Law No. 353-FZ deprived credit companies of the ability to force borrowers to take out insurance. The restriction applies only to contracts concluded between an individual and an insurance organization. The new law, in addition to refusing the insurance procedure, allows you to disagree with various additional services of financial institutions.

What is a "cooling off period"

Cooling period is the minimum period introduced by the Central Bank of Russia, during which the consumer of services has the right to cancel the insurance contract. The client submits an application and receives a refund of the insurance overpayment. Main condition: absence of insured events during this period.

From January 1, 2018, the duration of the period increased from 5 to 14 days. The period may be extended by several more days at the discretion of the insurer. After receiving the application, the insurer must return the funds within 10 days. The amount of the premium depends on the period covered by the insurance. If it is included in the body of the loan, the amount is written off, reducing the total amount of debt.

The insurance premium is refunded in full if the client cancels the agreement within 14 days after signing it and before the insurance begins. Part of the premium will be withheld if termination occurs after the entry into force of the insurance contract. The opportunity to terminate the deal after the cooling-off period only arises when it is provided for in the contract.

What types of insurance are refundable?

Insurance services provided in the lending sector may be voluntary or mandatory. Mandatory procedures include car insurance when taking out a car loan and real estate when applying for a mortgage.

The policyholder has the right to refuse additional services of the following types:

- health, life, property insurance;

- pension, investment, savings insurance;

- risk insurance, for example, a policy in case of layoffs, etc.

The client will be able to reimburse the costs of insurance assigned when applying for a credit card, cash loan, or consumer loan. The result of the return procedure depends not only on the type of lending, but also on the option for providing services.

Financial institutions offer borrowers two types of insurance:

- obtaining an individual policy;

- participation in a collective insurance program (substitution of concepts practiced by banks to circumvent legislative norms for the return of insurance).

Until 2018, companies voluntarily returned insurance premiums within 14 days only if they had an individual policy. Once the group insurance was received, the deal could not be canceled and the client could not return anything. In 2018, the Supreme Court of the Russian Federation recognized that insurance programs must provide conditions for refusal. In addition, the Supreme Court confirmed that a consumer has the right to benefit from a cooling-off period when enrolling in an insurance program.

Attention! If the bank refuses to return the insurance payment within 14 days, citing the refusal by the fact that this is impossible after joining the insurance program, the service consumer has the right to file a lawsuit.

Insurance refund

Features of the return procedure during the cooling period

Borrowers have the right to terminate the insurance agreement within 14 days without the assistance of a lawyer. According to the law, the bank or insurer must transfer funds no later than 10 days after receiving the request. To receive a refund during the cooling-off period you must:

- take into account the conditions specified in the contract;

- send an application to refuse the service to the insurer no later than 14 days (this period does not depend on the moment of payment of the insurance premium).

Example from practice. A citizen came to a financial institution to get a loan at 14% per annum. A bank representative explained that in order to set a lower rate, it is necessary to guarantee a refund in case the client gets sick or dies. If you refuse insurance, the percentage will be increased to 20%.

The borrower insured life and health for 20 thousand rubles. The next day I wrote a claim to the bank and sent it by email. The document indicated that if it is not considered or refused, it will send a claim to the Central Bank. A couple of days later he was invited to the office to receive money, which was immediately transferred to his account. At the bank, the client wrote an application for early repayment. The debt decreased by 20 thousand rubles.

You can contact not a bank, but an insurance organization, the details of which are given in the policy. If the policyholder does not wait for an answer or receives a refusal, it is necessary to prepare a lawsuit. In this case, the law will be on the side of the borrower. The client will be able to “sue” not only the insurance assigned by the policyholder or the bank, but also penalties and compensation for moral damage. The court will oblige the company to pay a fine and reimburse the costs of a lawyer.

Need to know! Before signing a loan agreement, you should carefully read its contents and study the Insurance Rules. Many banks provide for an increase in rates after cancellation of insurance.

Refund of insurance on outstanding loan after expiration of cooling period

The new law does not apply to policies with a validity period of more than 14 days. In this case, it is recommended to follow the rules specified in the insurance contract. Large banks, for example, Sberbank, VTB 24, Home Credit, still allow borrowers who missed the cooling period to refuse life insurance.

Insurers provide in the documentation conditions for the return of funds paid, taking into account the period used. As a rule, costs ranging from 25 to 90% are deducted from the amount. If there is no such provision in the contract, the paid fee is non-refundable. Then it will be impossible to return the invested funds, since in fact the client voluntarily agreed to the service.

Life insurance does not apply to the cases prescribed in Art. 958 of the Civil Code of the Russian Federation, which provides for the return of insurance payments. You can refuse insurance at any time, but return the premium only if the insurer makes a positive decision. If the borrower missed the cooling period and does not plan to repay early, then you should not expect a refund of the insurance premium.

Waiver of insurance for early repayment

The insurance contract is concluded for the period of loan repayment. The consumer has the right to compensation for the amount paid for insurance services. Since the responsible borrower paid off the debt, the bank's risk decreased and the insured event did not occur.

Example. The couple took out a loan for 600 thousand rubles. A Sberbank employee ordered insurance for 50 thousand rubles. under the pretext: “If you don’t complete it, you will get a refusal.” The debt was repaid ahead of schedule; of course, they did not have time to submit a request during the cooling period. They brought a statement and insisted on their position. The head of the credit department accepted the request. Within 10 days, compensation in the amount of 30 thousand rubles arrived in the account.

An application for cancellation of insurance must be submitted:

- after complete closure of the debt (as in the example presented);

- together with an application for early repayment (the insurance amount can be used to pay the remaining debt).

Early termination of a life insurance contract allows the borrower to return the overpayment for insurance under the following conditions:

- in the contract (policy), in the Insurance Rules of the organization there is a clause on partial refund of the insurance premium;

- Insurance payments were made periodically along with regular loan payments.

If the above documents contain a clause on the return of insurance, the bank is obliged to pay it to the client. The insurer does not intend to transfer the money or has returned a small part - you can safely go to court. It is more difficult to return an insurance premium paid in a lump sum, but it is possible if there is a corresponding clause in the policy and the Rules.

Attention! When applying for a loan, the borrower confirmed with his signature that the bank familiarized him with the Insurance Rules, which means the court will take this into account. Everything written in this document will be used to make a judicial decision.

Why is it impossible to sue for overpayments under “imposed insurance”?

In the judicial practice of 2010-2015, there were often cases where the policyholder did not have time to formalize the refusal of insurance, and went to court with a demand to return the overpayment under the imposed insurance contract.

Example. The borrower took out 300 thousand rubles on credit for 4 years. Insurance was taken out for the entire period for 60 thousand rubles. The credit manager did not inform the client that a significant amount was spent on life insurance. In addition to the loan agreement, the citizen was given papers to sign, in which insurance conditions were printed in small print.

A month later, the borrower learned that he had the right to refuse insurance. He wrote a claim to the bank and received a written refusal. The citizen filed a claim and demanded:

- invalidate the loan agreement;

- recover the amount of the insurance premium from the bank;

- recover penalties and compensation for causing moral damage.

The court recognized the fairness of the requirements.

Many similar cases in the courts a few years ago were successful, since consumer rights were clearly violated. But loan and insurance agreements have been reworked over the years. In 2019, the chances of canceling the imposed insurance and returning the overpayment are practically reduced to zero. Insurance is now offered openly.

Termination of the insurance contract : step-by-step instruction

The consumer has the right to cancel the policy and demand compensation when contacting the insurance company or bank. A claim or statement must be made in writing, handed over personally to an employee of the organization, sent by mail or to an electronic mailbox. After an illegal refusal, you can write to the Central Bank or file a lawsuit.

Table - Stages of termination of an agreement with an insurer

| 1 step. Preparation of a package of documents | Write an application, make copies of your passport, insurance contract, receipts for payment of contributions (other papers to confirm the legality of the request). Sample applications are presented on banks' websites. You can draw up a document in any form or take a ready-made form from the department. The application must be prepared in two copies. |

| Step 2. Contacting an insurance company with a claim | If it is impossible to contact the insurer, the client has the right to submit a request to the bank. Credit managers should help carry out the termination procedure and submit documents to the insurer. To protect your rights when filing an application you must:

|

| Step 3. Waiting for the insurer's decision | The company is obliged to respond to the client’s request within 10-14 days. Having no debt increases the likelihood of a positive response. A written agreement is drawn up with the insurance company to cancel the contract. Payments are transferred or the debt is recalculated. |

| Step 4 Preparation of documents for court | After receiving an unfounded refusal, you can go to court. In addition to the already collected papers, filing a claim will require a written refusal from the bank. It is recommended to record negotiations with employees of a banking organization on a voice recorder. If the bank has not issued the policy in hand, it is worth noting this violation in the statement of claim. |

Personal appeal speeds up the process of terminating the contract. If it is impossible to visit the insurer, you must send copies of documents by mail, fax, or email. Attach certified copies of documents to the application and send to the address of the main office of the insurance company. The day the request is submitted will be considered the day the letter is sent. The notification received may be used as evidence in court.

How to make an application

Application for termination of a life insurance contract written in free form. A standard sample can be found on the websites of banks or insurers.

The application must include the following information:

- full name of the financial or insurance company;

- information about the applicant (full name, passport details);

- information about the insurance contract - date of conclusion, expiration of its validity, details and policy number;

- indication of the reason for termination of insurance (for example, early repayment of debt);

- request to terminate the agreement and return money for the unused period. The document must indicate the method of refund, card number, account to which the client makes monthly payments.

- Date and signature.

After submitting a claim or application, it is recommended to periodically inquire by telephone about the insurer’s decision and about setting the date for the transfer of the refund. When the funds are transferred, you must prepare an application for partial repayment of the debt.