The private organization "Belarusian Currency Stock Exchange" began operating on December 29, 1998. whose shareholders are 124 individuals. It is engaged in the provision of services related to the acceleration of capital turnover in the republican and global economy. The organization is playing important role in the country's economy, helping to enter international markets, while attracting investors.

Structural organization of BVSE markets

BVSE, like other exchange organizations of this type, operate according to the same principle. They connect a buyer with a seller or an investor with a consumer. The Belarusian Currency Stock Exchange consists of the following departments, which act as intermediaries between parties conducting transactions in each of the markets below:

- government market valuable papers;

- currency market;

- stock market;

- derivatives market.

Trading in government securities

Since 2004, the Belarusian Currency Stock Exchange has become a platform on the basis of which auctions for the placement of the state are held. It also acts as the organizer of secondary trading in government securities. Key Feature participation in trading on this market - the need to register for membership in the Section stock market. This is possible after providing a set of documents, the list of which is presented in the regulatory acts of the BVSE. After this, the market participant is allowed to trade. There are three types of activities of a participant in the government securities market reserved in the BVSE:

Clients who use the services of trading participants can be both residents of the Republic of Belarus and non-residents of the country.

Foreign exchange market BVSE

One of the functions of the BVSE is trading in currencies and monetary units. Since it is not a currency (in the economic sense), its quotation in relation to other currencies and banknotes is not based on direct conversion, but on the basis of bidding and pre-orders. OJSC "Belarusian Currency and Stock Exchange" is the place of receipt official rate Belarusian monetary unit in relation to other currencies.

Based on information about supply and demand for the Belarusian ruble, its current price is set certain period bidding price. It is a guideline for banks of the Republic of Belarus and for the National Bank of the Republic of Belarus. All available currency quotes are established by the Belarusian Currency Stock Exchange OJSC. The exchange rate of the dollar, ruble, franc, pound sterling and many others are set depending on the results of trading taking place on the BVSE on weekdays.

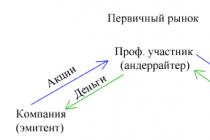

BVSE stock market

The stock market is a department of the exchange on which bonds of banks and exchanges, legal entities and financial institutions of non-banking structures, shares of OJSC, some as well as government short-term and long-term bonds can be traded. The Belarusian Currency Stock Exchange is only a platform for posting these documents, the price of which is equivalent to a certain share of the fund.

By purchasing or purchasing bonds, the investor receives or gives away a certain portion of the fund's volume in return sum of money in Belarusian rubles. Organization "Belarusian Stock Exchange" currency exchange» Trades are supported for 5 working days. Investors and traders can obtain quotes and indices in the specially developed BEKAS system. It is convenient and functional trading platform, meeting the requirements of regional market conditions.

BVSE derivatives market

It is still only a developing sector of trade on the BSE. Although now investors can trade using their assets using available instruments. The derivatives market itself is represented by futures contracts of various types:

- at the exchange rate of the American dollar to the ruble of the Republic of Belarus;

- at the exchange rate of the single currency of the Eurozone to the ruble of the Republic of Belarus;

- at the exchange rate of the Russian ruble to the ruble of the Republic of Belarus;

- at the exchange rate of the American dollar to the single eurozone currency established by the ECB;

- By interest rates in the government long-term bond markets.

Instrumental support for investors at the IMFB allows them to participate in trading on the principle of a “continuous double auction”. Technology also makes it possible to participate in trading operations remotely or from a workplace in the IMFB office. Market participants can enter into transactions in various directions with all available instruments.

OTC activities

The organization "Belarusian Currency and Stock Exchange" organizes exchange trading, which requires the presence of information security systems. Since trading results are posted and stored in files, the exchange has developed a mechanism to protect them, equipped with a digital signature. On this moment BVSE is also engaged in improving information security algorithms at each stage of its life cycle.

The Belarusian Currency and Stock Exchange has its own developments in cryptography, the most effective information security mechanism. This activity is inextricably linked with exchange processes, as it helps protect clients and their financial transactions. However, these processes do not affect changes in quotes, and therefore relate to over-the-counter activities.

Open Joint-Stock Company The Belarusian Currency and Stock Exchange has been operating in the Republic of Belarus since December 1998. However, back in March 1993, the prototype of the exchange, created by eighteen commercial banks in the form of a closed joint stock company. Currently, the controlling stake in the BVSE is owned by the National Bank of Belarus.

Exchange participants are represented by banks and non-banking enterprises that meet the conditions financial requirement. Today, the Belarusian Currency and Stock Exchange consists of 74 participants, of which 28 are banks. Only members of the exchange have the right to trade on the BVSE. Foreign companies cannot enter the BVSE without obtaining a license from the Securities Department of the Ministry of Finance of the Republic of Belarus, however, they can conduct a number of transactions on exchanges through professional intermediary participants.

The authorized capital of the BVSE is equal to 4.3 million dollars, and equity– 9.1 million dollars.

Sections of the Belarusian Currency and Stock Exchange

In total, the Belarusian Currency and Stock Exchange consists of three sections: foreign exchange, stock and derivatives market sections.

In the currency section you can carry out operations as follows: financial instruments:

- USD/BYR, RUB/BYR, EUR/BYR, UAH/BYR, which are allowed for trading on the exchange through separate personal accounts National Bank.

- AUD/BYR, GBP/BYR, DKK/BYR, ISK/BYR, CAD/BYR, LVL/BYR, LTL/BYR, NOK/BYR, PLN/BYR, SEK/BYR, CHF/BYR, EEK/BYR, JPY/ BYR, which are admitted to trading on the exchange through independent settlements between exchange participants.

Only BANKS can access the currency section.

The stock exchange is represented by government and non-government securities. Non-government securities include: bank bonds, municipal loan bonds, bonds and shares of legal entities.

On derivatives market trading is carried out with futures EUR/USD, RUR, USD, EUR. In this section, operations can only be performed by BANKS.

Despite the fact that the stock market is part of the BVSE, it has its own page on the BVSE website and a separate Information system with the presentation of more detailed information.

In 2009, the Belarusian Currency and Stock Exchange carried out trading volumes on all financial instruments in the amount of $29,167 million, of which $14,098 million were transactions in foreign currencies, $0.12 million on futures contracts, 13,727 million dollars for government papers Ministry of Finance of the Russian Federation on the stock market and $1,330 million for non-government securities on the stock market.

Note that in 2009, the Belarusian Currency and Stock Exchange distinguished itself by the fact that the volume of transactions on the stock market for the first time exceeded the same indicator on the foreign exchange market. However, this was realized through government securities, namely the sale by the republic of BPS-Bank to Sberbank of the Russian Federation.

The main player on the foreign exchange market is National Bank The Republic of Belarus, which regulates exchange rates through daily interventions. At the end of the trading day, the Belarusian Currency and Stock Exchange provides information on the number of offers and demand for the currency of interest, and the difference between these indicators (if demand exceeds supply) is covered by reserves National Bank. If supply is higher than demand, then the National Bank sometimes acts as a buyer and buys up excess currency, but this rarely happens. Well Belarusian ruble is formed based on the relationship between supply and demand at the end of the day. Those. the rate established at the end of the trading day will be the official rate of the National Bank on the next day.

Today, the Belarusian Currency and Stock Exchange remains in its infancy and sometimes there is even regression in its development. This is due to the fact that the state began to strictly regulate and intervene in the country's economy as a whole.

So, in the 90s, many citizens of Belarus received “Property” checks and “Housing” checks from the state. In the first case, this was supposed to stimulate the development of the stock market by exchanging checks for shares of Belarusian enterprises, which were approved by the corresponding list of the government, and in the second case, the checks were used for the privatization of residential real estate. At first, citizens began to actively exchange checks for shares, as a result of which companies were formed that accumulated these checks for further redemption of enterprises or obtaining a controlling stake. As a result, the state introduced strict restrictions and introduced the institution of the “golden share,” which completely blocked the market’s ability to further develop.

The Belarusian Currency and Stock Exchange allows transactions on securities to be carried out through the use of electronic trading system with remote access. Bidders may enter into Various types transactions that differ in the form of settlement.

The Belarusian Currency and Stock Exchange allows transactions on securities to be carried out through the use of electronic trading system with remote access. Bidders may enter into Various types transactions that differ in the form of settlement.

The government securities market operates in the “until maturity”, “simple auction”, “repo fixed pricing” and “simple repo auction” modes.

The corporate and municipal securities market operates in the following modes: “continuous double auction”, “simple auction”, “REPO free pricing”, “forward transactions”, “discrete auction”.

On the Belarusian stock market, issuers of securities in most cases are banks. This is due to the fact that the Belarusian Currency and Stock Exchange, in order to gain access to the issue of securities, establishes the need to have net assets in the amount of 1 million euros, which is a very high bar for other economic entities in the country. Such a strict restriction and the presence of shares in the hands of the state makes the stock market of Belarus unattractive for investment not only for domestic but also for external investors.

The Belarusian Currency and Stock Exchange also offers a narrow selection of trading instruments - bonds or shares. At the same time, there is no way to normally buy shares, which are completely concentrated in the hands of the state and are simply not in circulation.

In 2010, the Belarusian Currency and Stock Exchange, with the support of the state, took a number of steps to revive the stock market in Belarus.

- The tax rate on income from trading in shares has been reduced to 12%.

- The “golden share” institution, according to which the state could intervene in the management of an enterprise, was abolished.

- Restrictions on shares purchased by citizens through preferential conditions or “Property” checks.

- The moratorium on the alienation of shares in enterprises for which it was previously introduced has been lifted.

- legal entities and individuals were exempt from paying tax on income from transactions on corporate bonds.

- The issue of exchange-traded bonds has begun, for which mandatory registration with the securities department is no longer required.

- shares can now be purchased by individuals through a broker on the stock exchange, but only banks can participate in the foreign exchange and futures markets.

- accepted new law o securities, which provides for measures to stimulate the development of the stock market.

- conditions are created and implemented for the revitalization of the IPO sector.

Obstacles hindering the development of the Belarusian Currency and Stock Exchange

The Belarusian Currency and Stock Exchange cannot develop due to the complexity of laws and regulations, which in some cases completely contradict each other. Also in the country there are no various financial institutions And the legislative framework for their formation. The economy is dominated government sector, which is largely managed by outdated command-and-control methods. There are very strict requirements for the issue of securities. Thus, in order to issue its own bonds into circulation, a legal entity must have net assets of at least 1 million euros, and it must also have no negative financial results by main type of activity.

For foreign investors The Belarusian Currency and Stock Exchange does not provide for stable operating rules and reliable guarantees. It is not possible to develop and implement your own index used to analyze the state of the national economy.

As main flagships Belarusian economy perform state enterprises, the shares of which are mostly (approximately 72.5%) in the hands of the state. At the same time, the republic’s leadership does not plan to part with its financial assets in the near future. As a result, the Belarusian Currency and Stock Exchange is virtually paralyzed and does not have the ability to develop.

There are no conditions in the country for the circulation of financial instruments such as options, bills, etc. on the stock market.

And finally, the citizens of the country do not have enough financial education to maintain work and participate in trading on the stock market.

In 2008, the government of the Republic of Belarus decided that all transactions for the purchase and sale of JSC shares should be carried out on the exchange market, adding a number of exceptions. However, consolidation in regulatory documents only happened in 2009. As a result, transactions in shares of approximately 200 companies were concluded during the year. Until this point, the exchange market in relation to the over-the-counter market was only 1% to 99%. This situation did not make it possible to determine the market price of the shares, since their calculation must be carried out on the exchange market. As a result, it sometimes happened that the market price of a share was higher than the par value or book value, which indicated the high potential of a number of Belarusian enterprises, since such an indicator indicates the desire of investors to invest in them. In addition, the calculation of the market price of a share contributed to the fact that enterprises began to carry out additional emissions shares and placing them on the stock exchange market prices. Thus, enterprises were able to attract more investment.

Currently, the Belarusian Currency and Stock Exchange is at the initial stage of its development in the country. The pace of development will in the future depend precisely on the state, which must promptly adopt relevant laws and promote the privatization of state property, which will greatly revive the country’s stock market, as well as the economy as a whole.

OJSC Belarusian Currency and Stock Exchange, which also performs the functions of the National Forex Center (NFC) in the Republic, recently announced the launch of its new solution for currency trading - the Exchange Online application.

Belarusian Currency and Stock Exchange

“The new product “Online Exchange” is intended for businesses interested in buying and selling currencies. It allows you to monitor the progress of trading on the exchange foreign exchange market in real time for three financial instruments: euro, US dollar and Russian ruble. Detailed information on the current buying and selling rates of currencies of all banks that participate in the auction is presented in a simple and convenient form. The service is provided on a paid basis (Br30 monthly), starting from January 1, 2018,” says the BVSE release.

The application shows “demand” and “supply” for currency on the part of Belarusian banks, prices and volumes, that is, the so-called “order book” or “exchange book”. Thus the application depicts current situation on the local foreign exchange market practically on one screen. By entering the volume or lot of interest in the appropriate field, the application will show the best (most profitable) current rate, and also calculate the commission of the bank offering this volume.

Belarusian Currency and Stock Exchange(full title Open Joint Stock Company "Belarusian Currency and Stock Exchange") is the stock exchange of the Republic of Belarus, on whose platforms trading is conducted in three main segments of the financial market: foreign exchange, stock and derivatives. The exchange was established in 1998 in pursuance of the Decree of the President of the Republic of Belarus dated July 20, 1998 No. 366 “On improving the system government regulation securities market". The founders of the exchange were the National Bank of the Republic of Belarus, the Ministry of Management state property and privatization of the Republic of Belarus and a number of large banks of the Republic of Belarus.

The supreme governing body of the exchange is the General Meeting of Shareholders. The shareholders of the exchange, in addition to the founders, include banks, broker-dealer companies of the republic, etc. Management of the activities of the exchange in the period between General meeting shareholders is carried out by the Supervisory Board.

Links

Wikimedia Foundation. 2010.

- Belarusian Academy of Architecture

- Belorusskaya street

See what “Belarusian Currency and Stock Exchange” is in other dictionaries:

Exchange- (Bourse) Exchange is a form of trade organization for conducting regular trading, sales financial assets and contracts Work on the labor exchange, demand for offers and pricing policy commodity exchange, stock exchange activities, London currency exchange and ... Investor Encyclopedia

2011 financial crisis in Belarus

Financial crisis in Belarus- The financial (economic) crisis of 2011 in the Republic of Belarus is a complex of phenomena in the country’s economy caused by many years of negative balance trade balance and costs of elements administratively command system in economics, and... ... Wikipedia

List of European stock exchanges- This is a list of European stock exchanges. There are two main pan-European exchanges in Europe: The headquarters of the exchange is located in Paris. It was formed as a result of the merger of the Brussels, Paris, Amsterdam, Portuguese stock exchanges and the exchange ... ... Wikipedia

International Association of Exchanges of CIS Countries- logo The International Association of Exchanges of the CIS Countries (IAB CIS) was established in Moscow in April 2000 with the aim of coordinating efforts to develop organized financial markets in accordance with international standards. Executive Director... ... Wikipedia

List of European stock exchanges- This is a list of European stock exchanges. Europe is home to two main pan-European exchanges: Euronext. The headquarters of the exchange is located in Paris. It was formed as a result of the merger of the Brussels, Paris, Amsterdam, Portuguese stock exchanges... ... Wikipedia

Federation of Euro-Asian Stock Exchanges- was created in 1995 on the initiative and under the auspices of one of the most developed and advanced stock exchanges in the region, Istanbul. Stock Exchange Moldova became one of the founders of FEAS in 1995. To date, the number of members ... Wikipedia

EXCHANGE LEGISLATION- a system of regulations regulating both the legal status of exchanges, the procedure for their organization and activities, as well as trading on exchanges, execution of exchange transactions, etc. Currently, exchange legislation includes both laws (Law of 12... ...

PROCEDURE FOR ISSUING INDIVIDUAL SECURITIES- in accordance with the Basic Conditions for the Issue of Certain Government Securities of the Republic of Belarus, approved by Resolution of the Council of Ministers of the Republic of Belarus dated February 13, 2003 N 173 (hereinafter referred to as the Basic Conditions), the procedure is determined... ... Legal Dictionary of Modern Civil Law

FINANCIAL OPERATION- in accordance with Art. 1 of the Law of July 19, 2000 On measures to prevent the legalization of illegally obtained income (as amended by the Law of December 11, 2005) financial transaction a transaction with funds is considered, regardless of the form and... ... Legal Dictionary of Modern Civil Law

The results of trading on the Belarusian Currency and Stock Exchange largely determine the formed exchange rates for business entities, banks and individuals. The National Bank sets official exchange rates based on the auctions conducted, the generated rates are used legal entities when making payments.

The foreign exchange exchange provides the opportunity for registered participants to participate in the purchase and sale of foreign currency and conduct transactions in the required volume based on supply and demand in the market. Information about completed transactions is displayed online; the real time of the transaction allows you to quickly receive data on sales volumes. You can find out the results of trading on the BVSE today on our website. The latest trades and the weighted average exchange rate are transmitted directly from the BVSE website and are available in real time. You can find on our website trading volumes, minimum rates and maximum rate currencies for today. For the convenience of obtaining information, data on the results of past trading forms a chart that can be requested for any period of time. Exchange rate dynamics are available for the dollar, euro and Russian ruble.

A continuous double auction is used when selling major currencies; on its basis, the exchange rate of the dollar, euro, and Russian ruble is formed. Trading on the exchange is carried out on weekdays from 10.00 to 12.00, the session closes from 12.10 and lasts 5 minutes. The trading schedule and results are available to website visitors after the end of the session on the BVSE. Russian ruble, dollar and euro form a basket of currencies that determines the value of the Belarusian ruble. Based on the results of trading in these currencies, strengthening or weakening is possible national currency based on the volume of supply and demand on the exchange.

The National Bank of Belarus sets rates for tomorrow, taking into account the trading conducted; for weekends and Mondays, the rate is formed based on the results of Friday trading. The official rate is set on the basis of the weighted average rate during the main session and taking into account the rate at the closing of the session. Trading results foreign currencies at JSC BVSE allow to predict exchange rates in banks for individuals. At the moment, the National Bank of Belarus recommended that banks adhere to a deviation from the official rate of no more than 2%, but the increased demand for the purchase of foreign currency often serves as a factor in the rate increase.

Expand Collapse