Reflected the proceeds from the sale of fixed assets, intangible assets, materials (not the main activity)

VAT accrued on sold assets (not core activity)

Received payment from the buyer to the current account

Postings for accounting advances received (account 62.2)

If the buyer pays for the goods in advance and transfers the advance, then to account for settlements with buyers, in this case, subaccount 2 “advance received” is opened on account 62.

VAT is charged on received advances.

The accrued amount of VAT from the advance received is restored, then a posting is made to offset the advance.

|

Debit |

Credit |

Operation name |

|

62.2 Advance received |

From the buyer received an advance on the current account |

|

|

76. VAT on advances received |

VAT charged on advance payment received |

|

|

Reflected revenue from the sale of goods |

||

|

VAT charged on sold goods |

||

|

62.2 Advance received |

Advance payment against debt |

|

|

Accepted for VAT deduction in connection with the sale of goods paid in advance |

Example 1. Reflection of settlements with buyers in a general manner

Kalina LLC entered into an agreement with the buyer for the supply of goods and materials in the amount of 50,000 rubles, VAT 7,627 rubles. The cost of goods is 23,000 rubles. The contract provides that the buyer pays for goods and materials after shipment.

Wiring:

|

Description |

Sum |

Document |

||

|

Reflected revenue from the sale of goods and materials |

Packing list |

|||

|

Written off the cost of goods and materials |

Costing |

|||

|

18% VAT charged |

Packing list |

|||

|

The buyer received payment for the shipped goods |

Bank statement |

|||

|

Reflected profit from the supply of goods and materials (50,000 - 23,000 - 7,627) |

Invoice, costing |

Example2. Accounting for advances received on account 62

Kalina LLC entered into an agreement with the buyer in the amount of 60,000 rubles, VAT 9,153 rubles. The contract provides for an advance payment.

Wiring:

|

Description |

Sum |

Document |

||

|

An advance payment was received from the buyer's LLC under the supply agreement |

Bank statement |

|||

|

Accrued VAT from advance payment 18% |

Bank statement |

|||

|

76 Advances received |

Restored 18% VAT accrued from the advance |

|||

|

Reflected revenue from the supply of stationery |

Packing list |

|||

|

Advance payment received from the buyer |

Bank statement, bill of lading |

|||

|

18% VAT charged for transfer to the budget |

Bank statement, bill of lading |

Example 3 on account 62 "Accounting for settlements with buyers and customers"

Kalina LLC received an advance payment from the buyer for the shipment of goods in the amount of 250,000 rubles. A week later, Kalina LLC shipped another part of the goods in the amount of 47,200 rubles. (including VAT 7200 rubles)

Wiring:

|

Debit |

Credit |

Sum |

|

|

Advance payment received on the current account |

|||

|

VAT charged on advance payment |

|||

|

Sale of goods |

|||

|

VAT restored |

|||

|

62.2 Advances |

VAT restored |

||

|

62.2 Advances |

Closing advance |

Example 4

Kalina LLC sold goods through an online store. The organization entered into an agreement with the bank, on the basis of which the remuneration is 1.5% of the amount of receipts and the amount of proceeds minus remuneration is transferred to the current account.

The buyer paid for the goods with a bank card in the amount of 50,000.00 rubles, incl. VAT 18% - RUB 7,627.12 After receiving the money, Kalina LLC ships the paid goods to the buyer.

Wiring:

|

Debit Account |

Credit account |

Posting amount, rub. |

|

|

The buyer transferred the advance payment by bank card |

|||

|

We charge VAT on the received advance |

|||

|

Receipt to the current account of the amount of revenue |

|||

|

Bank remuneration under the agreement |

|||

|

Sales revenue accounting |

|||

|

Calculation of VAT from shipment |

|||

|

Write-off of shipped goods |

|||

|

Advance payment received |

|||

|

VAT deduction on advance payment received |

Example 5

The buyer using Yandex. Wallet" paid for goods in the amount of 95,000.00 rubles, incl. VAT 18% - RUB 14,491.53

The money was first credited to the "electronic wallet" of the seller, and then transferred to the bank account minus the commission.

The bank commission is 3.5% of the transfer amount - 3,325.00 rubles.

The next day the goods were shipped to the buyer.

Wiring:

|

Debit Account |

Credit account |

Posting amount, rub. |

Wiring Description |

A document base |

|

Received an advance from the buyer with electronic money |

Account 62 of accounting is a special analytical account that is used to reflect the transaction of the supplier with the buyer and customer. This article will give you an idea of the main entries on account 62, which is reflected in the debit and credit of account 62, as well as on the documents that are the basis for their implementation.

Account 62 - can reflect both our debt to the buyer (on a loan) and the buyer's debt (on a debit). Therefore, this account is considered active-passive - it can get into the balance sheet in Liability and in Asset.

On loan 62, funds from, as well as prepayment amounts for goods and services, are credited to the account. At the same time, payment for services rendered and advances are accounted for on different sub-accounts:

- Invoice - payment received in the general manner;

- Check - .

In addition, there is a subaccount for separate accounting of received bills (). If the supplier receives from the buyer a promissory note providing for the payment of interest, then the amount of interest is reflected at. The repayment of the principal amount of the debt is reflected in the posting Dt (for currency accounts Dt) and Kt 62.

For the convenience of the accountant, analytics on account 62 is kept in the context of each invoice sent to the buyer, as well as separately for each counterparty and agreement with him. In addition, operations can be classified according to the following criteria:

- method of payment (availability of an advance payment or payment upon shipment, provision of services);

- payment term (overdue payment or its due date has not come);

- availability (the bill is registered in the bank, its maturity has not come or payment on the bill is overdue).

The accountant has the right to independently choose the criteria on which the analytical accounting of account 62 will be built at the enterprise.

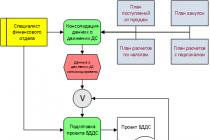

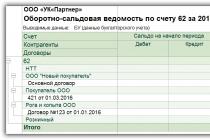

Turnover balance sheet for account 62 using an example

Consider an example of the formation of a balance sheet for 62 accounts from the 1C program:

What do we see from this OSV?

For example, in 2016, the counterparty “LLC Horns and Hooves” made a payment in our favor in the amount of 61,114.56 rubles, and we shipped goods to him or provided services in the amount of 27,110.68 rubles. The final before the buyer is 34,004.88 rubles.

Basic account entries 62

The main transactions on account 62 are the reflection of settlements with buyers in the general manner, based on the received prepayment, as well as in the presence of a bill. Let's look at each of these cases with an example.

Reflection of settlements with buyers in a general manner

Let's say between Faktotum LLC and Vestra LLC an agreement was concluded for the supply of goods and materials in the amount of 34,000 rubles, VAT 5186 rubles. The cost of goods is 000 rubles. The contract stipulates that the buyer of Vestra LLC pays for goods and materials after shipment.

This operation in the accounting of Faktotum LLC will look like this:

Using account 62 to record advances received

Consider an example:

Giper LLC is a stationery supplier. The organization entered into an agreement with Gamma LLC in the amount of 36,000 rubles, VAT 5492 rubles. The contract provides for an advance payment.

In this case, the accountant of the PA "Hyper" will make the following entries in the accounting:

| Dt | CT | Description | Sum | Document |

| 62/2 | Gamma LLC received an advance payment under a supply agreement | 36 000 rub. | Bank statement | |

| 76 Advances received | 68 VAT | Accrued VAT from advance payment 18% | 5492 rub. | Bank statement |

| 68 VAT | 76 Advances received | Restored 18% VAT accrued from the advance | 5492 rub. | |

| 62/1 | 90/1 | Reflected revenue from the supply of stationery | 36 000 rub. | Packing list |

| 62/2 | 62/1 | Advance payment received from Gamma LLC has been credited | 36 000 rub. | Bank statement, bill of lading |

| 90/3 | 68 VAT | 18% VAT charged for transfer to the budget | 5492 rub. | Bank statement, bill of lading |

Postings on account 62 "Bills received"

If the buyer does not agree to make an advance payment, and also does not have the opportunity to pay for the goods upon shipment, then in this case the supplier receives a bill of exchange from the customer, which acts as collateral for receivables.

Let's imagine that Nova LLC is a supplier, and Antika LLC is a buyer under a furniture supply agreement. The amount of the contract is 114,000 rubles, VAT is 17,390 rubles. As security for the debt, Antika LLC issues a promissory note to Nova LLC.

Nova LLC will record the following transactions:

Analytical accounting of account 62, organized taking into account all the necessary criteria, will ensure accurate and transparent maintenance of account 62.

Speaking briefly about accounting for settlements with buyers and customers, we can say that account 62 “Settlements with buyers and customers” is the basis of such accounting (Order of the Ministry of Finance of October 31, 2000 No. 94n).

Account 62 "Settlements with buyers and customers"

For a more detailed coverage of the features of accounting for settlements with buyers and customers, please refer to the Instructions for Using the Chart of Accounts.

62, an accounting account is usually debited for the amounts of settlement documents presented in correspondence with the credit of accounts 90 “Sales”, 91 “Other income and expenses”, and credited for the amount of payment received in the debit of accounts 50 “Cashier”, 51 “Settlement accounts”, etc. .

Analytical accounting on account 62 must be kept for each invoice presented to buyers, and in the case of planned payments, for each buyer and customer. Analytical accounting of settlements with buyers and customers should be organized in such a way that it is possible to obtain data on settlements with such counterparties:

- on settlement documents, the payment term of which has not come;

- for settlement documents not paid on time;

- for advances received;

- on promissory notes, the date of receipt of funds for which has not come;

- on promissory notes discounted (accounted for) in banks;

- on promissory notes for which funds were not received on time.

Documentation of settlements with buyers and customers depends on the features and procedure for settlements with buyers, on whether cash or non-cash settlements with buyers are made. As a rule, such documents are waybills, acts, invoices, cash and sales receipts. For example, the rules for settlements with buyers for cash, usually require the issuance of only cash register checks to them, and when settling for goods delivered by organizations, waybills are drawn up among themselves and, if the transaction is subject to VAT, invoices.

In the event of the creation of "doubtful" reserves, the debt of buyers in the balance sheet is reflected minus the created reserve (clause 35 PBU 4/99).

However, it is impossible to answer unambiguously the question whether settlements with buyers and customers are an asset or a liability. Indeed, according to settlements with buyers and customers, both receivables (there is a shipment, but no payment) and accounts payable (when receiving advances) can be formed. In the first case, information on settlements with buyers and customers will be reflected in the asset balance as part of receivables, and in the second case, in liabilities as part of short-term liabilities. The foregoing means that 62 accounting account is an active-passive account.

In modern conditions, improving the accounting of settlements with buyers and customers comes down mainly to increasing the efficiency of data on settlements with buyers and speeding up the exchange of documents between counterparties. One of the elements of the development of the system of settlements with customers is the introduction of electronic document management.

Settlements with buyers and customers: postings

For settlements with customers, the main transactions consist in recognizing income from the sale of goods, works or services and receiving payments to pay off receivables, as well as advance receipts.

So, for the amounts of the submitted settlement documents in the accounting of the seller, accounting entries are made:

Debit of account 62 - Credit of account 90 "Sales", 91 "Other income and expenses"

The use of accounts 90 and 91 depends on whether the recognized income is or.

In retail sales, the fact of sale can be recognized, bypassing account 62, when the posting is made: Debit account 50 "Cashier" - Credit account 90.

For the amounts of payments received (including advances), accounting records are formed:

Debit of accounts 50 "Cashier", 51 "Settlement accounts", 52 "Currency accounts", etc. - Credit of account 62.

At the same time, separate accounting of advances is kept on account 62, as a rule, by opening an additional sub-account.

In accounting for settlements with buyers and customers, postings are not limited to sales records and payment receipts. The procedure for accounting for settlements with buyers and customers involves a reliable reflection of information about such settlements in the financial statements. For these purposes, the debt of buyers and customers is analyzed for its doubtfulness and the need to create a reserve on account 63 “Reserves for doubtful debts” at the expense of financial results (clause 70 of the Order of the Ministry of Finance of July 29, 1998 No. 34n):

Debit account 91 "Other income and expenses" - Credit account 63.

The sale of goods and services is the transfer on a reimbursable basis of the right of ownership of goods and the provision of services for a fee by one person to another. We will tell you about typical accounting entries for the sale of goods and services in our consultation.

Sale of goods: postings

The main account for accounting for the sale of goods in accordance with the Chart of Accounts and Instructions for its use () - account 90 "Sales". This account reflects the proceeds from the sale of goods, as well as the costs associated with the sale and VAT accrued on sales.

Imagine typical postings for the sale of goods in the table:

The presented set of transactions assumes that revenue is recognized at the time of shipment of goods.

However, a situation is possible when, in accordance with the contract, the ownership of the goods passes to the buyer, for example, at the time of payment. In this case, the revenue at the time of shipment is not recognized, because one of the conditions for its recognition is not met - the transfer of ownership to the buyer (clause "d" clause 12 PBU 9/99). But since the goods actually leave the warehouse and are written off from the register, account 45 “Goods shipped” is used at the time of shipment:

| Operation | Account debit | Account credit |

|---|---|---|

| The goods were shipped to the buyer under an agreement with a special procedure for the transfer of ownership (after payment) | 45 | 41 |

| VAT charged at the time of shipment | 76 "Settlements with different debtors and creditors" | 68 |

| Received payment from buyers | 51, 52, etc. | 62 |

| Recognized revenue from the sale of goods | 62 | 90, sub-account "Revenue" |

| Written off the cost of previously shipped goods | 90, sub-account "Cost of sales" | 45 |

| Accounted for VAT accrued at the time of shipment of goods | 90, sub-account "VAT" | 76 |

| Write-offs related to the sale of goods | 90, sub-account "Sales costs" | 44 |

When they talk about reverse sale, they mean a set of accounting entries that the buyer must make in his accounting when returning the goods to the supplier. You can read about typical postings when returning goods for various reasons in.

Free implementation: postings

Sometimes the sale is also understood as the gratuitous transfer of goods. Naturally, in this case, the "seller" does not reflect the income from the disposal of goods. Yes, and the costs associated with the sale will not be taken into account on account 90. To account for a gratuitous transfer, account 91 “Other income and expenses” is used (Order of the Ministry of Finance dated October 31, 2000 No. 94n, clause 11 PBU 10/99).

Free sale of goods will be accounted for as follows:

Implementation of services: postings

The main difference between services and goods is that services are consumed directly at the time of their provision. In this regard, the costs associated with the provision of services collected on accounts 20 "Main production", 23 "Auxiliary production", 29 "Service production and farms" are written off to the debit of account 90 at the time of presentation of services without their intermediate accounting on the account, similar to account 41.

The rest of the accounting entries for the provision of services will be similar to those given above.

Account 62 "Settlements with buyers and customers" is designed to summarize information about settlements with buyers and customers.

Account 62 "Settlements with buyers and customers" is debited in correspondence with accounts 90 "Sales", 91 "Other income and expenses" for the amounts for which settlement documents are presented.

Debit account 62 "Settlements with buyers and customers"

Credit of account 90 "Sales", account 91 "Other income and expenses" - an invoice was presented to the buyer.

Account 62 “Settlements with buyers and customers” is credited in correspondence with cash accounts, settlements on the amounts of payments received (including the amounts of received advances). In this case, the amounts of received advances and prepayments are accounted for separately. The following entry is reflected in the account:

Debit of account 50 "Cashier", account 51 "Settlement accounts", etc.

Credit of account 62 "Settlements with buyers and customers" - the amounts of payments received from buyers (customers) are reflected.

When selling finished products to the buyer, the following accounting entries are reflected.

1. Finished products shipped to the buyer at the actual cost:

Debit of account 90 "Sales", sub-account "Cost" Credit of account 43 "Finished products".

2. An invoice has been presented to the buyer:

Debit of account 62 "Settlements with buyers and customers" Credit of account 90 "Sales".

3. Value added tax was charged on the sold finished products:

Debit account 90 "Sales"

Credit of account 68 "Calculations on taxes and fees".

4. Payment received from the buyer for the finished product:

Debit of account 50 "Cashier", account 51 "Settlement accounts" Credit of account 62 "Settlements with buyers and customers".

If an interest is provided on the received bill that secures the debt of the buyer (customer), then as this debt is repaid, an entry is made on the debit of account 51 “Settlement accounts” or 52 “Currency accounts” and the credit of account 62 “Settlements with buyers and customers” (on the amount of debt repayment) and 91 “Other income and expenses” (by the amount of interest). The account reflects:

Received funds from the buyer:

Debit of account 51 “Settlement accounts” Credit of account 62 “Settlements with buyers and customers”.

The percentage value is included in the income of the organization:

Debit of account 51 “Settlement accounts” Credit of account 91 “Other income and expenses”.

Analytical accounting on account 62 "Settlements with buyers and customers" is conducted for each invoice presented to buyers (customers), and in case of scheduled payments - for each buyer and customer. At the same time, the construction of analytical accounting should provide the possibility of obtaining the necessary data on:

- to buyers and customers under settlement documents, the payment deadline for which has not come;

- to buyers and customers for settlement documents not paid on time;

- advances received; bills of exchange, the date of receipt of funds for which has not come;

– promissory notes discounted (accounted for) in banks;

– promissory notes for which funds were not received on time.

Accounting for settlements with buyers and customers within a group of interrelated organizations, on the activities of which consolidated financial statements are compiled, is kept on account 62 “Settlements with buyers and customers” separately.