According to the Bank of Russia, in 2016 alone, fraudsters stole 1.08 billion rubles from the cards of Russians. There are many ways - from psychological impact on the victim in order to find out her card details to theft using screening devices installed in ATMs. The result is the same - the money is debited from the card, and the owner is "overwhelmed". Most people let everything take its course, believing that the stolen funds can no longer be returned. And completely in vain. Thanks to the steps taken in time, there is a high chance of getting the money back and leaving the attackers with nothing. Well, what exactly needs to be done, I'll tell you about it.

What to do if scammers withdrew money from the card!

Article 9 federal law 161 “On the National Payment System”, banks are obliged to reimburse their customers for funds stolen from cards in full. However, this rule only applies if the victim applied on time and it was proven that the funds were debited fraudulently. To get your money back, follow these steps:

- Immediately after learning about the theft of money from bank card should immediately call contact center issuing bank and block the card. Ideally, if you have an SMS notification about all transactions made, so you can find out in a timely manner about the theft of funds and block the card. It is very likely that you only received information about the first debit, and you will be able to prevent the theft of the rest of the money.

- Contact the bank and write a statement about the loss of funds and demand compensation for losses. Be sure to study the agreement on issuing the card, which contains data on the actions of the bank in case of theft of money from the card.

- Attach available evidence that the money was debited fraudulently. Unfortunately, the presumption of innocence does not apply here, and the bank will first of all assume that you yourself withdrew the money or your close relatives did it. For example, such evidence can be a document from law enforcement agencies stating that a bank card was stolen, and therefore you have nothing to do with the withdrawal of funds.

- Write a statement to the police about the fact of fraud. In most cases, the security service of the bank asks not to do this, as the reputation of the financial institution may suffer from this. However, it should be borne in mind that the bank does not really want to return the money, therefore, if law enforcement agencies can find the attacker or prove the fact of fraud, this will be indisputable evidence for the return of your money by the bank.

- Wait for the result of an internal internal investigation on the fact of theft of funds from your bank card. If the money was stolen on the territory of the Russian Federation, then the bank must report the results no later than 30 days after the application was submitted, otherwise - within 60 days.

- In case of evidence that the money was fraudulently stolen, for example, using screening devices in an ATM, the money will be returned. However, if the bank proves that cash were stolen due to the actions of the victim himself, for example, transferring card data to other persons, then the bank has every right to refuse to return them.

- Appeal to the court, as the last resort, if the bank refused to return the money and there is evidence that the money was stolen by fraudsters.

Unfortunately, banks are not very interested in returning stolen money to customers, especially if they cannot show evidence of fraud. Therefore, the chances of returning the funds are not very high, but still there. The best way not to lose your money is to contact the bank as soon as possible, as soon as you receive an SMS about debiting funds from the card. Money is not immediately withdrawn from the account, there is certain period authorization. Therefore, if the client has time to submit an application on time, the transaction will be canceled and the money will be returned.

Protective Measures

Even though there is a chance to get your money back, it is better to prevent them from being stolen by scammers. This will save both unnecessary worries and the hassle of processing a refund. You just need to follow a few precautions:

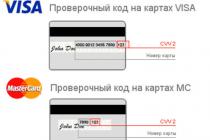

- Do not share your card details with anyone, and in particular the CVV code on the back of the card, as well as the pin code for it. Fraudsters can call and try to find out this information, pretending to be bank employees or representatives of the store where payment is supposedly processed with your card. There are many ways to fish out, but if you understand that they are trying in every possible way to find out your card details, in no case go forward and do not report them.

- Set a password that you will need to enter to confirm payments on the Internet. According to the data, out of 1.08 billion rubles stolen by scammers in 2016, 714 million were the result of the theft of online payments.

- Connect SMS-informing about all performed operations. So you will find out in time about the debiting of funds by scammers and will be able to take timely action against intruders. When changing a SIM card, it is imperative to rebind the mobile bank to a new phone number, since after disconnecting the SIM card, after some time, the operator transfers the number to the new user.

- Carefully check ATMs for additional devices. Also, if the card is stuck in the slot or if an error is reported when entering the pin code, if you are sure that it is correct, call the bank and block the card. Typically, such cases indicate that the ATM has special devices designed to read information from your card and redirect it and the pin code to fraudsters.

- If the card is lost, it should be blocked immediately.

- Install an antivirus not only on your computer, but also on your smartphone. Malicious programs "leaked" on devices can transfer your card details to attackers when using Internet banking or redirect payments to other accounts.

- Do not open links that are in SMS messages from unknown subscribers. There is a high probability that by opening them, you will catch a virus, due to which you can later find that funds have been debited from your card.

- Be careful when paying for purchases on the Internet, as often when a computer is infected with a virus, there may be a redirect from a normal store to a fraudulent website.

By following all these precautions, you will be able to prevent fraud with your bank card and reduce the risk of theft of funds to a minimum. However, if the money was nevertheless stolen, the most important thing is not to panic and not leave everything as it is. You don’t want to “give” your money earned by such labor to someone who doesn’t know? After completing all the steps described earlier, there is a fairly high chance of returning the stolen funds back, especially if you contact the bank on the day of the theft.

Internet crime has recently been growing as fast as the number of global network users. 20% fraudulent transactions with finances are connected precisely with the theft of money from bank cards. If we count in money, then the amount of "stolen" funds is about 2.5 billion dollars.

Fraud is different. The most popular destinations associated with the theft of money from cards are phishing And skimming . In the first case, your money is simply stolen using Internet resources. They give you a fake bank page as a link, you enter your data there (if necessary, which appears sooner or later), and you're done - the scammers already have your account data!

As for skimming, everything is also very simple here - there are input readers on the ATM. That is, the device remembers the numbers that you enter when prompted to dial a pin code. The numbers are fixed, and small cameras are also installed on ATMs, with the help of which your card number becomes visible. It is not difficult to make a duplicate, since the information from the magnetic tape of your card is still read by the skimmer. When making a duplicate, it is this information that is used, and to withdraw funds, all that remains is to insert the duplicate into an ATM and enter the pin code read by the skimmer earlier.

How scammers withdraw money by card number

Many often ask the question - can scammers withdraw money from a card knowing only the card number? The answer is unequivocal - of course they can. However, this does not apply to all types of cards. Let's tell you more.

Such a technique may lend itself to cards of the type master card And Visa Classic . In other words, those cards with which you can make purchases on the Internet. Cannot be "cleaned" due to this card acceptance Maestro, as well as products momentum.

It is Sberbank that has the ability to transfer funds from card to card without additional information- for this you only need to know her number. This method of translation is used by people quite actively when it is necessary to settle accounts between acquaintances. It's possible - just do it minimum transfer via Sberbank online, and you will receive an SMS message with information about the name and patronymic of the owner.

It turns out that if you know the card number, then the easiest way is to agree on the purchase of goods through third-party resources, for example, Avito subject to transfer to a Sberbank card. In this situation, the scammer will already know the card number, he will be able to find out his full name through the online account, and he will be able to make any purchase through your account on those platforms where there is no need to enter, and also where it will not be necessary to enter the security code from MasterCard SecureCode.

How do withdrawals work by number only? Consider an example using Avito.

The fraudster will first need to find out your card number, for this he can ask you for it to pay for the purchase (allegedly, it will be much more convenient to pay off this way). You can also write down the card number, remember it, fix it on the camera, or use many other methods for this.

Next, the fraudster will need the full name of the cardholder. This is much easier to do than to find out her number. It is enough just to ask a question in whose name to transfer money. You can also use the option mentioned above with the transfer of funds through the online account. There is no need to carry out the transfer to the end, because it is only necessary to reach the moment when data verification is required.

After the data is displayed, the scammer translates your data into transliteration, and this is also completely simple.

That's all, the scammer can start spending your funds from the card, while going to any resource where confirmation by CVV code is not required, there is also no transfer to SecureCode. Also, scammers choose resources where there is no need to use Sberbank one-time passwords. So you become a victim - you just need to give out three of your parameters: full name and card number, as well as its validity period.

If you have before your eyes the number of a plastic card, then it will not be difficult to find out the type of it. Accordingly, it will not be difficult for an experienced fraudster to estimate, according to the available data, what type your card belongs to. To do this, it will be enough for him to know the number of digits and the number with which the number itself begins.

Then the “most difficult” remains - to find out what the card has an expiration date. Everything is simple here - the card is valid for three years, respectively, 12 months for each year. In total, we get that there will be 36 varieties of dates for the validity period. Going through 36 options in order to add a card to a resource for payment is a matter of 10 minutes. There are no restrictions on entering information, so you can iterate until the card is added.

Now you are fully aware of how

How to withdraw money from the card, knowing the number and CVV

By card number and CVV code, stealing money is even easier. There are many more resources for paying for goods and services using a CVV code when paying than simple stores that do not require this information. ? To make a withdrawal, you need to know the following:

- CVV code.

- Full name in transliteration.

- Card expiry date.

- Card number.

After that, you just need to choose any product you like in the online store, or transfer money to an account with a bookmaker, payment system, e-wallet account, etc. It is enough to enter all the data and confirm the operation in a timely manner - and the money will be debited from the account.

How to choose a secure card

Thus, it turns out that if a person knows the card number, then he may well write off funds from it, and in order to carry out this operation, there is no need to look for all the other data about the card owner, because this can be done quite easily. Now you know how fraudsters can easily find out the name of the cardholder and how you can choose the expiration date of someone else's card on your own.

What can be said in favor of protection from such misconduct? It is quite simple to protect yourself from Internet scammers - you just need to use Everyday life type cards Maestro Momentum or cirrus. Such cards are issued by Sberbank, and without additional security information, an outsider will not be able to withdraw or transfer funds from your card, or make a purchase on the Internet.

In addition, it is worth considering which ATMs you use when withdrawing funds. It is best to use those devices that are located in the offices of Sberbank or those that you use constantly and consider them tested. Fraudsters will not be able to put a skimmer reader on such ATMs, so such devices are the most secure.

As for security measures, in addition to those listed, it is worth paying attention to the fact that you need to use Internet banking resources with great care. Fraudsters do not sit still and constantly improve their skills in sophisticated theft of money from cards.

Now it is very popular to create viral forms of pages that are a complete copy of popular resources for paying for services or goods. These include social networks, online stores, bank websites, etc. You should always carefully look at the address of the sites and compare it with the original. If you notice differences in them, then know that they are trying to deceive you!

How to protect yourself from credit card fraud

So, is it possible to withdraw money from a card knowing only its number? Based on the information above, it is certainly possible. This can be done in several ways - with or without a CVV code, using contact details, by reading information when withdrawing cash from an ATM, etc. The more information about the card and its holder is in the hands of a fraudster, the easier and faster he will withdraw money from the card.

In fact, all security measures are rather conditional for all cardholders. If someone outsider can find out your name and card number, one can only hope that he turns out to be an honest and decent person and will not use this information for his own personal benefit. If you take much more security measures to ensure that your bank card is less vulnerable, the chances that you will become a victim of an Internet scammer will be minimized. However, the minimum probability of being deceived will still remain.

All this does not mean at all that you do not need to keep your hard-earned savings on bank cards - this is not at all the case. You just need to be careful in the calculations and try, if possible, not to give out information about yourself and your card. It is especially important to secure your gadgets, which you sometimes use to view information on your account. Now, in recent years, cases have become more frequent when it is through phones and tablets that passwords are cracked. Based on the data already available, the fraudster will have access to the cardholder's account.

Pay attention to the degree of safety of using your gadgets. If they are equipped with the highest quality anti-virus systems, it will be difficult for scammers to slip you a phishing link so that you, having followed it, lose control over access to your bank account. Otherwise, in the absence of this protective degree, you will be much more vulnerable if you use Sberbank Online through your phone or tablet.

Try also not to use the card as the main payment force - after all, cash will never be able to displace electronic money, even despite the convenience of their use. By the way, the most interesting thing is that cardholders most often become to blame for being victims of fraud. You do not need to share your card details with anyone, either in person or over the phone. This can only be done if you yourself are sure that you are reporting the data to a bank specialist or a reliable person. If the phone number by which you were contacted does not inspire confidence and is suspicious, you should not even talk about such things as bank card details.

Based on the above, it is worth highlighting a few points in particular:

- Do not share your card details with anyone.

- Do not use suspicious sites and payment forms.

- Do not use unfamiliar ATMs to withdraw cash.

- Try to issue cards for yourself that have the maximum degree of security for online transactions.

Always follow these rules, and you will not become easy prey for scammers. If you are not satisfied with how safe Sberbank is, you can always change the bank for storing funds, but before that you need to think carefully whether it is worth doing and whether another bank will be more reliable.

Keeping funds in a bank may not always protect them from the actions of fraudsters. You never need to disclose your credit card details, write passwords on plastic, and so on. But what if the attackers still managed to use your card?

Most often, the victims of scammers are people who have phones with the Android platform. People have a question about whether Sberbank will return the money back to the victim.

Connection mobile bank usually done upon receipt of the card in hand. The service allows you to make operations and transactions on the card remotely, using mobile communications.

- The client is notified via SMS about all transactions performed on the card.

- When paying online, you must confirm the actions using a one-time code that is sent in the message.

- By following simple steps, you can get information about personal bank accounts.

- Instant notification of a transaction related to the transfer of funds, the receipt of cash.

How do scammers withdraw money from a bank card through Mobile Banking?

Attackers can resort to several theft schemes:

- By introducing a Trojan program into the smartphone. It is able to intercept all incoming SMS that come to cellular telephone. Having received necessary information, the attacker gets access to the transfer of funds to his account.

- Through phishing sites. Such resources display a bank page on the application screen. This page is not real, but fake. The client enters his username and password, which are intercepted by the scammer. Their attacker is already entering on the real website of the bank.

- Fake window in use Google Play. It contains the details of the card.

- When replacing a SIM card, when the Mobile Bank was not immediately linked to a new phone number.

Can scammers get money from a card using a phone number?

During a lifetime, every person changes their cell number more than once. The need for this may arise for several reasons: loss of a phone, purchase new card, change of operator and so on. The client ceases to use the old number, and over time it can be transferred to another subscriber.

How do attackers get money from a card without entering a PIN code?

No introduction security code withdrawing cash is not possible. It should be noted that if the password is entered incorrectly three times, the card will be blocked. In this case, access to your finances can only be obtained by personally contacting the bank. It is also possible to call hotline jar.

Attackers resort to a variety of actions to get money from the card:

- Make purchases of goods in those retail chains where no PIN codes are required.

- They withdraw money without any problems if the wallet is lost along with the password.

- They make purchases in online stores where there is no need to indicate the PIN-code of the card. Only basic information is entered, such as card number, CVV code and expiration date.

- By scanning the magnetic tape and making a copy of the card. This can be done thanks to specially installed equipment in remote ATMs. Fraudsters copy not only the card itself, but also the PIN code for it.

Reasons for cardholder SMS notifications about withdrawals

If on mobile phone cardholder received an SMS about cash withdrawal, it is necessary to analyze the possible options:

- the notification came a little later, but the money was withdrawn personally by the cardholder;

- withdrawal of a mandatory scheduled payment that was issued in personal account Sberbank Online;

- debt collection by bailiffs;

- card service fee;

- write-off of funds in favor of repayment of debt under a loan agreement;

- bank error.

If the withdrawal is not related to any of these activities, then most likely the money was stolen by scammers.

What to do if scammers withdrew money from a bank card?

If money is missing from a bank card, then first of all, the client should think that they were stolen using the Mobile Bank. The victim is wondering how to return the money to his account. Managers recommend doing the following:

- Call the hotline and report the misunderstanding.

- Explain what happened and how, and then ask to block the card.

- Familiarize yourself with the clause in the agreement on the conditions for challenging operations and actions in case of theft.

- Personally go to the bank office, having documents verifying your identity with you.

- Issue a statement to the bank that the transaction was not personally carried out by the client.

- Submit paperwork to the bank in two copies. One remains in the hands of the client, the second in the bank. The filing date of the application is the starting date.

- Show the bank evidence that the funds were withdrawn by an unauthorized person.

- If the bank considers the application and a decision is made to return the money, then they must be expected at the specified time.

If the bank refused, then the client has the right to try to return the funds in court.

Banking nuances

Upon receipt of an application from the client about the loss of funds from the card account, the bank begins to act in accordance with the approved scheme. Such a scheme includes some mandatory actions. It is important to perform these steps in the order shown.

First of all, you should draw up a claim appeal to the organization itself with a request to return the stolen money. In order to substantiate your claim, you must provide proof that the money was withdrawn by a third party.

After that, the situation is investigated by the security service of the bank. The study of the materials that were transferred by the client to the bank begins. The reputation of the applicant is also subject to verification. Consideration of the application may take up to 90 days.

At the time of the investigation, the security service in without fail will ask to provide evidence of the client's non-involvement in the theft of funds, since at this stage he is the main suspect. To do this, bank employees can contact the client's family members, friends, colleagues.

The main goal of the bank is not to return the funds, but to check the integrity of the victim. If this fact is confirmed by the bank, the funds will be returned to the client. The fact of fraudulent activity will be considered proven.

Contacting law enforcement agencies

The injured client, in parallel with writing an application at the bank, must contact law enforcement agencies. The bank is not interested in such actions, because for this reason its reputation may suffer. The application must be written in the same way as in the bank. Based on the written document, the police are investigating. The actions of the authorities are as follows:

- a request to the bank where the incident occurred;

- inspection of the shopping center or the device in which the action was performed;

- consideration of video from surveillance cameras;

- interrogation of the injured person, members of his family and friends;

- analysis of the information received and the current situation.

Will the funds be returned if they were withdrawn by the attackers?

With a fraudulent withdrawal, it is important to remember that the transaction was in any case carried out on behalf of the client. In such a situation, it is necessary to prove your innocence and integrity. If the client manages to do this, then you can count on a refund of your money.

If the victim was not transferred the money, then he has the right to write an appeal to the police station and go to court. If there is evidence of non-involvement, then the bank that owns the card returns the stolen funds to the person. An arbitration notice is issued to compensate for the trade.

How to avoid such situations?

- When installing the program on a smartphone, you need to make sure that there is no malicious utility.

- All applications should be downloaded only from official sources. It is important to pay attention to the requirements of the utility when downloading.

- You do not need to go to the links that come in SMS.

- Always use antivirus.

- In order to avoid theft, it is recommended to use only those self-service devices that are located in the bank office.

As you can see, inattentive customers themselves are most often to blame for withdrawing money by attackers.

In order to return the stolen money, you need to make every effort, and this does not give a guarantee of return. If you follow all the safety rules, then a person will not get into such trouble.

Modern people keep money, as before, in wallets, under mattresses, even in three-liter jars.

But still, most often, savings are transferred to "plastic", that is, to a bank account or simply credit card. Convenient, simple, affordable, reliable - the advantages of bank payment cards can be listed for a long time.

And if you add cashback to the list, Special offers, benefits in the network of bank partners, the product is not only convenient, but also profitable.

The problem is that in any area where big money is spinning, there are a lot of cunning machinations. You will learn more about how scammers withdraw money from a bank card, and what you need to do to secure your "wooden" ones.

Fraudsters who withdraw money from bank cards are also called phishers and carders.. In most cases, they have nothing to do with cybercriminals, but simply deceive personal data from gullible cardholders.

Fraudsters who withdraw money from bank cards are also called phishers and carders.. In most cases, they have nothing to do with cybercriminals, but simply deceive personal data from gullible cardholders.

Therefore, remember - the card number, its expiration date, the code indicated on the reverse side should not be given to anyone.

There are more cunning schemes that involve stealing data through special applications, online shopping sites, “unusual” ATMs.

You will learn further about whether fraudsters can withdraw money from a card knowing only the card number, and how they generally turn their schemes.

Interesting to know. In 70% of cases, people themselves give fraudsters data on their card.

Skimming is an old method of stealing money, but no less popular for that.. Fraudsters attach a skimmer (a device that reads data) and an overlay keyboard to the ATM card reader.

Skimming is an old method of stealing money, but no less popular for that.. Fraudsters attach a skimmer (a device that reads data) and an overlay keyboard to the ATM card reader.

It all looks like a real ATM should look like, so a person without suspecting anything enters all the data from the card, withdraws money, and leaves.

Fraudsters using a skimmer read all the card data and make it a duplicate. Well, then - a matter of technology.

Cash out at ATMs located in branches, or large shopping centers, business centers. In other places, it is very easy to become a victim of skimmers.

Such fraud occurs rarely, but aptly. Fake ATMs look almost the same as the real ones.

Such fraud occurs rarely, but aptly. Fake ATMs look almost the same as the real ones.

They do not give money, but they read all personal data from the card.

You go for cash at another ATM, and at this time the attackers "conjure" with your credit card.

ATM theft is not common, but if it does, your data could end up in the wrong hands.

POS terminals

A POS terminal is a convenient thing, because through it you can pay for any services (communal, Internet, even a child's kindergarten) around the clock.

And they are also dangerous for your money - terminals are the object of attack by scammers who install malware, then steal personal data about payment cards, and then, again, it's a matter of technology.

How do scammers withdraw money from a card without a pin code? It's easy - they just need to know the CVV code.

How do scammers withdraw money from a card without a pin code? It's easy - they just need to know the CVV code.

Therefore, do not enter the three-digit value that is on the back of the card when paying on the Internet or do not keep money on this card (it is enough to replenish it from the main account immediately before the transaction and strictly for the specified amount).

Another option - you give a credit card to a waiter in a restaurant, he takes it away and rewrites the data (number, expiration date, code). No one knows in advance what the representative of the service sector will do with them.

Insecure Applications

Downloading incomprehensible applications from dubious sites, you are at great risk of all the personal data that is on your PC or smartphone - malware simply steals them.

Therefore - either official app stores, developer sites, or nothing.

At the airport, restaurant, mall, yes, anywhere free web Wi-Fi gives you access to your bank accounts to everyone who knows what ClientLogin is.

At the airport, restaurant, mall, yes, anywhere free web Wi-Fi gives you access to your bank accounts to everyone who knows what ClientLogin is.

So either don't use public open networks, or don't transact with payment card from your smartphone or tablet.

Mysterious Messages

The method is old - it appeared far from 2020 - but still effective. Transfer money, send card details, follow the link, your account is blocked - do not believe such messages, since their main goal is to lure out personal data on the card.

Fake sites

They are allegedly used to pay for goods and services. It is enough to fill in all the fields, and especially the expiration date, the secret code, and you can say goodbye to hard-earned money.

If it seems to you that the site of the payment system does not look the same, not the same as usual, it is better to refuse to use it.

Phishing is extortion of payment card data from their gullible holders.. “Scammers withdrew money from the card through Avito”, “I won the lottery, and I was robbed” - such posts can often be found on the net.

Phishing is extortion of payment card data from their gullible holders.. “Scammers withdrew money from the card through Avito”, “I won the lottery, and I was robbed” - such posts can often be found on the net.

The scheme is as old as the world, but it works. Let's say they call you and say that you have become the proud owner of a super prize - only to receive it you need card data (with a secret code and expiration date, of course).

Or a potential buyer calls on an ad posted on Avito and says that he cannot make an advance payment - more data on the card is needed.

Do not trust anyone - to credit the payment, it is enough to know the credit card number, even the full name of the holder is given only to check the correctness of the entered data (so that the payment does not go the wrong way). Everything else is a hoax.

The scammer knows the card number and mobile phone - is it worth it to be afraid?

Except quite a bit. Can scammers, knowing the phone number, withdraw money from the card? Yes, they can, but bypass banking systems protection is difficult, so they are usually bypassed in a simpler way.

Let's see how scammers withdraw money from a bank card through mobile bank. Let's say you received a call from an unknown number - you pick up the phone, say "hello", and the very fact that you answered is used as confirmation to enter the mobile bank.

The execution method is quite complicated, so it is rarely used.. Plus, you can simply not answer incomprehensible calls.

In most cases, people lose money from bank cards due to their own stupidity and gullibility. Do not "shine" personal information, especially in the complex - card number, name of the holder, expiration date, secret code.

In most cases, people lose money from bank cards due to their own stupidity and gullibility. Do not "shine" personal information, especially in the complex - card number, name of the holder, expiration date, secret code.

Make payments on the Internet with caution, but rather get a separate card for this, on which you will not store money.

It is better not to use POS terminals once again, ATMs on the street, and even with strange keyboards, too.

Never share personal data with scammers on your own - even if they are presented by the police, security service, bank employees, and so on. Who is forewarned is forearmed.

Video: How do scammers withdraw money from a bank card?

Bank cards are a reliable means of storing money. Only the owner himself can withdraw the funds, since for this you need to know the PIN code. However, now situations have become more frequent when fraudsters have withdrawn money from a bank card, and the injured person does not even know what to do. Of course, you need to act immediately to protect yourself and punish the swindler. We will figure out how a fraudster can steal funds from a bank account, as well as how you can return the money.

How scammers can withdraw money from a bank card

There are many ways in which a fraudulent plan is carried out. Often, even the cardholders themselves are to blame for the fact that they managed to steal funds from them. Now you need to be as careful as possible so as not to become a victim of intruders. Because it is not so difficult to write off money if you have the necessary information.

What fraudulent practices are used:

- The person himself names the PIN-code necessary for withdrawing funds. For example, they can call him ostensibly from a bank and ask him to voice personal information. It is worth remembering that bank employees they will never ask for the password from the card or its other personal information. Also, they will not write SMS or send an email with such a requirement.

- You should not follow links on the Internet, even if they require you to do this to confirm personal data. Because, most likely, a person will get to a fake site, with the help of which scammers will receive information about the card.

- You do not need to disclose your PIN code, as well as write it on the card itself. Because there were cases when scammers took possession of the card and could easily cash it out, because the password was right on it. Moreover, you should not tell anyone personal data, even people you know. Because they will have the opportunity to write off funds.

- It also happens when data is stolen during payments to trading floors. The cardholder is redirected to the website of the scammers, where they receive bank details.

- Mobile banking service. It is useful for people who do not have internet on their phone. But in case of theft of a mobile, a fraudster can easily write off funds from the card. Because all messages about banking operations and confirmation codes. He will also be able to transfer money to another card using a special command.

Attackers may not even have the plastic on their hands, and at the same time they will have the opportunity to write off funds. Moreover, both debit and credit card. Alternatively, they can pay for any product on the Internet. In this case, the real owner will also lose his money and find himself in an extremely unpleasant situation.

What to do immediately

If someone is trying to cash out your account or is already using the card, you need to take immediate action. We will figure out what to do if you have debited funds through a mobile bank or in any other way. The main thing is to start acting in a timely manner, and then you can save the remaining funds and even catch the scammer.

As soon as a person realizes that his plastic or data was stolen, you should call the bank and block the card. This is necessary so that no one can use it for their own purposes. After that you can go to financial institution to report missing money. You should demand that the loss be compensated.

Important! You will need to attach evidence that you really became a victim of scammers. For example, a document from the police confirming the theft of the card.

Because it is quite difficult to return the funds, because the bank may claim that you yourself have withdrawn them or that relatives or friends did it. Actually, you also need to go to law enforcement agencies. The financial institution may ask you not to do this so that its reputation does not suffer. However, as experience shows, the money will be more willing to return if the person was in the police.

You will need to wait for a month while the issue of the theft of the card is considered. If it is proven that the funds were stolen fraudulently, for example, using screening devices in an ATM, then the money will be returned. However, if the victim himself is to blame for what happened, for example, he divulges personal data to outsiders, then the bank has the right to refuse a refund.

The main thing is to block the card in a timely manner. Because it is not possible in all cases to return your funds withdrawn from the card in a fraudulent way. Therefore, it is worth taking care not to suffer from scammers even more.

Where to go

It should already be approximately clear which authorities should be contacted if assistance is needed. The first instance is a financial institution, for example, Sberbank. If a person is a foreigner, for example, from Ukraine, then you will need to apply to the bank of your country.

You can also act through the police if the card or data is stolen. You can recommend going to the prosecutor's office or to the court in a situation where you could not achieve what you wanted in the usual way. In this case, the higher authorities will solve the problem and, perhaps, will be able to help the citizen.

How to avoid money theft

Of course, the easiest way is not to initially fall for the tricks of scammers. It is enough to follow the usual safety rules so as not to become a victim of scammers. You do not need to give your personal data to anyone under any circumstances. Because even the bank has no right to request secret information.

Also, you should not enter information about plastic on suspicious sites. In particular, you need to check that the Internet banking site is real and not fake. Because this is a common way to steal data. In general, it is quite easy to protect yourself from fraud if you remain vigilant. Do not respond to suspicious messages or calls. In extreme cases, you should personally call the bank and find out about the situation.