To calculate the loan, you must enter the loan amount, indicate the duration of the agreement and the size of your interest rate. This calculator can calculate both fixed annuity and decreasing differentiated monthly payments (open the “additional options” item).

The rate indicator can be selected as fixed or variable. To select the second option, you need to enter the number from which the new percentage will be entered.

Thanks to our calculator, you will no longer need to go to the bank to calculate early loan repayment. And you can do this in just 2 minutes! To do this, simply provide some additional data in the program form:

- What date are the funds deposited ahead of schedule (in the case of a one-time payment) or time period (if you plan to make regular payments several times a month);

- Amount of early payment;

- Specify the loan recalculation option;

- You can enter an unlimited number of early payments.

The nuances of partial early repayment of debt

Early repayment loan calculator

There may be 2 types of write-offs for partial early repayment:

On the day when the next payment is made. With this method, the amount of debt is reduced by the amount of the extraordinary payment made.

Between next payments. This option is somewhat more complicated in calculations. Interest, depending on the size of the debt, is accrued daily, and repayment occurs once a month. By the day the early payment is made, a certain amount of interest accumulates, which is canceled thanks to the funds intended for the early payment. With this option, only the remaining portion of the amount will be used to pay off the debt. Next month, the percentage of the next installment will decrease, since some of this interest has already been paid. There is no reason to worry about this moment and postpone early repayment until the next payment. If the payment is made earlier, it will be more profitable.

After paying the extraordinary installment, changes are made to the schedule of subsequent loan payments. The size of the principal debt decreases and, as a result, one of the parameters changes: the loan term or the amount of the monthly payment. A client of a banking institution can always choose a more convenient option for himself. This choice determines how the bank will recalculate the loan and what the next payment schedule will be formed. The updated schedule can be obtained at the bank office, or by logging into the Internet bank, if you have access to it. Our online calculator will give you the opportunity to choose any option and calculate the loan depending on your choice. You will have access to a detailed payment schedule, which already takes into account and indicates early repayments.

Reducing the loan term is beneficial because it significantly reduces the overall overpayment. It follows from this that if you can afford the monthly payment, then you should reduce the loan term.

You can try different options to find the most optimal payment scheme for yourself. The loan calculator stores the calculation results, and you do not have to remember all the numbers entered and received previously.

Variable interest rate

As the loan progresses, the interest rate changes quite often. Such cases arise when, at the request of the borrower or under the terms of the agreement, the bank revises the loan rate. Our calculator has its own function specifically for such cases. You can specify as many interest rate changes as you want over the life of the loan. For each individual time period, it is necessary to set the start of the bet and its size. All changes will be marked in color in the payment schedule.

A consumer loan is a loan that you take out for various consumption needs. For example, you want to buy a TV in a store or a washing machine, or go on vacation.

Purchasing a tour from an operator is purchasing a service. Those. you consume the service and take out a consumer loan.

The personal loan calculator is designed to calculate cash loans after taking into account fees and insurance.

Commissions and insurance are introduced through early payments.

Calculation options

The calculator allows you to simply calculate the loan - enter the amount, rate, term and click calculate.

The second option is calculating early repayment. You specify the loan data and the dates and amounts of early repayments. If you want to understand how much you will repay if you pay a certain loan amount each month, we recommend using a forecast calculator

See Also:

It will allow you to understand how quickly you will close the loan.

How to compare two loans

Before receiving a bank loan, it would be a good idea to calculate the overpayment on the loan. It is best to compare offers from several banks and choose the best. The calculator on this page can be used for this. However, you will have to open another page with a calculator to compare 2 different loans. We have created a loan comparison calculator specifically for comparing loans and early repayment schemes

See also:

It will allow you to understand which early repayment scheme to choose - reduce the payment term or amount. It will also help in choosing the most profitable lending option.

How to calculate a loan using a calculator

There are 2 options for calculating the loan

The first is a preliminary calculation when you want to take out cash on credit. For this calculation, the date of the first payment is not needed. It can be left as default. It does not affect the size of the monthly payment.

The loan amount is specified in the loan agreement and is taken without taking into account the down payment for a product or service.

Interest rate is the nominal rate on the loan excluding commissions and insurance. Taken from the loan agreement. You can enter 3 decimal places.

Expressed without dividing by one hundred.

Term - the whole number of months for which the loan is taken out. If you have 2 years, for example, then you need to enter 24 months

The second option is to calculate the existing loan

Next comes the field - the date of the first payment. This parameter is already important when you take out a loan

For a loan taken, calculation by date is important. That is, when constructing a schedule, the date of the next payment is indicated - the number of the day in the month.

Calculation based on dates is important for early repayments. The date of early deposit of funds determines in which month the new reduced payment will be made.

How to use the calculator?

After entering the required above data, you need to click on the calculate button.

After clicking it, the following options are possible

- Errors when entering data. Please note that dates must be entered separated by a period in the format dd.mm.uuuu. Amounts are entered using a dot; the rate can have 3 decimal places

- The loan settlement was successful. A payment schedule has been created. Loan overpayment calculated

Read also:

If the settlement is successful, you can start adding early repayments. In the form on the right - adding an early repayment - you need to enter the date, type and amount and click add. The loan schedule and other parameters will be automatically recalculated. The total overpayment will change.

In case of full early repayment, after this payment there will be zeros in the schedule, regardless of whether the amount or term was reduced.

If you added repayment with a change in term, there will be fewer lines in the schedule compared to the initial version.

Repayment with a change in amount will reduce the annuity payment on the loan. The number of lines in the payment schedule will remain the same.

If you added a change to the interest rate, the payment schedule will be recalculated at the new interest rate from the moment when this change occurred. The payment may increase or decrease depending on whether the rate was decreased or increased.

Export data to Excel

After calculation, you can save the results on your computer. To do this, click on the “Get Excel file” link. A file in Excel 2003 format will be generated and the “Download file” link will appear. You need to click on this link and the file will be saved with you. You can print the file and return to it at any time.

When calculating the loan, the link to this file disappears and you will need to generate the Excel file again.

I recommend adding the calculator to your bookmarks for ease of use in the future.

Popular questions and answers

How to calculate the interest per annum on a loan? Interest per annum is not considered. The bank determines the annual loan rate based on your income, credit history and other scoring parameters. Interest on the loan is accrued every day, but you need to pay it every month. If you want to find out the rate per month, you need to divide the annual rate by 12. Similarly - if per day, then multiply by 365 (366). If you want to calculate the interest for each month of using the loan, then you need to multiply the rate per day by the number of days in the month and for the balance of the debt at the beginning of the month.

Our bank calculator will calculate your loan in one click. Just indicate the parameters of the requirement you are interested in. loan and the program will make a preliminary calculation automatically. A monthly payment schedule will be generated under the form and will contain a table of payments divided into principal and interest.

Bank calculator for calculating a consumer loan in cash

Before applying for a consumer loan, many citizens are interested in the conditions under which lending occurs. How much will I have to pay per month? How much will I overpay for the entire term? What will be the percentage of overpayment on a future cash loan? These are common questions that people are searching for answers to online in 2019 and will continue to search for in 2020, 2021 and beyond. Our specialists have developed a universal loan calculator, working entirely online, that will help answer them.

We will describe in detail how to independently work correctly with this calculation program.

What can this calculator calculate?

Correctly calculating a loan does not require special knowledge. Our program is created in such a way that it will be easy to use for both average individuals and pensioners. Previously, you can set 4 parameters in the form:

- Cash loan amount(200000, 500000, 800000 or any other). By moving the slider, the maximum amount will be 15,000,000 rubles, but you can enter any arbitrary number.

- Loan terms, which can also be absolutely anything - year, 2 years, 3 years, 4 years, 5 years, 7 years, but the slider is set within the range of 6-180 months.

- Interest rate loans. We set 8.9% as the minimum value and 49.9% as the maximum. But you can also set the figure that is convenient for you - 15 per annum, 18 per annum, 16 per annum or 20 per annum.

- And the last thing - payment type. If you plan to repay the loan in equal payments (annuity), then select the “Equal” tab. If you want the monthly payment amount to become smaller over time, then select the “Decreasable” (differentiated) tab as active.

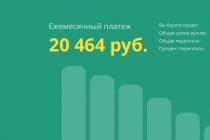

Having configured these conditions, all you have to do is click on the “Calculate” button. Online mathematical formulas will instantly provide you with data on the following parameters:

- Amount of monthly payment, in rubles.

- Initial loan amount.

- Full cost (initial + interest).

- Total overpayment (interest in rubles).

- Overpayment ratio, percentage.

Usually, after preliminary calculations, visitors talk about the calculator on social networks and also give a rating. It helps other people see how convenient and useful our program is to use. And reviews help form a common opinion about the functionality and usability of the calculator.

Drawing up a payment schedule or how to calculate loan payments

To solve this issue you also do not need to have specialized skills. After receiving the initial data, a table will open under the form, which will reflect an approximate payment schedule for a future short-term or long-term loan. It will present the following data on a monthly basis:

- month number;

- exact date of payment;

- monthly payment amount (principal plus interest);

- the amount of the principal debt in payment;

- the amount of interest in the payment;

- the balance of the loan after payment of the payment.

Below the payment table there will be a summary line that accumulates the full cost and overpayment on the loan. You will understand how much to pay for a loan under the selected terms of borrowing funds. The data presented will also be sufficient to estimate the preliminary early repayment.

Selection of a profitable cash loan

After you calculate the amount of debt yourself, a block with the most popular loan offers will be available to you. The site team tried to collect in one place the products of many Russian banks. A convenient location of information will help you submit applications to several banking institutions and, after receiving approval, withdraw money from any bank branch.

We hope you found our banking calculator useful!

Credit calculator- a convenient online tool designed for consumer loan applicants. The calculation is made for annuity and differentiated payments. It can be used to assess financial capabilities for early repayment of financial obligations. The service is free for external and internal bank clients.

Loan calculator functionality

The borrower can use an online loan calculator to select profitable borrowing program. The functionality of the tool allows you to make an accurate calculation:

- total overpayment for the entire period of fulfillment of obligations;

- monthly payment of principal and interest;

- total regular payment.

The financial instrument is equally useful both when obtaining a small consumer loan and when. Its work is based on a special algorithm for a specific bank, so its own calculations often do not coincide with those pre-approved by the lender.

Good to know! An alternative to a bank calculator is an online application. It will take more time to fill it out, but the client is provided with information that fully corresponds to reality.

Should you trust the universal loan calculator?

Universal online credit calculator gives the exact amount taking into account the specified parameters: borrowing limit, term and interest. When calculating the payment, a fixed rate is indicated that does not change throughout the entire period of fulfillment of obligations. When choosing a floating tariff, the data received should not be trusted. In this case, the overpayment is affected by:

- macroeconomic situation in the country;

- behavior of major stock market players;

- the availability of additional tools for the creditor to prevent the growth of overdue debt;

- chosen strategy for attracting assets.

With a fixed rate, the size of regular payments and the final overpayment may also differ from the calculated ones. The final value depends on:

- connection to a life and health insurance program (subject to its inclusion in the body of the loan);

- related commissions related to the issuance and servicing of debt;

- establishing an increased interest rate for several months before submitting a report on the intended use of borrowed funds.

Attention! A difference of 2-2.5% from calculations using a universal calculator always indicates hidden fees.

Algorithm for the loan calculator

The consumer loan calculator works on based on the interest calculation scheme depending on the selected payment type. In the absence of hidden commissions, its calculation algorithm can be easily checked manually using standard formulas.

When choosing a differentiated scheme, the payment includes a constant part (principal debt) and a decreasing part (interest). The contribution amount decreases every month. The total overpayment in interest is less than with annuities.

The following formula is used to calculate monthly interest:

Interest =

Each period, the resulting value decreases as the amount of the principal debt changes. Months and days can be used as the time period.

Annuities also have two parts: principal and a fee for using borrowed funds. At the beginning of the contract, the main part is used to pay interest charges. The monthly contribution is calculated using the formula:

Payment = loan amount *

Good to know! Annuities are used by most banks, as they allow you to receive income before the end of the obligation.

Calculation using a loan calculator

Calculator in a few milliseconds performs calculations on monthly contributions and total overpayment. To make a calculation using the online tool, you must indicate:

- amount borrowed;

- term;

- type of contribution;

- interest rate (this section can be set automatically).

Some banks use a tool for calculating the maximum loan amount. The user must enter information about average monthly income, total payment on existing obligations, and a convenient debt repayment period. Based on the information, the maximum limit for unsecured offers is calculated.

For clarity, a schedule for fulfilling obligations can be constructed based on specified parameters.

The online calculator allows you to get quick advice on loans without the help of bank specialists. It is convenient for comparing different offers from organizations. The disadvantages of the tool include calculation based on the nominal rate, which does not take into account additional paid options.

An online loan calculator will help you calculate your monthly payment and allow you to independently choose the terms that meet your financial capabilities. In addition, you can independently compare the different types of loans available to you and choose the best option in terms of payment schedule, size and type of payments, without the help of bank employees.

Two types of payments are available for calculation: annuity and differentiated. A differentiated payment is the repayment of equal amounts of the principal debt + decreasing interest accrued on the balance of the principal debt. As a result, with differentiated payments, the amount of monthly payments is constantly reduced. Annuity payment occurs in equal payments every month. It should be taken into account that, from the point of view of overpayment, differentiated payments are more profitable for the borrower, and annuity payments are more profitable for the bank. For short periods the difference in overpayment is insignificant, but for a long loan period the service will show a noticeable discrepancy. Especially if the interest rate is high.

A typical picture for long-term loans with equal payments is a minimal reduction in the principal debt at the beginning of use. In fact, the borrower only pays interest, and only a small part goes towards repaying the debt. The imbalance begins to disappear approximately halfway through the loan term. The calculator will be useful for calculating loans to both individuals and legal entities.

To start calculating, fill out the form fields below and click the "Calculate" button.