It's no secret that for most of us, a bank deposit is traditionally the main and almost the only tool that allows us to accumulate a certain amount of money. We resort to deposits when we want to raise money to buy a home, educate children, or simply provide an increase to our pension in old age, while the main argument explaining the choice of this particular method of savings is its reliability. Yes, interest rates are not high enough, yes, we can lose most of the accrued interest in the event of an unexpected termination of the deposit agreement, but all these shortcomings are offset by guarantees of the safety of invested funds provided by the state through the Deposit Insurance Agency.

Given such a high popularity of bank deposits, in this article we decided to acquaint our readers with how opening a deposit is carried out in practice, and provide recommendations for potential investors that will help them save their time, and possibly money.

Legal side of the issue

All accounts in Russia, including deposit accounts, are opened on the basis of clause 2 of Art. 846 of the Civil Code, which deals with a bank deposit (account) agreement. The required document for opening an account by a Russian citizen is his passport or a document replacing it. In most cases, bank employees may also ask you to provide a taxpayer identification number. If a deposit is opened by a foreigner temporarily staying on the territory of the Russian Federation, he will need to prepare a passport of a foreign citizen; a document confirming the right of a foreign citizen to stay (reside) in Russia (temporary residence permit or valid visa); migration card. If the foreigner is eligible for permanent residence, he will need to provide a foreign passport and residence permit.

Even a minor citizen who has reached the age of 14 and has a passport can open a deposit, however, the process of registering a deposit by a “partially capable citizen” (this is what the Civil Code calls teenagers aged 14 to 18) differs from the standard procedure: we will talk about this in more detail in the article “How to open a deposit in the name of a child? "

When opening a “pension deposit” (an account for crediting a pension), you should prepare a pension certificate, which is confirmation that the investor has already retired.

If a citizen has the documents necessary to open a deposit, he is legally and legally capable, he can contact the bank. We will describe the entire process of opening an account below.

The process of opening a deposit - choosing a bank, product, paperwork

First of all, you need to choose the bank with which you will cooperate, assessing its reliability. After this, you should find out for yourself for what purpose you are opening an account. If you are interested in a fixed-term deposit, it is important to choose the right program that provides maximum income and comfortable conditions. If you need a regular settlement (current) account, ask about the cost of service and the availability of additional features (working with the account using Internet banking, having a debit card to access the account, etc.). The conditions for registration and interest rates on deposits can be found in the deposit selection service or on the official websites of banks. Below are the main types of bank deposits:

Having decided on the choice of bank and type of deposit, go to the branch of the credit institution. If you have already worked with this bank, you can use the option of registering an account remotely, but for the first time you must visit the branch in person, taking with you all the necessary documents.

At the branch, the bank manager will find out what kind of deposit you plan to open and will familiarize you with the current conditions (they may differ from those posted on the website - not all banks monitor their resources and update information in a timely manner). If you are satisfied with everything, you must hand over the documents to the employee for verification and photocopying. Next you will need:

- fill out a client identification form (sometimes the client is provided with an already completed form, and he only needs to confirm the accuracy of the information with his signature);

- sign the card with sample signatures, which will be stored in the bank’s file cabinet. In the future, while working with the account, all your signatures will be checked against the card;

- sign the contract after carefully studying its terms;

- sign a receipt order for crediting funds (if money is deposited in cash) or a payment order (when transferring funds from another account);

- pay commissions if you have opened a current account, and the bank’s tariffs provide for a certain fee for this service;

- deposit funds into the cash register. As a rule, when opening a deposit account, the client is given a certain period during which it must be replenished: otherwise, the agreement is considered invalid. If you have opened a current (current) account, you can top it up at any time;

- obtain all the necessary documents confirming the fact of depositing money.

We will tell you in more detail about what documents the investor should keep in his hands. We will also give recommendations that will help protect yourself in the event of disputes with the bank.

All people can make mistakes, and employees of financial institutions who prepare a package of documents are no exception. Therefore, carefully study the contract before you sign it. In particular, you must make sure that your passport details are entered correctly, the agreement specifies the amount of your deposit (if you are applying for a time deposit without the right to replenish) and the term of the deposit. Also pay attention to the extension note. If there is one, your contribution will be renewed automatically in the absence of your application for termination.

Pay special attention to the issue of early termination. The agreement must clearly indicate what amount (part) of the amount you deposited you will receive, and whether interest will be accrued to you (if so, for what period).

After signing the agreement by both parties, you must be given a second copy, certified by the bank’s round seal. Without a round seal, the contract is considered invalid. Sometimes the agreement replaces the depositor’s application form: from a legal point of view, this is permissible if the document contains all your data and the bank’s data, and is also certified by the seal and signature of an authorized bank employee.

In addition to the agreement in accordance with Bank of Russia Regulation No. 318-P dated April 24, 2008 “On the procedure for conducting cash transactions and the rules for storage, transportation and collection of banknotes and coins of the Bank of Russia in credit institutions on the territory of the Russian Federation,” you must be given:

- cash receipt order, certified by the signature and seal of the cashier (considered mandatory, however, despite this, Sberbank does not issue it if a savings book is issued to the depositor);

- a savings book with a record of account replenishment, certified by the bank manager and cash desk employee (not in all banks);

- bank card (if the agreement provides for interest to be credited to the card);

- bank account agreement for payments, to which interest accrued on the deposit will be transferred;

- payment order (when transferring funds from another account).

- All documents issued to the investor are described in the agreement. In particular, it must be indicated whether a savings book has been issued and whether it is permissible to transfer accrued interest to a specially issued bank card. If interest is credited to a card or current account, their details must be specified in the bank deposit agreement.

- When registering a deposit remotely, the depositor must have:

- universal banking service agreement;

- check (when conducting a transaction using an ATM);

- saved web document with the mark “completed”, “paid”, etc. – when opening a deposit online.

In conclusion, I would like to note that depositors who want to be confident in the safety of the funds they place in deposit accounts should be attentive to the process of registering a deposit. It is important not only to choose the right bank and program, but also to study all the documents that you sign and make sure that the conditions offered to you are transparent. In this case, even if an emergency situation arises, you will know that the law is on your side.

The most common type of investment in many countries of the world is a bank deposit, which is called a deposit in economic terminology. This choice is due to the rapid and rapid development of the economy and investment sphere. What is a bank deposit and why is it so popular? The immediate accessibility and simplicity of this method of investing, saving and increasing funds attract ordinary citizens. But few people can really give a comprehensive answer to the question of what a bank deposit is. But this is the basis of economic literacy.

What can be called a bank deposit?

A deposit is money transferred to a bank at a certain percentage for safekeeping. After a certain period, these funds are subject to return. What is a bank deposit? It's not just money. Vlad can be securities, contributions, payments, precious metals and even real estate. Even without special knowledge in economics and investment, it is easy to monitor the state of affairs on the market in order to be aware of the various factors that affect the financial position of the region. It would seem that everything is simple: you need to deposit the required amount into the chosen bank and just wait for the deadline to collect the interest. Depositors, for the most part, demand certainty in the services provided to them, which includes a constant interest rate. What does it mean? A person wants to have profitable deposits in banks, that is, to receive the entire amount at the right time, taking into account interest, which characterizes profit. The average person is not interested in economic factors and trends. This is why deposits are so popular and honorable.

Impact of inflation

If a person plans to solve all his financial problems with the help of a deposit, then he will be disappointed. Basically, almost any bank provides an interest rate that is slightly less than or equal to inflation. What does it mean? If you decide to go to the bank, then be prepared that inflation will “eat up” almost all the profit. Naturally, a bank deposit can significantly slow down this process, but in matters of increasing capital, a deposit is irrelevant. But you shouldn’t refuse deposits and underestimate them. The vast majority of established and successful businessmen and investors one way or another keep parts of their capital in the form of bank deposits. In this case, such a choice is dictated by an investment strategy, which includes taking into account the expected risk and probable profit. As you know, a bank deposit is one of the safest ways to invest money.

Currency for depositing

Today it is not difficult to invest in a wide variety of world currencies. However, in all countries the most popular deposits are in national currencies, euros and US dollars. Foreign currency deposits usually have lower interest rates and, accordingly, bring less income. Today, multicurrency deposits have become very popular. They are characterized by accounting for each currency separately. As a rule, such deposits are formed on the basis of a compromise deposit - taking into account and the possibility of replenishing the account. A very convenient function is to transfer a currency to another at the current exchange rate on the interbank market. Interest on deposits in banks with a similar function is usually selected individually for each client. This makes multi-currency deposits popular among traders, brokers and dealers in the foreign exchange markets.

Interest rate in bank deposit

To form an investment portfolio, you need to understand the basic concepts. There are two types of interest rates - floating and fixed. The first can change under the influence of government financial institutions that regulate the market. This happens when various factors are taken into account - both economic and political. The fixed rate is directly established when the contract is signed at the beginning of the term and will remain the same all the time until its end. In a floating account, the bank is obliged to guarantee some minimum profit, but it is almost impossible to unambiguously predict the level of income.

It is also necessary to mention the term “capitalization”. It means that the funds that are accrued will take into account the size of the deposit itself plus the interest received for a certain part of the period. It is necessary to take into account the possibility of capitalization when planning your own investment portfolio and calculating the likely profit.

Hello! In this article we will talk about bank deposits.

Today you will learn:

- How to open a bank deposit;

- What types of bank deposits are there?

- What is the difference between a contribution and a deposit?

Contribution– a convenient and accessible financial instrument for citizens. It is very popular, it can be opened in any banking organization.

If you are thinking about what to do with your savings, this method is definitely worth paying attention to. Let's talk about what a contribution is and what features are inherent in it.

The concept of a bank deposit

Bank deposit - this is a specific amount of money transferred to a bank for safekeeping in order to make a profit.

The profit consists of the interest rate that the bank charges for the depositor keeping his savings in their account. Interest on the deposit is accrued for the agreed period.

Types of bank deposits

Deposit on demand

A distinctive characteristic of a demand deposit is the ability of the depositor to withdraw all or part of his money or replenish his deposit at any time. As a rule, the interest rate on such deposits is minimal and fluctuates around 0.1-1%.

Why then is such a contribution needed? This type of deposit is used to avoid storing large amounts of cash at home. For example, you sold your car and are going to buy a new one, but have not yet decided on the choice and in order to protect yourself and your savings, the best solution would be to open this particular type of deposit.

Urgent

This type of deposit is suitable for the category of citizens who want to receive additional income for storing their money in the bank. Each bank may offer you different terms for which you can open your deposit. The interest rate depends on the size of the terms.

Terms can be from one month to three years and the interest rate from 4 to 10%, respectively. Unlike a demand deposit, a time deposit does not allow free use of funds in the account. Neither replenishment nor withdrawal of money is possible until the expiration of the agreement concluded with the banking organization.

Targeted deposits

This is a type of deposit that in most cases is opened for a long period and has a highly profitable interest rate. The deposit period ends upon achieving a certain goal, for example, a child entering university, or reaching adulthood, or purchasing real estate.

The advantage of target deposits over time deposits is that the investor has the opportunity to replenish his deposit.

Savings deposits

Citizens who open a deposit of this type have the opportunity, and in some cases even the obligation, to replenish it by a certain amount specified in the contract on a monthly basis.

Interest on savings deposits is an order of magnitude lower than interest on time deposits, but such deposits are ideal for those who want to save a decent amount, starting with a small down payment.

Current deposits

Deposits of this type allow the investor to receive income from their investments, while managing them quite affordably. Current deposits are divided into two types: replenishable only and expense-replenishable.

In the first case, you are only allowed to replenish your deposit in order to receive more income. In the second case, it is allowed not only to replenish the deposit, but also to partially spend funds from the account, provided that the deposit balance does not fall below the established minimum, otherwise the interest rate will be reduced.

Multicurrency

By opening such a deposit, you can store your money in several types of currencies at once. Using this tool, you can make a profit not only from the interest accrued on the balance, but also from transferring money from one currency to another.

This deposit has a distinctive feature: the risk of losing funds is minimized.

Typically, banks offer to open such a deposit in the most common currencies: dollars, euros and rubles. Moreover, a deposit in rubles brings the maximum income, since the percentage of the highest level is set for it.

Deposits for pensioners

For this category of citizens, many banking organizations have developed a special product with a small minimum deposit amount. There are also various loyalty programs, bonus systems, and so on for older people.

For example, at Sovcombank the minimum deposit amount is only 500 rubles, you can withdraw accumulated funds once a month, and you can also top up your account at any time.

You can find more detailed information about deposits.

How to open a bank deposit

Sooner or later in every person’s life, the need arises to open a bank deposit.

Let's take a closer look at what needs to be done for this:

1. We choose the most suitable bank. How to do it? To begin with, at least look at the ratings of banks on various resources on the Internet, check out the official website, see what information is in the public domain.

Also check whether deposits in this bank are insured by the state; if not, then you should not become its client.

Read customer reviews of this banking organization. These could be your acquaintances, friends, family members. But the most reliable ones will be those that you find online, but not on the bank’s official website.

2. We contact the bank. In order to open a deposit in your name, you need to contact a bank branch in person. A bank employee will accept your application and offer several options for opening a deposit so that you can choose the conditions that suit you best.

Ask for specialist advice on every issue that interests you. After all, the correct choice of deposit determines how you can manage your savings and what interest rate you will receive from the bank.

To make a deposit at a bank, you will need only one document confirming your identity - a passport of a citizen of the Russian Federation. You will also need to fill out an application form in which you indicate the type of deposit you have chosen.

After all the necessary steps, within a few minutes, a bank employee will open a deposit account in your name and give you the original of the concluded agreement between you and the bank.

The agreement is drawn up in two copies: one is given to you, the second is kept in the bank branch. The deposit opening agreement contains all the detailed information and conditions for opening a deposit.

How interest is calculated

For each type of deposit, interest is calculated differently. But in most cases, accrual occurs at the end of the contract term. For some types of deposits, interest is accrued monthly or quarterly.

Some banks use a system of capitalization of interest on deposits, that is, interest accrued for the reporting month is added to the principal amount and in the next month interest on the deposit is accrued on them.

Recently, banks have begun to offer new types of interest on deposits. You deposit a certain amount into the account, but not less than the minimum (set by the bank) and the next day after opening the account, you receive the entire amount of accrued interest.

In this case, it will be impossible to use the funds on the deposit until the end of the contract. This method of calculating interest is suitable for those who find it more profitable to use the income received now and not wait for a long time.

The difference between a bank deposit and a deposit

A bank deposit is a narrower concept and defines a specific type of any deposit, and a deposit, in turn, covers all these concepts as one and is a generalizing term.

In this article we have already given the concept of a bank deposit, now let’s move on to the deposit. In addition to cash deposits, a deposit can be opened in the form of securities, precious metals (platinum, silver, gold) and other assets, with or without the purpose of receiving additional income.

Another important difference between a deposit and a deposit is that a deposit can only be opened in a banking organization that has the appropriate license and permission for such actions, while a deposit can be opened in any financial organization.

But keep in mind that by opening a deposit not in a bank, but in an unlicensed organization, you risk quite a lot, not only will you not receive any benefit, but you will also lose your savings.

The more the depositor has the ability to manage his funds on the deposit, the lower the interest rate set by the bank will be. Therefore, if your main goal of opening a deposit is to maximize profit, then the classic deposit option is suitable for you, without the ability to manage your savings.

Depositors' rights

Even if you enter into an agreement to open a deposit in a fairly well-known bank that has a positive reputation, you should not blindly trust this organization without reading all the clauses of the agreement in detail. Each banking organization has its own deposit agreement template.

But all banks are required to indicate the following mandatory points:

- The period for which the deposit was opened;

- The individual interest rate is usually indicated in % per annum;

- The system by which interest is calculated and paid;

- Conditions for early termination of the contract or its continuation;

- The ability to manage your money.

According to the legislation of the Russian Federation, citizens of the Russian Federation, citizens of other states, and stateless persons, in cases where the latter have provided a temporary residence permit or stay in the Russian Federation, have the right to open a deposit. Opening a deposit is only possible in person and individually. It is impossible to open a deposit to a group of several people.

A citizen who has entered into an agreement to open a deposit has the following rights:

- Top up your bank deposit account (if provided for in the agreement);

- Receive a profit at the specified interest rate in accordance with the agreement;

- Upon expiration of the period, return your funds in full;

- Terminate the bank deposit agreement early;

- Manage your funds on the deposit, if such an opportunity is specified in the agreement.

A banking organization cannot reduce the interest rate on its own. The rights of depositors in the Russian Federation are regulated by the law “On Banks and Banking Activities”.

Also, the state, taking care of depositors’ funds, necessarily insures deposits through the Insurance Agency and guarantees, in the case of a bank, a 100% return of funds to the depositor, but not more than 1.4 million rubles.

Bank deposit insurance

The amount for which each deposit is insured is currently 1,400,000 rubles. The savings of the population are thus protected throughout the Russian Federation. Such a system has been developed and operates in other states too.

The compulsory insurance system is part of a state program that is designed to protect the financial interests of citizens, while in order to insure a deposit, a person does not need to enter into separate contracts. The deposit is insured by law.

How are payments made?

As we have already said, payments cannot be more than 1,400,000 rubles, regardless of how much money a person keeps in his accounts in a particular bank, or in several of its branches. If the depositor’s accounts are opened in different banks, then he will receive compensation for each deposit.

But there are several types of funds that are not covered by insurance:

- Bank deposit opened to bearer;

- If the account is opened for the maintenance of a prof. activities by persons who are entrepreneurs without;

- If the funds are transferred to a banking organization for trust management;

- If the deposit is opened in a branch of a Russian bank located in another country;

- Funds from a deposit opened in precious metals.

It is quite possible that the insurance amount will only increase in the future. This will provide a higher level of protection for investors who do not have large funds, and therefore will increase the activity of accumulating funds.

If the investor has large funds, he has more than one million savings, the amount of insurance established by the state does not currently have much effect. They have to split their savings between different large banking organizations.

Positive and negative aspects of bank deposits

Let's consider both sides of using such an investment instrument as a bank deposit. It is clear that there are both pros and cons here; let’s look at them in more detail.

Pros:

- To open a deposit, you do not need to collect a lot of documentation;

- The opening process is simple and straightforward;

- Income can be calculated in advance;

- State guarantees;

- Tax benefits;

- Opportunity to open a deposit at a high interest rate.

To sum up, we can say that opening a bank deposit is a reliable way to invest savings. And now the promised fly in the ointment.

Main disadvantage– this is a high level of inflation, which can even be called difficult to predict. Although we are talking about only 4%, the actual percentage is much higher. Usually it exactly exceeds the level of return on the deposit. Very rarely equals profitability.

So what's the bottom line? It is very profitable to open a deposit if you need money for a specific purpose: purchasing an apartment, a car or another major transaction. Or the second option: to create a “safety cushion”, so to speak, for a rainy day.

Conclusion

A bank deposit has a right to exist. It will help preserve and protect citizens' savings.

Open deposits, look for current financial instruments, the main thing is to do it carefully and thoughtfully.

Bank deposits are the most affordable way to save money. All citizens can use it, regardless of the amount of savings: a deposit can be opened with 1000 rubles. Today there is no need to visit a bank branch and fill out a lot of documents; all operations are carried out online. Banks are expanding the functionality of online services, offering clients not only to control their balance, but also to actively manage their finances. We will tell you how to open a deposit through Sberbank Online, discuss the advantages and limitations of this method and give a number of useful tips.

Internet banking: advantages and disadvantages

The choice of topic in favor of Online Sberbank functionality is not accidental: today, the majority of residents of the country have Sberbank cards or use its other products. With such indicators, it is not surprising that the bank has one of the best Internet services: easy to use, with a user-friendly interface and advanced functionality, and reliably protected.

But this is just the beginning of the list of advantages:

- The main advantage of Internet banking is the ability to remotely monitor the state of personal finances and manage money without visiting a bank office. You can use the service at any time from any country in the world;

- The functionality of Sberbank Online allows you to perform many financial transactions: make transfers, pay for goods and services, open deposits, etc.;

- The terms of deposit in Sberbank Online are also attractive: the bank offers a line of accounts with increased interest rates in different currencies. The conclusion of the contract takes place on the basis of an offer; if desired, the client can always receive a paper version of the document at a bank branch;

- Opening a deposit for an active Sberbank Online user will take a matter of minutes. The financial structure does not limit clients in the number of accounts: you can have several open deposits in rubles or foreign currency at the same time, with different conditions and terms;

- The Internet banking security system is built on managing personal services using access codes. The client will be allowed to enter his personal section only after entering the password. Each transaction must be confirmed with a digital code sent to the account holder's phone number.

It would seem that such a system is extremely reliable, but scammers periodically refute this statement.

From here we move on to the disadvantages of the service from Sberbank:

- Theft of passwords and customer data. This type of fraud is very common and is encouraged by customers themselves. If you keep a bank card and a note with passwords to your personal online banking account in your wallet, you shouldn’t be surprised by the theft of money. Therefore, the security of a personal account largely depends on the discipline of the owner himself. For safety you can ;

- Restriction on opening a deposit online. Today the bank does not provide the opportunity to open online some types of deposits, for example (an unallocated metal account). You can open a deposit in Sberbank only by visiting the office. A common question among owners of such accounts is whether they can be topped up online? There is such a function here: through Sberbank Online, multi-currency and metal deposits are exchanged and replenished;

- Receive cash when closing a deposit. If a client closes a deposit and plans to receive cash, an application for withdrawal will have to be made through a bank branch: Sberbank Online does not provide such a function.

For users of the service, its advantages are obvious, which is why more and more operations are now being transferred to the Internet. We will talk about whether it is difficult to open deposits and how to choose the best one in the following sections.

Types of online deposits and their interest rates

In 2017, bank clients can open a deposit with Sberbank Online by choosing from three options:

- "Save Online." This deposit is chosen to obtain maximum income: the terms of the agreement do not provide for replenishment or partial withdrawal of money. In other words, you need to deposit a certain amount for a selected period (up to 3 years) and receive it with interest at the end of the term. A deposit can be opened in any of three currencies; the maximum rate on a ruble deposit will be 5.6% per annum;

- . A deposit for those who can periodically replenish their account with regular or one-time contributions, without partial withdrawals. To open a deposit, it is enough to deposit 1000 rubles (or 100 dollars or euros if the deposit is in foreign currency). The marginal rate for ruble accounts today is 5.12% per annum;

- "Manage Online". The agreement allows for deposits and withdrawals. To make a deposit, you need to make a minimum contribution of 30,000 rubles. Rates from 3.2 to 4.8% per annum for ruble contracts. The client chooses the validity period independently, from three months to three years.

There is another account that can be opened through a virtual service: . Interest rates are not high, up to 2% per annum, but this option for managing your money is very convenient: you can deposit and withdraw without restrictions, keep an amount in your account for current expenses and receive a small income on the balance.

We will tell you further what the algorithm of actions is and whether it is possible to open a deposit in Sberbank for novice Internet users.

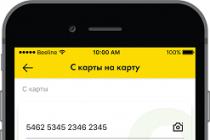

How to open an account online

To open a deposit in Sberbank Online you need to be a registered user of this system. We talked about the authorization process and gaining access in other materials, here we will discuss how to do online operations to draw up a deposit agreement.

The procedure is as follows:

- Go to your personal section and select the “Open contribution” function.

- Next, the program will provide a list of deposits, from which you need to select one and “click” on the name.

- A form will open in which you need to specify the initial amount and validity period of the deposit. Then, using the selection method, you need to select the account to write off the money. The program will generate an application card; you should check all its parameters.

- After confirmation, a contract will be formed. You need to read it and then sign it. This is done virtually by clicking on the “I agree to the terms” button.

- The program will generate an opening document certified with the “Completed” stamp.

- A new line will appear in the deposits section with the name, date, amount and other parameters.

As you can see, opening a deposit in Sberbank is not difficult even for a novice Internet user.

Bank deposit: what is included in this concept + 3 forms of deposits + 7 types of bank deposits + interest rate on deposits + how to open a deposit account + 6 tips for choosing a bank + how to insure your money.

If a person has a large amount of money, then he will definitely have a desire to hide it, but where?

Keeping savings at home is not always appropriate, because theft is still rampant. It is best to give your money to the bank and make a profit.

In this article we will tell you what is a bank deposit and where is the best place to open this account?.

What is a bank deposit?

Bank deposit– this is a certain amount of money that the client transfers to a financial institution (commercial or state bank) for a certain time period.

For the storage and use of money of a legal entity or individual, the financial institution undertakes to pay interest, which can be added to the deposit amount or transferred to a separate account. Can be both individuals and legal entities.

Banks are not the only ones involved in processing deposits.

Some microfinance organizations have also launched similar services, but due to the high risk of losing their savings, people refuse to trust microfinance organizations.

There is such a two-valued expression: “It’s better to keep money in the bank.” On the one hand, this means that it is worth giving your savings to a financial institution, but on the other hand, it is better to leave them at home.

Many Russians still prefer to put their money in the safe hands of the bank and also receive a profit for it:

What is a bank deposit? This is a special account, but through which you cannot make transfers or cash out money at any convenient time.

For opening a deposit, the investor will receive a profit. This source of income is also taxed. The profit will be more than you will have to spend on state duty.

The essence of opening a bank deposit account is very simple...

The client gives away his money for a while in order to make a profit and preserve his savings. The financial institution actively uses these resources by issuing loans to the population at a certain interest rate.

It is for the use of the client’s money that the bank pays interest to the depositor. After all, if the lender closes due to bankruptcy, all deposits will be lost.

Therefore, you need to carefully choose your financial institution.

There is also such a thing as contribution. Some people mistakenly believe that deposit and contribution are synonymous. This is not the case in practice, because there is a slight difference between the concepts.

Deposit- this is not only money, but also other banking assets, for example, metal, shares of a large company, etc.

Contribution- this is a sum of money that is deposited in order to receive additional interest as profit.

Criteria by which bank deposits are divided:

3 forms of bank deposits

There are many types of services in the banking industry, and each of them is divided into certain types, types, forms, etc.

In this case, it is a type that has its own subtypes. In this section we will look at what forms of investments there are.

A bank deposit can be opened in the following form:

Cash account.

The most common form that everyone knows about.

The investor opens a deposit account into which he deposits his funds and receives additional dividends for this, the amount of which is specified in the agreement.

Metal account.

The client credits a certain amount to his metal deposit account.

The bank transfers this money into gold, platinum, silver at the current exchange rate for the value of the metal chosen by the depositor.

Please note that this transfer of money into jewelry is, in fact, only theoretical, because all these metals are available only in information form, they are not physically in the storage of the financial institution.

Bank safe deposit box.

The depositor is given a key to a special cell in which he can place his valuables: money, precious metal, important papers, antiques, etc.

As a rule, money is not placed in the cells, because in this case interest on the deposit is not paid.

7 types of bank deposits

Each lender has its own deposit programs. Not all of the following species may be present in one institution.What conditions to set for clients depends only on the policy of the financial institution.

| Type of deposit | Description |

|---|---|

| 1. On demand | Banks charge a minimum percentage for this type of deposit. The client can cash out his savings at any time. Such conditions are not suitable for lenders, so the rate is too low. |

| 2. Savings | The client can save his funds, and the bank will also charge additional interest for this. |

| 3.Cumulative | You can continuously transfer funds to the deposit account, but only a limited amount and a certain number of times per month. |

| 4. Urgent | Savings are kept in the bank for a certain period of time, most often up to 12 months (short-term) and from 36 months (long-term). The interest rate here is the highest, but the client cannot withdraw his funds from the turnover until the end of the contract. |

| 5.Target | This type of bank deposit is usually opened by parents for their children. For example, the goal is to pay for school. To receive funds, parents must provide a document confirming that they need to pay a certain amount for the university. |

| 6. Foreign exchange | Transfers are made to the account in foreign currency or rubles, and the bank independently transfers funds at the current rate. |

| 7. Multi-currency | This type is rarely used. Using this program, you can open 3 accounts in different currencies at the same time. In addition, it is allowed to make conversions between deposit accounts, in this case this is not a violation of the agreement with the bank. |

How is interest calculated on a bank deposit?

The interest rate is a monetary thank you for entrusting them with your money, and lenders can use it for a while.

They value investors and try to attract them with the most favorable conditions. If you put a large amount into an account, then you can live on the profits from interest and not deny yourself anything.

Payments on a bank deposit are made in the following ways:

Monthly (quarterly, annually, etc.).

On a certain date (usually this is the date when the agreement was signed), a percentage of the deposit amount is accrued, but only to another account of the depositor.

At the end of the contract.

You can receive your interest on a bank deposit only after the expiration of the current contract.

Capitalization.

Interest is added to the bank deposit.

This is the most profitable, because interest is calculated based on the current account balance. The higher it is, the greater the profit will be.

If for some reason the client decides to withdraw his bank deposit prematurely, then interest may not accrue. It all depends on the terms of the contract.

Moreover, in order to receive your savings, you need to spend time writing an application at a bank branch (you need to have a Russian passport and the original agreement with you), and then wait until they are withdrawn from circulation.

The timing in such cases is very different, it all depends on the speed of the banking system itself.

How to open a bank deposit account?

A deposit is not a loan, so no extra documents are needed. Moreover, now you can open such an account even while sitting at home, using Internet banking.

If you decide to work personally with bank managers, then contact a branch of the financial institution.

It is advisable to have a passport and mobile phone with you if you are opening an account for the first time. Then they will provide you with a list of deposits and tell you about the conditions and interest rates for each separately.

When you choose a certain type, you can immediately sign the contract.

The contract must contain, first of all, the following information:

- Minimum information about the investor.

- Responsibilities of the depositor to the bank and the bank to the depositor.

- The following must be indicated: interest rate, duration of the contract, possibility of replenishment, making a profit, etc.

- In the contract, the bank party must write down a clause that states whether the contract can be terminated early, and what consequences await the depositor after this.

- Possible solutions to controversial issues.

Bank employees are involved in drawing up the agreement.

Before signing, it is better to consult with an experienced lawyer who will tell you what clauses need to be removed or added in order to protect your funds as much as possible from all possible force majeure events.

After the contract expires, you need to break it and take the money. To do this, you need to come to the bank on the appointed day with all the documents.

If you don’t come on this day, the money will be transferred to the category on demand. At the request of the client, the bank deposit can be extended.

How to choose a bank to open a deposit?

If, when taking out a loan, you can miss some points when choosing a lender, then if you open a deposit account, there should be no errors.More than once, each of us has heard from news reports that investors were deceived and their accounts were cancelled. To avoid such troubles, you need to check the bank very carefully.

6 tips for future investors:

How to insure your bank deposit?

If the investor has a large sum, then his worries about the fact that the creditor may go bankrupt are natural.

Since 2008, there has been a law that all bank deposits that exceed 700,000 rubles must be insured. This service is free, because it is the responsibility of the banking organization.

Therefore, if your bank closes, the deposit will be returned to you within 14 days from the date of the depositor’s insured event.

Note! One bank will only be able to return a maximum of 700,000 rubles, even if your deposit was many times larger.

For owners of large bank deposits, it is worth distributing their savings among several organizations.

In each of them, the amount should not exceed the maximum rate of compensation under insurance.

So what are the pros and cons of a bank deposit?

- Interest will be added to the principal amount, and this is additional money.

- Funds cannot be cashed out earlier than specified in the agreement.

This makes it possible to refrain from spending and save more money. - Some deposits can be replenished.

In a very short period of time, you can increase the amount of your initial deposit. - According to the conditions of some banks by type of deposit, you can withdraw money from your account, but only in limited quantities.

- There is a high risk of losing money if the bank is declared bankrupt.

- The interest rate is relatively low, especially for foreign currency (up to 1%).

- If you urgently need to withdraw money, the depositor will have to pay a fine, or the bank will simply refuse to accrue interest on the deposit.

As we see, a bank deposit has more advantages than minuses.

Wondering how to choose a bank deposit?

A bank employee will answer this and many other questions:

If you don't make a mistake with the bank, you can not only save money, but also make a small profit.

Useful article? Don't miss new ones!

Enter your email and receive new articles by email