Forte Bank is one of the most popular financial institutions in Kazakhstan. The structure lends to the population, services salary projects and attracts deposits. Forte Bank issues loans under several programs, some of which do not require collateral and the submission of income certificates.

A pleasant bonus for you will be the possibility of early repayment of the loan received without paying penalties.

Loan without credit collateral

Sometimes we need money for shopping, education or treatment. That is why the financial institution gives each applicant the opportunity to apply for an express loan that does not require credit collateral. Forte Bank offers loans without collateral under the following conditions:

- loan term 1–60 months;

- permissible amount from 100 thousand to 5 million;

- no need to provide collateral or take out insurance;

- the rate starts from 20.99%;

- the commission for issuing a cash loan by a Forte bank may be zero, or may be charged according to the tariff established by the bank (depending on the selected program option).

Loan for urgent needs

Suitable for those applicants who are counting on a large sum of money.

Assumes:

- a loan in the amount of 50 thousand to 50 million rubles;

- long loan term up to 10 years;

- the ability to get a loan without proof of income, but the rate is 2 percentage points higher than the base rate;

- the need to provide collateral and compulsory insurance of residential premises;

- interest rate is 17.99% when the loan amount is 70% of the loan collateral, otherwise - 19.99%.

Loan payments can be annuity, that is, divided into the number of payments, and in equal amounts, and differentiated - as the loan is repaid, the amount of accrued interest will decrease due to the minimization of the loan body.

Car loan

This is an interesting offer for everyone who wants to buy a car. You can compensate for the missing amount for the purchase of a vehicle in the amount of 8.5 million tenge.

- the need for a down payment from 5 to 20%;

- low interest rate - 4%;

- the maximum loan term is 60 months;

- there are no commissions;

- Mandatory car insurance is required;

- The work experience must be at least 12 months.

It is necessary to provide documents for the purchase of the vehicle, as well as an issued insurance policy. If the owner is married, the consent of the spouse will be required.

Mortgage lending program

You can obtain a mortgage for a term of up to 180 months. You can receive up to 85% of the market value of the purchased home if income is confirmed, or 50% without confirmation. The loan rate is set at 14.49%, but you will need to obtain insurance for the property.

Without fail, a loan from Forte Bank for housing involves drawing up a mortgage. The loan collateral is a residential property for which you do not have enough money.

Additional documents include a certificate of family composition and a real estate valuation report.

Requirements for the applicant

A financial institution in Kazakhstan puts forward the following requirements to the applicant for free funds:

- age from 21 to 63 years;

- citizenship of the Republic of Kazakhstan;

- permanent employment (you must have worked for at least 6 months with your last employer).

Of course, credit analysts will check your borrowing history for creditworthiness.

If you fail to repay previously taken loans on time or are in arrears, be prepared to hear a loan refusal.

Required documents

To apply for a loan you will need:

- identification;

- application form;

- document on marital status;

- document on the ownership of the object provided as collateral, as well as an estimate of its value;

- extract from the pension fund;

- insurance policy for car loans.

How to apply

Of course, you can go the classic route and visit the Forte Bank office. But in the era of modern technology, you can avoid some red tape regarding paperwork by filling out a form.

Forte Bank suggests submitting an online application for a loan on your official website. First, you make a preliminary calculation of the monthly payment by selecting the required amount, loan term and indicating whether you are a plastic card holder of this bank.

It is probably impossible to find a person who has never found himself in a difficult financial situation in his life. In this case, a loan is the simplest and most effective solution to the problem. Despite the fact that the number of banks offering credit products in Kazakhstan is quite large, not every one of them is ready to provide their clients with favorable terms of cooperation

One of the financial institutions where taking out a loan is not only profitable, but also convenient is Forte Bank. It is highly recommended that you pay attention to his suggestions.

To submit an online application for a loan from Forte Bank, it is absolutely not necessary to go to one of its branches. You can go through the entire registration procedure remotely on the official website https://forte.bank/.

A potential Forte Bank borrower must meet the following mandatory requirements:

- have a passport of a citizen of Kazakhstan;

- be over 18 years of age;

- have a residence permit in the region in which the application is being submitted;

- submit an online application.

If we are talking about a small amount of money, only one passport will be enough to issue a loan. When a larger amount is required at an acceptable interest rate, it is highly likely that you will need to present an additional document and a certificate confirming your level of income.

After the application is approved by the bank's employees, all that remains is to drive up to the bank's office to sign the agreement and receive the requested amount in your hands. To find out the amount of overpayment including interest, you can use a loan calculator.

Advantages of cooperation with Forte Bank regarding lending

Forte Bank has been issuing loans for quite a long time. Forte Bank's conditions for a loan applicant can be studied on the official page. Only if you are fully satisfied with the terms and conditions of the application and the interest rate, you can proceed to apply for a loan.

It should be noted that the bank has a sufficient number of interesting programs aimed at both corporate and private clients. Some of them offer particularly favorable conditions for interaction with a financial institution.

You can get a loan from Forte Bank for almost any purpose. Some of the loan products are issued against collateral. The latter may be real estate.

All Forte Bank credit lines offer the possibility of early repayment without penalties. The fee for arranging and servicing a loan starts at 4.99%, which is slightly lower than in some other financial institutions.

Our service is ready to analyze current offers and select the bank with the lowest interest rate.

Pick up

Wait, we are looking for the best offer: 17.0% loan.

We have selected several advantageous offers from banks with 12.0% per annum on loans.

The form to fill out is below.

Forte Bank is in high demand and popularity among the population. And this is quite simple to explain: high level of service, low loan rates, ease of registration.

If you decide to submit an online loan application to Forte Bank, then you can easily do this directly from the website, and thereby save your time. And if you decide to follow this advice, then you did the right thing. After all, many people who took out a loan from this bank are satisfied with the choice they made.

Conditions at Forte Bank

Here are the parameters of the most popular product, an express loan, which hundreds of people apply for every day.

- Amount up to 5 million tenge

- Repayment terms up to 60 months

- Loan rate 17.99 percent

- There is an opportunity to win money by taking out a loan

- Preferential rates for salary clients

- Without compulsory insurance

- No deposits

- For registration you only need a passport

As you can see, the conditions are too attractive to pass by. That is why we strongly recommend applying for a loan online right now, without leaving our page.

If you are interested in other bank programs, as well as various nuances associated with registration, then you can easily get all the necessary information. To do this, you just need to use the form on this page and send the corresponding request to our consultants. Help will not be long in coming.

Maxim Demchenko

Font A A

The Bank of Kazakhstan offers loans to individuals for any needs without collateral and insurance up to 5,000,000 tenge. A consumer loan from Forte Bank for a large amount requires collateral.

The bank offers two lending options.

Monthly payments can be of two types: annuity - divided into equal parts; differentiated - the amount of payments starts from the maximum and then decreases evenly.

Lending terms

For late repayment of the loan, a penalty is charged, the specific amount of which is determined by the contract. If there is a delay in payment of more than 40 calendar days, the bank sends a notice to the borrower with a request to fulfill the obligations within the period specified in the notice. If the borrower ignores the request, the credit institution has the right to demand early repayment of the entire amount of funds issued voluntarily or judicially.

Violations for which the borrower is financially responsible to the bank:

For clients who are holders of salary cards for loans for urgent needs, a reduced commission for arranging a loan is provided - 0.49%.

Requirements for the borrower

The following requirements are imposed on a potential borrower:

- age 21-58/63 years;

- citizenship of Kazakhstan;

- The borrower's total work experience is at least 6 months (for obtaining a loan for urgent needs).

If the specified requirements are met, the application can either be submitted online or visit one of the bank’s branches.

Required documents

To receive a loan without collateral, the borrower must provide the bank with a passport and fill out a form.

Sometimes a credit institution requires the provision of additional documents:

- extract from an individual pension account;

- document certifying ownership of real estate;

- document confirming marital status;

- appraiser's report indicating the value of the property.

Providing the maximum package of documents to Forte Bank will increase the chances of approval of your loan application.

Design methods

Through the Internet

Go to the official website of the bank. Click the “Credits”/“Get a loan” menu. Fill out and submit the form.

When submitting an application, the program will calculate the approximate monthly loan payment.

You can fill out the form and send it by email [email protected].

Personal visit

To apply, you can visit one of the bank branches with your ID card. You can find out the address of the nearest branch and operating hours by calling the hotline.

By phone

On the territory of Kazakhstan you can call free of charge on the landline number 8-800-080-08-19 or mobile phone 7575. You can order a call.

The bank manager contacts the client within 24 hours.

Methods of obtaining

You can get a loan from Forte Bank:

- cash;

- to a bank card.

The method of receipt is chosen by the client.

Repayment methods

Repayment of payments is possible in several ways.

With commission

When transferring a payment through a branch of KazPost JSC on a working day before 17:00, the funds are credited on the same day. When transferring after 17:00 – on the next working day.

No commission

There is no fee for early loan repayment. The minimum repayment amount for partial repayment is 50,000 tenge.

Forte Bank of Kazakhstan offers several consumer loan programs up to 5,000,000 tenge. If you want to get a larger amount, you can take out a loan for urgent needs secured by commercial or residential real estate.

Founded in 1993, ForteBank became one of the first regional banks opened in the Republic of Kazakhstan. Today the company offers consumers across the country a variety of products via the Internet, including online loans without collateral or collateral.

Any citizen of Kazakhstan who is 21 years old at the time of submitting an application can borrow money. The minimum loan amount is 100 thousand tenge, the maximum is 5,320,000 tenge. You can issue it on a card or receive it in cash at the cash desk.

The main parameters of loans at ForteBank are as follows:

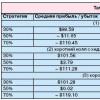

- Borrowed funds can be taken out for a period of 1 month to 5 years. Moreover, the longer the loan term, the higher the accrued interest rate;

- The amount of interest directly depends on the registration period. If the loan, for example, is taken out for 1 month, it will be 2.99% per annum. If the consumer wants to borrow money for 5 years, he must be prepared for a rate of 25.99%. Persons who receive wages on the card of this bank can count on a reduced payment rate, which ranges from 0.1% (loan for 1 month) to 19.99% (for 5 years);

- no property is required as collateral;

- are not covered by the insurance program, which makes them cheaper.

In some cases, commissions may be used:

- up to 10% of the cost of the loan for organizing its receipt;

- 0.75% for transferring finance in cash.

Repayment can occur by depositing:

- annuity payments;

- differentiated payments.

In the first case, the client will repay the debt evenly, constantly depositing a set amount of funds. With differentiated payments, the main part of the loan is paid in the first repayment period, due to which the amount of transfers will gradually decrease.

Requirements for the loan applicant

To receive money from Forte Bank, the client must meet certain requirements. First of all, they relate to the age of the borrower. The minimum age at which you can apply for a loan without collateral is 21 years. You can apply online until you reach 63 years of age. Money is issued only to residents of the Republic of Kazakhstan.

Another condition is that the person applying for the debt must be employed (to take out a loan you need to stay at your current place of work for at least 6 months). The package of documents that must be provided is minimal. The applicant will only need a passport. However, the manager reserves the right to require additional paperwork before issuing money.

Procedure for filling out an online application

You can apply for a loan online. To do this, go to the official website https://forte.bank/ and select the “Loans” tab (located at the top of the page). Using the Internet, you can submit an application in 5 minutes.

The algorithm of actions in this case:

- go to the Forte Bank website;

- select loan parameters in a special form (here you can also see the interest, depending on the selected conditions);

- click on the “Get” button;

- fill out the form that opens (full name, IIN, contact phone number);

- submit a request for review.

After an application for a loan at Forte Bank is submitted, the institution’s employees will need some time to process it. The applicant will be contacted within a few days and informed of the decision. If successful, the consumer will have to visit the office in person to sign the contract.

Thus, you can fill out a form to purchase money within a few minutes. To submit it, you only need to have a device with Internet access. The applicant will only be required to provide identification. Regular bank clients who receive wages on a card may be provided with more favorable lending conditions.