Before taking out a loan for housing or going on a trip abroad, it is recommended to purchase an insurance policy from Sberbank. It can be issued online according to the samples presented on the bank’s official website.

Sberbank insurance programs

The insurance service from Sberbank is a separate legal entity that provides services for obtaining insurance in the event of an insured event. The document has a standard form and protects its owner from various circumstances by compensating for material damage.Mortgage insurance policy

At the moment, the most popular policy is mortgage lending. This is explained by the desire to have guarantees from the insurer, which has a direct connection with the lender. This program is available exclusively to clients of Sberbank PJSC. As part of mortgage insurance, financial compensation is due in the following cases:- Loss of real estate on which a mortgage was issued.

- Any serious damage to real estate: consequences of fire, flooding, explosion of gas equipment, falling trees or structures located near the property, consequences of illegal actions of criminals.

- Recognition of a contract for the purchase of property as invalid due to coercion, threats or fraudulent transactions.

At Sberbank you can get a life insurance policy under most loan programs. In this case, you get the opportunity to take advantage of a discount on the interest rate. The risks take into account temporary absence from work, as well as death. The advantage of such a program is the opportunity to protect your loved ones from paying off debt obligations.

Insurance for tourists traveling abroad

For those who take out Sberbank’s insurance policy for traveling abroad, a set of insurance cases has been developed:- Providing medical care and treatment in another country.

- Loss of personal items or equipment.

- Loss of identification documents.

- Emergency cases for outdoor enthusiasts: inability to use the ski slope due to an avalanche, loss of equipment or illness.

Other insurance programs

Sberbank's insurance policy provides various insurance programs:- residential property policy;

- bank card insurance (against password hacking, unauthorized entry and any transactions without the owner’s knowledge);

- life and health insurance for loved ones (in case of burns, injuries, frostbite, etc.);

- insurance for the main breadwinner of the family in case of disability or death.

How to apply for an insurance policy?

To apply for an insurance policy from Sberbank, you can contact the nearest branch or use the online service (Internet banking). The application template is located in the “Investments and Insurance” tab. In order to sign up for the service and pay for it, you must perform the following operations: in the section “ Payments" choose " Insurance" and go further to the section " Sberbank Insurance" A suitable insurance program is selected from the proposed list. To pay for it, in the payment document you must indicate the amount of money, the application number and select a user account for debiting funds. To confirm the operation, you must indicate the code sent via SMS.How to check the relevance and originality of the received insurance policy?

If insurance is purchased online, the policy is sent in electronic format. In this case, it is important to know how to check the authenticity of the contract. To verify the authenticity of the document, it is best to contact the Contact Center and use the code to check the presence of the document in the Sberbank database.If the agreement is drawn up at a Sberbank branch, the employee can issue a paper version of the document. After receiving the policy, it must be activated on the Sberbank website. The recipient of the policy must provide the following information:

- date of birth;

- contract number;

- code (from the policy form);

- type of insurance;

- insurance amount;

- contact phone number, email, etc.

Today Sberbank is one of the most reliable banks operating in the Russian Federation. It employs the most qualified specialists to protect information. Despite this, it is still recommended to insure cards issued by this institution.

Is it necessary

Every day, more and more citizens are choosing electronic payment systems. That's why bank cards are becoming more and more common.

But along with the advent of a new payment method, various previously unknown methods of fraud have emerged.

And no one is safe from theft of funds from a card account. Even clients of such a powerful financial structure as Sberbank.

Especially in case of fraud or unauthorized use of funds, many insurance companies offer special programs for holders of plastic bank cards.

This service is not mandatory according to the current legislation of the Russian Federation. That is why Sberbank does not insist on its use.

Many less honest commercial structures, which also sell bank cards, impose the service in question on their client - this is illegal.

A previously concluded insurance contract can be terminated by contacting specialized authorities. The cost of card insurance is usually low. In addition, the entire amount of the insurance premium is already included in the cost of card servicing.

This applies to elite varieties of this means of payment:

- MasterCard Gold;

- Visa Gold and others.

Despite the fact that this type of insurance is not mandatory, it is still advisable to purchase a special policy.

This is especially true for those bank clients who have very large sums of money in their accounts. An insurance policy will help prevent property damage in the event of money theft.

Features of the policy

The insurance policy of this type for clients who are Sberbank card holders has a large number of different features.

The most important are the following:

- protection is provided around the clock;

- the policy covers the whole world;

- protection against all existing risks is possible;

- With one policy you can insure all your cards.

The most important advantage of this type of policy is its 24-hour coverage. It does not matter at what time the insured event occurred (day or night).

Monetary compensation will be paid in any case. Also, Sberbank’s bank card insurance policy protects the client’s property interests throughout the world.

That is why you can pay with a card in any country without fear. If an insurance risk specified in the contract occurs, the client is compensated for the damage incurred.

Insurance of funds on a bank card implies protection against a variety of risks. A client can choose the optimal program for himself directly at a Sberbank branch.

Moreover, he can choose a set of risks independently. Which is very convenient, first of all, for the card holder. Since only the owner knows all the specifics of its use.

If necessary, you can insure all available cards at once with one policy. What is very convenient is that there is no need to conclude several insurance contracts. You only need to fulfill one condition: all cards must be from the same bank.

What risks might there be?

The list of insurance risks that can be included in a contract of this type is very extensive.

It can be divided into three main sections:

- withdrawing funds from a card through fraud;

- loss of a bank card;

- theft of funds in any other way.

Payment of monetary compensation is provided for when fraudsters withdraw cash from the card:

- by stealing the card itself, as well as its access code (PIN code), through the use of violence or threats;

- by forging the signature of the card holder and then cashing it out at a bank branch;

- by making a counterfeit card;

- using various prohibited methods: skimming, phishing and others;

- through an ATM using a duplicate card.

The contract also provides for the loss of the card as a result of:

- robbery, assault;

- ATM malfunction.

This item is made of easily damaged material (plastic), which is why it is very easy to break. Sometimes the loss of a card can also occur as a result of its demagnetization.

Moreover, this case can occur at the most unexpected moment. All identified risks are included in the insurance contract of the type in question.

FAQ

Sberbank cardholders often have various questions regarding insurance.

Is it possible to purchase insurance for a regular VisaClassic card with the maximum insured amount and all possible risks?

The type of card the client has does not matter. Regardless of the type, the holder can purchase an insurance policy, while independently choosing the risks he is interested in, as well as the maximum amount of insurance compensation.

An additional card has been ordered for the child of a Sberbank client. An insurance policy was purchased on an existing card. Is it possible to include another card in the insurance coverage?

The concluded agreement is tied to one specific card. That is why, if it is necessary to insure another means of payment, the client will need to conclude a new contract. But at the same time, the client has the right not to purchase an insurance policy for the newly issued card. A Sberbank client always has a choice.

What is the point of concluding an insurance contract directly with Sberbank itself? There are quite a large number of insurance companies offering services of this type.

It is best to purchase an insurance policy directly from Sberbank for many reasons:

- the bank offers the most favorable insurance conditions - to verify this, simply compare the cost with offers from other insurance companies;

- all offered products are deprived of a franchise - that is why, in the event of an insured event, the loss will be fully compensated;

- The list of insurance risks taken into account is very extensive.

The most important advantage of purchasing a policy from a bank is that the protection does not apply

Is it possible to issue a special insurance policy for a credit card?

If the card holder is a client of Sberbank of Russia OJSC, then he has the right to conclude an insurance contract of any type from the entire list offered by this bank. This is not only a policy for the card, but also life, health, and accident insurance.

What to do if the insurance risk occurred abroad?

You must immediately call the special telephone number indicated on the insurance policy. The operator will explain in the client’s native language what needs to be done in this case.

How to activate a bank card insurance policy in Sberbank

In order for the policy to take effect, you must first activate it. To do this, you need to provide certain information to the insurance company.

It is necessary to fill in the following fields in a special form on the official website:

- place of purchase of the policy;

- cost of the policy;

- last name, first name and patronymic of the policyholder;

- gender of the policyholder;

- date of birth of the policyholder;

- contact details: phone number, email address;

- policy number.

It is very important to transfer all data as quickly as possible. Since if an insured event occurs before the policy is activated, the company may refuse to pay insurance compensation on completely legal grounds.

Price

The cost of bank card insurance depends on a large number of different factors. This is the amount of insurance coverage, the duration of the policy, as well as the region of use, and the type of card.

Currently, Sberbank offers the following insurance programs for a period of 1 year:

Bank card insurance is a necessity today. Since every year scammers steal details in more and more sophisticated ways. Therefore, you should not skimp, an insurance policy will protect you from serious financial losses.

Video: What to do if money is stolen from a bank card

Your feedback

On the same topicDiscussion: 3 comments left.

I constantly use my salary card to pay for purchases in various stores - regular and online. That is why I decided to purchase an insurance policy for this means of payment. Since the card rarely contains amounts of more than 200 thousand rubles, I entered into an agreement, the amount of insurance coverage for which was 250 thousand rubles. This service cost me 3.9 thousand rubles for 12 months. During a visit to Chelyabinsk, I lost my card, and I didn’t find out about it right away. It was only when I received an SMS message that money had been withdrawn from her that I discovered it was missing. I immediately blocked her by calling Sberbank by phone. About 23 thousand rubles were withdrawn. The insurance company paid for all damage. I am completely satisfied with the quality of the services provided.

I received a credit card from Sberbank. The limit on it is 350 thousand rubles. Accordingly, such a large amount of money may become the subject of close attention of scammers. That is why I decided to purchase a special insurance policy. As it turned out, not in vain. One of the ATMs I used to top up had a pirated reader. The CVV code of my card was stolen. Fraudsters began paying her in various online stores. The card was blocked, and all damage received was compensated by the insurance company. I am very glad that I purchased the insurance policy. It cost me only 5.9 thousand rubles.

When concluding an agreement, you choose one of the proposed programs for protecting funds on your Bank cards and pay for the insurance policy.

Our life is full of surprises, so even the most reliable place in the world - your home - needs protection. But how can you predict what might happen while you are away from your apartment or country house?

To be confident in the future, you need to enlist the support of a reliable partner who will come to your aid when needed. Sberbank of Russia together with its partner LLC IC Sberbank Insurance* offers a Home Protection program, which allows you to insure the finishing and engineering equipment of your apartment or house and the property in them against various damages for a year, as well as civil liability to your neighbors.**

The program was created for those who think about the future and how to protect themselves and loved ones from the consequences of unforeseen situations.

In addition, you can take care of your family and friends by gifting them a policy. For older people, such gifts will be especially relevant.

When might you need insurance?

The most common everyday situations are fire, flood, burglary, natural disasters, etc. It is very difficult to prepare for their consequences, both morally and financially. But you can protect yourself from unexpected expenses by purchasing insurance on time. You do not have to wait until the competent authorities give an opinion on the incident if the amount of damage is no more than 100,000 rubles, and the circumstances of the occurrence of the insured event are clear from the available documents.

What can you insure?

By Home Protection program you can insure not only the interior decoration of your home, but also television and audio equipment, household appliances, computers, furniture, carpets, a book library and much more.

In an unpleasant situation, such as a flood or fire, caused by your fault, Sberbank Insurance will cover damage caused to your neighbors’ property.

How much does it cost?

The cost of the “Home Protection” policy can vary from 2,500 rubles to 7,500 rubles, depending on the amount for which you want to insure property and civil liability (from 600,000 rubles to 2,000,000 rubles)***. It turns out that it is more profitable to buy one policy, which will subsequently help reduce the cost of indemnifying losses from a possible incident.

How to buy it?

One of the advantages of Home Protection insurance is the ease of obtaining it. The program itself is presented in the form of an attractive box that can be easily purchased at any Sberbank branch. On the site www.sberbankins.ru You can purchase the product “Home Protection Online”****.

All you have to do is choose how much you want to insure your property for and pay for the policy.

*Insurance services under the Home Protection Program are provided by Sberbank Insurance LLC (License SI No. 4331 dated 10/08/2014). OJSC Sberbank of Russia (General license of the Bank of Russia No. 1481 dated 08.08.2012) acts as an agent of the insurance company on the basis of an agreement.

**A detailed list of risks and insurance objects included in the insurance program, with limitations in insurance coverage, exclusions from insurance, the procedure for determining the sum insured and the amount of insurance payment (including liability limits), as well as other insurance conditions, can be found on the website " Sberbank insurance"

One of the most profitable financial investments is the use of insurance services from Sberbank. This financial instrument allows you to provide yourself and your property with protection from the bank, which in case of unforeseen situations will issue a pre-agreed amount of compensation to the victim. Both investment life insurance and a traditional fixed payout option are available.

The Sberbank insurance system provides protection for almost any event in life. Anyone can use the service; it is enough to conclude an agreement and gain access to a separate account on a specially designated website.

All data on the conditions for providing insurance to individuals and their property are located on the official page of the system. A site visitor can independently familiarize himself with the list of services and the rules for their use using detailed instructions, as well as thanks to round-the-clock support from online consultants. Potential clients of the Sberbank insurance system have access to simple registration, after which they will have access to their personal account.

Features and advantages of the insurance system

Insurance products

To use the services provided by the insurance company to its clients, a minimal financial investment will be required on the part of the system user. Small monthly contributions will not harm the family budget, but thanks to them, any unforeseen situation in life will be resolved much easier. Using the Sberbank insurance system, an individual, after the expiration of the contract, will receive 100% compensation for all funds spent on paying regular contributions.

During registration, the client will be offered one of the existing programs, consisting of the following parameters:

Regardless of whether an insured event occurs or not, the client of the service will receive compensation with a minimum amount equal to 100% of the amount invested. Thanks to the 24-hour operation of the personal account, the user will be able to issue a policy at any time, as well as view current information on the personal account. In addition to the main functions of Sberbank Insurance, the site offers additional services, such as online consultation with a specialist and provision of data on current offers via e-mail.

Registration and service capabilities

To gain access to your personal account, you will need to go through a simple registration procedure on the company’s official website. To do this, you will need an email address, a mobile phone and a passport of a citizen of the Russian Federation.

Registration

The entire registration process is as simplified and intuitive as possible, thanks to which even a person who has no experience in operating a computer can gain access to the system.

After entering the data, an activation code will be sent to your email

Activation code

When using Sberbank Insurance services for the first time, the user will be offered the following choice:

- selection of persons who will be covered by the policy. Three options are offered - spouses, children and parents. Depending on the choice made, access to types of insurance coverage may change;

- a policy program that specifies unforeseen events that serve as the basis for payment of compensation. In the Sberbank insurance system, you can select both a whole group of situations and their individual elements;

- a choice of the amount that will be paid in the event of physical damage or financial damage as agreed upon by the parties is provided. The amount of the monthly contribution will depend on this parameter.

Personal Area

By choosing the appropriate conditions provided by Sberbank’s services, the company’s client will receive a reliable partner who will help reduce the negative consequences in the event of unforeseen circumstances that pose a threat to a person’s physical or financial condition.

Home insurance from Sberbank is a current company product for protecting citizens' property.

Insurance is available for registration both at the bank’s office and via the Internet. The amount of insurance coverage is related to the cost of the Home Protection policy.

Let's talk in more detail about this product and consider the features of its acquisition and use.

What risks are included?

After purchasing the Home Protection insurance policy, bank clients have the opportunity to protect their property from:

What could be an object?

When purchasing a “Home Protection” policy, the client purchases an insurance product that allows you to protect:

Insurance price

How much does insurance cost in a bank office and online? Depending on the policy purchase option, its cost will vary. It is more profitable to purchase insurance online, on the official website of the Sberbank company.

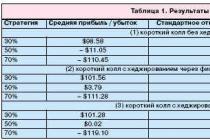

Table 1: “Cost of policies when purchased at a bank office.”

Insurance from Sberbank will help you reliably protect the money on your bank card.

North-West Bank and AlfaStrakhovanie company offer holders of Sberbank debit and credit cards a new convenient product - bank card insurance.

The service covers almost all possible risks associated with using cards and allows customers to feel as protected as possible in any situation.

Card insurance – all risks included

When developing an offer for Sberbank clients, AlfaStrakhovanie specialists tried to take into account all the many years of experience in the insurance industry and make the service truly convenient, affordable and reliable.

What does a company offer that has the highest financial stability rating of A++ from the Expert RA agency and the international Fitch rating, whose services are used by 16.5 million private and more than 390 thousand corporate clients?

The unique advantage of the new product is that when purchasing one policy All debit and credit cards of Visa and MasterCard payment systems issued by Sberbank are insured in the name of the policyholder (including newly issued ones). Only premium cards (Platinum, Infiniti) are not covered by insurance. The policy is valid throughout the world 24 hours a day for a year from the date of purchase.

There are five options for insurance amounts from 20 thousand to 300 thousand rubles with a policy cost from 790 to 3890 rubles. The product covers the optimal set of risks, namely: – unauthorized withdrawal of funds from the account. Unlike earlier insurance offers, the new product also covers criminal transactions using the most modern criminal technologies - skimming (theft of card data using special reading devices) and phishing (fraudulent access to card data via the Internet).

- criminals receiving money from a card given to them by the holder under threat of violence, or from a lost card (lost or stolen);

- theft (by robbery, theft or robbery) of cash received through an ATM, if it was committed within two hours from the moment the money was withdrawn;

- loss of a card due to malfunction of the ATM, loss, theft, accidental mechanical damage or demagnetization.

There's no reason to be careless

Sberbank and the AlfaStrakhovanie company remind: despite the protection provided by insurance, its presence is by no means a reason to neglect the rules and forget about caution when handling the card.

Any loss of a card or money is an extremely unpleasant situation. If only because collecting documents confirming the occurrence of an insured event, contacting the insurer and making a decision on payment takes time, during which you are left without a card and/or money.

Therefore, even after purchasing a policy, try to follow normal precautions: keep the card in a place hard to reach for thieves, inspect the ATM before making a transaction, cover the keyboard when entering the PIN code, do not conduct transactions on suspicious Internet sites, etc.

In addition, ignoring the rules for using the card established by the bank may serve as a reason for refusing an insurance payment. In particular, if it is established that you yourself transferred the card with which something happened to another person.

Also remember that if you detect an unauthorized transaction, you should contact your bank as quickly as possible and block the card. If this is not done (except for cases where the blocking operation could not be completed due to health reasons), then the insurance company has the right to refuse to compensate you for damage.

Bank card insurance – from theory to practice

And now a little about how to buy a policy and what to do if an insured event occurs. You can purchase insurance at numerous Sberbank offices. Thanks to the “package insurance” technology used in the sale of this product, its registration will only take a few minutes.

Just pay the amount corresponding to the selected insurance coverage and receive a ready-made package of documents. Next, you need to activate your policy within 30 days - via the Internet or by phone.

In the first case, on the website www.alfastrah.ru in the “Bank Card Insurance” section, select the paid insurance option (790/1190, etc.), enter the unique policy number and fill out the form fields. In the second, call 8-800-333-0-999 (calls within Russia are free), following the voice menu, go to the “Bank Card Insurance” section and tell the operator the policy number and other necessary details.

If something happens to your insured card, first of all call Sberbank at 8-800-555-55-50 and block the card. Next, you should file a claim with the bank about the disputed transaction and/or report to law enforcement agencies about the offense committed against you.

A written application to one of the 400 branches of AlfaStrakhovanie OJSC must be submitted within three working days from the date of the insured event (if the trouble happened to you abroad, then within three working days after returning).

Make sure to provide the company with all documents confirming the incident: a police certificate, a report on the card account, a letter from the bank about blocking the card, receipts for the purchased goods (if funds were withdrawn in a larger amount), etc.

The insurer makes a decision on payment of insurance compensation within 10 working days. Sberbank of Russia and AlfaStrakhovanie OJSC wish you financial well-being and hope that you will not have a reason to use your insurance policy. However, in an unforeseen situation, reliable partners are always ready to help you.

Features of activating a Visa card issued by Sberbank

Being the largest issuer of plastic cards, Sberbank of Russia OJSC serves tens of millions of Russians - more than half of the country's population. Therefore, many may have a question about how to activate the card they just received.

You should know that at the time of issue to the client, the plastic is not active. You can top up your card account by transfer through a terminal, using an electronic wallet or another card, but you will not be able to make debit transactions. It happens that the cardholder comes home after signing a service agreement with the bank, wants to make an online transaction on the Internet, but cannot do this.

Why immediately after receiving the Sberbank visa card is “blocked”?

Based on security reasons to combat fraud. The issuer blocks the plastic to prevent transactions from taking place before the card is handed over to the client. As a result, the client is confident that no one has used the card before him, and the bank, having handed over the card, places all responsibility for further transactions on the card account on its holder.

The process of activating a card issued by Sberbank of Russia is completely free, simple and will not cause difficulties, regardless of the client’s financial literacy.

Instructions for activating a Sberbank card:

- Before activating a plastic card, you need to print the envelope where it is located. Examine it carefully. Check the correct Latin spelling of your first and last name. The card number will be sixteen digits and you will need it to make money transfers. Also on the same side you will find the logo of the VISA payment system;

- Turning the plastic card over, you will see a white stripe. Place your signature; without it, the data carrier will be invalid. This is usually done in the presence of a bank employee;

- Along with the card, service agreement and tariffs, you will be given a personal identification number, sealed in a PIN envelope, against signature, without which you will not be able to use ATMs or pay for goods (services) in stores;

- Sberbank of Russia promises that the plastic card will be active no later than the next business day after it is issued to the client, that is, on the third day maximum, if the card is received on Friday;

- Considering that the client is already at the branch, it is best to activate the card yourself. You will be sure that everything is fine with her. To do this, you need to perform some action at the nearest ATM. Let this be a request about the availability of funds on the card account. If you have any difficulties, a bank employee will always come to your aid.

The ability to independently remove the primary block is provided only for debit cards. In addition to ATMs, the client can use any electronic terminal or self-service device of Sberbank of Russia. In the case when a Sberbank visa credit card is issued, which is an instrument for providing a loan, activation is automatically carried out by the issuer itself. Some types of Sberbank plastic provide that the client sets the PIN code himself when receiving the card at the branch. This action will also result in instant activation.

Sberbank of Russia offers the widest selection of card products: only eighteen types of debit cards and eight with a credit limit. With such abundance, difficulties with choice will certainly arise. Before you decide, get the appropriate advice at a bank branch or call the hotline.

Comparative characteristics of products, as well as a mini-questionnaire located on the bank’s website, will help you make your choice. To fill out this form, click the “Select card type” button and answer several questions:

- What means do you use to pay for your daily purchases?

- What to do if you don’t have enough money before you receive your salary;

- Sources of financing for unforeseen expenses.

Thus, they will tell you which type of plastic card is more suitable for you: credit or debit. Then choose the product that suits your needs.

Each bank card differs in functions, tariffs and service:

- Visa Electron. The simplest and cheapest option is an electron visa card. Sberbank uses such a card, as a rule, to implement salary projects, transfer pensions, scholarships and other social payments. This product is most popular among the population. Using an electron visa, you can pay both in Russia and abroad, top up/withdraw cash from an ATM in any currency, pay for the Internet, mobile communications, etc. This is a debit card with a cash withdrawal limit of 50,000 rubles per day;

- Visa Classic. A Sberbank classic visa card would be a suitable option if, in addition to the optimal range of banking services, the client is interested in the possibility of using a credit line. The main differences are a higher limit on cash withdrawals, a grace period for lending, electronic chip protection, payment transactions using card details (MOTO: by email or mobile phone), emergency cash issuance in case of loss of the card abroad. The cost of servicing such a card will be higher;

- Visa Gold. Gold card privileges are not available to owners of “simple” plastic: an individual approach to service, a higher level of financial security, special offers and discounts from leading companies around the world. The Sberbank visa gold card not only has a lot of advantages, but also emphasizes the high status of the owner.

We offer you a wide selection of plastic cards, which you are unlikely to find in another bank. Decide on your needs so that the card best suits your needs, and when you receive the card in your hands, do not forget to make sure that it is activated.

kreditvbanke.net

Sberbank insurance

Updating your personal account

Manage your documents

simple and fast

Apply online now!

Hotline

for those affected by seasonal natural disasters:

8 800 555 555 7

Read more »

Protection against tick bites

Apply online now!

Online card protection

Insurance of funds on your card from fraudsters. Apply online now!

Home Protection Online

Insuring an apartment or house in three simple steps. Apply online now!

Multipolis Online

Mortgage online

Comprehensive protection

mortgage property.

Apply online now!

Buy online

Travel Insurance Online

A product designed to provide personal protection against unexpected risks encountered while traveling.

Renewal of mortgage insurance Online

Comprehensive protection of mortgaged property

Home Protection Online

Insuring an apartment or house in three simple steps. Apply online now.

Online card protection

Insurance against fraudulent activities with your card.

Apply online now!

Tick protection Online

Tick bite insurance

Multipolis Online

Take your confidence to the next level!

Apartment insurance at Sberbank Online

For individuals

Home protection

Comprehensive protection for your apartment or house

Mortgage insurance

Financial protection of mortgage loans for Sberbank clients.

Bank card protection

Comprehensive protection of funds on your Bank cards

The procedure for insuring a Sberbank card

Bank plastic cards have long become a part of everyone's everyday life - they are a modern and universal payment instrument. Pay for services, pay for purchases, receive loans, withdraw cash at a convenient time and place convenient for you. This and much more is now available to plastic card holders.

But modern realities are such that scammers who are inventing new ways of deception can gain access to your funds.

Is it possible to protect yourself and your money from criminal attacks?

Sberbank of Russia provides this opportunity through the insurance product “Protection of Funds on Bank Cards”. By using this service, you will receive:

- 24/7 worldwide protection;

- protection against the most common risks;

- the ability to insure all cards linked to your Sberbank account with one policy;

What risks is the card insured against?

An insured event occurs if:

- Violence or the threat of violence was used against you or your loved ones, as a result of which strangers gained access to your card and PIN code and subsequent withdrawal of funds from an ATM.

- Funds were withdrawn from your account by forging a signature.

- The withdrawal was made from a counterfeit card using the cardholder's details.

- The card was used after it was lost, robbed, or robbed.

- As a result of fraud, access to confidential plastic card data was obtained, followed by withdrawal of funds from an ATM.

- If the plastic card malfunctions due to mechanical, thermal, demagnetization or other damage;

- As a result of the loss of the card as a consequence:

- robbery or assault;

- technical malfunction of the ATM;

For how long can a card be insured?

The insurance period for a plastic card is 1 year, but cannot exceed the validity period of the card.

How to insure a card?

In order to insure a bank card, you can use one of the following methods:

- contact any Sberbank branch convenient for you;

- apply for an insurance policy online by filling out the form at http://sberbankins.ru;

The cost of insuring a Sberbank card

Which companies insure Sberbank cards?

Insurance is provided both directly by Sberbank of Russia and by many other insurance organizations. Registration of an insurance policy directly at Sberbank has a number of advantages:

- the most favorable insurance conditions in comparison with similar offers from other insurance companies;

- in the event of an insured event, the bank will fully compensate for the damage incurred;

- an extensive list of risk risks;

How to activate the policy?

To activate the policy, you can use one of the following methods:

- You can activate the policy at any Sberbank branch convenient for you;

- online by filling out the form at http://sberbankins.ru/products/ActPolis;

How to receive payments?

To receive payments, you must submit the following documents to the bank branch:

- General documents:

- a written statement of the established form;

- insurance contract;

- a check, statement or other document confirming payment of the insurance premium;

- identification document;

- Additional documents:

- If the bank card has been lost or stolen, in case of robbery or theft. You must provide a bank certificate about the cost of restoring your plastic card.

- You or your loved ones were subjected to violence or the threat of violence, resulting in someone else gaining access to your card and PIN code and subsequently withdrawing funds from an ATM or in the event of a robbery or theft. It is necessary to provide a copy of the decision to initiate, suspend or terminate the criminal case.

- If a plastic card malfunctions due to mechanical, thermal, demagnetization or other damage, submit a certificate from the Bank about the damage to the card.

The amount of payment for an insured event will be equal to the amount of damage you suffered, but cannot exceed the amount of insurance protection.

In case of theft of funds, you must contact the bank branch within 12 hours from the moment you discover the loss of money from your account.

Payments are made within three working days from the date of confirmation of the insured event.

In what cases can a payment be refused?

You can receive a bank refusal to pay insurance if:

- when the insured event occurred as a result of intentional actions of the cardholder;

- if the victim provided the bank with deliberately incorrect information about the circumstances of the occurrence of the insured event and (or) the financial losses incurred;

If these clauses are violated, the bank has the right to terminate the insurance contract. If insurance payments have been made, the person who received the payment is obliged to return the payment to the bank in full.

Is it necessary to insure a Sberbank card?

According to the current legislation of the Russian Federation, insurance of plastic bank cards is not mandatory.

Questions clients often ask

Answer: The type of bank card does not limit the choice of insurance policy in any way; you can choose any amount of coverage.

Answer: You can get a full consultation in your native language by calling the international phone number indicated in the insurance policy.

Answer: No. Full compensation for damage is made if the amount of damage does not exceed the amount of insurance coverage.

Answer: Yes, after payment for an insured event, the amount of coverage is reduced by the amount of the insurance compensation paid.

Answer: If for any reason you have lost access to your card (loss of card, theft, robbery, etc.), you must contact the bank as soon as possible to block the card. In case of theft, robbery, use of violence or threat of violence, you must contact the police.

Answer: Yes, insurance applies to both payment and credit cards.

Answer: If one Bank card is insured in the insurance policy, then the insurance contract is terminated and the insurance premium is paid taking into account the duration of the contract. If several cards are insured in the insurance policy, the contract continues and applies to the remaining cards.

prostopozvonite.com

- How can you write and correctly file a complaint against the management company to the housing inspectorate? The housing inspection is the first authority that a dissatisfied tenant turns to after the management company has not fulfilled his requirements set out in the complaint. Some utility consumers even […]

- The amount of the state fee for an old-style international passport for a child under 14 years of age and where to pay it. Applying to government agencies to receive any service is always accompanied by payment of a state fee. To obtain a foreign passport, you also need to pay a federal fee. How much is the size [...]

- How to contact you? Online service for preparing a single tax return for the simplified tax system for 2018. The service allows you to: Prepare a report Generate a file Test for errors Print the report Send via the Internet! Download the new single tax declaration form for the simplified tax system for 2016-2018. […]

- How to restructure housing and communal services debt? Sample of writing an application The Housing Code (Article 153) obliges apartment owners to pay utility bills on time and in full. Debt on housing and communal services threatens the owner of the apartment with shutdown of utilities (water and electricity), […]

- Calculation of payments from an unemployed person: how is alimony calculated if a person does not work? Article 83 of the RF IC defines the main provision of the alimony system in Russia - both parents are obliged to provide for their common children who have not reached the age of majority. The responsibility also falls on unemployed citizens, who must also […]

- Sample of filling out a travel certificate in 2018 A document confirming the fact that an employee is on a business trip for official reasons and for this reason is his absence from the workplace is a travel certificate. In addition, it is one of the main conditions: for registration [...]

- How to write a claim for the return of a mobile phone of inadequate quality: a point-by-point analysis of the sample A mobile phone is a rather complex device from a technical point of view. It is included in the list of consumer goods that cannot be returned. However, there is not a single […]

- How to register a bathhouse correctly How to register a bathhouse and is it necessary to do it? Such questions concern many land owners. It must be said that these questions are quite reasonable. Moreover, the decision on how to register a bathhouse on a plot of land depends on the type of building and the plot itself. Any building […]