Today, perhaps, there is not a single area of life left that would not be affected by new information technologies. Even finance, in fact, can now be virtual. What is meant? Let's talk about currency. It is common for us to perceive this concept as a specific monetary unit of a state. So, in our country the national currency is the ruble. Currency can also be collective. This is the euro. There are a large number of classifications for this concept. But it’s harder to explain in simple words what cryptocurrency is.

Cryptocurrency concept

Digital or in great demand among Internet users. It’s worth immediately distinguishing between the concepts of electronic currency and Internet money systems. The main difference is that the equivalent of the latter is real currency, for example rubles. This is how the Yandex.Money and Qiwi systems work.

And the Webmoney system has its own electronic currency, which works only within itself. That is, when money is transferred to the wallet of this system, it turns into its own currency.

Cryptocurrency occupies a separate niche. It is a digital currency whose exchange, issue and accounting are based on cryptography, that is, encryption. To summarize what has been said, what is cryptocurrency in simple words and how does it differ from other types of electronic currencies? Unlike money in electronic form, for example, Yandex.Money, it does not have a physical embodiment. And unlike electronic currencies, for example Webmoney, cryptocurrency is decentralized, that is, it is not controlled by a single server that belongs to a bank or any organization.

How did cryptocurrency appear?

For the first time, cryptocurrency appeared in the Bitcoin payment system. This happened in 2009. The system was developed by a group of people or a person under the pseudonym Satoshi Nakamoto. It was constantly refined and changed, and Bitcoin is still dynamic.

In 2010, the first purchase of bitcoins was made. One of the Americans bought two pizzas for 10 thousand bitcoins. Note that initially Bitcoin cost $0.1, and then soared to $1,300 per bitcoin and even higher - up to three thousand US dollars in the summer of 2017.

What is the basis of cryptocurrency?

What is the existence of cryptocurrency based on? To explain what a cryptocurrency is in simple words and what underlies it, let’s compare crypto coins with gold coins.

Like the supply of gold, the number of cryptocoins is limited; this is a kind of protection against emission. The cryptocurrency was originally created using a technology that will not allow it to fall. Bitcoins, like gold, cannot be counterfeited. Like gold, you can buy cryptocurrency or even mine it yourself. Again, as with real gold, the number of bitcoins is limited (21 million coins are available, more than two-thirds are already in circulation).

The algorithm for creating virtual money is based on the following:

- Each computer stores a public database.

- To make a transfer, a key is used, which is created only once.

what is it in simple words

Bitcoin is the very first type of cryptocurrency. What is cryptocurrency in simple words? These are Bitcoins because they became the first cryptocurrency. In principle, Bitcoin can be another name for a computer program that creates a virtual currency. The operating principle of Bitcoin can be compared to the operating principle of torrents. Several people immediately install the program on their PCs, and then transfer files among themselves without anyone’s control. The difference from torrents is that it is not files that are transferred, but “virtual glasses”.

Bitcoins can be exchanged for real money at ATMs. They can also be used to pay for goods and services.

The most popular cryptocurrencies

In addition to Bitcoin, the ancestor of cryptocurrency, there are other types of cryptocurrencies:

- Ethereum. Appeared in 2013. As of August 2017, its rate is $300.

- Litecoin. Appeared in 2011. Limited to 84 million. Course - 40 dollars.

- Zcash - a unit of currency is equal to 200 dollars.

- Dash is equal to 210 dollars.

According to various sources, from 200 to 800 types of cryptocurrencies now exist in the virtual space. All of them, in one way or another, are based on the operating principle of Bitcoin.

Ethereum as a type of cryptocurrency

In 2013, a programmer from Canada, Russian by birth, Vitaly Buterin created a new type - the Ethereum cryptocurrency. What it is? In simple words, this is essentially another analogue of Bitcoin, but with new capabilities. The Ethereum platform can be used to create new cryptocurrencies. On Ethereum, like on Bitcoin, you can mine.

Mining, or How to make money on cryptocurrency in simple words

The process of extracting cryptocurrency is called mining. Comes from the word “mine” - “to carry out excavations”. The method, of course, differs from gold mining. To implement mining, they take a motherboard, a server or other power supply, a hard drive, a monitor and video cards. A special mining program is selected and installed, then it is launched, then a fork and a pool are selected and the mining process itself begins.

Further, in simple words, the program installed on your PC will create tasks that it must solve. For this action the computer will receive virtual money. So, for Bitcoin, the program issues no more than 3,600 crypto coins per day.

Each time, the tasks that a miner's PC must perform become more complex, and miners have to create more powerful machines to solve them. The main idea is that whoever solves it first will receive Bitcoin. Today there are a huge number of so-called “farms” - machines for solving program problems.

How to exchange cryptocurrency?

There are two ways to exchange cryptocurrency. Further, in simple words, this is a cryptocurrency exchanger. In the virtual space there are special services for exchanging such money. Simply - exchangers. First of all, when choosing one, pay attention to the rate and commission.

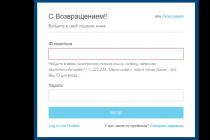

Advanced users put exmo.com first. Here you will need to enter your email and create a password. If we want to exchange bitcoins, go to the “exchange” menu. We indicate the number of bitcoins that we want to exchange. The system will show us the course. To finish, click “exchange”.

Another exchanger is 60cek.com. We register in the same way, confirm via email and activate the account. Next, we also enter the number of bitcoins we want to exchange for. You can immediately transfer to a card at the bank. To do this, enter the card number, full name of the owner and other data.

The third most popular exchanger is blue.cash. We register in the same way as in the previous options. Click “Exchange” and enter the number of bitcoins you want to exchange. You can withdraw exchanged money to Yandex. Wallet. To do this, you need to specify your wallet number and email.

Exchange as a means of exchanging cryptocurrency

The exchange is very popular among Russian miners. The exchange works with 6 types of currencies:

You can perform exchange operations using payment systems:

- VISA/MASTERCARD.

- "Yandex money".

- WebMoney.

- QIWI.

The commission is 0.2 percent of the transaction amount.

On the official website of the exchange, click the “Start” button. This is how we launch the system. We register in the “Profile” - “Verification” section. You will need a passport here. You need to upload a scanned copy of it.

The site operates in English and Russian. In the “Trading” tab you can see the exchange rates.

EXMO works with both regular and cryptocurrencies.

LiveCoin is an exchange created in 2014. Supports the following trading pairs:

- BTC/EUR.

- BTC/USD.

- BTC/RUR.

- EMC/USD.

- EMC/BTC.

- LTC/BTC.

- LTC/EUR.

- LTC/USD.

On this exchange you can not only purchase or give away currency, you can simply exchange it. The site operates in English and Russian.

Cryptocurrency in Russia

There is no clear position in our state regarding cryptocurrencies. But still, most compare them to financial pyramids. What is cryptocurrency in Russia? In simple words, it is called surrogate money.

The Ministry of Finance has prepared amendments to the legislation on punishment for the use of cryptocurrency and transactions with it.

In Russia, the concepts of cryptocurrency and blockchain are separated. If the first is treated sharply negatively, then the situation with the second is different. viewed as a technology. It is proposed to develop blockchain for further use in the banking system or registries. Currently, the use of cryptocurrency by legal entities is considered as anti-money laundering.

Hello, dear readers of the blog site. Of course, one of the most discussed topics on the Internet for quite a long time is cryptocurrency and everything that is closely related to this type of electronic money. Therefore, I could not get around this circumstance, as a result of which this manual was born.

The very essence of this digital currency initially contains many nuances and points that require attention and detailed understanding. Even the name of the creator, Satoshi Nakamoto, is shrouded in deep mystery. In general, for the inexperienced Internet user there is a lot of curious and interesting things here.

What is cryptocurrency in general, what are its advantages and features, where to store it and how to use it? Well, most importantly, is it possible to make decent money on it? In this article I will try to touch upon, if possible, all of the above aspects.

We will talk about some in more detail, others (such as blockchain, mining, faucets) I will touch upon only briefly, but only in order to return to them in the format of full-fledged publications. Naturally, I will try to tell you everything in the simplest and most understandable words possible.

What is cryptocurrency and why is it needed?

With the advent of electronic money, it became possible for all users to carry out numerous financial transactions via the Internet using payment systems, which began to charge a certain fee for the provision of such services. But these electronic currencies are still associated with real monetary units (dollars, euros, rubles) and are their virtual analogues, unlike the crypto-currency that opened a new era.

Cryptocurrency is a special type of digital money, the basic unit of which is coin (translated from English as “coin”). A coin of any currency is presented in encrypted form, therefore, obviously, it is maximally protected from counterfeiting. Actually, for this reason, the name of the electronic currency contains the prefix “crypto”, which comes from the well-known term “cryptography”, meaning the branch of the science of data encryption.

The first cryptocurrency to be named “bitcoin” (BTC) was created in 2009 by an anonymous user (or even a group of people, this is not known for certain) under the nickname Satoshi Nakamoto. Exactly bitcoin became the progenitor of the following cryptocoins, of which today there are about one and a half thousand (Satoshi’s idea turned out to be infectious).

In order to make it easy to identify network money, a logo is created for each of the electronic coins (already proven and newly emerged):

![]()

The main distinguishing feature of any crypto currency is that it has no owner or even administrator, therefore, it is not controlled by anything or anyone (neither a private person, nor, especially, the state apparatus). The only means of controlling the system is the algorithm installed in it, which regulates all necessary actions.

It is also in no way connected with the global financial system in the traditional sense and is not really backed by anything (neither gold, nor securities, nor the economic power of any state or community of countries).

However, each of them has its own rate in relation to traditional monetary units; it can be sold or bought. Moreover, many have some protection against inflation, since there is a limit on the issue of monetary units, which is already included in the algorithm and no one can exceed it (for Bitcoin, for example, this limit is set at 21 million coins).

Exists two main types of cryptocurrency. In one case, cryptocoins are always the main purpose of creating a platform, which then simultaneously serves as a payment system. A striking example is Bitcoin (BTC). In another case, a cryptocurrency is created as one of several components and may not even be a basic one, but an additional option. An example is the Ethereum system, the monetary unit of which is ether.

It must be borne in mind that the cost of any cryptographic currency depends largely on the level of excitement and demand. Therefore, its value can be seriously influenced by external factors related to this circumstance.

For example, the recent news that the authorities of China (a country where one sixth of the population of the entire Earth lives), due to the desire to take control of the financial situation in order to strengthen the yuan, began blocking the cryptocurrency market, seriously affected some virtual currencies, as a result of which quite noticeable depreciation of many of them.

Crypto-money does not yet have a widespread physical embodiment outside the global network, representing only a special set of encrypted symbols.

However, there is already experience in creating real Bitcoin coins in the classic design, not only collectible ones, but also containing a wallet with a built-in private key, which is used as an external medium and is designed for more secure storage of Bitcoins and for offline payments. But, I repeat, things have not yet reached the point of mass application of this idea, including due to the ambiguous attitude of a number of countries towards crypto money.

When promoting a newly created digital currency, investors are usually attracted, receiving so-called tokens. They are an obligation of developers to provide a specified number of internal, newly created monetary units to structures investing in the project (in fact, these are shares). Tokens are also called the actual coins of the cryptocurrency system.

This largely depends on the peculiarities of the legal legislation of a particular state in relation to new monetary units. In some places, for the same bitcoins you can buy an airline ticket, a mobile phone, pay for pizza or buy software, but in some places there is no such option. In general, coins have not yet taken root everywhere, if we take into account their mass distribution.

From here the answer to the question smoothly follows, and Why is cryptocurrency needed at all?, which is quite banal. For the same thing that regular money is needed for. That is, with their help you can pay for goods and services in the same way as with bills or coins in your wallet, or (a more advanced option) using their electronic analogue.

The essence of the structure of the cryptocurrency system (blockchain)

So, we have examined the main parameters regarding cryptocoins and their role in modern realities. Now I propose to go a little deeper into the essence and consider the internal structure of this electronic money, at least in general terms.

The system of many types of cryptocurrency is built on, as this is the best that is available today. This technology is often associated exclusively with this area of application, although in fact it has considerable value in its own right and can be implemented in many other projects.

Blockchain in general is chain of sequential blocks, containing certain information and arranged in accordance with a given algorithm. In the case of cryptocurrency, each block contains data about , which are sets of sequential operations using a database (the most striking and understandable example would be the transfer of a sum of money from one bank account to another).

To optimize the storage of this information, each subsequent block is built into an already created chain, and it necessarily contains a header, which includes data converted using a hash function, as well as a list of transactions.

The block chain is constantly growing as new transactions are made, while forming database, copies of which are stored on the computers of all participants. Therefore, each of them can easily trace any payment (information about transfers in blocks is not encrypted, which minimizes the possibility of fraud).

This situation allows us to consider decentralized system, which greatly enhances its safety. After all, there is no central server with all the information, an attack on which could cause damage on a global scale. An original and practical solution.

Each user of most cryptocurrency systems (including BTC) based on the blockchain has a pair of keys: private (closed) and public (open), which are generated countless times. Keys are needed to encrypt information during transmission and are stored in .

Although there are no mandatory commissions for transferring funds, the system of a particular cryptocurrency can set its own commission amount to speed up the process of conducting various types of transactions. To automatically calculate the optimal commission, specialized client programs are usually used.

Differences between crypto coins and regular money, pros and cons

In order to fully determine the essence of cryptographic coins, one cannot do without analyzing their features. It should be taken into account that very often advantages for some turn into disadvantages for others. Or a particular feature contains both advantages and disadvantages, depending on the angle from which they are viewed.

I’ll try to demonstrate this with a couple of characteristics that crypto-money has and which are directly opposite to standard currency:

| Peculiarity | pros | Minuses |

|---|---|---|

| Pseudonymity (names, surnames and other personal data of system participants remain anonymous, only wallet addresses are known) | There is no control when transferring funds (no one will be able to protest or block transactions) | Transactions are irreversible (if errors occur, it is impossible to recover lost funds, for example, if the wallet address is entered incorrectly) |

| High volatility (instability, expressed in sudden changes in exchange rate, both upward and downward) | Opportunity for experienced stock speculators to gain significant income | It is more difficult to predict the behavior of cryptocurrency, which automatically means a higher degree of risk in general when conducting exchange transactions (when compared with regular currency) |

As you can see, some features of cryptocurrencies have two sides of the coin, that is, their inherent disadvantages are a continuation of their advantages. More about advantages of crypto coins over regular money in its pure form (again, relative to the system user):

- high level of security (protection against counterfeiting of coins and reliability of funds transfer);

- lack of total control by the state;

- the opportunity to mine cryptocurrency for everyone (mining, which I will talk about below);

- complete independence from the political or economic situation in a particular country, except when it comes to the cryptocurrency itself (remember, I mentioned the fall in rates in light of the intentions of the Chinese government to influence the situation?);

- there are no mandatory commissions for transfers, usually minor commission fees can be assigned only to speed up processes in the interests of the system;

- significant insurance against possible inflation in the form of the final size of the total issue (the emergence of new digital coins);

- With crypto money, all operations are carried out much faster than with fiat money.

So oh shortcomings, where would we be without them:

- there is no actual backing of crypto money, its price depends almost only on the level of user interest;

- the risk of a ban - if government agencies are unable to directly control cryptographic money, then they are quite capable of taking radical measures, say, in the form of blocking web resources associated with them, and thereby indirectly influencing the situation.

If your interest in “electronic currency” is not superficial, take a class hour for a more complete immersion in the topic by watching the following video below:

");">

How can you make money on cryptocurrency

Let's take a brief look at the main types of earnings associated with digital currency. Let's start, perhaps, with the one associated with direct receipt of crypto coins and the blockchain system:

In order to get started, you just need to create a cryptocurrency wallet (to receive money earned on it), go through a simple registration on one or more similar sites, then periodically log into your personal account and complete tasks.

Naturally, the amount of reward for completing them depends on the difficulty. Here are several web resources where you can get a certain amount of virtual money (the first five give out satoshi, the last two give out litecoins and dogecoins, respectively):

3. Freelancing for crypto currency. Not all online resources are yet ready to pay freelancers (specialists in various fields: designers, programmers, copywriters, etc.) for work performed in “online currency.” Most of them, mainly in RuNet, still prefer traditional fiat (rubles, less often dollars or euros). Therefore, at the moment I can only offer foreign sites of this type:

4. Trading (trading on cryptocurrency exchanges). The whole point is that you play (speculate) on the rates of certain currencies. The main goal of all activities is to buy on time (at the minimum price) and after some time to sell (at the maximum cost) this or that crypto currency.

Of course, at first it is difficult for the ignorant to understand the numerous nuances, unlike those who are familiar with trading firsthand (for example, on Forex), so I strongly advise beginners to first undergo theoretical training and start trading by investing small amounts, so as not to get into financial problems . I recommend the following exchanges:

5. Investing in crypto coins. In short, this method consists in the fact that you buy cryptographic coins for fiat money (rubles, dollars, euros) and calmly wait for some time until their rate reaches the maximum level, after which you sell and put the net profit into your own pocket.

Then you repeat a similar operation, perhaps with other currency pairs or even in parallel with several, if the budget allows. In words, everything seems to be simple, but in practice it is necessary to take into account a bunch of circumstances and take into account possible risks, because you will be investing your own money.

The best place to carry out such transactions is the same exchanges (their list is given above), where it is most convenient to make transactions and at the same time monitor quotes. But this is not the only way, although it is the most comfortable. You can exchange cryptographic currency for fiat currency, and vice versa, using exchangers, here are the most popular ones:

You can also buy crypto coins (in order to sell them at a higher price later) privately from an individual. Of course, it is not a fact that it will be possible to do this with greater profit than through exchanges or exchangers, however, this possibility should be taken into account.

There are even special services that provide information on the purchase and sale of crypto-money, taking into account the geographic location of a particular user (you can find a seller or buyer in your own city), bringing together the buyer and seller, and also acting as guarantors for transactions made online.

True, if such an operation takes place in a personal meeting, then the parties to the transaction must agree on it themselves. One of the most famous such services is LocalBitcoins, which can also be considered a full-fledged exchange.

6. Arbitration. The scheme of this type of earnings is also based on the purchase and sale of crypto money. Its mechanism is that you buy the desired currency on one exchange, and then sell it on another site at a higher cost, using difference in price of the same asset on different resources.

This strategy only works in a young market, where prices are not fully settled and quotes are not brought to a common denominator. The cryptocurrency market is still in its infancy, so it’s quite possible to make money this way.

To make serious transactions with cryptocurrencies, you need to receive up-to-date information to analyze the situation. For this purpose, it is quite suitable, for example, this web resource, where you will find real-time digital currency quotes.

True, here it is necessary to carefully calculate and weigh everything, including the size of the transfer fee. If you want to conduct arbitrage or invest in crypto-coins, you can use the services of monitoring exchange offices, where you can obtain data on the most favorable exchange rates at a particular moment. Here are some of these services:

7. Creating your own cryptocurrency. Yes, yes, no more, no less. Following in the footsteps of the followers of Satoshi Nakato is a very real idea. True, for this, first of all, you must be a professional in your field of programming, or have a similar person in your team whom you trust infinitely.

But that's not all. When developing, it is advisable to study the experience of creating other digital coins so as not to repeat their shortcomings. It will be absolutely great if you can find some fundamentally new solution regarding the algorithm of operation of the entire system.

However, even this is not enough to achieve maximum success. You also need to get attention for your product, and for this you need to start the promotion flywheel by finding investors and distributing tokens to them (which are the equivalent of shares) in exchange for financial assistance. If well-known brands are interested in new coins, then consider it a done deal.

Of course, the mention of such a method of generating income will make ordinary readers smile, but there are a lot of ambitious people. Perhaps one of them, who does not yet have sufficient knowledge and has not yet decided on the direction of their activity, but is ready to move mountains, uses this method and puts this idea into practice. As they say, God help you.

When choosing a way to make money with investments, you need to take into account that in the wake of interest in cryptocurrencies, services using clearly fraudulent methods began to appear everywhere on the Internet. These include the so-called HYIPs, which work like financial pyramids, the only goal of which is to grab a bigger jackpot and then disappear into oblivion.

Before you start making money online using cryptocurrencies by investing your hard-earned money in this enterprise, you need to analyze the project that you intend to use for this purpose. If there is the slightest suspicion that, a balanced and reasonable person will definitely refrain from working with him.

The most popular cryptocurrencies (TOP 10) for 2018

Bitcoin (BTC)— the most popular monetary unit among digital coins at the moment. With her, as I said, it all started. Now BTC is used everywhere as a means of payment for goods and services. Its exchange rate against the dollar is now very high, although there has been some decline recently, but stabilization is planned. Capitalization has currently reached $156 billion.

Fork- a system created on the basis of another cryptocurrency, but with some important changes that usually improve its algorithm. Prominent examples of forks are Dogecoin (from Litecoin) and Stellar (from Ripple).

Ethereum (ETH)- in Russian transcription it is designated as “etherium” (the coin is called “ether”). This cryptocurrency system was originally conceived in 2013 by Canadian programmer Vitalik Buterin, who has Russian roots, and the first coins were released in July 2015. Just like BTC, it is based on blockchain technology, and for a long time remained the only serious competitor to Bitcoin.

This happened because the Ethereum system stands out for one very unique feature, which is the use of so-called “smart contracts” (transactions without intermediaries with various types of assets), which are compiled and executed using special programs, and therefore cases of bias and fraud are excluded. In terms of capitalization, it is right behind Bitcoin (the total value of Ether is approaching $95 billion).

Ripple (XRP)- another successful development that has its own characteristics. Let's start with the fact that the system does not use traditional blockchain as a basis, this alone already sets it apart from the mass of other cryptocurrencies.

The basic component of the Ripple Labs company (the founder of these coins) is a decentralized distributed protocol, with the help of which the main goal is realized - achieving complete consensus (agreement) between the participants of any transaction.

Ripple also has a number of features that distinguish it from other cryptocurrency systems. For example, internal coins were released only once at the inception of the project, so mining (mining new ones) is excluded. The most interesting thing is that commission payments are eliminated, so the total amount of money gradually decreases.

The price of internal money of the XRP system began to grow actively in the spring of 2017 and today the capitalization is already more than $32 billion. Considering that the world's largest brands in the field of finance are interested in this currency, we can assume that the future of Ripple is very promising.

Bitcoin Cash (BCH)— this crypto coin appeared in the summer of 2017 and is essentially the “younger brother” of the classic BTC. There are several versions about who initiated the emergence of the new coin, but the purpose of its creation was clear - to achieve a higher transaction speed and a much lower amount of commission fees compared to the main currency, which was successfully achieved.

In all technical parameters, the new “cue ball” is absolutely identical to its “big brother”; in principle, that is why it apparently retained his name in its name. However, this division had virtually no effect on the rate of the main Bitcoin, but the capitalization of BCH began to grow at a breakneck pace and is now approaching $20 billion.

Cardano (ADA) is another project born in 2015, built on the blockchain and, like Ethereum, based on the implementation of smart contracts (“smart contracts”). It was developed by Charles Hoskinson, who was one of the founders of Ethereum.

But there are many differences with the latter, one of the main ones is the use of the Ouroboros algorithm, which eliminates the need for powerful cryptographic encryption, which consumes a large amount of electricity. The internal token ADA has already moved into the top five and occupies one of the leading places in terms of capitalization (more than $10 billion).

Litecoin (LTC)— a coin of the system of the same name, which is essentially a fork (branch) of the Bitcoin system. Simply put, the founders used Bitcoin's open source code to launch Litecoin. Its founder was programmer Charles Lee, who launched the project in 2011 with the support of the Bitcoin community.

This is not the first such experience, most of such projects ended in failure, but not in the case of Litecoin, the coin rate of which, despite temporary difficulties, began to grow steadily from a certain moment, and the size of LTC capitalization (more than $8 billion) allows this cryptographic currency to confidently be in top ten.

Stellar (XLM)— this project was created in 2014 as a fork of the above-described Ripple system and used its open source code as a basis. But then its own protocol was developed, much more advanced, although the essence of the mechanism remained the same (reaching consensus between users participating in a particular transaction).

This happened, among other things, because Ripple Labs began to suspect that it was some kind of centralized structure, primarily concerned with enriching the main holders of the XRP currency. It must be said that the suspicions did not seem groundless then and did not dissipate after a significant period of time. As for Stellar’s XLM crypto coins, their capitalization today is $7 billion.

NEO (NEO)— this platform with the digital asset (token) of the same name, considered an internal currency, was created on the basis of the Antshares system developed in 2014 by Chinese programmers Da Hongfei and Eric Zhang, one of the components of which is the smart contracts I have already mentioned. It is this circumstance that allows it to be identified with Epherium and similar projects.

Cooperation with the Chinese government and large global corporations like Microsoft and Alibaba gives hope for NEO’s breakthrough in the cryptocurrency market. To date, the capitalization of this monetary unit has exceeded $5 billion.

EOS (EOS)- another young project (founded in July 2017), based on which its creator, the famous developer Dan Larimer, who has a reputation as an innovator and a true professional in his field, took the Ethereum model, which he thoroughly refined, thanks to which the system amazed with its speed and high throughput transaction ability.

During its existence, the price of the EOS currency has grown from $1 to $7 and its capitalization today has reached 4.6 billion.

NEM (XEM)(New Economy Movement). The main feature of this platform is the use of blockchain with a POI (Proof-of-Importance) algorithm. According to many estimates, the monetary unit of this system, the token of which is designated XEM on crypto exchanges, has good prospects, including its monetary unit. Capitalization exceeds 4 billion.

Of course, a rating compiled in this way smacks of subjectivity. Moreover, due to many circumstances, calculating the fate of electronic currencies (some of which may ultimately turn out to be a “soap bubble”) is much more difficult than their fiat counterparts.

At the end there is one more video, since the topic is very pressing and causing a stir.

Good afternoon, dear readers of the blog site. Most likely, you have already heard in one way or another about such concepts as cryptocurrency, bitcoin, crypto exchange, etc. So this topic began to interest me. That is why I decided to share my thoughts and descriptions of the main points in the crypto world. If any of you are interested in this, and you are ready to dive into the world of e-commerce and digital money, then I advise you to subscribe to my blog and continue to receive the latest articles, as well as keep abreast of the main news on making money online. First, it’s worth starting with the basics and talking about the basic concepts in simple words. Let's start with the main thing, what is cryptocurrency.

What is cryptocurrency and why is it needed?

In simple words, cryptocurrency is digital money, like many other currencies, they are counted in coins (in common parlance, coin). However, ordinary money of different countries (fiat money) is issued by central banks, the value of which completely depends on the economic relations and political situations in the country. At the same time, cryptocurrency does not belong to any currency in the world and has no relationship with well-known currency systems.

Cryptographic currency is fundamentally different from the basic concepts and is currently a completely different way of mutual settlements.

Cryptography is called methods of encrypting and decrypting information; it is on the basis of these algorithms that the principle of mining (in common parlance is called mining) of digital currency is built. To generate cryptocurrency, certain powers are used that make it possible to perform a complex calculation algorithm (such powers are those created by ordinary users or large companies).

Cryptography allows you to protect chains of ongoing operations (transactions). The crypto money network actually consists of so-called transaction blocks. Each new block contains information about the previous one, which allows you to create a specific chain (blockchain - I will talk about it in another article), which in turn makes it possible to obtain information about transactions.

For a general understanding, I would also like to say that the creators and developers of cryptocurrency strive for it to become an analogue of a mined resource, and as a result have a limited supply, which will avoid banal depreciation, as with fiat money.

Let's summarize the above and highlight for ourselves the main points why cryptocurrency is needed:

- The ability to mine digital money yourself. Using the above-mentioned farms, each person has the right to mine (extract) independently.

- No inflation. The amount of cryptocurrency is limited in advance and thus uncontrolled release is impossible, which will prevent the depreciation of a particular cryptocurrency.

- Anonymity. Yes, there is a way to track the number of transactions from one account to another, but due to encryption, it is simply impossible to determine the owner of the wallet, which is what many segments of society take advantage of.

- Protection against hacking and counterfeiting. Also, thanks to encryption methods, coins cannot be counterfeited.

- No commission. If you conduct banking transactions, the bank charges a certain percentage for its services. Using cryptocurrency wallets, transactions between users occur directly, which avoids commissions (another reason why this type of digital money was developed).

Ways to make money on cryptocurrency

As mentioned above, thanks to the development of cryptocurrencies, you can make good money on them. There are several ways in which you can get rich quite simply, but at the same time wisely.

I really hope that my words will be perceived correctly, because if you want to make additional profit somewhere or make this or that type of income your main one, then you should definitely work on it and develop yourself in the right direction. As life shows, easy money is almost impossible to find.

So, what ways to make money on cryptocurrency exist:

- . There are two types of mining. In the first case, certain capacities (video cards, processors or asi) are used to mine crypto coins. In fact, you acquire quite powerful equipment that allows you to carry out a large number of calculations, and create a so-called mining farm, with which you are free to do anything, as well as buy additional equipment, increasing productivity and thereby profit. There is also always the opportunity to sell purchased video cards in parts.

It is worth considering that the payback period is quite long, however, taking into account the growth in the value of cryptocurrencies, your idea can pay off quite quickly.

The second type is cloud mining. This type of mining is most suitable for a beginner who has not yet had time to understand all the intricacies, but is already in a hurry to get money. The bottom line is that you lease the required amount of power and all worries about paying for electricity, maintenance and setup remain with the company providing the service.

Try to choose the service wisely, since on the Internet there are many scammers or simply services that resell these services (so-called intermediaries).

- Trading on exchanges. There are now a huge number of exchanges online, thanks to which you can make money by changing the cryptocurrency rate. By buying or selling this or that currency at the peaks of decline or growth, you can rise quite significantly. However, this option is not suitable for many, since you need to have nerves of iron and, if possible, constantly monitor news that affects the exchange rate.

If you decide to make money by changing the exchange rate, I recommend creating an account on social networks (the most popular in the crypto world is Telegram) and receiving the latest news from various sources.

- Cryptocurrency faucets. As many of you know, there are ways to earn regular money on the Internet by completing simple tasks (solving a captcha or simply watching an advertisement). So, such an opportunity has also appeared for earning cryptocurrency. However, you won’t be able to earn a lot from this right away. If you choose this method, I advise you to register for several faucets at once, since tasks will be received in limited quantities.

- ICO Well, the last, in my opinion, the most popular and effective way is investing in ICO. In fact, an ICO is a pre-sale of a cryptocurrency announced by the developer. Sometimes there are projects that at the ICO stage sold their coins for thousands of dollars, and after a while their value increased thousands of times, which had a very positive effect on profits.

I hope that I was able to explain in simple words what cryptocurrency is and how to earn your first digital money. In conclusion, I would like to give a graph of the price of Bitcoin for 2017 to make the growth prospects more clear.

Firework. Despite the fact that it has become warmer outside, many people have begun to spend more time outdoors. We decided to work a little to give you more information about the projects.

It's no secret that the first areas where they began to accept bitcoins as payment were not entirely legal areas. This included the adult entertainment industry, if you know what we mean? In this article, we will introduce you to the SpankChain platform, which is developing in this direction.

What is Spank Chain cryptocurrency (SPANK)

SpankChain (SPANK) cryptocurrency is an ERC20 protocol-based token that will be part of the entertainment platform. Spank Chain is based on the Ethereum blockchain, so it will be able to interact with other decentralized applications on Ethereum. The platform will be implemented as a website where you can view public shows, as well as buy content that interests you.

Features of the SpankChain platform

The peculiarity of the platform is that it consists of 3 layers:

– Application layer;

– Service layer;

– A micropayment layer called SpankChain Core.

On this platform, developers will be able to develop their own applications as well as create their own content.

Blockchain technology, in combination with other technologies, will help every user to be anonymous and safe. In addition, each user will save money on commissions and fees.

Prospects for SpankChain cryptocurrency

To be honest, there are already a lot of projects like SpankChain, for example, Bunny Token - advertising for which does not leave the screens of YouTube. But we don’t have much faith in the development of the SpankChain platform. We don't even know what this is connected with. Maybe because we don’t use such platforms.

And at the same time, it will provide real companies with tools for asset tokenization.

The value of blockchain technology is recognized by experts as promising for use in many areas. Along with the public systems Bitcoin, Ethereum, NEM, organizations and companies have a need to create non-public blockchains with closed code to solve their problems. However, there is a need for public and non-public systems to interact with each other. Comsa solves this problem.

The new platform aims to provide startups and real-world companies with the tools to tokenize their cryptocurrency and/or fiat assets. In addition, such companies will be given the opportunity to conduct an ICO and will be provided with advisory and legal support. The issued coins are guaranteed to be listed on the Zaif crypto exchange.

New projects can be based on the public blockchain Bitcoin, Ethereum and Nem or the private service mijin. Organizations will use their usual business practices, but through the interaction of various blockchain systems, they will be able to significantly expand their reach to other ecosystems without changing anything much.

For example, they will continue to sell their goods or provide services for NEM or their issued token, but will accept payment in BTC, ETH or other tokens. Funds will be automatically converted within the Comsa platform.

Technologies used

To launch a new ecosystem, it is planned to create 2 tools:

- Comsa Core;

- Comsa

The first service is designed to ensure the transfer of values between blockchains through the conversion of related tokens. At the same time, the service will monitor the total volume of assets.

Let's look at an example of how Core will work. The main Komsa account will receive assets from different blockchains, indicating information about the recipient to whom they are being transferred. The system will block or burn the received amount on the main account. At the same time, alternative cryptocurrencies or tokens for the corresponding blockchain will be unlocked or issued. They will be sent to the final recipient.

The Core network will operate on 2 private blockchains based on mijin. The first is for converting cryptocurrencies (BTC, ETH, NEM) into pegged tokens, and the second is for converting pegged tokens into one another. Companies can issue tokens linked to both cryptocurrency and fiat money. An example of the latter could be Tether, whose developers claim that it is backed by the dollar.

Comsa Hub is software that links company accounts in public and private systems based on mijin. It is designed to control the balance of an organization's assets across different ecosystems.

When cryptocurrencies or tokens arrive on the main public account, they are blocked by the Hub service. Next, the service issues equivalent private tokens and sends them to the corresponding private account of the recipient in a private network based on mijin. When a company, on the contrary, carries out an outgoing transaction with its tokens, they are debited from the private mijin account, and funds are unlocked on the public account. Next, cryptocurrencies and tokens are sent to the final recipient.

Komsa team

The Japanese company Tech Bureau is working on the launch of the Komsa project. It was founded in 2015 by Takao Asayama, a member of the NEM Foundation Board. Another leader is a specialist known under the nickname Jaguar0625, the leading developer of the NEM blockchain.

In early 2015, Tech Bureau became the owner of the first exchange in Japan to trade Bitcoin. After rebranding, the exchange received a new name Zaif. Since the summer of 2016, only tokens have been traded on this platform.

The ICO Committee has been created under the Tech Bureau. His task is to provide advice and support in the development of the Comsa platform, select and invite companies to issue tokens and conduct ICOs using Comsa. This committee includes well-known people from the crypto, financial and venture capital worlds, including NEM President and Vice President Long Won and Jeff McDonald, respectively.

History of the coin

To ensure the operation of the ecosystem, CMS coins will be used. In total, after the ICO, 2 Comsa tokens were released on the Ethereum and NEM blockchains. They were simultaneously listed on the Zaif exchange on December 14, 2017. The original cost was $3.65. That is, at the time of entering the exchange, investors received a profit of 365% compared to the price for which they received the coins.

At the time of writing, Komsa tokens were trading at $0.57 and had the following indicators:

- Comsa – 1312th place among all cryptocurrencies with a daily turnover of 157.6 thousand dollars;

- Comsa – 1316th place with a daily turnover of 153.7 thousand dollars.

How to get coins

To buy Comsa on the Zaif exchange, you must first add another crypto asset there, such as BTC, and exchange it for yen. To purchase Komsa tokens, click the Trade button in the upper right corner. Next, on the page that opens, you need to open the drop-down list to determine the pair. Here you will be asked to choose between tokens issued on Ethereum and NEM. After clicking on the selected pair, the desired page will open with the Comsa chart and forms for placing buy and sell orders.

To buy coins, you need to click the “Buy CMS:XEM” tab. There will be 2 transaction options offered here:

- with placing your own order;

- fast at market rate.

In the first case, you need to independently indicate the purchase rate and set the required number of coins. The total amount of the submitted transaction will be duplicated in yen. The current rate of the Comsa cryptocurrency can be viewed on the chart. There is also a separate field for setting a sales limit, so that in case of a rate jump, you can make a reverse exchange with a profit. After clicking the Buy button, the order will be placed in the corresponding order book.

In the second option, it is enough to fill in just one field - the number of coins required. The exchange will be made at the average rate. It is calculated based on orders placed by other traders. The maximum buy price and minimum sell price are summed up and divided by 2.

Advantages and disadvantages

The positive aspects of the Komsa project include:

- an experienced team of developers with great authority in the crypto industry;

- support from large financial and venture companies;

- providing a full package of tools to companies that want to attract investment in their startups through ICO;

- already existing products (crypto exchange Zaif and service for private blockchains Mijin), which are components for the successful functioning of the Comsa platform;

- the opportunity for token holders to vote for certain projects and participate in non-public ICOs;

- gradual repurchase of part of the CMS coins on the Zaif exchange and their burning, which will have a positive effect on the price.

One of the disadvantages is that the CMS does not quite fit into the usual understanding of cryptocurrency. These are coins for maintaining a private service, a significant part of which is in the hands of developers.

Information on ICO

Raising funds for the development of the project was carried out in 2 stages. First, as a result of the pre-sale, we managed to attract $9 million from Japanese venture companies ABBALab Inc., Nippon Technology Venture Partners, FISCO Capitals.

At the second stage, from October 2 to November 6, 2017, the public ICO Comsa was held, which aroused increased interest in the crypto community. Almost 245 thousand people registered on the token sale website. Funds were raised in Bitcoin, Ethereum and NEM.

Many experts who analyzed the project before its ICO pointed out the lack of an upper threshold for raising funds as a negative point. Concerns were expressed that the developers would hide the real amount of funds collected. However, the progress of the ICO was openly shown on the website. As a result, it was possible to attract more than $95.6 million in investments. The token cost was $1.

Investors who entered the project for amounts of $100,000 or more received a bonus of 20% of the number of tokens purchased. All ICO participants will receive the privileged right to invest in non-public ICOs of other projects that will be held on the Komsa platform.

Token distribution

The Komsa team indicated that the number of issued tokens will be 2 times the amount of funds raised. Based on the results of the ICO, it can be assumed that more than 191.2 million coins were issued. They are distributed in this order:

The Comsa team intends to use the raised investments to develop its platform for conducting ICOs by other projects, the Comsa Core converting service, and the Comsa Hub software. The developers also intend to create tools that will allow third-party companies to issue tokens linked to cryptocurrencies and fiat money. Part of the funds should go to the development of the Zaif exchange.

The Future of Cryptocurrency

At the moment, it is difficult to make a forecast for the Comsa cryptocurrency. Over the past 3 months since its appearance on the exchange, the value of Comsa has fallen 7 times. Compared to the price at the ICO stage, the coins fell in price by 2 times. But this is the general trend of deep drawdown, which was observed in the first months of 2018.

The development team after the ICO gives little information about the state of affairs. There is no clear roadmap for when the announced products will be released. On the Russian-language thread of the project on Bitcointalk, it is discussed that the developers have encountered difficulties due to the beginning of legal regulation of ICOs in Japan. Also, some users indicated that the project could change jurisdiction because of this and move to Switzerland.

However, the long-term outlook for Comsa appears positive. Behind the project is a strong team of well-known developers who are unlikely to want to spoil their reputation. They, along with similar projects COSMOS and Polcadot, took on the urgent task of creating a system that would ensure the interaction of disparate blockchains. In addition, Comsa will provide all the tools for tokenizing company assets and conducting ICOs for them.

Of all the necessary components for the new platform to work, only Core and Hub are missing. The cryptocurrency exchange Zaif and the service for creating private blockchains Mijin are already operating successfully.

With the settlement of legal issues and the emergence of positive news, the Comsa rate should go up. Token holders believe in the coin, as evidenced by the low trading volume at the moment. Other users should consider entering the project right now, since the coins cost only about $0.5. This is 2 times higher than at ICO.

It is also worth paying attention to the XEM coin. Komsa’s success can have a positive impact on its value, since a member of the Foundation Council and the leading developer of NEM are responsible for the development of the new platform.