Have you decided to buy an apartment, but can’t choose the right one? Are you worried about the integrity of the developer? There is an exit! Use the list of new buildings accredited by Sberbank.

Peculiarities:

- reduced interest rate

- prompt loan approval

You can learn more about Sberbank accreditation at the “Real Estate from Leaders” exhibition, which will be held in Gostiny Dvor (Ilyinka, 4) from March 29 to April 1.

Benefit for the buyer

If the house has already been put into operation, it ceases to be considered a new building and goes into the category of secondary housing. Accordingly, the conditions and interest rate change not in favor of the buyer, so many people prefer to buy real estate at the foundation pit stage.

There are many risks associated with this! Will the house be completed and how soon? Doubts plague everyone, because no one wants to give their money away. Sberbank can dispel doubts and reassure.

Sberbank accredited developers are reliable construction companies that have been on the market for a long time. Companies deliver their properties on time and eliminate inevitable defects in residential premises quickly and without litigation.

It is much easier for Sberbank to check the reputation of a particular developer than for a person who is buying an apartment for the first time. Therefore, a database of accredited new buildings allows you to minimize risks when purchasing a home.

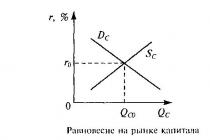

Benefit for the bank

Of course, Sberbank also has its own benefits from accreditation of developers. A mortgage is a loan secured by housing. If there is no home, then there is no collateral. It follows from this that the bank has no guarantees that the money issued will be returned to it.

Interest rates of any size cannot in any way protect the bank from losses if the borrower loses a well-paid job and has no collateral.

Therefore, it is very important for the credit institution that the house be delivered on time, or better yet, even earlier.

In addition, it is important for the bank that the residential building is in good condition for the entire period for which the mortgage is issued. Thus, the interests of the bank and the borrower coincide.

You can find out the entire list of developers accredited by Sberbank at the “Real Estate from Leaders” exhibition, which will be held in Gostiny Dvor (Ilyinka, 4) from March 29 to April 1.

To get to the exhibition you need to register on the website, download a free ticket and print it.

Lending terms

Sberbank has created a special program for new buildings, which allows you to get a lower percentage than in other offers.

- interest rate from 9.5% per annum

- the minimum amount is 300,000 rubles

- the maximum amount is limited to 85% of the assessed value of the property

- the duration of the contract is no more than 30 years

- Maternity capital funds are accepted.

Reading time: 6 minutes. Views 98 Published 02/09/2019

Many modern Russians, having set themselves the goal of acquiring new housing, opt for buying an apartment in new buildings. And they go to Sberbank to apply for a mortgage loan. This bank has long and firmly occupied a leading position in the market for providing services of this type. But Sberbank clients should also learn about some nuances regarding mortgages.

For example, it is better to prefer buying housing in accredited residential complexes, which are offered by Sberbank; accredited new buildings are the most optimal objects under construction in terms of reliability. The Russian mortgage lending market is developing rapidly, banks are developing more and more advanced methods designed to protect the interests of borrowers. And one of these steps is the accreditation of residential buildings under construction.

Applying for a mortgage to purchase a home from an accredited developer is an extremely profitable serviceWhat is banking accreditation

A mortgage for a new building is the most complex lending procedure. The process of registering collateral obligations is becoming more complicated (their role is played by the purchased housing). The banking organization itself is also at risk, because if the borrower is unable to fulfill its obligations, the bank takes the collateral, that is, the apartment under construction.

But if the house is not built and put into operation (and such cases are not uncommon in modern construction), then the credit institution will suffer large losses. Therefore, in order to provide a guarantee, a service such as accreditation was developed.

Accreditation of developers involves a comprehensive preliminary audit of a specific construction company for the purpose of further cooperation with it.

Accredited developers of Sberbank are those companies that have successfully passed all bank checks and have proven their reliability both for potential buyers and for financial institutions that issue loans for them for the purchase of real estate. The accreditation process itself consists of two stages:

- Checking financial reliability.

- Audit analysis of the construction process itself.

Mortgage lending with accreditation is beneficial for all participants in the transaction

Mortgage lending with accreditation is beneficial for all participants in the transaction Developer reliability audit

This stage of inspections is aimed at studying the reputation of the construction company. The number of completed residential properties commissioned is taken into account. Reviews of people who bought housing there are analyzed. All information relating to a particular construction company is checked. In particular:

- existing relationships of the company with other banks;

- information about the managers of the construction company;

- information from the NI (tax office) on the payment of taxes and existing fines;

- the presence of litigation;

- data from other sources about the nuances of financial reporting.

A big advantage for developers wishing to obtain accreditation from Sberbank is the presence of at least two successfully commissioned projects and indicators of a stable financial position for at least 2 years.

Construction Process Check

This audit is carried out on the basis of the results obtained after conducting general legal examinations. Constitutive and business permitting documentation is reviewed. The financial institution carefully studies such aspects as:

- The developer has a certificate of ownership of the land plot where the house is being built.

- Documentation permitting the use of land for the development of a large residential property.

- Competency in drawing up the necessary working documentation.

An on-site commission from a banking institution is also carried out. At this stage, the quality of the stages of the construction work itself is analyzed. Sberbank may also put forward its own (other) conditions to confirm the trustworthiness of the developer, for example, a check is carried out using communication networks.

The list of housing offered for mortgage from accredited developers can be seen on the DomClick website

The list of housing offered for mortgage from accredited developers can be seen on the DomClick website Advantages of cooperation with accredited companies

This procedure becomes useful and important, because it is beneficial for all participants in the future transaction. For the bank itself, the construction company and, of course, for consumers. It is worth finding out what benefits accreditation brings.

For the buyer (potential borrower):

- providing guarantees for the construction of houses and commissioning of apartments;

- when applying for a loan, there will be no need to involve co-borrowers/guarantors;

- time for loan consideration is reduced;

- obtaining a loan at lower interest rates;

- increasing the loan amount;

- permission to use Maternity capital funds;

- extending loan terms.

For the creditor bank:

- securing collateral for a loan;

- the possibility of providing more favorable mortgage conditions and, consequently, an increase in the volume of lending;

- increasing the rating of the banking institution itself.

For a construction company:

- increase in sales;

- expansion of plans for the future work of the company;

- increasing the rating in the construction services market;

- savings (having accreditation from Sberbank allows you to refuse to employ full-time specialists on lending issues).

Accredited new buildings from Sberbank

PJSC Savings Bank introduced its own developed accreditation program in 2012. This made it possible to significantly simplify the procedure for issuing loans, increased Sberbank’s rating and contributed to the active expansion of its client base. This step also helped to improve the security of issuing housing loans, making them more repayable (options of dishonest use of loan funds by borrowers and developers themselves were excluded).

Initially, Sberbank's partner developers could receive accreditation for those residential properties that were 70% commissioned. At the moment, this condition has been lowered to 40%, which has made it possible to more actively attract potential buyers.

On the DomClick website you can also use the services of an automatic calculator

On the DomClick website you can also use the services of an automatic calculator Lending terms

Sberbank has developed separate mortgage lending programs for the purchase of real estate in accredited complexes under construction. These are preferential programs and are offered under the following conditions:

- rate: from 9.50%;

- minimum amount for obtaining a loan: RUB 300,000;

- maximum loan term: 30 years;

- down payment amount: up to 15% of the cost of housing;

- possibility of using maternity capital.

All conditions for preferential mortgage lending (subject to the purchase of housing from an accredited developer) can be seen on the official website of Sberbank.

Where to see the list of accredited new buildings

Several years ago, potential borrowers could familiarize themselves with lists of accredited development companies on the Sberbank website. Now a separate portal domclick.ru has been created specifically for these purposes. On its pages, the user can find a list of new buildings from developers accredited by the bank in any region of Russia (to do this, indicate your place of residence in the search bar).

You can apply for a mortgage loan on DomClick

You can apply for a mortgage loan on DomClick It is also possible to use an automatic online calculator to calculate the cost of a future loan and the amount of regular payments. To get acquainted with the available proposals for new buildings, you should follow these instructions:

- Go to the DomClick website.

- While on the main page of the portal, go to the “Real Estate” subsection.

- In the search line, indicate the region where the client wants to find real estate.

- Then click on the “Apartments in new buildings” function.

- The system will automatically generate a map indicating all projects under construction from accredited construction companies.

conclusions

If a Sberbank client wants to take out a mortgage loan and purchase an apartment in a building under construction, he should definitely pay attention to the possibility of purchasing housing from accredited construction companies. Such a service already implies the reliability of a future transaction and a guarantee of completing the construction of a house until it is fully commissioned. A separate point worth considering is that such a mortgage has better and more attractive conditions from Sberbank.

By what criteria does the bank evaluate the reliability of the developer? Why is it important to check for accreditation when choosing an apartment in a new building?

These and other questions were answered by Vasily Seliverstov, executive director of the DomClick division. He is developing the accreditation process for partners and facilities under construction. Therefore, he knows everything about accreditation with Sberbank.

Why is accreditation needed?

Accreditation is an assessment of the likelihood that the construction of a house will be completed, the bank will receive collateral, and the client will receive his apartment.

Let's compare accreditation to the standard mortgage process. After the loan is approved, the client sends the apartment he intends to buy to the bank for approval. In fact, accreditation replaces this procedure for an apartment in a new building - the entire house under construction is approved at once. In addition, for accredited projects the transaction process is faster.

How does the bank check the developer?

Category A includes developers with the least experience in the market. To receive accreditation, they must construct at least 30% of the above-ground portion of the project. After this, the bank assesses the financial condition of such companies. If everything is in order with these minimum requirements, then the accreditation process itself begins.

The most experienced and reliable companies fall into category E. To do this, the developer must have 20 or more residential or commercial real estate properties built over the last 10 years. But even for such companies, the bank conducts a more serious and detailed analysis of previously constructed facilities. This distinguishes Sberbank’s position from other organizations.

What exactly is checked during the accreditation process?

We check the developer’s experience in the market and the construction readiness of the property in question. The pace of construction of the developer’s previously accredited facilities is also taken into account.

An important factor is the business reputation of the developer - here a detailed check is carried out by the bank's security service.

Sberbank is one of the few banks that checks not only the reliability of the developer, but also the reputation of the company’s managers.

It is checked whether the company took part in arbitration courts. The bank's legal department checks construction and land documentation, as well as the compliance of these documents with the share participation agreement. It is important that the documents strictly respect the rights of clients and the bank.

How long does this check take?

Existing partners who fit categories D or E can complete the accreditation procedure in 2-3 days, provided they provide a full package of documents.

For companies that have not yet cooperated with the bank, or if additional clarification on documents is required, the procedure may take 10 or more days.

Is it possible to speed up the verification?

Yes, we recently launched the ability to apply for accreditation in a partner’s personal account at pro.domclick.ru. During testing, the average time for reviewing applications from a partner’s personal account was 5.5 days, compared to the old procedure, when the average time was 9 days or more.

In the personal account, for the convenience of the partner, an “assistant” for creating a package of documents has been developed. After answering a few questions, the partner will understand what needs to be provided to the bank - now there is no need to read bank regulations and documents. This was done to speed up the review procedure, because, as I already said, when you provide a complete package of documents, review occurs faster.

Why is it important to check for new build accreditation?

Firstly, based on the results of the inspection, we understand that the accredited developer has a reliable business reputation.

Secondly, the developer can additionally attract client funds, consisting of mortgage loans received from banks that have accredited the project, to finance the construction.

This strengthens its position in the market. However, it is important to understand that even accredited facilities may not be completed. This is influenced, among other things, by how the developer conducts business activities, how procurement and other operational procedures are organized. That is, those things that the bank cannot influence.

Therefore, even after accreditation, the bank continues to monitor the activities of the developer. If monitoring reveals that the developer is not fulfilling its obligations in good faith, the bank will be able to promptly warn its clients and the market about the risks.

How to protect yourself when choosing a developer?

If a residential complex has received accreditation only in 1-2 banks, this may mean that the object does not meet the reliability requirements, and the remaining banks refused it. In some cases, it is important to consider that there are developers who have relationships with certain banks. The bank may be a participant in the developer’s business, for example, a founder, a shareholder, or have a seat on the board of directors. In this case, the developer does not seek to obtain accreditation from a large number of banks.

Mortgage lending with state support at Sberbank began in May 2015. The task pursued by the financial institution was to help Russians purchase their own square meters at the lowest possible cost.

State subsidies continued until March 1, 2017. The founders of Sberbank have not yet given a specific answer whether the program will be extended, reserving the possibility of introducing the system again.

What is mortgage lending with government support?

By becoming a participant in the program, a solvent citizen of Russia with a permanent job and a stable income can count on the payment of a certain share of funds by the state, which, in turn, subsidizes the program proposed by Sberbank using money from the Pension Fund.

Signing a mortgage loan agreement, of course, imposes basic financial obligations on the debtor, but at the same time a preferential interest rate is offered - 11.4%, a decrease of 0.5%.

Taking out a mortgage from Sberbank is primarily beneficial for the borrower, but at the same time Sberbank supports development companies, because new buildings accredited by a financial institution become a prerequisite for purchasing an apartment. Purchasing housing on the secondary market is prohibited.

Conditions for participation in mortgage lending

If previously only needy families, for example, low-income families with many children, could take advantage of preferential mortgages, today the state is showing interest in supporting Russians, regardless of the social status of the respondents.

The only thing you need to remember is the mandatory conditions and requirements for participants valid until 2019 inclusive:

- the down payment received from the borrower is 20% of the established cost of housing;

- the loan can be issued for a period from 1 to 30 years;

- the minimum loan amount is 300,000 rubles;

- the maximum loan limit is 8,000,000 rubles for residents of the Moscow region and St. Petersburg, 3,000,000 rubles for residents of other regions of Russia. Such a large gap between different localities is associated with different levels of economic development and wages;

- There is always the possibility of unforeseen events that may result in the inability of a bank client to repay a mortgage debt, for example, a layoff at work. For reinsurance, Sberbank requires the provision of collateral, which is in the form of residential space included in new buildings accredited by a financial institution;

- it is impossible to do without taking out life and health insurance for the borrower, and this point is one of the most important and fundamental in the signed agreement (a borrower who does not renew the insurance, thereby “frees the hands” of the credit institution, which, in turn, now has the right to increase the interest rate to 12.4% per annum).

What type of housing is available for mortgage lending under the program from Sberbank

- Housing included in new buildings accredited by the bank.

- Multi-family real estate.

- A newly built or under construction private house.

- Townhouse with land.

What is real estate accreditation

The list of real estate that has passed state accreditation is presented on the official website of Sberbank. Accredited new buildings mean those approved by a financial institution, available options for consideration by potential borrowers and future apartment owners.

Accreditation immediately declares to the future owner that the bank and the state are responsible for the proper condition and quality of the constructed facility, being responsible for safety, timing of completion of construction and compliance with residential premises standards. Recently, in Russia, fraudulent actions by construction companies have become increasingly common, abandoning the process halfway and not returning money to their clients.

Sberbank and mortgage lending with government support exclude such an outcome, which means the borrower does not have to worry about the final result.

Base of new buildings accredited by Sberbank in 2019

The majority of applications for mortgage lending were received from Moscow residents, and this despite the rather high cost of square meters. But new buildings are also offered in other cities of Russia. In 2019, the full list looks like this:

- Club house Brilliant House, located in St. Petersburg. Price per 1 sq. m of living space was established within the range of 200,000 - 355,000 rubles. The landscaped area includes recreation areas, and the apartments boast spacious rooms, glazed large loggias and balconies. For the convenience of the owners, there is a 2-level parking lot underground.

- 1 sq. m of the family residential complex "Mishino" in Volgograd is estimated at 45,000 - 50,000 rubles.

- The Arsenal company offers new buildings in Center+ at a price per 1 sq. m. m from 57,500 to 87,500 rubles.

- New apartments located in Nakhabino Square will cost from 57,000 to 62,500 rubles.

- The construction company RusStroy is carrying out several large residential projects at once, the leader among which is Posad-Premier in Yaroslavsky, Moscow region. New buildings in this area will require cash investments from the future owner in the amount of 50,000 - 51,000 rubles per 1 sq. m. m. In return, property owners will be able to enjoy the amazing architectural design of the houses, underground parking, a green garden along with modern playgrounds.

- Square meters in Park Tower, visually similar to 2 towers, were distributed in the price range of 95,000 - 100,000 rubles. The advantage of this residential area is its proximity to nature - the Aleshkinsky Forest and Butakovsky Bay are nearby, where it is convenient for Moscow families to go on a picnic.

- The Sport-life complex under construction in Zvenigorod is located in the very center of the city. You can buy apartments designed for 1 living room, 2 and 3. There is a green area and a children's playground nearby, and the first floors are allocated for renting offices and shops. 47,000 - 51,000 rubles is an acceptable price for comfortable accommodation for Russians.

- In Noginsk, consumers are invited to look at the apartments that are part of the new buildings of the Zakharovo-Park complex in the Moscow region; they cost from 52,500 rubles per 1 sq. m. m. Nearby are Glukhovsky Park and Sernogolovsky Pond, the beauty of which can be enjoyed at any time. The social infrastructure is luxuriously presented, there is a bus stop 200 m away, and a railway platform is 1.4 km away, allowing you to take transport and get to Moscow in a breeze.

- Construction work on the arrangement of the Park Alley complex is in full swing in Krasnogorsk. The beauty of this area is that it is located in a park area, next to a large shopping center, beauty salons, medical clinics and a city hospital. In the courtyards there is a city museum; for children to relax, a 10-minute walk away is the children's leisure center "Fairytale".

Requirements for the borrower

Who can apply for a mortgage on real estate included in accredited new buildings?

- An individual over the age of 21.

- The maximum permissible age of a participant in the program for males is 60 years, for females – 55 years.

- Availability of registration stated in the passport of the system participant.

- Having a regular income.

- Cumulative work experience – from 1 year or more.

- If we are talking about the current place of work - from 6 months.

If the borrower wants to increase the loan amount, he has the right to hold the co-borrower liable, of course, with the latter’s consent. It is allowed to attract 3 co-borrowers at once; the spouse is considered the borrower by default. Therefore, it is necessary to obtain written consent from the other half, with whom the official marriage is concluded, to take out a mortgage. The exception is when a marriage agreement is concluded between husband and wife.

Where to receive and make loan payments

- at the place of registration of the recipient of the housing mortgage;

- at the location of the new building that the borrower has chosen;

- at the place of accreditation of the company, which acts as an employer for the debtor.

At the request of a Russian citizen, Sberbank can issue a loan in one amount or gradually, in parts. These nuances are negotiated by the two parties and then specified in the contract. If you plan to repay the debt ahead of schedule, of course, this option is unprofitable for the financial institution, because it loses profit, but it is also possible.

The borrower draws up an application and indicates in it the following details:

- your data;

- the date when the application was written;

- amount to be repaid;

- the account from which the funds will be transferred to Sberbank.

Please note that Sberbank does not require payment of commissions if the loan is repaid on time.

Additional sources of loan repayment

Sberbank offers additional options for repaying a mortgage, for example, it’s a good idea to use maternity capital. To minimize expenses for an individual, a tax deduction can be issued equal to 15% of the money paid. The maximum possible tax deduction in 2019 is stated to be 2,000,000 rubles.

How much loan can I expect?

The bank always approves the maximum amount that it can issue to the borrower and co-borrowers specified in the application form. However, the loan amount cannot be more than 85% of the value of the property you have chosen.

I was denied a loan. Why? What to do?

The bank does not explain the reasons for the refusal, as this would lead to the disclosure of the borrower assessment system, which is a trade secret. There are potentially about twenty parameters of the borrower and co-borrowers that this system can rely on.

If the bank refuses you, you can reapply for a loan within the period specified in the accompanying text of the refusal. In some cases, you can reapply immediately.

How to increase your chances of getting a mortgage with a small official salary?

For example, you can apply for a loan with a certificate in the bank form instead of a 2-NDFL certificate. An income certificate in the form of a bank is an alternative document that is accepted by the bank as confirmation of the borrower’s income, but in which additional earnings can be taken into account.

I am an elderly person, will they give me a mortgage?

You can take out a mortgage until you turn 75 years old. For example, if you are 65 years old, you can take out a 10-year mortgage.

If I receive a salary on a Sberbank card?

Salary clients of Sberbank, depending on other loan conditions, may receive additional benefits. At the same time, benefits are available if any of the co-borrowers is a salary client.

· If over the past two months you have had at least one salary deposited onto your Sberbank card or account, you can receive a discount on your rate.

· If you have had your salary credited to your Sberbank card (account) in at least 4 of the last 6 months, you will not need to additionally upload an income certificate and a copy of your work record book.

How can I find out the overpayment on my future loan?

You can see the amount of overpayment by registering in your personal account. After registration, click on the calculation panel and you will see the overpayment diagram in the calculator.

Is it profitable to buy a life and health insurance policy for the borrower?

Life and health insurance in the insurance company Sberbank Life Insurance LLC or other companies accredited by Sberbank allows you to reduce the loan rate by 1%.

Considering the purchase of the policy, you will actually save about 0.5 percentage points on the rate. In addition to saving on the rate, the policy fulfills its immediate purpose - the insurance company will pay the bank the balance of the debt on your mortgage loan upon the occurrence of an insured event (disability or death).

I am a citizen of another country, can I get a mortgage?

Mortgages from Sberbank are issued only to Russian citizens.

Who can be a co-borrower?

Most often, co-borrowers are relatives of the main borrower - spouse, parents, children, brothers and sisters. In total, you can attract up to 6 co-borrowers. If you are married, your spouse must be a required co-borrower. Exceptions are possible if a marriage contract is concluded between the spouses.

For example, to increase the chances of receiving a larger amount upon approval, you can attract co-borrowers - participants in salary projects. And when applying for a loan, you can note that you do not want to take into account the solvency of the co-borrower. This will reduce the list of required documents, but may reduce the maximum approved amount.How to use maternity capital for a mortgage?

You can use maternity capital funds in whole or in part as a down payment when obtaining a mortgage. You can use only maternity capital or the sum of maternity capital and own funds. For the minimum down payment amount, we recommend using the DomClick calculator.

When using maternity capital funds, it is important to agree with the seller on the procedure and deadline for receiving maternity capital funds, since this amount is not transferred from the Pension Fund immediately.

Also, maternity capital funds can be used for early repayment of an existing loan.What additional costs will there be when applying for a mortgage?

Depending on the type of property and the selected set of services, when applying for a loan you will need to pay:

· Evaluation report – from 2,000₽ depending on the region and appraisal company (required for assessing the collateral);

· Insurance of the collateral (for the purchased apartment) - directly depends on the size of the loan;

· Life and health insurance of the borrower (not mandatory, but reduces the loan rate) - directly depends on the size of the loan;

· The state fee for registering a transaction in Rosreestr is 2,000₽ at independent registration or 1,400 ₽ for electronic registration instrations (this is an additional service and is paid separately);

· Renting a safe deposit box and paying for access to it (when buying a secondary home for cash) or paying for a secure payment service - from 2,000₽ .

The cost of services is approximate. Check the exact cost on the websites of the relevant services.

Which is better: new building or resale?

As a rule, an apartment or apartments in a new building are purchased directly from the developer, while resale apartments are purchased from the previous owner.

No one lived in the new building before you, the price per square meter is less than that of an apartment of the same class in the secondary market, there are promotions from developers, more modern layouts, however, you will not be able to quickly register at your place of residence, the elevator and gas will not be turned on until Most of the residents will not move in; most likely, they will have to wait for the development of infrastructure and the completion of repairs from the neighbors.

As a rule, you can move into a secondary property and register immediately after purchase; the infrastructure around it is already developed, however, most likely you will have to be content with a standard layout, worn-out communications, and you will need to check the legal purity of the property and the parties to the transaction.

What is the processing time for a loan application?

Review of the application does not exceed two days, but most clients receive approval on the day of application.

How does the process of obtaining a mortgage from Sberbank through DomClick work?

Depending on the type of property and other parameters, the process of obtaining a mortgage may vary.

However, the first stage is the same for everyone - submitting an application for a loan. To apply, calculate the loan using the DomClick calculator, register on the website, fill out the form and attach the necessary documents. Review of the application does not exceed two days, but most clients receive approval on the day of application.

If you have not yet selected a property, you can start doing so immediately after receiving approval from the bank, when you find out the maximum loan amount for you.

When the property has been selected, upload the necessary documents in your DomClick account.

Within 3-5 days you will be informed about the approval of the property you have chosen. You can choose a convenient date for the transaction, which is carried out at the Sberbank mortgage lending center.

The last stage is registration of the transaction in Rosreestr. Congratulations, you're done!

Why register on DomClick?

After registration, you will have access to a consultant’s help in the chat and a borrower’s questionnaire. Registration allows you to save your data so that you can return to filling out the application at any time. After receiving loan approval in the borrower’s personal account, you will be able to communicate with your manager, send documents to the bank online and receive the services necessary to obtain a mortgage.

How do I find out the bank's decision?

Immediately after consideration of your application, you will receive an SMS with the bank's decision. A bank employee will also call you.