To transfer money from one Sberbank card to another using a phone or card number, you must use one of the available instructions given in the article. The transfer can be made through the Mobile Bank at 900, in your personal account or through any self-service device (ATM or terminal).

To transfer money to another Sberbank client by phone number, you must use the following instructions:

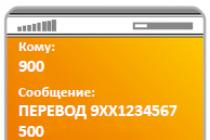

- Send the command to the short number 900: TRANSFER 9XX1234567 500 .

- After the word "TRANSFER", sequentially enter the recipient's phone number and the amount of the transaction.

- Wait for a response SMS with payment details and a combination of numbers that you need to use to confirm the operation.

Sometimes there is more than one Sberbank card available, in which case, for convenience, it is possible to select the preferred card for transfer. To do this, send the following command to service number 900: TRANSFER 1234 9XX1234567 500, where 1234 is the last four digits of the desired card.

Sometimes there is more than one Sberbank card available, in which case, for convenience, it is possible to select the preferred card for transfer. To do this, send the following command to service number 900: TRANSFER 1234 9XX1234567 500, where 1234 is the last four digits of the desired card.

The procedure for sending money by card number is simple, let's denote the algorithm of actions:

- You need to type a text message in the format TRANSFER 1234567891234567 5000 and send it to number 900 .

- After the word "TRANSFER", you must specify the recipient's card number and the amount of the transaction.

- You will receive an SMS with payment details and a unique code to confirm the operation.

Sometimes it is required to indicate from which card the transfer will be made to another client of Sberbank. To do this, you need to write an SMS on your mobile device in the format TRANSFER 1234 4321 5000 and send it to the short number 900.

Sometimes it is required to indicate from which card the transfer will be made to another client of Sberbank. To do this, you need to write an SMS on your mobile device in the format TRANSFER 1234 4321 5000 and send it to the short number 900.

With the command from the example, you can transfer an amount of 5 thousand rubles between cards with numbers ending in 1234 and 4321. Note that the first is required to indicate the card from which the transfer is made, and the second - to which the payment will come.

USSD commands for sending money quickly

For subscribers of Beeline, Megafon and Tele2, a transfer service is available via a USSD request.

To transfer funds between Sberbank cards, type the command:

* 900 * 11 * X * Y * Z # , where X is the last 4 digits of the sender's plastic number, Y is the last 4 digits of the recipient's card number, and Z is the amount of the transaction.

If you need to transfer funds by phone number, dial a USSD request:

* 900 * 12 * X * Y # , where X is the phone number to which the recipient's card is linked (without 8), and Y is the payment amount.

Restrictions and tariffs

On the part of Sberbank, the following restrictions are imposed on such operations: no more than 10 transactions per day can be made, while the total amount of payments for the sender and recipient should not exceed 8 thousand rubles.

Commission is not charged, provided that the transfer goes to the client's debit card within the same city, otherwise the commission is 1% (maximum 1000 rubles). Current rates are available at the link.

Transfer funds to Sberbank Online

Sberbank allows you to send money from one user to another without leaving your home or office. To do this, it is enough to have access to the Internet and be registered in the Sberbank Online system.

Transfer to a Sberbank card of another client

To quickly transfer to another person, just follow these steps:

- Log in to Sberbank Online using the link online.sberbank.ru and go to the "Transfers and Payments" section.

- Since the transfer is carried out to another user, you need to click "Transfer to a Sberbank client".

- Now you need to drive in the card number or phone number of the recipient. Then specify the account to be debited and the payment amount. Then click the "Translate" button.

- In the new window, you need to check the payment details and click the "Confirm by SMS" button.

- It remains to enter the code received via SMS and click on the "Confirm" button to complete the transaction.

- The operation is completed, the sender and recipient will receive SMS notifications about the successful transaction.

- Step 1

- Step 2

- Step 3

- Step 4

- Step 5

- Step 6

You can transfer any amount, Sberbank does not set restrictions for its users, moreover, sending funds to debit cards opened in the same branch of Sberbank goes without commission, but if the recipient's card is opened in another branch of the bank, the commission will still be 1% (maximum 1000 rubles).

Balance transfer between own cards

Taking into account the fact that the operation takes place between the personal cards of the same user, no commission will be charged for the operation, and the time of its execution is reduced to a few seconds. The transaction is executed as follows:

- The user must go to the personal account of the system and then open the "Transfers and payments" page.

- Then give preference to the button "Transfer between your accounts and cards."

- In the window that appears, indicate the card from which the funds will be withdrawn, and the card to which they will be received, as well as the amount of funds. Then you need to click the "Transfer" button.

- After completing all the steps, you need to check the details and click on the "Confirm" button.

- The operation will be executed instantly, if necessary, you can print a check.

A credit or debit card is a universal payment method. Using the card, you can buy goods and services, make payments to third parties, withdraw funds and use the card product abroad. Sberbank cards are the most popular among the population. Using the example of such a card, we will tell you how to transfer money to a card without a card.

One of the ways to replenish the card is to deposit cash. Such operations can be carried out both on your own card products and in favor of third parties. Such operations can be performed directly through Sberbank or third-party organizations or services offering online payments through electronic systems.

Through banking specialists of Sberbank

One of the ways to transfer cash to a card account is to apply directly to a branch of a banking organization. You will need to have your passport with you. To carry out the operation, it will be necessary to indicate the card number to which the transfer will be made, as well as the full name of the owner of the plastic and the amount. In this case, the steps are as follows:

- Go to the office and select the appropriate menu for transferring money in the electronic queue terminal.

- Wait until the autoinformer invites you to a banking specialist and fill in the payment details.

- Give money.

Such a transfer is acceptable for people who do not have a valid account with Sberbank. A commission is charged for the operation depending on the type of transfer. Standard transfer is possible with a deduction of the amount of 1.75%. The minimum cost will be 50 rubles, the maximum amount will not exceed 2,000 rubles.

Urgent transfer is also possible with a commission of 1.75%. In this case, the minimum is 150 rubles, and the maximum is 3,000 rubles.

You can top up a Sberbank card at a bank branch

Through third party banks

A transfer to a Sberbank card without a card is also possible through any commercial bank. The procedure is similar to transferring money at a Sberbank branch. To do this, there is no need to open an account, you can complete the transaction by filling out a payment order. Need to know and report:

- passport data;

- card number;

In some cases, crediting money only to the number may not be possible. Then the money must be transferred to the card account. To do this, you will need to know the full bank details of the bank that issued the card.

Funds are credited to the account within 3 business days. The sender independently appoints a commission. The amount that is charged for such an operation must be clarified with the person who transfers the money. The owner of the Sberbank card will not pay anything extra, he will receive the amount minus the commission.

Post office

The central postal operator is also empowered to make money transfers. A clear disadvantage is that the money is transferred to the account within 7 business days.

The commission is 1.5% of the amount of the payment, provided that the minimum is 40 rubles.

You need a passport and card details. A standard form is filled out, after which the postal worker issues a receipt for payment. Operations are possible in any department, not necessarily at the place of residence.

You can deposit money to a Sberbank card at the post office

Cashless transfers

The development of modern technologies makes it possible to exclude the use of money in the classic version in the form of paper. Increasingly, mutual settlements are made by means of bank cards or with the help of electronic money.

This method provides additional protection against cash loss or money theft. Since the funds stored on electronic media are protected by additional passwords and pin-conds, access to which only the owner has.

Replenishment of the card via Webmoney

WebMoney is electronic money that can be converted into rubles and dollars. Money is transferred to Sberbank cards instantly. The system charges a commission depending on the type of transfer. Consider how to transfer webmoney to a Sberbank card:

- You need to log in to the system and select the type of your wallet. WMR corresponds to a ruble account, WMZ to a dollar account.

- Under the name of the wallet there is a function “withdraw funds”.

- There are two transfer options: to a bank card and to a bank account.

- If you need to transfer money to a bank card, the transfer will take up to 3 business days, but it usually arrives instantly. The commission is 2.5% plus a fixed figure of 40 rubles. It is enough to indicate the card number and the amount to be debited, the system will automatically calculate the transfer, taking into account the costs. You can confirm your intentions using SMS informing or the E-NUM program, which can be downloaded as an application to your mobile phone.

You can select another menu item with a transfer through the exchange. It is located in the same section. Terms, as a rule, do not exceed two days. Commission 2%. The principle of such a transfer is that when creating an application, you will wait for a person who will accept a counter similar operation, as a result of which the transfer will be completed. In this case, the operation may not be performed if the request is not satisfied on the exchange.

Through the WebMoney payment system, you can transfer money to the card directly or through the exchange

Via Yandex.Money

Consider how to throw money through a similar electronic system Yandex money.

Here you will need:

- select the "translations" section;

- in the paragraph "from" indicate your wallet;

- in the "where" section - "to a bank card".

Money is usually received on Sberbank cards instantly, but there may be a delay of up to 3 business days. You will need to indicate the number of the plastic in favor of which you need to credit the money. The system takes a commission of 3% and an additional 45 rubles.

Qiwi

Another popular payment system in Russia is Qiwi Wallet. Consider how you can send money through this system:

- in the main menu, click on the "Translate" section

- hereinafter - "to a bank card".

The interface of such systems is similar. Therefore, the number and amount are indicated. Money can be withdrawn both from the wallet and deposited through the terminal. Commission 2% plus 50 rubles for one operation.

Sberbank Online

Sberbank has the largest number of clients who use banking services. In many ways, the love for this commercial organization is connected not only with its reliability, but also with the fact that the company provides excellent remote maintenance services.

Transfers via the Sberbank Online system are carried out instantly, and no commission is charged.

To use the personal account service, it is enough to get a debit card, a credit card in a bank or open a deposit account.

From your account, it will be possible not only to transfer money to other individuals, but also to carry out transactions in favor of legal entities, paying for certain services, including repaying fines, taxes, and utility bills. The sequence of actions is as follows:

- Click on the "transfers and payments" section.

- Find the function "transfer to a Sberbank client."

- There are several options for filling out the form, depending on your knowledge. Money can be transferred by entering the card, account or phone number.

- You can also specify the text of the message to the recipient.

- Then confirm the intentions and check the status of the transaction.

You can make transfers between cards through online banking

Mobile app

It is not necessary to perform a similar operation through a personal computer and a personal account located on the website of a banking organization. Transfers can be made by downloading the mobile application. This is a personal account that is designed for portable devices. To use the functions, you must log in using the same data that is used for Sberbank Online.

If you are not registered in the system, then such a procedure can be performed at any office of Sberbank by making an appropriate application. The experts will provide the necessary login information. You need to have your passport with you. The money transaction itself is made in the same way as described above in the Sberbank Online section.

Mobile bank

An additional service provided by Sberbank is the remote management of accounts via SMS messages. You can connect the system yourself through ATMs or terminals of a banking company, as well as in a branch by contacting a specialist.

The service can be paid depending on the tariff and reach 60 rubles per month. You can transfer funds both by card number and to the phone number linked to the card account, but in this case you need to make sure that the recipient also uses the mobile banking service.

Payments are made through the number 900. An SMS message is sent to it.

If the operation is required by card number, then in the text you need to indicate the word "Transfer xxxx-xxxx 1500", where the number of the card where the money is sent is indicated in place of the characters. It can be 18 or 16 digits depending on the type of payment system. 18 digits are typical for Visa and MasterCard, while the Maestro payment system prefers 16 digits on plastic.

When money needs to be credited by account number, the phrase is written as follows: “Transfer 916xxxxx 1500”. The phone number is indicated starting from the number 9, skipping 8, and the amount for the transaction. Funds are credited to the card account instantly. In this case, the system does not charge a commission. You can check the write-off by requesting a "balance" on the same number.

In contact with

BEST LOANS THIS MONTH

JavaScript must be enabled in your browser settings for the survey to work.

Cash, you can do it directly at the bank branch. To do this, you need to contact the bank with a passport to the cashier (or manager). A bank employee will check your passport details and send the amount you need to your card within a few minutes. Of course, you will first need to name the card number to which you want to send funds. If the recipient's card does not belong to you, you will also need to clarify for the cashier the full name of the person to whom the transfer is being made. This is necessary so that the cashier can check whether the data of the card you named match the data of its owner. An error in even one digit of the card number can lead to loss of funds.

How to transfer cash to a card?

Today, you can send money to a card without the direct assistance of a bank - through a self-service terminal or an ATM that has a bill acceptor. When transferring cash from your own card, you do not need a bill acceptor. To make a transfer, you need to insert your card into the ATM, activate it with a PIN code and select the "Money transfers" item in the section of the services offered by the ATM. Then you just have to follow the instructions that the ATM gives you, carefully enter all the details for the transfer, double-check this information and finally confirm the transfer of funds.

How to transfer cash through a Sberbank ATM?

If you do not have funds on your card to make a money transfer or you want to replenish your own card in cash, you will need a Sberbank ATM that accepts cash for payment. In the ATM menu, you will need to select the “Money transfer” service and in the field that opens, indicate the number of the card you plan to replenish. When choosing a method of sending, indicate the item "Cash". The ATM will offer you to deposit the amount of replenishment specified by you through the bill acceptor. After the operation, the device will print out the appropriate check for you. When replenishing the card within one territorial district, no commission will be charged for the service.

How to transfer cash to an account?

Many users are interested in whether it is possible to send money to their bank account without additional fees. It is worth noting that if you replenish your own cash account with cash, rare banks charge a commission for this. When making transfers within the same bank, you can also count on the fact that you will not be charged a commission. You can also replenish your current account at the terminals and ATMs of your bank without additional fees. It is also possible to make a money transfer to the account through the Qiwi wallet. In this case, you will need to know the details of the account being replenished, as well as the phone number of the person to whom you plan to deposit money.

How to convert electronic money into cash?

You can withdraw money from an electronic wallet to a bank card, and then get cash in a fairly simple and secure way. True, for this you will need to verify your own passport data in the electronic payment system that you use. After that, it will be possible to apply for the withdrawal of funds to the bank of your choice to your personal account. Please note that some electronic money systems allow you to link bank cards to wallets in order to simplify the withdrawal procedure. In addition, you should know that money transfer in most cases is only possible to a personal bank account or money transfer system in your name.

Advice from Sravni.ru: Banks allow most money transfers only from customers' debit cards, as well as from their own funds placed on.

In recent years, in Russia, all settlements of the population are gradually being transferred to a non-cash plane. Individuals draw up in financial institutions not only credit, social and salary plastic, but also debit, through which payment for goods, works and services is made. Also, bank customers often need to transfer funds to other card accounts. Today we will analyze all the ways how to transfer money from card to card (for example, in Sberbank), what limits are set, and what commission will be charged for each payment.

Methods of transferring funds and restrictions

As a rule, the options for making a transfer in all banks are the same:

- through Internet banking;

- through ATMs/terminals;

- through mobile banking;

- through a branch of a financial institution;

- via SMS;

- through the hotline.

Internet banking

If the owner of the debit plastic has free access to the Internet, he will be able to make payments online. To do this, he needs to act in a certain sequence:

Via SMS

If the plastic holder has a special application “banking” recorded on the gadget, then he can transfer finances from his card account to the card of other Sberbank customers via SMS messages. In Sberbank, there is a telephone number "900" for this:

The bank will receive a message with a digital combination, which must be sent back to the number "900". Thus, the financial transaction will be confirmed.

Attention! You can transfer money in this way only in Russian rubles. It is forbidden to make payments with credit cards. The word "transfer" individuals can replace in this way: PEREVESTI / TRANSLATE / PEREVOD.

Through ATMs/terminals

To use this method, the owner of the debit plastic needs to find a terminal / Sberbank and act according to the plan:

Mobile banking

Initially, the client must install a special application on his gadget using the link

Plastic cards are a convenient tool for managing personal finances. Most of their users know how to transfer money from card to card. But there are certain nuances when transferring money between cards, and we'll talk about them.

When You Might Need a Translation

As a rule, bank account holders have several plastic cards for the convenience of using them. For security, it is better to use one card for purchases, and transfer a certain amount for purchases from other cards.

Transfers from card to card are necessary to replenish the account of a wife, relative or friend, at their request. It can be a transfer from a card of one bank to a card of another bank.

Often, when performing work between individuals, there is a need to pay for the work. This applies to freelancers or paid consultants. In this case, the customer transfers payment from his card to the card of the contractor.

There is also a need to pay for purchases on the websites of Avito, Yula and the like. And often the question arises how to make a transfer from card to card to the seller, so as not to be deceived. Top tip: the purchase amount, in order to avoid fraud, should be small.

The main ways to transfer money from card to card

Consider the main ways to transfer money from card to card.

Intrabank transfer from card to card online

If plastic cards are issued by one bank, this greatly simplifies the procedure for transferring money from card to card. For the owner of several cards in one bank, such a transfer is even easier.

For example, in Sberbank of the Russian Federation, when using the Sberbank Online service, cardholders just need to open the "Transfers and payments" section in their personal account and select "Transfer between their accounts and cards" there. In the window that opens, select the card from which the transfer will be made and the one to which the money will be transferred, and the amount of the transfer. Then perform the "Transfer" operation, and the money without a password will be credited to the specified card, about which you will receive a message here and the requirement to "Confirm" by clicking on this entry in the window.

The transaction will be announced in the next step. If desired, you can print a transaction receipt.

And although Sberbank is a leader in the development of a remote service for customers, most banks perform this option without commission (unless it's a credit card) and without a confirmation password.

The limits on transfers between your cards in one bank are quite large and amount to up to 1 million rubles. per day. The exact restrictions must be clarified with the servicing bank.

When transferring money from one bank client to another in the same bank online, you must select "Transfer to a Sberbank client" in your personal account. In the window that opens, select "recipient's card" or "card by mobile phone number", fill in one of the two options.

The next step is to select your debit card and specify the debit amount. Optionally, you can send a short message to the recipient. Click "Transfer" and in the window that opens about the transaction, you will need to confirm this operation with the code received on your phone. Only after that the transaction will be completed.

How to transfer money from card to card in a smartphone? In Sberbank, the procedure is similar. Enter the application and select the "Payments" tab, selecting the direction "Sberbank Client" there. In the window that opens, enter the recipient's card number and the transfer amount and click send. After receiving confirmation of the transaction, the money will go to the specified card.

The main banks of the country have mobile banks and online service systems, within which intra-bank transfers are free and available to owners of plastic cards issued by these financial institutions.

Limits on transfers in a mobile application between your cards in the same bank are often similar to the limits set for Internet banking. But operations via SMS are more strictly limited. So, in the Mobile Bank of Sberbank, the daily limit is up to 1 million rubles, while using SMS you can send no more than 8 thousand rubles.

Online transfers between clients of different banks

How to send money from card to card of different banks online? The procedure differs from the previous one by a more thorough check of the elements of the transaction and a commission for its implementation.

Online transfer is easiest to do in the personal Internet account of the credit institution where your card was issued.

For example, in Alfa-Bank, to transfer one of the online methods, you should enter Alfa-Click with your username and password, select the "Money transfers" section on the top panel of your account and then select "Transfer to card", select a debit card and dial recipient's card number with the transfer amount.

Click "Continue" and the bank will further report the amount of debiting money from your account along with a commission (1.95% of the transfer amount) for the money transfer. An SMS message with a transaction confirmation code is sent to the phone linked to the bank, enter it in the window to confirm and complete this operation.

The mechanism for transferring money from card to card online is similar for most banks with this service, the differences are in the details. But following the instructions in the online service of each bank, it is quite simple to make such transfers.

It is also easy to transfer money from your card through the Mobile Bank using the phone linked to it, provided that there is a phone connected to the Mobile Bank at the other end.

For example, in the Mobile Bank of Sberbank, the problem of how to transfer money from card to card is solved in several steps: send an SMS to number 900 with the text "Transfer, the last four digits of your card, the recipient's phone number, the transfer amount." After a couple of minutes, a response will come with the translation parameters, if everything is correct, confirm it.

Limits on transfers between cards in different banks are different. So, for clients of Alfa-Bank and Sberbank, the maximum amount of such transactions per day is 150 thousand rubles, but the limit for one transaction in Alfa-Bank is set at 100 thousand rubles, and in Sberbank - 30 thousand rubles.

Transfers via ATMs

How to transfer money from card to card if you are away from your computer and do not have a smartphone with mobile service. And this happens quite rarely today. To carry out such a transaction, you should find an ATM of the bank that issued your card. This is more convenient, since you know better the ATMs of your financial institution, and the fee will be significantly lower than in ATMs of other banks.

Enter a card with a PIN code and password and select the "Payments and Transfers" section in the menu. Next, you have to select the "Transfer by card number" section. In the window that opens, fill in the details of the transfer:

- recipient's card number;

- transfer amount.

In some banks, at terminals, you will be required to fill in card details: card expiration date and CVC. After filling in all the details, you can send money to the address. The ATM will give you a check that will indicate the completion of the transaction, but the transfer can last from several minutes to several hours.

Choosing a transfer method

When choosing a way to transfer money from card to card, the important questions are:

- transaction security;

- minimization of money transfer costs.

Choice from the standpoint of operation security

To counter scammers and hackers, most large banks apply security measures when working with plastic cards:

- enter a request for the secret code of the CVV2 card;

- introduce the 3D-Secure system.

When transferring funds from card to card, most banks without these funds transfer responsibility for the stolen amounts to the bank's customers. In fact, the transfer of information about the card number to a third party relieves the bank of responsibility for the safety of your funds on the card account.

Therefore, choose banks where security rules are observed with the 3D-Secure system.

The choice of money transfer with minimal costs for it

Banks charge fees for money transfers. The size of the commission in each bank is determined independently. If the money transfer operation is one-time, then the choice of the card issuer's bank is not critical. If the operations are regular, then you should look for a bank that has the lowest commission for these operations.

The following banks have the highest commissions on the transfer amount:

- OTP-bank - 2%;

- Alfa Bank -1.95%;

- Tatfondbank - 1.95%;

- Russian Standard - 1.9%;

- Rosgosstrakh bank -1.9%.

Banks charge the lowest commission:

- FK Opening - 0.5%;

- Vanguard - 1%;

- Moscow Industrial Bank - 1%;

- MTS Bank - 1%.

The best option would be to choose a minimum commission, taking into account the security of transactions.