(9

ratings, average: 3,78

out of 5)

(9

ratings, average: 3,78

out of 5) During times of economic uncertainty, more and more people are faced with collection agencies. There are quite a few similar organizations, but perhaps the most famous of them is Sentinel Credit Management.

Information about the collection agency "Sentinel Credit Management"

This is a professional collection agency that provides services for collecting partial or full debts. Its field of activity includes pre-trial collection - remote and on-site, and the organization also accompanies collection within the framework of legal proceedings.

This is a professional collection agency that provides services for collecting partial or full debts. Its field of activity includes pre-trial collection - remote and on-site, and the organization also accompanies collection within the framework of legal proceedings.

The main founder of Sentinel Credit Management LLC is Alfa-Bank LLC. This collection agency has been observed in cooperation with a large number of banks and MFOs (micro financial organizations). Major partners are VTB, Home Credit Bank, Tinkoff. The geography of the organization's work is about 100 cities in Russia.

The scheme for an agency to receive work from a bank is simple:

- Issuance by a bank or other credit institution of a loan to a borrower.

- After some period of time, payments according to the schedule stop, or the borrower refuses to repay the loan and becomes a debtor.

- The bank decides to contact a collection agency to begin the process of collecting debt funds.

- The collection agency has already officially begun work on collecting debt funds.

Positively designed website of the collection agency "Sentinel Credit Management"

There are few precedents that speak of real threats from Sentinel collectors, but they do exist.

Basic operating methods of Sentinel collectors:

- Sending letters and notifications indicating the amount of debt, requirements and terms of its repayment.

- Conducting verbal negotiations with the borrowers themselves.

- Collectors have the right to seize the debtor's collateral property and ensure its (property) storage.

- Constant interaction with law enforcement agencies on issues of debt obligations of the borrower.

The above methods are methods of out-of-court (pre-trial) settlement. Regarding methods within the framework of legal proceedings, they are as follows:

- Legal analysis of documentation provided by the bank.

- Seeking a settlement in court.

- Filing a claim.

- Collectors are representatives of the bank in court.

- Presentation of enforcement documents to the bailiff service and support of enforcement proceedings.

The collection agency's benefits from its work are quite large. It turns out in the area 10% of the debt amount, if the bank simply hired an agency. If the debt obligations were sold, then the collection agency pays around 30-40% of the debt amount to the bank and keeps the rest for itself. That is why there are minimal claims from collectors. Their earnings directly depend on the interest imposed on overdue debts.

From what is written above, it becomes clear why collectors behave so aggressively when communicating with borrowers and resort to the use of threats and illegal actions.

Examples of inappropriate behavior on the part of Sentinel collectors

There are quite a lot of such examples. Oddly enough, in most cases found on the Internet, they complain about the inappropriate behavior of the Sentinel agency’s collectors regarding erroneous calls and demands to repay non-existent debt.

The point is that a certain collector representing Sentinel Credit Management LLC calls a person on the phone and demands to repay the debt on a loan that this person allegedly issued and did not pay on time. But in fact, there is no debt, much less debt. This is a common case - a successful mistake of such collectors. In some cases, a person is so pestered with calls and threats that he pays off the mythical loan debt. In such cases, you should record the conversation with the collectors and go to the prosecutor. How to find out your ID debt, read

Another example of inappropriate behavior is pressure on relatives, namely older people (grandparents and elderly parents). In some cases, such pressure on them leads to health problems. In order to prevent collectors from touching the borrower’s relatives, you should also contact the prosecutor or the police, since such actions directly contradict the laws of the Russian Federation.

There are often examples of how debt collectors directly threaten the health and life of the debtor or his family members. Again, in this case, you should record the conversations and threats of the collectors and send these recordings to law enforcement agencies.

A particular example of inappropriate behavior based on a story that occurred in Moscow. Two men were banging on the door of a citizen who was in her apartment with her sister and children. Men broke down doors and shouted various threats. As it turned out later, these were collectors from the Sentinel agency who wanted to demand that the debtor pay off the loan debt. Both were taken to the police station.

Alfa-Bank transfers credit debts that clients do not want to repay to collectors. To collect debts, the bank established its own collection agency, Sentinel, which provides services throughout the Russian Federation to various financial organizations. What are the principles of the organization and the methods used to solve the problems of lenders and borrowers?

How does the transfer of cases from one creditor to another occur?

Most clients who apply for a loan from Alfa-Bank are confident that they will repay the funds on time. But unforeseen situations happen, due to which payment is delayed, and the lender charges fines and penalties. As a result, a high credit burden is formed, unbearable for the debtor, which leads to long-term delays. Alfa-Bank does not want to lose its money and transfers the debt to a collection agency. The period for transferring a case varies from 3 months of delay to a year or more. This depends on many factors:

- Does the borrower get in touch?

- Does he have good reasons not to pay, for example, bankruptcy, illness.

- Have you made minimum payments in the past, what is your credit history?

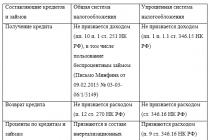

If the client stops making payments without warning or refuses to repay the debt at all, the bank resorts to the services of Sentinel. The following options for interaction between the bank and the agency are possible:

- An agreement is concluded with Sentinel to provide assistance in repaying the loan, but the bank remains the owner of the debt.

- The debt is sold to a collection agency. Sentinel receives all documents related to the loan and has the right to collect the debt through legal methods.

The possibility of transferring rights to claim debt to third parties must be stipulated in the loan agreement.

If the debt is sold to collectors because there is no chance of returning the money, then the agency pays the bank 10-70% of the cost of the loan, and collects penalties and interest from the borrower. Collectors who only help to repay the debt charge 20-50% of the debt amount for their services.

The lender is obliged to notify the borrower about the sale of debt to collectors; usually a letter is sent by email and a message in the personal account.

Sentinel Agency

Official site.

In 2011, Alfa-Bank established the Sentinel Credit Management collection service, which today operates in 85 Russian regions. The agency's central office is located in Moscow.

For reference! The word sentinel translated from English means “guard” or “sentry”.

The organization’s website sentinelcredit.ru has been operating since 2013, and since then it has been constantly modernized.

Phone numbers for borrowers.

It contains all the necessary information for clients and debtors, as well as addresses and telephone numbers of the company’s representative offices. Documents for the activities of Sentinel and contracts for the provision of services are located in the relevant sections of the site.

Feedback form.

A special service allows everyone to contact the support service and get answers to their questions.

By what methods does Sentinel collect debts?

The agency states that when working with debtors it acts within the framework of the law and uses the following methods:

- Conducts negotiations with citizens who are mortgagors and guarantors.

- Sends written notices to customers reminding them to repay debts.

- Informs debtors of the terms and amounts of debt.

- Evaluates, seizes and stores property registered as collateral or other valuables in order to repay the debt.

- Cooperates on debt collection issues with representatives of judicial and law enforcement agencies.

If the case is brought to court, the agency provides the customer with legal support at all stages of the process and enforcement proceedings.

Stages of working with debtors

If the borrower has not agreed with the lender on debt restructuring or deferment of payment, then the bank resorts to the services of Sentinel.

When working with debtors, Alfa-Bank collectors act as follows:

- Notify the client about the amount of debt and repayment terms.

- They influence psychologically - they make home visits, make phone calls, talk with the debtor’s manager and use other methods.

- They file a lawsuit if the measures already taken have not yielded results.

In the process of collecting debts, debt collectors use various legally competent tools that allow them not to break the law and work effectively.

Borrower reviews

There are quite a lot of reviews about this organization on the Internet. Most borrowers are unhappy that they have to repay the debt, but they do not leave sharply negative comments about the work of specialists.

I have temporary financial difficulties, I pay the minimum on the loan, I can’t take it anymore. I will not refuse payment. The Sentinel collector came and behaved politely. He listed some articles of the law and promised to talk with his superiors to resolve my issue. He refused to provide documents, so I asked him to leave my house. I read reviews on the Internet, it turns out that you can write an application to Alfa-Bank so that collectors do not call, write or come. Let them go to court. If you make at least some payment, it means you are not refusing the loan, and the truth is on your side!

Victor Stilba.

I have never taken out a loan from Alfa-Bank; one of my friends indicated my phone number as the employer’s contact. Now collectors are calling me, scaring me, threatening me, sending me SMS messages. But in fact, they do not even have the right to call the numbers that the borrower indicated in the application form.

Inna Melnikova.

I have a debt on an Alfa-Bank loan - I was laid off and am without work. Collectors call, threaten to send children to an orphanage, lie in wait for relatives, and seize property. They don't go to court. I recorded threats on a tape recorder and will contact the police and the FSSP. The lawyer said that you can sue and demand payment of moral damages.

Olga Stolnikova.

The employees of the Sentinel company are ill-mannered young people who behave impudently and are rude on the phone. They say they will soon be expelled from NAPCA. She didn’t pay, let them sue.

Alena Bushunova.

I applied for a credit card at Alfa-Bank, spent the money, but didn’t have time to repay it within the grace period, and didn’t make the minimum payment. As a result, a debt arose to the bank. I applied for a credit holiday or debt restructuring and submitted an application to revoke permission to transfer information about me to third parties. I did not receive an answer, and a month later I received an SMS that the debt had been transferred to Sentinel collectors. Now they call me 5 times a day. Although they are trying to meet the legal time limit, such a number of calls per day is too much.

Alla Ageichik.

If you have problems with collection agency employees, you can call the numbers listed on the website and leave a complaint.

Today, conversations about collection agencies are popping up more and more often, and few people are surprised by unpleasant calls (including threatening ones). Nevertheless, almost no commercial organization can do without the help of such organizations, since they cannot always collect debts on their own. The most famous collection agencies in this type of activity today are Sentinel.

Modern collection agencies are not much like the collectors of the 90s. Their activities are carried out only within the framework of the law. However, reviews from debtors often indicate the opposite. And even if the borrower has and loved ones are threatened by collectors, you can protect and secure yourself.

Advice: If collectors have become intrusive, threaten you and behave rudely, first of all you should not panic. In any case, the law is on the borrower’s side, and conversations with debt collectors should be recorded on audio media as future evidence of illegal actions. However, you should notify an employee of the organization about this at the beginning of the conversation.

Collection agency Sentinel

Sentinel Credit Management LLC is a professional collection organization that provides a full range of services and measures for debt collection. The company is able to represent the interests of its clients throughout the Russian Federation; it has been working in the field for 11 years in 85 regions of the country. The founder of the company (Alfa Bank) is located in Moscow.

Advice: On the organization’s website you can find all the necessary documents on activities, as well as on cooperation agreements with clients.

How does the system of transferring debts to collectors work?

The scheme by which Sentinel receives work from the bank looks something like this:

- The borrower applies for a loan from a bank (any bank);

- For some reason, loan payments stop;

- The bank contacts a collection agency to collect the loan debt;

- Loan documents are transferred (or sold) to the organization;

- The organization is engaged in collection.

Debt collection methods

Contrary to popular belief that debt collectors most often use brute force and threats in their work, Sentinel operates only within the law. The company is interested in cooperation with debtors and uses the following methods in its activities:

- Conducting negotiations with guarantors and pledgors.

- Sending notification letters to borrowers demanding debt repayment.

- Informing about the terms and amounts of debts.

- Conducting face-to-face negotiations with debtors and guarantors.

- Seizure and storage, valuation of pledged property, as well as other assets in order to pay off debts.

- Communication and interaction with representatives of law enforcement and judicial authorities on issues of debts and their collection.

In addition, the company operates within the framework of legal proceedings:

- Legal analysis of documents, determination of the feasibility of going to court.

- Dispute settlement.

- Formation of the correct documentary base, debt calculation, preparation of documents for going to court.

- Filing a claim.

- Representing the interests of the customer at all stages of the legal process.

- Receipt of all judicial acts and documents.

- Submission of the writ of execution to the lawsuit service and support of enforcement proceedings.

Stages of working with debtors

Regardless of which repayment method was provided when applying for the loan (or a differentiated one), the client may ask for debt restructuring. If the bank refuses or for some reason such requests are not received from the client, the work of the collection agency comes into force, which, as a rule, carries out its activities in stages:

- Notifying the debtor about the terms and amounts of debts.

- Psychological work with debtors, namely multiple calls and visits, conversations with management at work, etc.

- Trial. Comes into force if the debt could not be repaid at the previous stages.

Advice: After the first notification from collectors, it is necessary to check the statute of limitations of the credit case. If three years have passed since the last payment, collectors do not have the right to demand repayment of the loan debt, since by this time it has already been canceled. If the period is shorter, then you should wait for the trial. In this case, the debt will still have to be repaid, but there will no longer be a need to overpay the collectors. It is not worth contacting them, since their help may cost more than paying off the debt, and will not produce results at all.

Reviews from debtors about the Sentinel collection agency

Today on the Internet you can find a huge number of different reviews, including from various banks and other organizations. Reviews vary due to the fact that each situation is purely individual. You can follow the advice of experts, but you should not look for universal instructions for solving problems, including with collectors.

Inna:

I have big complaints about both Alfa Bank and the Sentinel collection office. A year ago, I took out a loan from Alfa Bank and paid it regularly. But having paid off about half of the debt, she encountered financial difficulties and lost her job. In this regard, I decided to contact the bank with a request to issue me a credit holiday or debt restructuring. With the help of a lawyer, I prepared and sent the necessary documents. But I did not receive a response to any of the letters (and there were three of them). But after a while, I began to receive calls and SMS messages demanding that I immediately repay the loan debt. In response to the answer that the bank was notified of my situation, I received only rudeness. After some time, I received an SMS from Alfa Bank, in which it was written that my case had been transferred to the collection agency Sentinel for debt collection. After that, only the collectors began to pester me. Moreover, they received calls and threats with a completely boorish attitude. I don’t know what to do with all this. I decided to wait for the trial.

Nikolay:

If there were competitions for credit debts, I would probably be a champion. I have debts in two banks and an unclosed credit card, and recently I got a microloan, which I took out to cover part of the debts. I took out my first loan a year and a half ago, and it was quite affordable for me until I was demoted. My (now) small salary was simply not enough, so I took out another loan and used a credit card. But instead of solving old problems, I also encountered new ones and was completely mired in debt. Of course, banks started calling me and asking why I wasn’t paying the loan. Then I stopped responding to them altogether, and I started receiving SMS messages with demands from collectors. I didn’t want to follow their lead and turned to banks with applications for debt restructuring. And they didn’t refuse me. Of course, Sentinel (that’s the name of the collection organization) probably didn’t like it, but on their last call I answered that my debt had been restructured. Fortunately, so far it’s been possible to repay the loans in installments, so I was able to take a deep breath and reduce the number of my problems.

Evgenia:

I generally don’t understand people who write in their reviews about threats from the Sentinel collection agency and about big problems. I took out a loan from Alfa Bank, but it so happened that I could not repay it. I didn’t expect that the debt obligation would be so heavy. Nevertheless, calls from the bank did not stop for a long time, but I could not do anything about it and simply did not know what to do. Then I received an SMS message on my phone from the bank that my case had been transferred to the Sentinel collection agency for further debt collection. The message also indicated the deadline for repaying the loan. Then a young man called me and started asking about my credit situation. I explained to him that repayment at the moment is an impossible task for me and asked directly what I should do. They told me that first of all, you need to keep paying, even in small installments. The young man recommended that I borrow money, sell something, or contact a microfinance organization. That’s exactly what I did, now I’ve almost paid off the debt, and my parents and fiancé are helping me pay back the microloan.

Save the article in 2 clicks:

For debtors, a collection agency stereotypically seems like a dangerous organization that you least want to deal with. Of course, few people can enjoy communicating with debt collectors, but nevertheless, collection agencies like Sentinel are ready to act as assistants in repaying the loan and even give some advice on solving the problem. If an organization operates within the law, then it is better to cooperate. The Sentinel company, in turn, is ready to provide assistance to both parties: both the client and the debtor. After all, her task is to come to a compromise and save both of them from problems.

In contact with

Many borrowers and credit card holders are faced with late monthly payments, which leads to the appearance of debt and a subsequent increase in its amount.

As a rule, banks accommodate customers halfway, offering installment plans, “credit holidays” and other ways to overcome the current situation. However, in some cases, the debt is transferred to a collection agency.

Reasons for transferring debt from Alfa-Bank to collectors

In most cases, or credit card occurs unintentionally. The reason for failure to make a monthly payment may be:

- dismissal of the borrower from his position;

- reduction in the salary received by a person;

- the appearance of a new dependent;

- deterioration in the health of the payer or the health of his family members;

- temporary loss of ability to work by the client;

- the emergence of unexpected financial costs.

If you unintentionally avoid paying your debt and have a good reason for the loan being overdue, contact the nearest Alfa-Bank branch for debt restructuring.

It is important to have with you documentary evidence of the existence of problems (for example, a medical certificate of health, a copy of the work book with a record of dismissal, etc.).

In order to resolve this problem in the future and avoid transferring the debt to a collection agency, it is important to repay the debt on time and no longer be late in payment.

If the client does not have valid reasons for missing the loan payment deadline or deliberately avoids repaying it, he can expect a meeting with Alfa-Bank collectors. The telephone number specified in the agreement concluded with the bank will be used by specialists to notify the debtor of the need to pay the loan.

LLC "SCM" - collectors of Alfa-Bank

Sentinel Credit Management LLC is a collection agency owned by Alfa-Bank JSC. Formally, the directorate for the collection of overdue debts was created by the bank in 2007, although the legal entity SCM itself was registered later - in 2011.

Five years later, the company took first place in the state register of collection agencies.

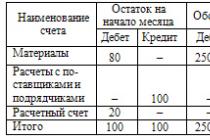

The main areas of work of SCM:

- interaction with the creditor regarding ways to pay off the debt;

- carrying out activities aimed at paying the debtor for the existing loan;

- support of the collection process at the stage of litigation and/or enforcement proceedings.

SCM from Alfa-Bank complies with the provisions of Russian legislation and ethical standards of behavior, acting within the framework of the law. At the initial stage of receiving existing debt from the borrower, company employees negotiate by phone.

If the client avoids paying the debt, collectors move on to more active actions - personal meetings with field managers.

Regulation of collection agencies

The procedure for debt collectors to work with debtors is established by Federal Law No. 230 of July 3, 2016. Employees of such agencies cannot use physical force against debtor borrowers, threaten them, damage their property, or exert psychological influence on citizens and their family members.

Russian legislation allows the following methods of interaction between collectors and debtors:

- conducting telephone conversations;

- exchange of text, voice and other messages;

- sending letters;

- organization of personal meetings.

At the same time, communicating with a collector by phone or meeting with a field manager is permissible during the hours established by law: from 8 a.m. to 10 p.m. on weekdays and from 9 a.m. to 9 p.m. on weekends and non-working days.

If an employee of a collection agency violates the rights of a debtor, it is necessary to file a corresponding complaint against a specific collector to his manager.

As a rule, this is enough to stop unlawful actions on the part of an official. If filing a complaint does not help, the complaint is sent to the court, the territorial department of the FSSP or the prosecutor's office.

How to avoid problems with collectors?

If Alfa-Bank transferred your debt to SCM LLC or another collection agency, you should not avoid contact with its representatives. The purpose of the negotiations in this case is to find the best ways to help the debtor and take measures to pay off the existing debt.

If you can repay the loan in whole or in part, inform the agency manager about this. A way to pay off a debt can be refinancing a loan with another bank, borrowing money from close relatives or friends, looking for additional income, selling expensive property, etc.

Negotiating with debt collectors is a way to avoid taking your case to court. If the bailiffs initiate enforcement proceedings, the amount of the existing debt will in any case be forcibly collected from you.

The FSSP has the right to seize the debtor’s property, seize it and put it up for auction for the purpose of selling and paying off the debt with the proceeds.

If your debt was transferred to SCM LLC, contact Alfa-Bank collectors at the phone number listed below:

- 8-800-222-04-63 (if there is a debt to yourself);

- 8-800-222-04-98 (if the creditor is another financial organization).

The numbers of Alfa-Bank collectors can be found on the official website of SCM LLC in the “Debtors” section.

If you receive SMS messages about the need to repay loan debt, but you did not apply for this loan, inform the agency managers about this. This can be done by calling the numbers listed above, contacting the company office, or by filling out an electronic application form on the SCM LLC website.