You go to work every morning, day after day, year after year. And your whole life is more like Groundhog Day. Every day is similar to the previous one. You safely spend all your income received at work on life. The result is a vicious circle. What's next? - you think. Something needs to be changed in this life. One way to break the current situation is to invest.

After all, what is investing?

Investment is investing money today in order to receive it tomorrow, but in larger quantities. Or receiving permanent passive income from funds once invested.

Of course, you won’t be able to find a large amount right away. Most investors start with very modest amounts that they manage to save from their salaries. The main thing here is consistency and time. Taken together with these parameters, any, even insignificant, capital can grow into a fairly decent amount, allowing its owner to receive a very good income that will exceed your current income. Please note that this will be completely passive income, generated with virtually no participation from you.

Beginning investors face many questions, the main one being where to invest. Especially if we are talking about a very small amount of money. It is the limitation on the volume of invested funds that makes its adjustments to possible investments. But nevertheless, even with little money, there are many ways to earn and increase your hard-earned money.

6 ways to invest money for a beginner

Investing in bank deposits

Bank deposits or deposits are the simplest and most reliable type of investment. When you open a bank deposit, you will know in advance. what income you will receive at the end of the term. And most importantly, GUARANTEED INCOME. Deposits are practically the only financial instrument for which the profitability is known in advance. Other investments do not carry such a guarantee. In them you can both earn and lose. Also, do not forget that the safety of deposits is guaranteed by the state (in the amount of 1.4 million rubles). If the amount exceeds this threshold, then it is better to open several deposits in different banks.

Bank deposits are used mainly as a means of initial capital accumulation. When a certain level of funds in the account is reached, other investment opportunities become available to the investor. Why? The answer is quite simple - very low profitability. Typically, deposit rates are within the inflation rate. Therefore, it is unlikely that you will get rich by investing in deposits.

Currency deposits

In the context of a difficult economic situation in the country, foreign currency deposits again began to gain popularity. The ruble is rapidly losing its position compared to other financial payment systems. And in order to somehow preserve their savings, deposits in foreign currency are used. And although the yield on such deposits is quite modest, around 2-5% per annum, real earnings can exceed the current yield several times. Due to the weakening of the ruble and, accordingly, the strengthening of the currency.

In the context of a difficult economic situation in the country, foreign currency deposits again began to gain popularity. The ruble is rapidly losing its position compared to other financial payment systems. And in order to somehow preserve their savings, deposits in foreign currency are used. And although the yield on such deposits is quite modest, around 2-5% per annum, real earnings can exceed the current yield several times. Due to the weakening of the ruble and, accordingly, the strengthening of the currency.

It was foreign currency deposits that were the most profitable over the past 5 years among the main types of investments. Those who opened similar deposits several years ago have already earned more than 230% profit. For comparison, simple ruble deposits for the same period showed a return of 83%.

Investments in mutual funds

- possibility of investing small amounts

- tax exemption

- no need to store at home, exposing the risk of theft

- can be bought and sold in parts, if necessary

Other possible ways of investing in gold (buying bars, gold coins) have exactly the same disadvantages that are the advantages of compulsory medical insurance.

But this will be of little use if you do not know how to increase your capital, which you managed to accumulate. Of course, you can simply continue to save money, or keep the accumulated amount for a rainy day. But there are many ways to use this money more effectively and increase your capital with even a small amount of money

- Attitude to money.Indeed, those people who respect their finances always earn more than others. Many people say that money does not buy happiness. Of course not, happiness lies in their quantity. Naturally, there are many important, intangible things, but in our time you cannot survive without money, and everyone knows it. Therefore, you need to love your money, even, preferably, keep it in a beautiful wallet, and not in just anything.

- You need to think positively.You need to think well not only about money, but also about life in general. Mental attitude is a powerful thing. Therefore, if you tell yourself that you will get rich, and, most importantly, believe in it, then your chances of earning more will definitely increase! Of course, in addition to positive thinking, you also need a lot of work, but believe me, it is also worth a lot.

- You need to get rid of bad habits.Now it has become very fashionable to live in the moment, not to think about tomorrow. It sounds good, of course, but if you spend half your salary today, what will you live on for the next month? Someone says that if you don’t have money, then you need to spend it and not limit yourself in anything. Naturally, you can’t limit yourself too much, since you need to live on something, but spending everything to the last penny is stupid and unreliable. If you have good profits, do not forget to save and think about the future.

- It's better to invest money in something than just save it.It will be a little more promising and profitable to invest your savings in some business than to simply deposit them in a bank account. This way you can earn passive income without doing anything for it;

- Investments are not only about money, but also about losses.You must understand that before you invest your finances in something, you need to become thoroughly familiar with the project you are going to invest in and calculate whether it can bring you real profits or only losses.

How to save and increase a small amount of money

Which method of saving and accumulating finances is best for you depends on what goals you are pursuing. Quick accumulation of money, stable income in the future or others.

If we are talking about increasing a small amount of money, then there are several options for how to deal with them correctly:

- Storing money in precious metals.The main advantages of this type of financial investment are that jewelry is always in value, it is easy to buy and sell, both in the form of jewelry and in the form of scrap. However, problems may arise in purchasing such a commodity in the form of bullion, storing it, and changing its price due to various incidents. In general, the option is real, but there are more disadvantages than advantages.

- Storing money in securities.There are also pros and cons here. The good thing is that they can be easily purchased, and you can earn a lot from them quickly and a lot. The bad thing is that you always need to be aware of various changes in the market, it’s easy to both earn a lot of money and lose it in one moment, constant dependence on brokers and the market. Here the number of minuses also exceeds the number of pluses. Therefore, the option is not bad, but quite risky.

- Storing money in deposit.A fairly common option, but now it is losing its popularity a little. Putting money on deposit is, of course, very convenient, but you need to find a bank that you trust, and also take into account the fact that the percentage of return will always be less than inflation. Conclusion: you can put money on deposit, but it is advisable that the amounts are not large and that they are not stored there for too long a period.

- Investing in yourself: training, studying.This, of course, is a very good and promising investment option, since if you learn to better understand a particular area, then, naturally, you will be able to earn more. The main thing is to choose the right direction. It is better that these are specialized courses and master classes than standard higher education, since the courses will give you much more practical skills and knowledge.

- Investing money in your business.There are approximately the same number of pros and cons here. Pros: you can work for yourself and realize the idea that you want. Disadvantages - all responsibility, naturally, will also lie with you, and in case of failure, you will have to pay for everyone. Therefore, the investment option is a good one, but before you start implementing it, you need to think everything through very well and carefully.

- Become a member of an investment fund.In order not to deal with capital market transactions yourself, you can become a member of an investment fund using the collective investment service.

- Buying a property.This is probably the most reliable option that can bring you stable profits over a long period of time. Of course, you will need a large initial capital, but the result is certainly worth it.

How to increase capital without risks

Most likely - no way. Whichever option you choose from the above, some risk will still exist. Everyone has the right to make mistakes, and when dealing with investments it is very difficult to always get everything right. The main thing is not to rush, carefully and carefully explore all the sites and markets in which you want to work, evaluate your competitors on their merits and do not immediately invest all the finances that you have in one project. It’s better to play it safe and distribute your money across more than one project, or simply invest some part, and after receiving the first profit, do the rest. This way you can reduce your risk as much as possible.

They will also help you on this difficult path. They will help you understand the processes of money movement, the principles and rules of working with them.

01Feb

Hello! In this article we will talk about how to increase money without taking any risks.

Today you will learn:

- How to profitably and increase them;

- How to eliminate risks when investing money;

- What tricks of scammers should you not pay attention to?

Types of profit

Each of you has repeatedly wondered how to profitably increase money, while choosing a safe way to increase your capital. Often the choice of method depends on the form in which you would like to receive your profit. Should it be periodic payments that will be your additional source of income, or will it be a long-term investment to make a profit at the end of a certain period.

So, we have conditionally divided the ways of making profit from two ways:

- Periodic payments, in installments;

- One-time payment of profit.

Now let's look at each method in more detail and detail.

Short-term financial investments

In order for increasing money in a short period of time to become your additional source of income, there are several proven ways to invest money.

Binary options

Probably everyone, whether they want it or not, has heard about binary options and financial markets. Many people have doubts about the honesty and reliability of this income - and this is correct, but partially.

As for honesty, there can be no doubt about it. To select a site, use recommendations from friends and user reviews on the Internet. Choose already wealthy sites with an established reputation.

As for the reliability of this type of profitable increase in money, there are big risks here. There is only one way to eliminate the risk of losing your financial assets - by constantly increasing your knowledge in the field of trading in financial markets. If you are not strong in finance, then it is NOT worth starting to increase your money in this way.

Borrow money

Another way to profitably increase your money is to lend money at interest. If moral principles are alien to you, then it is quite possible to make money from people who are willing to borrow money at 2% daily.

By correctly filling out the documents when transferring the borrowed amount, you eliminate almost all risks of losing your own funds. The worst case scenario is the return of your own funds through law enforcement agencies, perhaps even the court.

But at the same time you have the opportunity to make a profit of 700% per annum. In this case, the amount of profit received directly depends on the financial resources you invested. Most of your borrowers, with an 80% probability, will become your regular customers, and no one will be in a hurry to repay the principal debt; borrowers will only repay the interest on the debt.

Sales

The next way to increase your capital is a little less profitable, but still more humane. , and you do not need to purchase anything in bulk and collect full warehouses in order to provide your customers with the availability of the goods they are interested in. It is enough to be an intermediary between the seller and the buyer.

Your job is to find a buyer, then contact the seller, bring these two links together to conclude a deal and receive your percentage. In this case, the amount of earnings will depend on the number of goods you sell and the commission that the seller is willing to pay you. An ideal way for those who do not have a large amount of money to invest in a larger project.

Bank cards

At the end of this section, I will describe a way to earn money using bank debit and credit cards.

Let's start with debit cards. Now many banks, ready to go to great lengths to lure customers to their side, offer debit cards with cashback of up to 5% on all purchases and 10% per annum on the balance of funds on the card. That is, in principle, apart from how to get a card from a bank, on favorable terms and use your bank card, as always, you don’t need to do anything else.

Does it seem like a small thing? On average, 600-700 rubles come out per month. Calculate how much you will receive in a year? A nice amount, isn't it?

Now you can earn money using debit and credit cards together. You issue two cards at once in the same bank (it is possible in different ones, it doesn’t matter). Debit card with interest on the balance and credit card, limits equal to your average monthly income. Using a debit card, you fill out a salary project and receive your salary on this card.

Having received your first salary, do not rush to spend it or withdraw money from the card, leave it entirely on the card and receive your interest. But with a credit card, which has a period during which no interest is charged for using the funds (usually from 55 to 100 days), pay in stores, pay for housing and communal services and all your expenses. After you receive your next paycheck, reload your credit card and use it again.

What you get as a result: Every month you receive % on your debit card on your balance and do not pay anything for using credit funds.

Long-term financial investments

Here we will look at the option of increasing your money in the long term. This is less profitable, but the risks are completely minimal.

Bank deposit

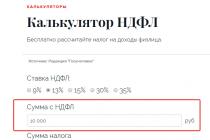

One of the most reliable and most common ways to invest your funds in order to save money is to open a bank deposit at annual interest. Important .

There are two types of bank deposits: replenishable and non-replenishable, respectively.

Replenishable deposit convenient for those who do not have a large enough amount to invest, but are ready to replenish their deposit monthly in order to receive a larger amount of interest on the deposit. This type of investment is suitable for almost everyone.

Open a bank account and top it up with a couple of thousand from each salary. By the end of the year, in addition to your own accumulated funds, you will receive a pleasant bonus in the form of interest declared by the bank. As for the disadvantages of a replenishable deposit, it is a significantly lower interest rate compared to a non-replenishable one.

Non-replenishable bank deposit, is perfect for those who have an impressive amount of money that is not involved in any assets. After depositing funds, it will no longer be possible to replenish it. But the interest rate on this type of deposit is almost twice as high as on a replenished account.

In both cases, you can interrupt the accumulation of your deposit ahead of schedule, but you will lose interest only for the period that remains before the expiration of your deposit. Simply put, how long your money has been in the bank is how long you will receive interest on this deposit. Please note that not so long ago, if you withdraw funds from the deposit early, you could lose absolutely all the interest on the deposit. This applies to both replenishable and non-replenishable deposits.

Precious metals and foreign currency deposits

Long-term ways to increase your money also include foreign currency deposits and purchasing precious metals at a bank.

Foreign currency deposits are a rather risky way to increase your capital. Exchange rates directly depend on the political situation in the world, and since in our time it is extremely unstable, with a foreign currency deposit you can either get rich overnight or lose everything you had.

It is considered more stable in the bank. And to be more specific, gold. In fact, you don’t see this gold; everything is done exclusively on paper.

The price of gold is always stable and almost always rises, but this happens extremely slowly, so investing your money in gold is more suitable for preserving your capital, rather than expecting super-profits from it.

Saving money is the initial stage of increasing money during a crisis

In order to increase money, the first thing you need is its availability. You need to analyze your income and expenses. Everything is very detailed and detailed, without missing the slightest detail. Having broken everything down point by point, imagine the overall picture of your financial condition.

Below is a basic example of how to do this:

| Income | Expenses | ||

| Salary | 50000 | Flat rent | 15000 |

| Communal payments | 5000 | ||

| Products | 10000 | ||

| Entertainment | 10000 | ||

| Cigarettes | 4000 | ||

| Transport | 4000 | ||

| Other | 2000 | ||

| Total | 50000 | 50000 | |

Now a general picture emerges in front of us, in which we see that our income corresponds to our expenses and this is already good. It would be much worse if we did not fit into what we have.

Now we need to reduce possible expenses on some items in order to get a free amount of money. First of all, you need to understand that you will have to squeeze your needs. Therefore, to alleviate your hardships, set yourself a goal, an incentive that will help you overcome difficulties.

Looking at the expense items, the first thing that catches your eye is the item “cigarettes”; you should definitely exclude it. Just imagine 4,000 rubles a month to slowly kill yourself - we’ll remove it. Next comes the “entertainment” article; there is no doubt that by cutting it in half, we will not lose anything for ourselves. Another minus 5000 from the expense item. Quite a significant amount, 10% of the entire budget.

Having looked at the expenditure part of our plan, we discovered that we are not spending 9,000 rubles rationally. Having saved 9,000 rubles per month, we can begin to increase our capital. Let's assume that we are illiterate in financial markets and similar earning systems, and the amount of initial savings is not that large.

The surest way to increase your money is to open a replenishable deposit in a bank. We go to the bank, open a deposit at 6% per annum and deposit 9,000 as the initial amount. Then the usual arithmetic: every month we replenish our deposit by 9,000 rubles. In total, in a year we will collect 108,000 rubles, plus the interest declared by the bank of 6,480 rubles. In total, at the end of the year we receive 114,480 rubles. Decent, isn't it?

What to do next with this money is up to you, but after a year you already have a decent amount for more serious capital investments. The most important thing is not to spend all this money on your pleasures, so as not to start this whole path again.

Correctly managing the accumulated amount is the key to future financial victories. To successfully increase your money in a short time, you should not spend more than half of the profit received. The second half of the money must be directed to improving methods for obtaining maximum profits. If you have been able to accumulate a decent amount by cutting down your expense items, then wisely managing the profit received will not be difficult for you.

Opening your own business is a quick way to increase your money

Having a certain amount of your own funds, you should seriously think about it. To do this, first of all, you will need a thought-out plan down to the smallest detail, which anyone can draw up, approaching the matter with great responsibility. When drawing up a business plan, rely only on yourself, your strengths, and financial capabilities.

In order to choose the right direction, analyze all possible market niches, what is the demand and what is the supply. If you have identified what is missing in the market, make sure that you can provide it to the consumer in a quality that no one else can. One head is good, but two are better, so you should seek advice from people more experienced in this area.

Choosing an idea for starting your own business is the most difficult question. But the most important aspect in this matter is not to choose what you are not familiar with and what you do not know how to do. Even if an area unknown to you is quite profitable, taking it as a basis is a big mistake. Work with what you know, and even better, with what you like. No one can guarantee that your business will immediately be highly profitable and successful, but if you delegate competently and invest all your knowledge in development, success will definitely await you.

From personal experience. Two identical people in terms of business development level, simultaneously selling draft beer. One of them was looking for premises with lower rent in order to cover as many retail outlets in the city as possible, while the other did not chase quantity and placed only one retail outlet, but in the busiest place in the city, sparing no money on renting the premises, since calculated his benefit from the investment.

As a result of this competitive struggle, a person who opened only one point allowed himself to open two more points in no less busy areas of the city the next month, and a person who opened several points at once on the outskirts of the city had to close them and end with this type of business forever .

This example of the wrong approach to doing business is one of many, so even here there are risks, which only self-education and self-development will help you avoid.

Investments in real estate, one of the ways to increase your capital

If you have an impressive amount in your savings, then the most reliable investment would be buying real estate. In terms of its profitability, investing in real estate can only be compared with the purchase of precious metals.

Real estate will always be in price and always in high demand. Real estate prices mostly rise and rarely stay the same. Therefore, there is practically no risk of losing your money.

It is very profitable to invest money in, in which case the cost of the apartment will be one and a half times lower than the cost of finished housing.

After purchasing real estate, questions will arise about utility costs and payment of property taxes. In this case, it is worth considering your apartment as a permanent source of income. Renting out residential premises is a fairly profitable business that covers not only the costs of housing and communal services, but also brings a stable income to the owner’s pocket.

If you do not have enough free time, then rent out the apartment for a long time, to permanent tenants, but if you have enough time, then a more profitable type of rental housing is daily. Daily housing is rented by employees who are sent on a business trip to your city.

When choosing where to stay: in a hotel or rent an apartment, there is no doubt that the renter will choose the apartment. After all, the price of a room per night in a hotel is much more expensive than in an apartment, and the quality of the services provided leaves much to be desired.

In order to choose your apartment, take care of good advertising in advance, using free platforms for posting ads on the Internet.

Social networks and earnings from advertising

They are a great way to increase your money in the shortest possible time. An advertiser is willing to pay decent money if you are willing to provide him with a good platform for advertising.

Social networks are replete with various communities that each of you is subscribed to. The owners of these communities produce high-quality, interesting content for their readers in order to increase the number of subscribers and traffic to their community.

After the community passes the minimum threshold of activity, it has access to the advertising exchange. This is where the fun begins. You don't have to look for advertisers, they will find you themselves. Depending on what topic you have chosen for your community, the number of advertisers will vary. The most hackneyed topics are humor communities and quote books.

Before creating a community, think about who will advertise with you and what the future holds for your advertising platform. Once you have decided on a topic and created a community, make sure you have enough quality content on your topic. You shouldn't copy material from larger communities, this is a utopian idea. Having collected more than 15 publications, you can start advertising your community.

The effect will not take long to appear; if your material is interesting to the reader, then the number of subscribers to your group will steadily grow. You shouldn’t immediately spend a lot of money on advertising in large communities; start with the smallest ones, gradually gaining momentum and adjusting the content of your community to the interests of readers.

YouTube as a way to increase your money

If you know how to shoot a beautiful video or you have something to show the viewer, then it will be the best way for you to increase your capital. Unlike many social networks, YouTube pays you money from the first day you broadcast your videos on your channel. All you have to do is activate monetization of your channel. The amounts are quite insignificant, but if you manage to interest subscribers in original material, then you will not have any difficulties earning good money.

When posting your new video, use as many tools as possible to ensure that your video is seen by as many people as possible. Add your video to other social networks, send it to your friends, suggest it for publication in groups relevant to the topic. Becoming popular on YouTube is quite simple, this niche is still practically free, and if you are original and unique, then you have every chance of success.

After you achieve your popularity on the channel. In addition to the automatic advertising that the service administration independently displays on your videos, advertisers will start contacting you directly and the amount of fees will be quite serious. If your material is truly interesting, you won’t have to spend a penny on advertising and promoting your channel. Word of mouth on the global network will do everything for you.

Investing in yourself

As surprising as it may sound, investing in yourself is one of the most profitable. No, there is absolutely no risk that you will lose your funds.

So that you understand what investments in yourself can be, I will tell you about this in more detail:

- Get additional education. This will help you expand your horizons, take a different look at things that are familiar to you, and perhaps even radically change your lifestyle.

- Improve your profession's qualifications. Always be one step ahead of your colleagues. And in this case, you will definitely achieve high results in your work, promotion and opening new horizons for your professional activity.

- Improving your physical condition and health. Visit fitness clubs, play sports, improve your health, which will be useful to you in later life.

- Buy books, attend public readings and seminars. Self-development is a big key to success in all areas.

Loans - why you shouldn’t go into debt

If you decide to achieve certain success in your financial independence, under no circumstances count on credit funds. If you decide to take out a loan from a financial institution to start your idea, you will automatically put an end to a successful future.

For clarity and to avoid misunderstanding of what we are talking about, the following example:

Petya decided that he needed to grow and earn decent money.

Without a permanent job, Petya goes to the bank and takes out a loan under two documents at 30% per annum to open a vegetable shop. Petya buys a kiosk, pays rent and purchases goods. Petya ran out of credit money, but for some reason things didn’t go well. And the watermelons seem to be good and the tomatoes are sweet, but no one takes the goods from Petya.

Petit the businessman’s first month of work is coming to an end, and he has nothing to pay off the loan with. Petya does not despair and sells his goods at the purchase price. Petya collects the required amount for the monthly payment and settles with the bank. But Petya still needs to pay rent again and purchase goods.

Petya borrows money from his good friends on parole. He pays rent, buys goods, but again no one takes the goods. The new price does not attract buyers. Everything repeats itself and Petya has nothing to do with the bank and his friends and the business.

He has to sell his kiosk, but for the price at which he bought it, no one agrees to buy it. The deadlines for repaying debts and loans are running out and Petya is selling his kiosk for half the price he bought it for. There is barely enough money to pay off friends and pay the monthly payment to the bank.

As a result, all that Petya has acquired and earned is a loan and a nervous tic. Further more. Petya can’t find a job, and the next payment deadline comes unnoticed and Petya decides to take out another loan to pay off the first one and gets into a credit pyramid, from which only a few find a way out.

This example is not made up. Such cases happen all the time. People, in pursuit of wealth, commit reckless acts that they have to regret for the rest of their lives. Therefore, before choosing a way to increase your capital, think a thousand times whether you can do it.

Conclusion

Based on everything that was written above, you can identify the main points for increasing your money:

- Set a goal for yourself and don’t deviate from this path;

- Use all possible tools to achieve your goal;

- Don't take on what you don't know how to do;

- If you take up a task, always bring it to the end;

- Be prepared for unforeseen difficulties;

- Never, under any pretext, take out loans;

- Believe in yourself and your capabilities.

Anyone at least once thought about how to increase money in a safe way. Often, the choice of method of accumulating and increasing capital is determined by the form in which you would like to receive income: you are interested in periodic payments that would turn into an additional source of income, or a long-term investment that would bring profit in the future.

From this article you will learn:

Is it possible to save and increase money for a person with a low salary?

Financial intelligence is the ability to solve problems related to money. For some it is higher, for others it is lower. What does this depend on?

Such intelligence is formed as a result of solving practical financial issues that rarely arise in everyday life. As for mathematical intelligence, numerous tasks at school and higher education help us train it. We resolve issues related to funds in the background.

Why don't people work on improving their financial intelligence? The fact is that every day they are faced with already familiar questions, but at the same time they do not strive for new knowledge. There are thousands of ways to save and increase money, but we don’t use them.

What is the best way to increase money for a person who receives, for example, 40 thousand a month? Let's say he saves 5 thousand monthly. What can you do to increase your income in the future?

When a person starts saving money, he can “break out”, as in the joke: he started saving for a Lexus, then couldn’t stand it and bought a Snickers. It is important to save and not waste the funds you have set aside.

People live by calculating their expenses using four basic formulas:

- Bankruptcy formula: received money and spent more. Let’s say you got into debt “until payday.” If this is the formula for your financial life, bankruptcy is inevitable.

- Poverty Formula No. 1: got the money and squandered it all. Most people, receiving 40 thousand rubles, do not try to save anything. Do you stick to this formula? You will be poor all your life. And if force majeure occurs, you will become completely bankrupt, because you will have to borrow money and return it with interest.

- Poverty Formula No. 2: received money, saved a little, spent it. This option is better, but still leaves you at the same level.

- Wealth formula: received money, saved it, invested it and increased it.

What is the fundamental difference? The psychology of the poor is such that they save money hoping to spend it. As for the rich, they save it to increase it.

All the wealthiest and most successful people in the world, thinking about how to increase their money, applied this formula and turned their earnings into capital that generates passive income, which has an important property: it increases exponentially due to the effect of compound interest. This is what the path to wealth looks like, and as we can see, it is quite simple.

Choose your formula. Or you save to buy a car, an iMac, or renovate an apartment. Or you are wondering how to increase money without risk in Russia, and are following exactly in this direction.

Remember: multiplication is a long-term progressive action. At first it will seem that there is no effect. You save money and realize that you managed to save very little. When you receive 40 thousand rubles, you leave 5 thousand per month. After a year, you have saved up 60 thousand, which, of course, is not enough compared to the desired result.

An emotional rollback occurs: “I’m saving, but to no avail.” Just wait out this period, and then your investments will certainly begin to increase noticeably. Typically, this happens around the fifth year after you start saving money. It is important to be patient and not give in to the temptation to spend everything you have put aside.

How to attract, save and increase money: 5 principles of investing

This may be trivial for some, but if you want to increase your money, first acquire the necessary knowledge. That is, it is better to invest the first funds not in the purchase of shares, gold items or make a deposit in the bank, but use them for your own development. This is exactly what the two most successful, rich and famous people in the world - Bill Gates and Warren Buffett - advise to do.

Once you have acquired the necessary knowledge and understand what a particular financial instrument is, how it works, what risks and profits are expected, proceed to practical application.

Principle No. 1. First create an airbag

If you don’t have a financial base, it is ABSOLUTELY IMPOSSIBLE to invest. The only exception may be a bank deposit. How to increase your money in the bank? Just deposit funds into the account, but remember that this is rather a way of saving rather than investing.

What is a financial airbag, how to create it? A financial cushion is a reserve of funds with which you and your family can live as usual for 6 months and feel absolutely comfortable without other sources of income.

How to get one? Just defer financial income (salary) at certain intervals or sell the property that you have.

Let’s say that you and your family are used to spending 60 thousand rubles a month. Then to invest you must have 400 thousand rubles.

You can invest funds at interest without a financial cushion only if you have a source of passive income. This is the name for the flow of incoming funds that you do not make daily efforts to receive. Passive income comes from renting out a house or apartment, stock dividends, or profits from an operating business.

Principle No. 2. Don't put all your eggs in one basket

To make your funds work for you, invest them wisely, diversify, i.e. divide by different investment instruments.

If you are interested in investing, thinking about how to save and grow your money, then you most likely know about diversification. To put it figuratively, you simply “don’t put all your eggs in one basket.” There is a risk that it will fall, all the eggs will be broken, and you will be left with nothing.

If you invest all your money in one project, you may lose it.

Note that when diversifying, you invest not only in different financial instruments, but also in different economic sectors. Let's say, when directing funds to the stock market, form an investment portfolio so that your money works in companies in different sectors.

To achieve maximum stability of your investment portfolio to market changes, invest 20% of your available funds in the banking industry, 20% in the oil and gas industry, another 20% in the manufacturing industry, and 20% in the agricultural or food industry.

If one enterprise (industry) suffers losses, then others will “pull” your funds upward, and the portfolio will not sag.

Principle No. 3. Don't take uncontrolled risks

Risk is the main problem of all investors without exception. Please note that before investing in a particular project, you need to calculate all possible losses and only then the potential profit. Alas, novice businessmen, thinking about how to properly invest, save and increase money, are led by ambitions, do not calculate the risks and enthusiastically, with their eyes closed, wait for incredible financial success. Everything is different in life. Overestimating opportunities, entrepreneurs immediately begin aggressive investments and lose money, instead of following the proven path.

The science of investing, just like any other professional field, requires understanding. Therefore, one should develop in it gradually, starting from the elementary and moving on to the complex.

The highest indicator of financial illiteracy is to take funds at interest and try to quickly increase them using some “win-win” method. The ending of such actions is almost always the same - the loss of the entire amount and the credit burden hanging over you.

Take your time, because if you master the science of investing well, you can make great money in the future. And vice versa, trying to increase money here and now, you risk never reaching a high level of income.

Principle #4: Attract co-investors

As you become a more successful investor, start investing together and forming pools. This will allow you to gain more options and understand what to invest in so that it works for you at its best.

Suppose you managed to find some instrument or project that, in your opinion, is profitable for investment. You have free money, but not in the amount you would like. In this case, you need to find those who are ready to share your investment idea and invest funds on parity terms, jointly.

In the last few years, PAMM accounts have become widespread. When using them, investors entrust the management of their financial assets to a specialist.

Trust management of assets is one of the forms of financial and business relations when one party or organization transfers its funds (property) to another (trustee). In this case, the second party does not have the right to distribute this money or property as an owner. It can only make a profit and receive a percentage of it as a reward for effective management.

Thus, several investors can create a PAMM account together and transfer this amount to a financial asset manager. In this case, investors bear all risks of losses, in accordance with the invested funds.

Investors can agree with the trader (manager) to terminate work on the account in case of loss of money in a certain percentage of the account amount.

So, to summarize this method of investing, we can say that investors are willing to sacrifice, for example, 15% of their funds to receive 30% of the income.

Principle #5: Find sources of passive income

Increasing capital is good. But you also need to create passive income from investing.

Example. You invested 100 thousand rubles and after a year received 130 thousand rubles. That is, they earned 30% on the money invested.

But there is a nuance. No one can guarantee one hundred percent that next time you will earn another 30% in a year. Since the profit here is much greater than the income from bank deposits, and the risks are higher. It is possible that you will lose all or part of your money if things don't go according to plan.

At the same time, if for 100 thousand rubles you managed to secure passive income for yourself, for example, the same 2500 rubles monthly and 30 thousand rubles annually, what prevents you from taking a loan of 100 thousand rubles and investing these funds more conservatively? After all, your asset with passive income of 2,500 rubles guarantees the return of the new amount of 100 thousand rubles taken on credit.

How to quickly increase money: short-term investments

How to increase money in a short time and turn it into an additional source of income? There are proven ways to invest.

Perhaps everyone is familiar with the concept of binary options and financial markets. Many doubt the reliability and honesty of this type of income increase. Doubts are fully justified, but partially.

Is this way of earning money reliable? There is a high risk here. There is only one way to protect yourself from loss of funds: by continuously improving your knowledge in the field of trading in financial markets. If you have little knowledge of this industry, we do not recommend increasing money in this way.

There should be no doubt about honesty. Choose a site based on recommendations from friends, read reviews on the Internet. Give preference to already established sites with a solid reputation.

2. Borrow money at interest

The next option to increase capital is to lend money at interest. If you are not so burdened by moral principles, then you can easily provide loans at 2% daily, turning this into an additional source of income.

Thanks to the correct execution of documents when transferring borrowed funds, you have almost no risk of losing your own money. The worst that can happen is that the money will have to be returned through law enforcement, possibly even through legal action.

But at the same time you can receive an income equal to 700% per annum. The amount of earnings received directly depends on the funds invested. It's safe to say that most of your borrowers have an 80% chance of becoming repeat customers. At the same time, no one will be in a hurry to repay the main debt. Borrowers will only pay interest on the debt.

Another method to increase money. It is not as effective, but more loyal. The idea is that you sell products online. At the same time, you do not make wholesale purchases and do not store goods so that products that interest buyers are always in stock. It is enough to act as an intermediary between the client and the seller.

The essence of your work is to find a buyer and then contact the seller. You bring these two parties together, hoping to make a deal, and get your percentage. The size of your profit will be determined by the number of products sold and the commission that the seller is willing to pay. This is the best way to increase money if you do not have a large amount to invest in large-scale projects.

Let's look at debit cards first. Today, many banks, trying to get as many customers as possible, offer to issue a debit card with cashback of up to 5% on all purchases and 10% per annum on the balance in the account. Thus, apart from issuing a card at the bank on favorable terms and further using it, you don’t need to do anything special.

At first glance, the amount is insignificant. On average, 600–700 rubles come out monthly. Now calculate how much you will receive in a year. Nice, isn't it?

How can you make money using debit and credit cards at the same time? Your task is to issue two cards at once in the same or different banks. Debit must be issued with a percentage of the balance, credit - with a limit equal to your monthly income.

Make sure your paycheck goes to your debit card. After you receive your first salary, do not rush to spend it or withdraw money from your card. Let the entire amount remain there so that you can earn your interest. And in everyday life, use a credit card, paying for purchases, housing and communal services and all your expenses. Interest does not accrue on it for, as a rule, 55–100 days. When you receive your next paycheck, top up your credit card balance and use it again.

What is the result? Every month you earn interest on your debit card balance and pay nothing for using credit money.

How to increase money without risk

Long-term investing is a safe option where you can increase your money. This method is suitable for those who are ready to invest their own funds for a long period in order to get maximum profit in the future.

Where else can you invest money to increase it?

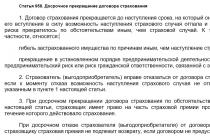

1. Life insurance

Have you ever thought that, God forbid, an accident would occur and as a result you would lose your ability to work? Of course, someone will say that nothing like this will ever happen to him. But life is unpredictable, and things don't always go the way we want.

Dear readers! Don't tempt fate and invest in insurance as the foundation of your security. To insure financial risks, there is “accumulative” or “risk” insurance.

We understand why it is needed. Now let's look at its main types.

- Endowment insurance. This is a financial instrument that allows you to accumulate savings and at the same time protects the investor during the entire period of insurance. How does it work? You come to an insurance company with a reliable reputation, create a personal financial plan and deposit funds in equal installments over a set period. Over time, capital grows, in other words, it works.

By a specific date, you receive all your savings, and until that date, your life and health are reliably protected.

It must be said that the risks covered by the insurance also include disability due to illness and compensation for treatment in the hospital if you stay there for more than 7 days. - Risk insurance. You buy an insurance policy for a certain period, usually for a year. Risk insurance regulates all insured events and the amount of payments for them. This type only covers financial risks for injuries caused by an accident.

Insurance can be both cumulative and risk.

Advantages:

- You have funds for unexpected situations along with good savings (if you use endowment insurance).

Flaws:

- You lose money once and for all if the insured event does not occur (if you use risk insurance).

- The interest rate on the savings portion of your funds invested in insurance is low.

Everyone knows about this method of investing. It has been known since time immemorial. Silver, gold and platinum will never depreciate in value.

Buying precious metals allows you, first of all, to avoid inflation and loss of your funds. This is due to the fact that banknotes have always been correlated with gold. It was this metal that acted as a guarantee of funds. However, in the second half of the twentieth century, this link was canceled, and money became valuable in itself.

How can you profitably increase your money by investing in precious metals? There are several options. Here are the most common:

- purchase of precious metals in bullion;

- investing funds in impersonal metal accounts;

- purchasing futures on the stock market or shares of relevant enterprises.

The first method is extremely simple. All you need to do is just go to a bank that has a license for operations with precious metals, for example, Sberbank, and buy bullion there. The other two methods require some minor comments.

Unallocated metal accounts are bank accounts that reflect the precious metal purchased by the buyer in grams. However, it does not indicate individual characteristics (sample, manufacturer, serial number).

To purchase precious metals, you need to come to a bank branch and open an appropriate account there.

A futures (for gold or other metals) is a contract for the supply of these materials in a specified quantity. When you purchase a contract on an exchange, you indirectly become the owner of a shipment of precious metals.

Advantages:

- Stable investments and safety of funds from inflation.

Flaws:

- Loss of precious metals prices with the growth of speculative assets.

An excellent option for investing free money for those who love art and have good financial resources. As we know, antique items, paintings and sculptures by famous masters are becoming more expensive every year and can cost several tens of millions of dollars per collection or even one item.

Everyone knows the painting “Black Square” by Malevich, “Sunflowers” by Van Gogh, and the collection of Faberge eggs. It is important that the law recognizes as antique any product whose age is over 50 years, although not all of them are valuable. These are considered old objects that are significant from a historical, artistic and cultural point of view.

You can increase your money if you buy antiques recognized by famous collectors, scientists and artists. You can purchase or sell such products and other objects of art at special exhibitions and auctions, in specialized stores.

Be careful because scammers don't sleep. Only an expert who has specialized equipment can accurately determine whether an item is genuine and how valuable it is. If someone asks you to invest in supposedly antique items, take the time to determine for sure whether they are antiques.

Advantages:

- Over time, the cost of products increases, and this is an excellent opportunity to preserve and increase capital.

Flaws:

- Relatively low liquidity, risk of buying a counterfeit item.

4. Investing in collectibles and rare items

Continuing the topic described in the previous paragraph, we will also consider the issue of collectible and rare items, since they are also valuable, and their value can increase over time.

Let's say there are fan clubs of some famous person, for example, an artist or a football player. In these communities, all celebrity belongings have a very high value. Such items for a narrow audience may be considered even higher than money, while for the common person they are completely unimportant.

For example, David Beckham's sneakers or Lady Gaga's concert costume can hardly be called an antique or highly artistic item. But for fans these things are of high value, and therefore they will not hesitate to give money for them.

There are also lovers of history or any subject area, for example, collectors of coins, old records, etc. If you know where these things are in demand and understand them, you can invest some part of your capital in purchasing them .

If, for example, you are planning to travel abroad in the near future and visit places where celebrities have been or currently live, take the following advice into account. Buy things related to these people's lives, personal or creative, and sell them for a good markup when you return.

There will be no problems finding buyers: fortunately, there is the Internet and numerous thematic forums.

Advantages:

- The opportunity to quickly receive a high income from the resale of a valuable item.

Flaws:

- Relatively low liquidity and lengthy search for a client.

5. Purchase of patents, brands, trademarks (intellectual property)

Most likely, you are aware of the possibility of obtaining a patent for any invention or technology. Why is this necessary? As a rule, to ensure that no one other than you can use this item without permission from the author.

Buying intellectual property is another great option to increase capital.

Everything is exactly like that, and the best thing here is that the author, most likely, will not refuse you. On the contrary, he will be very happy that you will use his technology or invention. But there is one condition: every time you receive income from the invention, a certain percentage will have to be paid to the copyright holder.

What if you can't invent something? The answer is obvious: acquire the technology in the form of a patent. In this case, if someone introduces an invention or technology into the production process to make a profit, you will receive a percentage in the form of passive income.

This is a great way to increase money. Investing in intellectual property should be done by those who know who may be offered to use the patent in the future.

Note that the situation is approximately the same with the trademarks of well-known brands. For example, the most valuable global brands now are Apple, Google and IBM. If you have a good understanding of business and marketing, then you are more likely to invest in a promising growth enterprise. And only then it will become a source of large income for you, while at the same time increasing in price due to an increase in the value of the brand, an intangible asset of the company.

An intangible asset is an item of intellectual property that generates income. At the same time, it cannot be “touched” in the literal sense of the word (a well-known brand, patent, technology, idea).

Advantages:

- Possibility of receiving passive income or making money by reselling a patent (trademark).

Flaws:

- There is a possibility that you will not find buyers (tenants) of your intellectual property.

You can develop a similar project yourself and make a profit from it, as well as invest in a startup. If you have already launched an Internet project that regularly generates income, then you can simply invest your own funds in it and become the owner.

What is called monetization of a project? Actions that the project owner performs to make a profit from it. The concept of “monetization” is usually used for Internet projects. For projects in the offline environment, the term “commercialization” is more often used.

A startup (from the English “start-up”) is a commercial project, usually with minimal investment, which is planned to be launched and repaid in the shortest possible time. In this case, you acquire a ready-made business that consistently generates income.

But don’t forget: if you don’t know much about Internet projects and technical details, then be sure to find an assistant - a project manager.

A manager acts as the hired leader of your business. He can work on a project independently, supporting its vital activity and developing it. If the project is large-scale and involves the participation of multidisciplinary specialists, the manager can hire assistants, creating a team.

You have the opportunity to create and promote your own project, and then sell it or do something different - purchase a ready-made project that makes a profit.

For the purchase and sale of Internet projects there is a well-known exchange telderi.ru

Investing online is another effective way to learn how to attract and grow money and make it work for you.

Advantages:

- Low investment with high profitability. A project in which 100 thousand rubles are invested can bring you 10–50 thousand rubles monthly in the form of passive income in six months.

Flaws:

- You need special knowledge. If you don’t have them, you’ll have to hire professionals, which costs money.

Experts unanimously say that there is only one way to achieve personal financial freedom - investing. Theoretically, there is nothing complicated in this matter: you just need to study the features of different investment instruments and correctly allocate your capital. But for an ordinary person living from paycheck to paycheck, it is not so easy to entrust the funds accumulated with great difficulty to someone else.

In fact, it is quite possible to ensure the safety of your investments: to do this, you need to figure out how to increase your money without risk. The basic rule of investing will help a beginner to choose the right instruments: profitability is always proportional to the level of danger. In addition, the investor must clearly understand where exactly he is going to invest funds, how they will work, and how the profit will appear. Of course, he will have to learn a lot of new knowledge, but otherwise, the chances of success in investing will not exceed the probability of winning the lottery.

How to save money?

Not every citizen can boast of a highly paid position or a profitable business. Accordingly, the question of how to attract, save and increase money is relevant for most people. The problem of lack of funds for investment should be solved step by step. First of all, you need to figure out how to accumulate initial capital:

- You should make a detailed list of expenses and study it carefully. It will probably reveal regular expenses that can be avoided - for example, going to a cafe, taking a taxi, ordering sushi at home;

- You need to draw up a budget for the month - without being too strict, but also without waste. Here it is important to provide yourself with an acceptable level of comfort so that the process of saving money does not turn into an ordeal;

- One of the prominent investors once said that you need to pay yourself first. Therefore, you need to start saving at least 10% from each income in order to form your own financial reserve;

- There should always be a certain amount of money in your account or wallet. It will be unpleasant if the car breaks down at the very moment when all the savings have been spent on buying the latest model smartphone or on a vacation abroad;

- Without financial literacy there is nothing to do in investments. You need to constantly read books about business, learn new ways to increase capital without risk. If possible, it is advisable to enroll in financial courses for beginners;

- Activities aimed solely at acquiring wealth will not bring moral satisfaction. Therefore, you need to find a dream that will make you get out of bed every morning and work hard;

- It is better to forget the stereotype that wealth is the lot of the elite. In almost every job you can find hidden resources to increase your earnings. If they are not there, you should think about changing your employer or even choosing a new direction.

How to save money?

The first accumulated savings are a great temptation. When almost every person receives a large sum of money, they remember that their phone or car is long overdue for an upgrade, and that their apartment hasn’t been renovated for many years. But the unpredictability of circumstances makes it clear that you need to have a financial reserve. Moreover, it is worth understanding not only how to create it, but also how to properly increase money. There are some proven tips:- The funds accumulated as a result of saving 10% of the profit cannot be spent under any circumstances. When the size of these savings reaches the amount of personal income for 4-6 months, you need to put them on deposit to protect against inflation;

- As soon as the reserve fund is formed, you should begin accumulating capital for investment. This amount may be small, in the range of 20–30 thousand rubles, since today there are many tools available to beginners;

- On the question of how to increase capital, advice will be useless if you succumb to the tricks of marketers and constantly make impulsive purchases. Some people have the habit of spending the rest of their money the day before payday;

- You should strive to make any purchase using your own funds, without taking out loans. The fact is that deposit rates are much lower than interest rates on loans. Therefore, the borrower loses more than he earns;

- You should give up the habit of paying for everything by card or using your phone. If you don’t keep real money in your wallet, then you may not notice how quickly it is spent on various trinkets;

- It is advisable to plan large expenses in advance, distributing them over time. Otherwise, the personal budget simply will not withstand such a load. For example, it is better to buy clothes and shoes in advance, at seasonal sales;

- If you cannot refuse a bank card, you should learn how to use it. You need to learn about the rules for servicing the account, find out the duration of the grace period, and familiarize yourself with the bank’s advantageous offers for refunds;

- If you are planning to start investing, you should not leave your day job. No one can predict the success of an investment, and reaching an acceptable level of income may take several years. At this stage, you cannot survive without a salary.

Bank deposit

- The return on investment is easy to predict;

- Choosing a bank does not require any special knowledge;

- The institution guarantees profit regardless of the economic situation;

- The agreement is concluded very quickly - there are bank branches in every city.

But can this type of investment be called profitable? Unfortunately, the deposit has the lowest return among all financial instruments, and therefore it is used mainly for the initial accumulation of funds or for diversifying capital in order to increase the overall level of investment security.

How to increase capital without risk? First of all, you need to make sure that the selected bank takes part in the DIA program and insures depositors' deposits within the limits stipulated by law - 1,400,000 rubles. In addition, it is advisable to take into account:

- The bank's position in the overall rating;

- The amount and validity of the interest rate;

- The size of the bank’s own and attracted capital;

- The relationship between an institution's credit and deposit funds.

A feature of structured products is the guaranteed preservation of funds. This is achieved through reasonable capital distribution: the broker invests 80–90% of the money in deposits and bonds. For the remaining 10–20%, futures and options are purchased, which, if the circumstances are successful, bring huge profits.

How to profitably increase money? For example, the oldest broker in Russia, Alpari, offers to invest in the following structured products:

Profitability of Alpari structured products

Loans to individuals

Bank security policies do not allow them to issue money to all citizens without exception. Therefore, some people have to look for alternative sources of financing - for example, turning to private lenders who are less strict about the borrower's credit history.

For an investor learning how to increase money in a short period of time, the most profitable option is to borrow for 15–45 days. The fact is that when issuing a loan for six months or a year, the rate usually does not exceed similar indicators for microfinance organizations, while for short-term loans 0.5–1.5% per day is considered acceptable. Where is the best place to look for citizens interested in credit money:

- You can place advertisements on platforms for entrepreneurs starting a business with insufficient funding;

- You can find local forums and groups on social networks where citizens in need of funds post their requests;

- Finally, you can register for special P2P lending services, which are a kind of exchange.

Credit exchanges are the best way to increase small capital: thanks to loan insurance and borrower ratings, such services increase the security of lenders and guarantee repayment of funds. There are few of them on RuNet:

P2P lending platforms

Own business

Most financial instruments are directly or indirectly related to business investment. So why pay numerous intermediaries in the form of exchanges and brokers if you can do business yourself?

Video on the topic

Of course, this way of earning money can hardly be called passive, since running a business requires a constant investment of effort and time. Moreover, it is not suitable for everyone, as few people have the necessary skills. But at the same time, the entrepreneur receives not only full control, but also the right to individually dispose of profits. Investing in your own business has other features:

- The choice of direction is almost unlimited. An entrepreneur can always find an interesting and understandable niche for himself;

- To open a small business from scratch, you do not need knowledge of how to save and increase money through investing;

- There are also no restrictions on profitability. With proper business management, you can increase your capital tenfold;

- There is no need to invest millions of rubles in the business. There are many ideas that require fairly moderate investment.

At the same time, not all entrepreneurs achieve success. Most often, the reasons for failure are the newcomer’s attempts to break into a niche with very high competition or ignoring the need to develop a detailed business plan.

How can you increase your capital by doing business? Here are some profitable small business options:

Small business profitability

Someone else's business

People who do not have entrepreneurial skills, but understand the prospects of investing in a business, should think about financing other enterprises. Of course, the safest way to invest money is in a stable operating company, but you won’t get much income this way: the growth of long-established organizations does not exceed 15–25% per year. Therefore, the most effective way to increase capital tenfold is to invest in startups.

Start-ups are entrepreneurs who have come up with a promising business idea, but have not yet found the funds to implement it. For this reason, they are actively looking for and trying to interest venture investors by publishing their proposals on special platforms on the Internet.

When learning how to quickly increase money by investing in startups, you should take into account an important feature of this method of earning money: no one guarantees the investor a profit. As a rule, 20% of projects generate income in the thousands; the rest either break even or fail completely. Accordingly, to protect funds, it is necessary to invest money in at least five to six startups at the same time.

How to increase capital in 2019? On the www.napartner.ru site you can invest in any of several hundred projects. Here are some of them:

Startup profitability

Conclusion

So how to increase money without risk? This is very difficult to do: the danger of losing capital is always there. The bank may lose its license, the mutual fund may receive negative income, the issuer of reliable bonds may default. Even, they don’t always help you choose the right way to invest. Therefore, the main task of the investor is not the search for the most profitable instruments, but the correct distribution of capital between them. To solve this problem, you need to understand that investing is not a game of chance, but hard work combined with strict financial discipline.