In order to successfully and quickly send money for a service / product, or replenish the required current account, you need to make bank transfer. To do this, you can use the nearest bank branch, or make a transfer online, for example, on the website. At the branch, the payment will be made with the help of the payer's counterparty, or in cash through the selected transfer system. And when making such payments via the Internet, a card account is used or online wallet(You can top up through the terminal, or through the card online). Just a few minutes on the site page - and the necessary banking Money transfers will go to any specified account in Ukraine. To get started, you need to select the “Money transfers” page, then “Transfer funds”, and fill in the free fields correctly.

Let's look at how to transfer money to props and what data is needed:

- You need to enter the name of the recipient / name of the recipient, as well as his an identification number/ beneficiary's code (EDRPOU);

- Indicate the recipient's bank, MFO, beneficiary's account;

- The payer also indicates information about himself, namely: full name, purpose of payment, phone number;

- Next, you need to specify the amount and confirm the operation.

If the data is specified partially or has an invalid error, the system will not proceed to the payment page. Also, the client needs to know that the cost of the transfer should be at least 1 kopeck, and the possible limit should not exceed UAH 24,999. Payment is made in national currency, but if the recipient receives it in another currency, the conversion takes place automatically. The commission for the operation is charged according to the conditions of the tariff of the counterparty to which the transfers are received.

When making bank transfers using EasyPay, the user receives the following benefits:

- The simplicity of the interface allows you to quickly and safely transfer funds;

- The amount will become available within 3 working days;

- You can always contact the company's support service and get answers regarding enrollments.

Sberbank Online allows you to make payments and transfers not only using ready-made templates and plastic data, but also using full account details. This payment option is convenient if you need to pay for services / goods of a company that does not have partnerships with the largest Russian bank, as well as when transferring to your own and other people's accounts in other banks. But it is worth studying the procedure before the operation in order to exclude the possibility of various problems.

How to pay by details through Sberbank Online

Payment according to the account details is made using a payment order. With this document, the client instructs financial institution transfer money from your account to another owned by him or a third party. You can generate a payment order in the convenient interface of Sberbank Online or by contacting a teller. The first option is much more convenient.

Important! In the online bank, you can only generate transfer orders for details in rubles. Payment in foreign currency is possible only through branches due to the need to control such transactions in accordance with the law.

Before you pay for the details, you need to familiarize yourself with some of the nuances of this operation:

- The transfer can be internal or interbank. Sberbank considers only transfers between clients of one branch (territorial bank) to be internal.

- No commission is charged for internal transfers. For interbank (interbranch) transfers, you will have to pay 1% of the transaction amount (max. 1000 rubles). In offices, the commission is higher - from 1.5% (min. 30 rubles) for transfers within Sberbank (between branches) to 2% (min. 50 rubles) - for interbank ones.

- Transfer by details to another bank is not carried out instantly. It is processed not only by the internal systems of Sberbank, but also by the services of the Central Bank of the Russian Federation. The term for transferring money to the recipient is up to 5 days. They usually arrive no later than the next business day.

- Transfers by details can be sent to organizations and individuals. The main thing is to know all the necessary data (BIC, account number, etc.).

Transfer of organization funds

Most often, bank customers have to make transfers by details to organizations. Not all service providers and sellers of goods have agreements with Sberbank for accepting payments, and with the help of such transfers, you can send money to anyone. Russian organization or IP.

Step-by-step instructions for transferring funds to an organization using account details include 4 steps. Necessary:

Transfer to individuals by details

A transfer to an individual within Sberbank to an account is slightly different from payments to organizations. After authorization in the online banking service, the client needs to perform 4 steps:

Transferring funds to another bank

If the recipient is served in another bank, then he can also send money to the account. To do this, you need to go through authorization in the Sberbank Online service using your account and then do 3 things:

Transfer confirmation

In some cases, it is required to provide the recipient with confirmation of the fact of the transfer. And also a receipt may be needed in case there are controversial points, it is necessary to prove the fact of payment, etc. A check or certificate can be downloaded at any time in Sberbank Online. To do this, you need to perform 3 steps:

The receipt and the certificate contain virtually the same information. The client can choose the most suitable option document. In most cases, a check is sufficient. If you need to confirm the payment completely officially, you will have to contact the branch and get a certified copy of the payment documents.

How to pay by details through the Sberbank Online mobile application

Quite often, to manage money and make payments, Sberbank customers prefer not to use the web version of the account on the site, but the smartphone application. It is available in versions for Android, iOS and Windows Phone through the official stores of operating systems. Functionally, the application is practically no different from the web version of Internet Banking.

To make a payment according to the details in it, you must also perform 4 steps:

Transfers through Sberbank Online using details significantly expand the system's capabilities. With their help, you can make payments and transfer money to companies and individuals, regardless of whether they are customers the largest bank RF or not. But we must take into account that transfers by details are carried out for a long time.

Today we will tell you how to transfer money to the current account of a business partner. There are many ways to do this. For example, you can make a payment online, visit a branch of a credit institution for these purposes, or use the services of an ATM.

Transfer from card to current account

If you have a card, then it greatly simplifies the possibility of transferring Money. , allows you to replenish the balance quickly and with minimum commissions. To do this, you can contact the bank branch or carry out the operation yourself.

Transfer conditions:

If you want to make a payment through a specialist, you will need a passport and a card. It is important that there is a sufficient amount on the plastic account. Some banks charge a commission, and therefore the funds should be enough. Money can be transferred both from the card of an individual, and from the one that is tied to current account entrepreneur or legal entity.

When transferring own funds With personal card IP to the current account in the payment order must be indicated basis of the document. They may be " Transfer of own funds ". If this is not indicated, then the tax office may regard such an operation as income that will be taxed.

If a payment is made in favor of another legal entity or individual entrepreneur, it is also important to indicate it base, For example, number of the contract with the counterparty . When you attach a card to it in a bank, you can connect electronic service remote service. It means that you have the right to carry out operations on the account without the help of employees of a credit institution.

At any time, you can transfer funds from the card to the current account online. The service is available for owners of computers, as well as tablets or phones. You can save templates for future payments. In other words, the transfer details will remain in the system's memory, and you will only need to enter the amount for the next payment. This is convenient if you often transfer money from a card to a current account.

Transfer to IP account

If you are going to make such a payment, then you can use several methods:

Transfer from your current account(this can also be done using a card linked to it. Internet banking is suitable for these purposes, as well as mobile app allowing operations to be carried out without assistance bank employees. The operator of the credit organization will also help to transfer funds if you contact the bank branch directly);

Deposit cash through an ATM or bank office(You do not need to have your own current account for this. It is enough to know the details of the account number and have an identity document with you).

If you are transferring funds from your account, you must correctly indicate the purpose of the payment. When transferring own money for business purposes, it is necessary to indicate that these are personal funds so that the tax office does not regard them as a tax. The offset of money in favor of the counterparty must have a basis in the form of a specific agreement or other documents.

Most banks offer self-collection services. This means that the entrepreneur or his representative can deposit funds to the current account through an ATM. This action is available at any time of the day, which is very convenient. It is also not required to visit the bank branch.

To use the service, you must first obtain a special code from a bank employee, which is subsequently entered on the ATM keyboard. Then the money is deposited into the bill acceptor, and after a while they will be credited to the current account of the individual entrepreneur. If the operation is not carried out by the entrepreneur himself, but confidant, then he needs to immediately receive his code, which will differ from the numbers of the IP itself.

Transfer to the current account of Sberbank

If your counterparty is, then it will not be difficult to transfer funds to him. And if you also have an account with this bank, then this greatly simplifies the task.

There are several ways:

Go to the branch of Sberbank and contact the operator(you need to have the details of the organization or individual entrepreneur, as well as the current account number. You must have a passport. Also in payment document it is necessary to indicate the reason for the transfer);

Through Sberbank online(the service is available for those who already have an account with Sberbank. It does not have to be a settlement account, a regular account opened on individual. To transfer, in the appropriate fields of your personal account on the bank's website, you must specify the account number, TIN and BIC of the recipient of money, the system will automatically generate the rest of the data. Next, you need to enter the amount and account number from which the debit will take place. Be sure to save the receipt so that you have proof of payment on hand);

Through the mobile application of Sberbank(it works on the same principle as an online bank. You will need to download the application and enter the payment details in it. It is more convenient to save the transfer template in your personal account in order to enter only the amount in the future and send funds without wasting time);

Transfer from an account opened with another bank(this can be done through a bank branch or in your personal account. It is enough to have payment details. The term for crediting money is from 1 day to a week. It all depends on the bank through which the transfer is made. A commission is usually charged for the operation, which will be automatically deducted from your account when the payment is sent).

Transfer to the bank account of the organization

If you need to transfer money to the account of a legal entity, then it is not necessary to have a bank account for this. There are several options for sending payments, which you can find in the table.

| Translation method | Peculiarities |

| Through the branch of the bank where you have an account | You can come to the branch and fill out a payment order. Usually the document is compiled by a specialist according to the details that you provided. You need to indicate the purpose of the payment and verify the correctness of the data entered by the operator. If everything is correct, you need to put your signature and receive a document confirming the deposit of funds. If you are transferring funds between your accounts, be sure to include the appropriate payment reason. |

| Through any bank without opening a current account | If you do not have an account opened with a bank, this is not an obstacle to payment. You need to take cash with you and go to any bank that offers transfer services. You can visit the bank where the organization has an account, and if this is not possible, then another one will do. credit organisation. You need to bring your passport and payment details with you. Be sure to keep the receipt until the money is credited. |

| Through an ATM | In this case, an ATM is suitable only for the bank in which the organization has a current account. You need to select a money transfer service and enter the account number. Some self-service devices accept such payments only if you have a card from the same bank, while others need only know the account number. |

| Via internet banking | If you have a connected Personal Area on the bank's website, then you can transfer funds from your current account. To do this, you need to enter the TIN of the organization, the BIC of the recipient bank, as well as the transfer amount. Funds are credited quickly and do not require a visit to the bank. Don't forget to keep the electronic version of the receipt. |

| Using mobile banking | To do this, you need to connect a mobile application. It can be downloaded and identified by the card number. The transfer is carried out from your current account or opened to an individual. If you save the payment template, then in the future you can send money much faster without entering information about the addressee. |

| From map | If you have a card of any bank linked to the account, you can replenish the current account of any organization. To do this, you need to know the details that you will need to provide to the operator when transferring through a bank branch. If you are making a payment yourself through electronic service bank, then information about the recipient will need to be entered in the appropriate fields, and then save the payment document. |

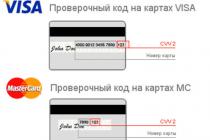

Very often, clients need to make a transfer not by card number, but using the full bank vault details or only a digital number. It should be immediately clarified that the plastic number and the account number are different things. They consist of a different number of digits and do not match. How to transfer money from bank card to the account of Sberbank and any other credit institution?

Sberbank Online

Let's see how to transfer funds to a current account in Internet banking.

Transaction to another bank

- We go to the personal account of Sberbank-online using the login and password.

- In the top menu, select "Transfers and payments", and then go to the "Transfer to a private person to another bank by details" section.

- Next, enter the full details of the bank and information about the recipient and click transfer. Before the transaction, you will need to confirm the transaction, with a code - it will come to your phone.

Thus, you can pay off a loan at another bank, pay for goods and services, as well as make large transfers. But remember, in this case, a commission of 1% will be debited. Maximum amount commissions - 1000 rubles.

Transaction to a Sberbank client

- To do this, we also authorize in Internet banking, and go to the "Payments and transfers" section.

- Next, select "Transfer to a Sberbank client."

- In the tab at the top, select the transfer type "Account". Here, in a similar way, you will need to fill in all the details and data of the recipient: account number, Last name, First name, Patronymic name, TIN, Address, Bank name, BIC, Corr. with., select the card with which you will send funds. Enter the amount of the shipment and enter messages for the purpose of payment.

- Click "Translate". We confirm the transaction with an SMS code. As soon as the funds are transferred, you will receive a notification on your phone. You can also see the transaction in the transaction history.

NOTE! If you send rubles to plastic that was received in another region, then the commission will be 1%. This is due to the fact that the BICs of banks in different regions and cities are different (When transferring funds in foreign currency, the commission will be 0.5%).

The bank itself makes excuses that it was a forced measure - it is necessary to break up branches and offices, since Sberbank is a huge institution. But in fact, most likely this is just an excuse to rip off their hard-earned money from customers.

In other banks: RosEvrobank, Tinkoff, Alfa-Bank, Rosselkhozbank, etc. Absolutely the same enumeration scheme. The only thing that may differ is the names of the tabs in your personal account.

ATM or terminal

- First you need to find a terminal or ATM that can transfer. Usually next to them is written a number of functions that they support, so this should not be a problem.

- Next, insert the plastic and enter the pin code.

- In the main menu, go to the "Payments and transfers" section.

- choose the right way transactions.

- Here you need to enter 20 digits.

- Next, as usual, enter the amount you want to send and click on the "Transfer" button.

- Before sending, the system will ask you to check the details. Check the number again for every fireman. After, confirm the transfer.

If you make a mistake with the number or other details, then there will be nothing to worry about, just the money will be frozen for 10 days, and then returned to you on debit card. But you must admit - if you need to do it urgently, then this situation may not be very convenient.

Bank branch

Before going to any department, you should clearly find out and write down all the details on a piece of paper or on the phone. The most important of them is the number of the personal account, but it is better to know the BIC. Take your passport and the card with which you want to make a debit with you. You may not take plastic, but you should take several of them so as not to confuse them.

Next, you need to tell any bank employee that you want to transfer to the account. Provide all the details and indicate the amount. You will need to sign a debit paperwork. The commission in this case will be 1.5%, but not more than 1,500 rubles - if you send money to an account in another bank or to a Sberbank plastic account that was opened in another city or region. It is also more convenient to make a transfer from a Sberbank account to a bank card in a branch.

- The transfer can be sent both from the account (i.e. with debiting funds from the account) and without account opening(i.e. with the deposit of cash at the cash desk).

- Transfer from the account can be made in any foreign currency, regardless of the currency in which the account is opened.

To send a transfer:

- Contact the branch of Zapsibkombank in your locality with an identity document (if you are a foreign citizen or a stateless person, then you will additionally need a document confirming the right to stay (residence) on the territory of the Russian Federation).

- Tell the operator the following information or show the contract in which it is:

for transfers within Russia

- FULL NAME. / name of the recipient,

- the name of the bank that will pay the transfer, and its details (BIC and correspondent account),

- account number of the recipient of the transfer (if any);

for transfers outside Russia

- exact full name / name of the recipient (Latin spelling),

- recipient's address (for transfers that will be received without opening an account),

- details of the identity document of the recipient (for transfers that will be received without opening an account and when transferring an amount over the equivalent of 5,000 US dollars*),

- name and address of the bank that will pay the transfer, its details and SWIFT code or code clearing system Bank - ABA, FW, BLZ, etc. (if available),

- account number of the recipient of the transfer (if any), and for transfers to the countries of the European Union and the Common economic zone the IBAN code must be indicated,

- details of the intermediary bank.

Restrictions:

- On the territory of Russia, money transfers between Russian citizens are carried out only in Russian rubles.

- Russian citizens can transfer money outside Russia foreign currency and rubles in favor of a Russian citizen in the amount of not more than the equivalent of 5,000 US dollars * per day, and in favor of a foreign citizen without limits on the amount.

*at the official exchange rate set Central Bank Russian Federation on the date the funds are debited from the account.

According to translations international system SWIFT connection for each payment individually selects the optimal route, which allows you to minimize the delivery time of the transfer and your costs. There are also several options for charging fees. You can send a payment from at your own expense for guaranteed delivery of funds in full, or at the expense of the recipient.

How to cancel a transfer?

If the transfer has already been sent, unfortunately, it is impossible to cancel it: the law prohibits the bank from debiting money from the recipient's account without his consent. You can ask the recipient to return the money.

Please carefully check the details of the recipient when sending the transfer.

How to return the money if I made a mistake in the details when transferring?

In case of an error in the full name or account number, the transfer will be returned to the sender's account.

If you provided the correct details, but transferred to the wrong person, try contacting the transfer recipient for a refund.

If necessary, you can get a copy payment order with confirmation of the transfer at any office of the Bank.