Redrawing money from bank card - this is more likely a system error (technical error) than malicious intent or bank fraud.

How does it usually happen? After you have paid for the goods with a card on the Internet (see how to do it correctly) or at a regular outlet, you will receive an SMS message about the transaction and debiting the purchase amount from your account. After some time, you receive a second message (this can happen right there or after a few hours) about writing off the same amount, and you are aware that you have not made any more purchases.

The thing is that on your card there was a repeated write-off of funds for a previously completed operation. Interestingly, double debiting can occur not for the most recent transaction, but for one of the previous ones, when you paid for a purchase in a particular store.

To understand the essence of the problem, let's look at a simplified scheme for calculating the card.

As you can see, the payment process consists of a "chain" of requests and responses between its different links. This process is called authorization. And the error can take place at every stage of authorization.

Initially, the request goes from the store to the acquiring bank, which serves requests for cards of any banks (not only their own). Next, the acquirer generates a request to the payment system (the basis of online card payments). The best known international payment systems like Visa, MasterCard, let's not forget about the domestic MIR. The acquiring bank can send information twice - this is one of the reasons for the secondary debit.

Another unlikely reason- a failure in the payment system itself or in the processing center where transactions (requests) are being processed. The equipment may fail, the impact of interference during signal transmission or the wrong actions of employees (during troubleshooting or maintenance) can affect.

But most common cause is a problem with payment terminals in the stores themselves or outlets, or inability to use them (human factor). If the terminal failed and sent a second request for authorization, then the request will be processed and “passed” as a re-purchase.

Here it is important to notice the fact of an unauthorized operation in a timely manner, in which the connected SMS informing service will help you. That is why it is recommended to connect it to without fail, even though she is paid service(on average 60 rubles per month).

A similar problem can occur not only when paying, but also when bank transfer . Cases of fraud are not excluded. As noted in the reviews on this topic, they sin with a secondary payment small companies such as car rentals or small retail outlets.

Faced with the problem of secondary withdrawal of money from your bank card, you should not panic, as this situation is not so rare and quite solvable. First of all, it is worth understanding that it will be to blame for this " banking system', not specifically you.

It is also worth noting that if the system recognizes an error, the bank will automatically return the money debited again to you. However, there are also situations when, in order to return their money, the buyer needs to act independently by calling the operator or sending an application to the bank, which we will discuss later.

How to protect yourself from a possible double write-off

You are unlikely to be able to fully insure yourself against problems and sudden financial difficulties, and the recommendations below will minimize the risks of falling into a double write-off.

When paying on the Internet, you should not show your credit or debit card- get a virtual one (a matter of 2 minutes, for example, on Yandex) or open an additional card. At worst, get a special debit card (with disabled overdraft service). Before buying, replenish the card balance for the purchase amount - they will not physically be able to debit money from your account again.

When traveling abroad (or to the far corners of our Motherland), it is foolish to rely on a single card- get two or even three (let it be credit cards and debit cards), and be sure to have cash - at least a third of the planned expenses. Plastic may be suddenly blocked or an ATM, the only one in the area, may be without money.

In both cases, follow the rules for the safe use of cards.

How to get a refund after a second debit

If you feel something is wrong, then the only thing the right decision is a call to contact center bank (usually such calls are not charged).

In order to fully, without unnecessary strain and ambiguity, convey the essence of your problem to an employee of your bank's support service, you must prepare in advance all the available data on the secondary write-off:

- The web address of the site or the name of the store (outlet);

- Date and time of the duplicated operation;

- The exact amount of the purchase;

- Operation number.

You can find this data in the Internet bank (see the parameters of a specific operation).

For your identification, the employee will ask you to voice your passport data, so it would be better if your passport is with you during the call. Surely the employee will want to know your control information that you came up with when filling out an application for a card (if you forgot, then do not be upset, passport data is enough).

Now you can dial hotline the bank on whose card the debit was made (look for the number on the back of the card or on the bank's website). You should talk to the call center operator calmly and intelligibly, he is definitely not to blame for what happened.

The main purpose of your call is not to prove someone else's fault, but to quickly return your own money. In the case of structured communication and a clear message of the essence of the problem (sometimes it is worth being persistent), the operator will quickly respond to your request. As a rule, any bank already has a well-established set of actions for returning a double charge or for another emergency situation - this will allow you to quickly fix the problem (if it is of a technical nature) and return the money in the coming days.

- If you failed to return the funds “by phone” after the second debit, proceed to the next step - prepare a written claim to the bank. It must be taken to the bank branch or sent by registered mail. In the body of the letter: a description of the problem and a request for a refund.

A complaint can also be sent in other ways (for a start, you can try them): to the bank's e-mail address, through the feedback form. But a written claim is the most effective way. And if you demand to make a copy of your application with a mark of acceptance, then the bank will not "get out" in any way. In both cases, if possible, you should have on hand confirmation that your application was accepted (application number, copy of the application, etc.).

After all the operations described above, it may take the bank no more than a week to consider the application you sent (depends on internal rules credit institution). The bank starts investigating a specific case, and if the bank employees do not have suspicions about the technical nature of the write-off, then most likely you are guaranteed to receive money back to your card account in a few days.

Otherwise, if in their opinion there were two purchases in a row, the investigation may take longer - up to 120 days.

If you booked hotel rooms, bought plane tickets or carried out similar transactions on websites, and double the amount was deducted from your card, then, as advised in the reviews, you can contact the online services support service directly. Usually, well-known Internet companies meet the needs of customers and resolve the issue of a refund at their level.

In general, there is nothing impossible, and the money will be returned to you, though you will shake your nerves a little. But there is a small nuisance that can happen if you are repeatedly charged the purchase amount with an insufficient balance on the card, i.e. balance will go negative. This phenomenon is called an unauthorized or technical overdraft - it turns out that you take an unnecessary loan from a bank for a while and are forced to pay interest on it.

On the part of the bank, it would be good form to return the accrued interest to the cardholder for a technical overdraft that occurred through no fault of his. But usually banks do not do this, although you, as an illegally “robbed”, could argue with them - write claims demanding a refund or make them anti-advertisement on the Internet, but is it necessary, because the interest is usually not large, the main thing is to return the re-debited amount!

Plastic cards are considered reliable instruments for financial transactions, but certain risks still exist. Customer complaints have become more frequent that fraudsters have withdrawn money from a Sberbank card.

Page content

Russia has taken a leading position among other European countries in terms of the number of thefts in 2013. Anyone who has been a victim of illegal withdrawal of money needs help. Regulation of such issues on the territory of the Russian Federation is carried out federal law No. 161, which began to operate in 2011.

The main types of banking fraud:

- Phishing. Attackers send an SMS or an email to the cardholder's email box containing a link to a malicious resource. After going to this site, the scammers become aware of the user's login and password from the personal account of Internet banking.

- Skimming. Criminals use overlays that can stick to a keyboard or camera to get a PIN code. They install a special device on the receiving device that allows them to steal all the information contained in the magnetic strip of plastic. Then a duplicate of the product is made, and the funds begin to be withdrawn without the participation of the owner.

Funds stolen from Sberbank card

Consumer stories that the attackers withdrew money from the Sberbank card, and what to do, are often found on the Internet. Write-offs also occur for other reasons, such as a technical failure in the ATM OS. It is illegal to withdraw funds without the consent of the plastic holder, which means that the owner has every right to receive a refund.

If the erroneous withdrawal was caused by a malfunction of the terminal, the situation is easier to solve. Sometimes a refund occurs even without the owner's request, as the finances remain on the account after each successfully completed operation, but become blocked. At the end of the day, the traffic report is sent to the acquirer. This is the bank to which the terminal belongs.

All completed operations begin to be checked for the question of successful completion. Then, for each of the successfully completed transactions, money is transferred, and debits are posted by banks. The entire process takes approximately 4 business days.

However, if you believe the reviews of users affected by uncoordinated write-offs, you cannot rely on the well-functioning of the banking system, so you should not wait for a return without taking any action. It is recommended to immediately call the Sberbank hotline and tell about the problem.

A call center specialist will offer solutions and explain how and where to file an application if the money was stolen. Evidence such as a check from an ATM or a photograph from a terminal screen is often attached to it.

Attention! Maximum term the investigation may take 180 days, and during this period it is possible to write off the commission for considering the issue.

In the case when funds began to partially disappear on a regular basis, it is imperative to write an application on behalf of the holder for a refund. However, this does not apply to transactions confirmed by a PIN code, since the client is responsible here, and therefore the money is not returned.

The successful resolution of such issues is 50 percent dependent on the promptness of the client. Immediate treatment increases the chances of a positive outcome. Connecting notifications will eliminate the need for constant monitoring, as the holder will know about each replenishment of plastic or withdrawal of cash from it via sms.

Online transactions are more difficult to protest, but the procedure required from the client is similar here. Most banks refuse to accept such applications, having entered the relevant provisions into the contract in advance.

Important! If plastic is not used, please contact call center and block the account linked to the card.

In case of unauthorized removal, the following recommendations should be followed:

- Do not panic, but analyze the options, because the money could not just disappear. This is a payment for mobile alerts, annual maintenance, or a write-off for a previous purchase.

- Immediately block the card through the support service, or at the Sberbank office.

- Prepare and apply for a refund.

- In case of loss of money from the card, lawyers recommend going to the police and reporting it in writing. As a result of such actions, bank security specialists begin to work more quickly. The police officer is required to file a criminal case. Further, at the request of the victim, a video is withdrawn from the ATM camera to prove unauthorized cashing.

- If the return is rejected, you should go to court. If the illegality of the write-off is proven, the holder will be refunded.

If the scammers transferred funds

In case of theft of money by intruders, you should adhere to the following algorithm:

- Call the call center to block.

- Exclude such write-off options as auto payments or debt to bailiffs.

- Contact any of the offices of Sberbank and file an application with a request to figure out how the money could have disappeared, as well as a claim for damages. It is worth carefully studying all the clauses of the agreement with the bank, which contain cases of theft of funds. If you do not agree to accept the complaint, you should warn the manager about your intention to go to court, this usually helps to resolve the dispute. Evidence of theft will be especially useful. If the client has previously applied to the police with a statement about the theft of a bank card, he has the right to attach a copy of it to the complaint to the credit institution. This will help to prove non-involvement in the transactions made after the date of the institution of the criminal case.

- It remains to wait for the agreed period and hope for a positive result of the appeal. If the answer is negative, you should take a written refusal from the office and go:

- to the police department to initiate proceedings against the bank;

- to the prosecutor's office and file a claim.

An application in court must be accepted on the basis of Articles 14 and 7 of the Federal Law governing the protection consumer rights on the territory of the Russian Federation.

If money was withdrawn from the card at an ATM

There is a possibility of erroneous withdrawal of money from the account as a result of a failure in the operating system of the ATM. In this case, the device returns the card, but does not issue funds. The holder's phone receives a notification of the debit. act in similar situation should immediately:

- Make an application remotely with the help of a support service employee, or at a branch of Sberbank.

- Wait for the bank to review the request.

Often the decision to return funds that were debited as a result of a program failure is positive. As a result, the consumer will receive an SMS about the updated status. If the owner of the plastic was refused, it remains to appeal to the court or the police.

However, terminal malfunctions are not the only reason for erroneous withdrawals. If the criminals got the PIN code and information from the magnetic strip using special devices and began to steal funds, the algorithm of actions remains the same.

Once the application is submitted, security personnel will review the video from the ATM based on the date and time of cashout without the consent of the customer. Based on the file, it will be established that the theft actually occurred. In this case, the bank is obliged to return the amount that the criminals were able to steal.

The bailiffs took the money

Bailiffs use the following powers in their practice:

- search for the location of debtors, their property, requesting information from the bank;

- arrests of accounts;

- withdrawal of money without the consent of the holder.

Bailiffs constantly cooperate with Sberbank, since most consumers choose the products of this particular bank.

Important! Based on the decision of the court, the funds will be debited from the card, including the credit card, regardless of whether the owner agrees or not.

Many users are interested in how to find out why the bailiffs withdrew money from the Sberbank card. This can be done when requesting an extract on the write-off at the Security Service department, and then contacting the bailiff service attached to the registration address. In case of refusal to provide the necessary information orally, you need to write a statement to the head of the organization asking for help in the current situation. It usually takes up to 7 days to process.

To find out why bailiffs deducted money from the Sberbank card and the presence of debts, it is not necessary to come to the office. The option is available on the website http://fssprus.ru/iss/ip/. Recovery from accounts begins after a decision is made on their arrest and crediting to the details of the bailiff department.

After joining court order into force, the authorized officer of the FSPP begins to act. He is obliged to notify all parties of the initiation enforcement proceedings. However, this is not always the case, especially in cases of immediate execution.

If the money was taken illegally, you will have to go to the FSPP again and write an application demanding to check, cancel the decision and return the debited amount. The process is accelerated by the provision to the bank of a certificate of the absence of claims against the applicant from the bailiffs.

Funds can disappear without notifying the holder for common reasons:

- overdue fine traffic police;

- non-payment of alimony;

- loan debt;

Unpaid fines can also cause a forced debit from the card account. Here, no action is required from the holder. After the payment of the fine is credited to the details of the bailiffs, the money will be transferred to the traffic police.

If there was a second write-off for an already paid decision and an alert was received on the mobile phone, you will have to contact the bailiff responsible for the execution of the client’s case with a copy of the receipt. There, the consumer will need to write an application to unblock his account and demand a refund of the overpayment.

Write-off of money without the participation of the consumer can occur at the initiative of a credit institution. As soon as this happens, you need to call the bank support service or go to account"Sberbank Online" and find out the reason for debiting funds.

Attention! If at the expense of plastic received wage and it was completely written off to reduce the debt on the loan without warning the owner - this is illegal.

This is a difficult situation, but it can be resolved. It is prohibited by law to write off more than 50% of the amount from the debtor as a recovery. However, the entire amount is automatically debited. This practice is often used against bad debtors. To find out why this happens, consumers begin by carefully reading the contract. It states that banks have the right to withhold money from accounts if the consumer evades the payment of the loan.

The client can write an application addressed to his manager with a request to issue a salary in cash or transfer it to the plastic of another credit institution. The bailiffs cannot oblige the director to make contributions in excess of half of each of the payments to pay off the debt.

Poll: Are you satisfied with the quality of services provided by Sberbank in general?

YesNo

The money was debited to odnoklassniki.ru

If a cardholder registered in Odnoklassniki has set VIP status on his odnoklassniki account as part of a free promotion and has not turned off the service in time, 249 rubles will be debited from his account. To prevent unwanted withdrawals, it is important to remember that subscriptions and services connected to social networks may be paid. Restoring the balance in such a situation will not work. You should also not link a plastic card to an account.

How to protect your funds

Although it is possible to recover money due to illegal withdrawals, it is more advisable to take steps to prevent such situations:

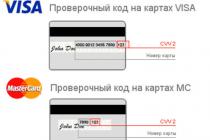

- Personal information printed on both sides of the plastic, as well as the PIN code, cannot be trusted to unauthorized persons. This data should not be disclosed even to employees banking organization under no circumstances.

- It is better to avoid shopping in suspicious online markets. These include sites whose address does not start with the standard https://.

- For online payments, you should set a separate password. According to statistics, most of the theft occurs when making purchases on the Internet.

- If the PIN code cannot be remembered, it can be written down in cellular telephone in the form of a draft SMS or a contact with a fictitious name.

- Protects against unauthorized write-offs connection of mobile banking. For each financial transaction notification will come. If the holder has changed the SIM card, it is important to immediately rebind, as operators transfer phone numbers to other subscribers.

- Sberbank Online as an application for Android OS will become an excellent travel assistant and provide constant access to account management.

- Before withdrawing plastic money from an ATM, you need to carefully look at whether there are extraneous and suspicious devices in the device. If the product is stuck in the terminal or a message appears that the PIN code was entered incorrectly (and it is correct), you should immediately call the bank's hotline, as this is the main sign that a device for reading information by fraudsters is installed in the ATM.

- No need to confirm operations that the user did not perform.

- A lost card should be blocked immediately.

- The installed anti-virus utility on a PC and mobile OS will protect the device and its owner from thinking about how information could be stolen from my phone.

- You should not go to suspicious sites in SMS or emails.

Citizens refuse to participate in the uncoordinated protest action, which is planned by the opposition on August 3 in the center of the capital. The report says that the police receive information about possible violations of public order and impending provocations, including the use of aerosols and pyrotechnics. The police warned that they would respond promptly to offenses and take all measures to ensure law and order and security.

As Sergei Boyko, chairman of the Libertarian Party, told Vedomosti, party members applied for a rally in Moscow on August 3 in support of unregistered candidates for the Moscow City Duma. They asked the city authorities to coordinate the event on Lubyanka Square. The party also tried to negotiate a procession from Strastnoy Boulevard through Turgenevskaya Square along Myasnitskaya Street to Lubyanskaya Square, Interfax reported. However, the capital's mayor's office offered instead to move the rally to Akademik Sakharov Avenue, where on July 20 an agreed-upon rally was already taking place to allow independent candidates to participate in the elections. Libertarian Partyshe did not agree to this site and sent an official refusal to the rally to the mayor's office.After that, the officials invited politicians to meet and re-discuss the place and format of the event. To do this, the leaders of the Libertarian Party arrived at one of the buildings of the capital's government on Novy Arbat.One of the leaders of the party, Mikhail Svetov, was detained immediately after the negotiations. Most opposition politicians will also miss the August 3 rally: Alexei Navalny, Dmitry Gudkov, Ilya Yashin, Yulia Galyamina, Ivan Zhdanov received administrative arrests.

The previous uncoordinated protest against the exclusion of independent candidates took placeJuly 27th. She was one of the most popular. According to the Ministry of Internal Affairs, 3,500 people took part in it, the organizers counted at least 10,000. The Ministry of Internal Affairs reported on the detention of 1,074 people. According to OVD-info, there are more detainees -1373 people. Among them were 42 minors. At least 25 people were injured.Moscow Mayor Sergei Sobyanin assessed the actions of the police as adequate.

As a result of the uncoordinated action, the Investigative Committee opened a criminal case on mass riots at an opposition rally. As noted in a press release from the department, a group of people “repeatedly posted calls on the Internet to take part in it,” but the names of the defendants were not named. The maximum punishment under this article (many defendants in the Bolotnaya case were convicted under it) is 15 years in prison. T Three criminal cases have also been opened on the use of violence against representatives of the authorities. The maximum sentence for it is five years.

Every day the number of consumers who turn to plastic card when paying for purchases and services. People are becoming more and more convinced of its convenience and safety when paying. A bank card has gained popularity, becoming the main payment method for purchases in online stores and online payments, All in all. Number non-cash payments is growing day by day. Online shopping has become convenient and fast.

But they also have disadvantages, among which is a double debit from the card, including from Sberbank. How to solve this problem? What to do if Sberbank debited money repeatedly?

Why is this possible? Money deducted twice from the card may be due to problems with the equipment, although consumers are sure of bad intent or fraud of bank employees. Basically, such an error occurs due to a system failure. How does it happen? When paying for the purchased goods via the Internet or in any mall you receive an SMS-message stating that you have made a purchase, and the money for it has been debited from the card. Everything is as usual. But after a period of time, another SMS comes about the same. You remember that you did not buy anything else, and you understand that the operation was repeated. The second write-off duplicated the first. And this can happen even not for the last purchase, but for any one that was paid for by a card.

Card payments are, as it were, links in the chain between which requests and answers occur, i.e. authorization. An error can occur at any point in this chain. How?

- Card requests are accepted by the acquiring bank. He can make a mistake and send the purchase information twice.

- Hardware failure, although this happens infrequently.

- Poor operation of the terminal or an error when working with it by the cardholder is the most common reason why Sberbank can write off money twice.

It is good if the repeated debiting of funds from the card is noticed by the owner immediately from SMS. Although the connection of this service is paid, it is better to use it for account security purposes.

Cases of fraud are also possible when making a transfer Money through a bank. Consumers notice similar violations when applying for services from small companies.

Withdrawing funds from the card repeatedly is not a rare mistake, so there is no need to be scared. It is possible to solve this problem. First of all, figure out if you or the bank's system made a mistake. If the banking system is to blame, your money will be returned in full without any problems. In some cases, calls to the operator, to the bank are required.

Actions to protect against secondary write-offs

There is no absolute way to protect against a possible double write-off, but you can reduce the risk by following the tips:

- If you often make payments via the Internet, it is better not to risk your card - it is better to get an electronic, additional or special one. If you are going to buy something, put money on this card only for the purchase price. Double write-off is already excluded.

- When traveling long distances, you should not rely on the main card. It is advisable to have additional cards and cash. After all, the card may not work, and the lack of ATMs or money in them will be an unpleasant surprise.

Important. In any case, be sure to follow the rules for the safe use of cards.

What to do to return double debited money

If you find this, contact your bank at a free rate by calling the contact center. Gather all the specific information about the double withdrawal before calling:

- the name of the trading company or the address of its website;

- day and hour of secondary withdrawal;

- purchase price;

- number under which the operation took place.

All this can be found in the data of the required transaction in the Internet bank.

A passport should be at hand - after the call, a bank employee will ask for personal data. It would be nice to remember the control story invented to receive the card - this can also be asked.

If all the above information is ready, you can call the hotline of your bank. Calmly and accurately describe the situation.

Do not look for the culprit of the error. The main thing is to quickly return the lost amount. With a clear explanation, your problem will be solved promptly.

Important. Sberbank has debugged actions to correct the situation and returns the funds in a short time.

Phone calls didn't help? The action is as follows - submitting an application to the bank in writing, describing the problem and requesting a refund. You can file a claim in person or by registered mail, by e-mail with a request to make a copy and note the acceptance. You will have a supporting document in your hands, and the bank will be forced to investigate the situation.

The rapid increase in remote payment methods is gradually replacing cash from circulation. Paying with plastic is faster, more convenient, and access to bank services is almost around the clock. However, there are situations when credit cards are withdrawn from the account a large amount than set. Double debiting from a Sberbank card occurs for several reasons that can be established independently or with the help of branch employees.

The essence of the problem of double debiting money from a Sberbank card

When a bank client purchases certain goods or makes a payment using plastic, the SMS notification of the transaction may be repeated. In this case, cardholders are faced with double debiting of funds.

The main reason for the problem is a technical failure of the bank's system. You can re-debit money not only for the last transaction. Notice of additional deduction financial resources may come in a moment or several hours.

In addition to a technical error, the decrease in the account is due to fraudulent activities and some other reasons, the probability of which is much less. Payment bank card is a chain of actions, including the passage of authorization at each stage. The problem can occur at any stage of the process.

A technical error

The procedure for debiting money from the card contains the following steps:

- when paying by card, the device sends a corresponding request to the acquiring bank before withdrawing the amount;

- this is followed by an appeal to the Sberbank system through the payment system to which the card belongs;

- the financial institution processes the request;

- the response is transferred to the payment system, then to the acquirer;

- money is debited;

- through the terminal a report on the purchase is displayed in the form of a check.

If the owner of the plastic has activated the notification service via SMS, then after the payment is made, a notification is received containing information about the amount, date and seller. The acquirer can make a mistake by sending information regarding the purchase twice. One of the infrequent causes is also considered to be a failure of the terminal, equipment, payment system. Most often, difficulties are observed at direct points of sale due to the human factor.

Fraudulent activities

Deliberate debiting of money double size predominantly in small organizations. The list of such institutions usually includes small points of sale, car rental points.

Options for clarifying the reasons for withdrawing money from the card

If the same amount was withdrawn from the account of a Sberbank client twice, you can find out the source of occurrence in the following ways:

- dial single number contact center, ask the relevant question to the operator;

- enter Personal Area online service, view the latest transactions, order the details on the card;

- visit the Sberbank branch with a passport, request an extract.

In most cases, the bank safely returns the debited money in a short period of time. When contacting a financial institution, it is recommended to provide a certificate of the absence of debts from the FSSP.

How can you protect yourself from repeated withdrawals?

No way can protect the card account one hundred percent. The following recommendations will help minimize the likelihood of double debiting money:

- start additional card(virtual), to which only money calculated for a specific purchase will be transferred;

- when traveling abroad, it is recommended to travel with an additional card, take cash for an unforeseen event;

- carefully monitor the status of the account, checking each transaction;

- protect the card from third parties, do not transfer details to other citizens;

- refrain from going to dubious sites through unverified links.

Main return instruction withdrawn money includes a call to a single contact center. For the most effective dialogue, it is recommended to follow the instructions when talking with the operator and name:

- name, official website of the outlet;

- the exact time when the money was re-withdrawn;

- the amount of payment down to a penny;

- transaction number.

When talking with a hotline employee, you will need to give passport data, sometimes a code word specified in the agreement with the bank. The dialogue should be structured, with a clear message of the essence of the appeal.

If after a conversation with the operator the problem is not resolved, then it remains to visit any branch of the financial institution, write a corresponding application. Claims can be sent by registered mail to email address or through the official website. The most effective method is a personal visit, a photocopy of the application with a note of perfect acceptance. With confirmation of acceptance of the request, Sberbank is obliged to respond to the applicant.

Consideration of the situation takes up to seven business days. If Sberbank suspects a client of two equal purchases, then the analysis will take up to one hundred and twenty days. When buying tickets, booking rooms online, it is recommended to contact the support service of seller sites. Companies with big names, cherishing their reputation, resolve the issue in accordance with their own regulations.

Conclusion

The complex chain of the plastic payment process includes many different probabilities of problems. Most cases end with a refund as soon as possible. For round-the-clock control and management of your own account, it is recommended to activate the SMS informing service.