2016 will be a year of testing for the Russian economy and for the wallets of Russians. How to protect yourself and save your money as much as possible?

Gold

Gold, along with oil and other commodities, is an antagonist to the dollar. Given that the US Federal Reserve has set a course for a gradual key rate for the US currency, it is probably not worth focusing on precious metals in 2016 against the backdrop of a slowdown in the global economy. In addition, unlike deposits, the banking system is facing difficulties. There is no need to hope for compensation if something happens.

Real estate

In 2016, the construction market will also be in a difficult position. Probably ruble prices will reach their "bottom" and stop falling. Within a few years, due to the shortage of square meters, prices can even bounce up by 20-30%, but you need to understand that the planning horizon here is rather uncertain, and the risks have grown significantly. At the same time, dollar prices will continue to fall due to and.

mutual funds

Some mutual investment funds at the end of 2015 showed a decent (40% -60% per annum) profit. In particular, these were Eurobond funds. Meanwhile, there is no guarantee that the trend will carry over to 2016. At the same time, investments in securities are always a risk, and especially in times of crisis.

Ruble

A ruble deposit in 2016 will traditionally not even cover inflation, which is likely to exceed double digits. We can only hope for oil, the price of which is 50% likely to start in the second half of 2016. Or not, given the latest news and the unpredictability of geopolitical risks.

Euro

The European economy continues to be tormented by the crisis. Near-zero growth rates and negative rates on bank deposits remain a sign of this. In 2016, the euro will grow against the ruble, and become cheaper against the dollar.

Dollar

The 0.25% increase in the Fed's key rate can be called symbolic. Along with this, it is stated that in total such increases can be up to 1.5%. At the same time, the main thing here is not so much the number, but the very fact of the US Federal Reserve's confidence in a conjuncture favorable for this.

- 1. Bank deposit - which bank is better to put money at interest

- 2. Real Estate Acquisition (Editor's Choice)

- 3. Investing in mutual funds

- 4. P2P lending

- 5. All or Nothing - Binary Options

- 6. Investing in someone else's business

- 7. Invest in your own business

- 8. Investment in precious metals

- 9. The magical power of art

- 10. Investing in venture funds

- 11. Invest in cryptocurrency

- 12. Invest in phone apps (iOS, Android)

- 13. Investing in groups, publics in social networks

- 14. Purchase of a payment terminal

- 15. Invest in yourself

- Method number 1. Acquisition of shares

- Method number 2. Microcredit in Webmoney

- Method number 3. Investment in web projects (websites, portals, services, etc.)

- Method number 4. Investing in PAMM accounts

- Method number 5. Earnings in dachas and summer cottages (editor's choice)

- Expert Tip #1. Deposit in a commercial bank

- Expert Tip #2. Investing money in real estate

- Expert Tip #3. Currency investments

- Expert Tip #4. Investing in your own online business

- 4. Where it is better not to invest money - recommendations

- 5. Conclusion

Economists' forecasts for 2019 (the 20th, most likely, too) are becoming less and less comforting. The catastrophic collapse of the ruble, the irrational jumps in lending rates in banks, the tense atmosphere in the stock market - all this sad news leads to serious reflections of every Russian.

Everyone thinks about the same thing: how to avoid unfortunate financial losses, what and where to invest your money in order to earn, save, or at least not lose, in order to receive monthly income and so that the wave of financial cataclysm does not completely absorb money, as well as from what purchases should be avoided today, etc.?

But first you need to recharge optimism . Just think about the fact that, unlike millions of other people, you have free capital today. It means that you did everything right before and you have a chance to get out of this situation. Main– choose the most justified investment instruments.

What if you want to invest money and earn money, but you don’t have money. For this, we wrote an article - in the same place we described what to do if banks and microloans refuse to give you money.

About ways to invest money in order to save and increase, read below. There you will also find expert advice on where to invest during and after the crisis.

1. Where to invest money so as not to lose - 15 ways to save capital

Each of the following ways of investing is characterized by a greater or lesser share of risks. And at the same time, under favorable conditions, each of them is able to provide liquidity and profitability to your capital.

Let's take a closer look at financial instruments and their capabilities, where you can invest money today in order to consistently receive monthly income.

1. Bank deposit - which bank is better to put money at interest

This method is hardly more profitable than saving money at home "under the pillow." It is hardly worth considering it for a serious investor. It is reasonable to use a bank deposit only as a "transit" point on the way of capital movement into more solid financial instruments.

Investing in a bank deposit is not the best way to increase capital, it can rather be attributed to a way to save your money.

Any economist will express doubts about the reliability of " airbags » bank deposit. After all, in the case of an urgent withdrawal of money, you can lose all the accrued interest. It is generally difficult for banks to part with dollar deposits.

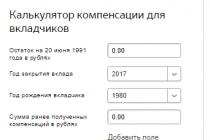

If you want to entrust money to a financial and credit organization for a while, then the best solution would be to distribute 1,400,000 rubles to various banks. Such a volume of deposits will allow you to reliably insure your capital in the event of the ruin of any of your chosen financial institutions.

Where to invest money to make it work - 7 ways of investing that I have experienced on people

In which banks is it better to invest money at interest?

When deciding which bank to invest in and where to open a deposit account, get to know TOP 10 leading banks in the country, pay attention to their reliability rating. It is good if the co-owner of the financial institution is the state. It is unlikely that it is interested in terminating the activities of its own banks. Among them belong, For example, such "bison" of the Russian financial market as Rosselkhozbank, Sberbank, VTB and some others.

We present the TOP 5 banks in which you can safely invest your money at interest

- Bank "Sberbank"

- Bank Rosselkhozbank

- Bank VTB24

- Bank "Gazprombank"

- Alfa Bank

2. Real Estate Acquisition (Editor's Choice)

There is a misconception that in order to start making money in real estate, you need to have a large start-up capital. In fact, there are several options to get all the benefits of investing in real estate with a small amount of 200 to 1 million rubles at your disposal:

- Using the principle of leverage and good debt

- Participating in a co-investment project, when a group of investors pools up to buy some tasty asset

One of the principles of investing that Kiyosaki talks about all the time is using good debt and leverage. The bottom line is that you use only part of your money for the purchase, and take the rest from the bank at a certain percentage.

For example, you have 1 million rubles that you are ready to invest in real estate, consider two options:

You purchase for cash a small studio apartment in a new building in a provincial town. When a new building is commissioned (about 1.5 years after the excavation), it usually rises in price by about 20-30%, that is, in fact, you will receive a yield of about 1.5 - 2 times higher than the bank.

Option number 2 - you take 1 million rubles and purchase 3 apartments using leverage (mortgage). For each apartment you make a down payment of 10% and the bank pays the rest. While the new building is being built, you pay interest on the mortgage - about 10,000 - 15,000 for each apartment or 30 - 45,000 per month for a loan, then exit the transaction at the final stage - with such a scheme, the yield increases to 60 - 100 per annum.

Watch a fragment of Nikolay Mrochkovsky's seminar in which he analyzes this strategy in more detail:

Acquisition of real estate at the stage of closed sales

A real example of one of our investors Nikolai Mrochkovsky - he bought an apartment in a new building in the city of Gorodets in the Nizhny Novgorod region at an early stage at closed sales for 975,000 rubles, after 6 months he sold it also at an intermediate stage through a developer company for 1.3 million) profit amounted to 325 thousand rubles for 6 months of investment or 33% in just 6 months.

But such projects usually do not appear in open access, it is better to look for them at closed meetings and in investor clubs,

Investing in real estate with maternity capital

Investing in real estate in 2019

During the collapse of the ruble, square meters become much more affordable. However, this investment tool requires a professional approach.

In 2019, we recommend considering real estate investment strategies that are focused on getting a stable cash flow, and not rely on the growth of property values. There is a high probability that the price tag for sale will be low for quite some time many new buildings are at risk of becoming - unfinished

Investing in real estate will almost always save your investment, and with a competent approach to investing in real estate, it will increase your investment.

Real estate investment options with stable rental income

Free knowledge base on investing

41 ways to invest in real estate

If you are going in the future make a profit by renting out housing, then it is most rational to purchase several apartments now in a new building of a single building or an apartment building. The cost of rent will be increased by such factors as the location of housing near the metro or railway station, the developed infrastructure of the area, the presence of large enterprises, airports, etc.

By investing in real estate for rent, you can consistently receive a monthly income. (This can include both commercial real estate (renting a room, warehouse, office, etc.) and residential (cottage (house), apartment, room, etc.))

Download a free business plan from Yury Medushenko

How to buy an apartment building with bank money and receive rent from 100,000 to 300,000 per month

It is advisable to carry out investment activities with real estate at the peak of the crisis. To determine the moment when the recession reaches the bottom, only a true pro can. Therefore, enlist the support of such an expert. It will give you the best deal.

3. Investing in mutual funds

The essence of this contribution is as follows: you entrust your capital to the fund, where it is managed by a team of professionals. You pay for the activities of those who manage your money and you yourself are responsible for it. But for all that, it is a fairly stable source of average income.

It is important to choose a mutual fund with the most popular securities and hope that the market does not “storm” from strong fluctuations. According to statistics, after the previous crisis, solid mutual funds managed to return money to investors only after 4-5 years. The most persistent of them were able to accumulate up to 40 % arrived. (What is a mutual fund, as well as about other ways to invest money in order to make a profit)

A significant advantage of this method of investment is the ability to withdraw your capital or its share at any time.

4. P2P lending

We are talking about the so-called social loan, when ordinary citizens act as lenders and borrowers. The monthly yield of such peer-to-peer lending can reach 50 % . Your clients will be ready to enter into insured transactions with you at one and a half percent per day.

True, the system that provides a platform for such microloans takes half of each of your percentages. However, you will have your 0.70% per day stably. And after some time, having withdrawn your deposit, you can already earn on profit.

5. All or Nothing - Binary Options

This is sometimes called binary options. This investment tool either gives a fixed amount of profit, or gives nothing. It all depends on the fulfillment by its participant of a certain condition at a certain time. Here you can acquire a huge capital, and you can lose it.

If you do not understand the marketing topic, then fortune is unlikely to smile at you here. Like a fish in water on a binary option, only the “aces” of the currency sphere, who are able to predetermine the potential risks of the transaction, feel. What are binary options and how to make money on them read in.

Binary options are a high-risk financial instrument, but where there is high risk, there is high profit.

If you still want to try yourself in binary options trading, we recommend choosing a reliable broker that has been providing its services for many years. For example, this could include a company IQoption.

6. Investing in someone else's business

Investing in someone else's business is always a risk, especially in times of crisis. After all, it’s not just, as some people think, “invested and forgot”, but the interest itself “drips”. To be profitable, you must be 100 % confident in the people you trust with your savings.

In Russia, such "numbers" are rarely held. Any business we have requires personal participation. If you still decide to invest in someone else's company, do not part with all your money at once - limit yourself to some part.

7. Invest in your own business

Small-scale business is the surest tool for increasing investment in times of crisis. Of course, at the very beginning, one cannot avoid meeting with risks. However, having stepped over the starting line, you can breathe a sigh of relief.

It is clear that it is hardly worth counting on something grand against the backdrop of a fading banking activity and wage arrears. However, passion for an interesting business and overcoming difficulties on the way to success guarantee moral satisfaction. (you will find business ideas with minimal investment, what kind of business you can open at home, etc.)

Investing in a business is an excellent investment in order to generate monthly income. Recommendations on how to start opening a business, see the picture

Well established business is a reliable financial instrument where you can now invest money in order to receive monthly income, since it is the business that will not only generate income stably, but over time it will provide funds for investing in other financial instruments.

- Try to find your niche in the market with a minimum number of competitors. Do not rush into the "whirlpool", inhabited by "foreign devils."

- Follow the beaten paths: use ready-made models and business schemes - you will fill fewer cones.

- It is best to start with the sale of services, especially if there is not enough money to purchase goods.

- Try to avoid bank loans.

- Do not be afraid to start: not the gods of the company open.

8. Investment in precious metals

This is a proven way to save and multiply your savings. Precious metals are considered to be used in the manufacture of jewelry. Such valuable raw materials include palladium, platinum, silver, gold . They are too tough for inflation, so they are always in favor with far-sighted people.

There are several ways to acquire precious metals:

- Buying bullion in banks ( keep in mind that you will have to pay a 13% tax if they are sold (after 3 years, the tax on the sale of property (gold) is not charged)).

- Buying coins from these metals (you can use the services of Sberbank, the main supplier of such products). Unfortunately, the value of the coins is initially very high in relation to the value of the precious metals from which it is made.

- Acquisition of art objects and antiques from precious metals.

- Buying securities backed by gold on stock exchanges.

- Creation of a metal depersonalized account. On such an account, metals act as a currency. At the same time, a person who opened a metal account does not actually have any metals on his hands. There is a huge plus in this conventionality: no need to store valuables. Income from a virtual product is possible when metal prices begin to rise.

The profitability of this method of investing money is also not very high. In fact, no one will give you gold in your hands

9. The magical power of art

This reliable type of investment is far from being liquid for everyone. First of all, you should be well versed in art. Then the profit from these investments can simply go off scale. One masterpiece of painting or one marble figurine can bring hundreds of percent of income.

It is clear that the cost of ingenious creations is not threatened by any financial cataclysms. However, finding their true connoisseurs is oh so difficult. Practice shows that by buying a true work of art, you can absolutely save money in troubled times. But usually only 4 masterpieces out of 10 manages to come true.

10. Investing in venture funds

Investing in startups- innovative projects or enterprises are a business, both profitable and risky. We are talking about the introduction into production of previously unused technical know-how. Statistics show that only 2 % enterprises justify such investments. But the profit from them, as a rule, overlaps the rest. 7-8 % unsuccessful investments.

A deposit can be made not only with real money, but also with promised amounts (commitments). Profit should be expected in 3-7 years, until the financially protected companies are on their feet. The most chances in this business are small enterprises created in high-tech production areas.

11. Invest in cryptocurrency

Cryptocurrency is a new electronic means of payment that has come into practice on the threshold of a new millennium. It has a high level of protection. Bitcoin became the pioneer, followed by the other 150 of its “clones”.

Today, cryptocurrencies are becoming real competitors to conventional money and have a significant impact on the global economy. eBay and Amazon are already working with cryptocurrencies.

Of course, like any innovation, cryptocurrencies do not yet have a large scope of distribution. However, many experts believe that they are the future. Their main argument is the complete impossibility of inflation of a new type of money.

12. Investing in phone apps (iOS, Android)

The most profitable business– profiting from applications that can provide real help. It is no less profitable to invest in applications that aggregate useful information on a specific topic.

Noteworthy are also free applications, the hallmark of which is the sale of something.

13. Investing in groups, publics in social networks

Publics in social networks- one of the most common online messages of our days. Some try to make money in public, although this is a rather risky business - since there are a lot of scammers and schoolchildren in this field who have come for easy money

The main thing is to be a mega-active performer. If you are one of those, you are guaranteed success. This activity does not require special investments. It is enough just to fork out a little at the initial stage. And in the future, the number of subscribers can be increased through exchanges.

A large role in this matter is given to the content of the public, or rather, its quality. You need to be able to choose a topic that is interesting for a wide audience. The relevance of the topic will attract a lot of advertisers. The most popular and most monetized are publics that touch on the problems of money, success, gender relationships.

On the basis of such a popular public, it is quite possible to establish a profitable sales channel. The main thing is that the products sold are not very expensive and are intended for the mass user.

14. Purchase of a payment terminal

Payment terminals currently serve millions of people. The range of options for these software packages is constantly expanding. Using them involves a fairly high commission. Having bought several such devices, you will burden yourself with only one concern - to take money from them on time.

15. Invest in yourself

Finally, let's talk about the main thing - investing in your own development. It's not just important. This is the starting point of any business success.

Spare no money on "smart" books, useful seminars, practical trainings, valuable information products especially courses on investing and earning . They will become your guides in the ocean of money flows and investment whirlpools. They will teach you how to avoid pitfalls and avoid shallows. With their help, you can quickly filter out unnecessary, inefficient methods of earning.

The capital acquired in this way will always be with you. No one, under any circumstances, can take it away from you. He is not threatened by any force majeure, any crises. This is the lowest cost and at the same time the most profitable type of investment. After all, it is not just risk-free - it is anti-risk. Any investor can only dream of such a combination.

Without self-development, building an investment business is doomed to failure. Investing in yourself is a powerful idea generator and a unique catalyst for success.

Before you decide where to invest money at a high interest rate with a guarantee, you need to understand what an investment is - this is a difficult task, since a guarantee implies low risks when investing. The activity itself (investing) is a risky business, therefore, in any case, where high yield (high percentages) present and high risks.

2. Where can you invest money to earn money - 4 ways to invest money profitably

A fatal mistake is an unforgivable luxury for an investor. Especially in times of crisis. Therefore, experienced financiers know that a reasonable investment has nothing to do with what is popularly called "flogging a fever."

And one more investor taboo: he never reacts to the revelations of some unknown "trader-investor" Vasya Pupkin accidentally found on the Internet.

Basic rules for break-even investing

- Until you have experience, use only free funds for deposits. They do not include money borrowed from someone, bank loans. Investing always comes with risks. Don't deprive yourself of the last penny.

- Don't invest with your last money

- Take care of passive income by regularly saving part of your salary.

- Keep in mind "easy" money (won or inherited) tends to go away just as easily: they are not a pity, they are not earned. With them, you will need to be especially restrained.

- Stick to your investment plan.

- Carefully study each niche of your investments, relying on the advice of competent people who have achieved real results and sincerely wish you success.

- Start learning investing right now, just like you did when you studied art or physics in school, most people remain poor only because knowledge determines success in any business - especially in investing.

Consider the main ways where to invest money at a high interest rate with a guarantee.

Investment - is a risky investment of capital with the aim of generating income. Therefore, no one will ever give a guarantee that you will receive a return on investment. Each type of investment has its own risks, some risks are greater, others less.

Method number 1. Acquisition of shares

Buying securities can be a source of stable income. After all, becoming a shareholder of a reputable company, you can count on regular dividends. But this investment tool needs to be mastered thoroughly. You can’t just rely on luck, although there have certainly been cases in the history of the stock market when the price of shares “flyed up” dozens of times in a few years.

However, more often there are unadvertised stories with the loss of all investments. In order not to go broke, it makes sense to entrust the management of your savings to a professional trader with a credible history of profitability.

Method number 2. Microcredit in Webmoney

This payment service provides an excellent opportunity to earn on microloans. You can determine the amount of the borrowed amount and interest on your own. But it will not be easy to return a loan from an Internet fraudster.

So the risks of such online investment are quite high. Experts recommend getting a large clientele and giving out small amounts. And you can check the absence of claims against a virtual borrower by his account.

Method number 3. Investment in web projects (websites, portals, services, etc.)

The advantages of online investment include the following:

- the admissibility of their small volume;

- return speed;

- high level of profitability;

- the ability to scale the business without the threat of serious risks.

Now consider the features of various types of investment in sites:

1. Investing money for CPA affiliates

The essence of this method is that you receive your reward for a certain action on the site, namely: game registration, product purchase, application for a tour, credit card processing. Such affiliate programs are necessary for the promotion of any selling resource. At the same time, each affiliate solves its own specific problem.

For example, you are tasked with creating a landing page for bank cards. You describe several offers, after which you give affiliate links. If the application of the user of your page is approved by the bank, you are entitled to a reward, say, 1,500 rubles (payment for each application is determined by the conditions of work in a particular bank).

There is only one difficulty here - to catch up with traffic. However, if your efforts have had an effect, such affiliate programs can be very profitable.

2. Invest in MFA sites

This time we are talking about resources aimed at generating income from contextual advertising. You can hardly wait for an extra-large profit from this type of earnings. However, it has one very big advantage - the ability to install an ad unit on the site almost immediately. (For example, Adsense blocks or YAN blocks (Yandex advertising network))

And this means that the site will start making money almost from the first day of its existence. The level of profitability is largely determined by the theme of the site.

For example, a popular medical portal can bring from 15,000 rubles of monthly income (with an average attendance of 1,500 users per day).

It all depends on the ability to monetize traffic on the site. The most profitable sites for payments in contextual advertising are sites for financial, construction, etc. theme.

For example, the average financial "trust" site can generate income every month in the amount of 10 - 30 thousand rubles selling links.

True, at the current stage of development of search engine robots, the income from this type of investment has dipped significantly for many. Some even stopped betting on it after analyzing the unprofitable dynamics of income.

The main disadvantage of such monetization - after it, the site can be confidently written off as scrap, since search engines can impose sanctions on web resources and then the project's traffic will drop, and, accordingly, the income from selling links too. If the site earns in a similar "impure" method, you will not see a large amount of traffic for "clean" methods of income (contextual, banner advertising, etc.).

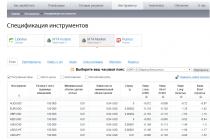

Method number 4. Investing in PAMM accounts

This type of investment in Forex is becoming more and more attractive today. The amount of the deposit can be limited to just 500 rubles, which contributes to the growing popularity of PAMM. The mechanism of this method of investing is to transfer cash savings to the management of a professional trader. This virtually eliminates non-trading risks. (We recommend reading in - How to trade on the Forex market, where to start playing on the Forex exchange)

A guarantee of the security of the interests of the depositor is the presence on the PAMM account of the capital of the manager himself. The latter is only allowed to make transactions on the account without withdrawing the principal's money from it. The depositor can always follow the progress of transactions online or view the history of their completion.

Big plus PAMM investment is an opportunity for the contributor take full control of your funds , entering and withdrawing them at your own discretion. An investor can also diversify his money by placing different traders on PAMM accounts. You can also make trading operations yourself by copying the transactions of experienced traders.

Method number 5. Earnings in dachas and summer cottages (editor's choice)

Dachas are one of the most undervalued markets today and here's why:

- Now it has again become fashionable and profitable to relax in Russia

- You can now register at the dachas

- You can live in dachas all year round and connect all the necessary communications

- Transport accessibility in big cities has increased significantly

- The dacha market has not yet won back the new conditions and there is practically no competition on it, while there are more and more people who want to buy a house for the weekend or for a vacation every day.

Watch a lesson from our expert - Anton Murygin, who just specializes in this special type of real estate:

3. Where to invest money to receive monthly income - 4 expert advice on where to invest money

The 2020s in Russia promise to be testing years for all citizens, including investors. So that it does not become ruinous for you, experts unanimously urge not to keep savings at home. In a year, they can depreciate by 10-15 % , or even higher.

You should also follow the forecasts of specialists and the advice of experts in various sectors of the economy and, of course, rely on your sixth sense.

Where is the best place to invest now? What investment recommendations do experts give in 2019? In what areas of investment now, in their opinion, are there minimal risks for investing funds? Where to invest to get monthly income?

Expert Tip #1. Deposit in a commercial bank

This financial instrument, popular with our compatriots, is recommended to be used, first of all, for those who seek not to increase their capital, but only to protect it from depreciation.

It is expected that in the 2020s, the inflation rate in the country will reach 13% - 15% (The Ministry of Economic Development predicts inflation at the level of 5-7%, but it all depends on the state of the economy and we can safely assume that inflation will reach the aforementioned 13-15 percent) . Meanwhile, the interest on deposits in the national currency averages 10-13%. Thus, interest payments in banks should cover the depreciation of money.

However, when depositing your savings with banks, you need to take into account two important points:

1 . When choosing a deposit program, give preference to the most reputable and stable financial and credit organizations. Today, the first positions in the reliability rating are occupied by such large financial institutions as Sberbank, Gazprombank, VTB, FC Otkritie And Rosselkhozbank.

2 . Before opening a deposit in a financial institution, you need to clarify whether it is a participant state deposit insurance programs. Upon receipt of an affirmative answer, you can open an account without fear, depositing up to 1,400,000 rubles : such a deposit is considered to be insured, and, in case the bank loses the license, it will be guaranteed to be returned.

Expert Tip #2. Investing money in real estate

Experts rightly believe that investments in residential buildings in 2019 are long-term investments. Now many industries have already begun to win back sharp jumps in the course and prices have risen, real estate is still holding on, and many developers and private traders give good discounts.

But if you know how to wait, then such a use of your money will be optimal. In a couple of years, prices will rise again, and you will become the owner of a decent profit.

Regarding the choice of investment objects, experts give the following instructions:

- Don't invest now (buy) commercial real estate.

- It is advisable to purchase housing in small, but promising cities: it is they who will become the "first swallows" in terms of rapid development in the post-crisis period.

- The ideal option is to acquire one- and two-room apartments: they are easy to rent out even in times of crisis; moreover, they are considered the most liquid type of real estate.

- To successfully sell a house after a crisis is over, it is often necessary to carry out repairs, worry about finishing work, which will give the room an imposing and respectable look.

- Solid investors can consider offers in foreign real estate markets. Today there is an increase in prices in the markets PRC, Thailand, Morocco, Brazil, Malaysia. And the cost of housing in these countries is not much higher than in the Russian market.

- If you do not feel confident enough in this area, hire a pro and pay him well. The financial assistant will warn you against many risks and will provide you with valuable information about promising construction projects located in residential areas convenient for living. You won't go wrong with this advisor.

Expert Tip #3. Currency investments

This type of investment is considered a worldwide recognized way of income in a crisis economy. Experienced investors can get a good income in a few weeks by transferring money from one currency to another. (We recommend reading -)

However, currency investors should take note of the following information:

- Those who are willing to take risks can make traditional deposits in dollars and euros: the value of these currencies will change depending on price fluctuations in the oil market and the balance of the world political arena. The main thing is when concluding contracts, keep track of forecasts.

- A more conservative group of contributors it is necessary to give preference to more stable currencies - the Swiss franc, the Chinese yuan or the pound sterling.

- Looking to buy now euro and dollars with a view to selling them next year, when the increase in market value is expected.

Expert Tip #4. Investing in your own online business

The most profitable business in the context of current economic problems is conquest of virtual space . The production of goods, as well as the provision of services, are extremely risky ventures in today's real market. Therefore, experts advise to invest (invest) money in Internet projects.

Your own Internet project can be created in various ways:

- in the form of an online store selling consumer goods;

- in the form of a personal blog or forum providing users with paid services or consultations;

- in the form of an information portal that allows you to place ads and advertising banners of third-party organizations and persons for a fee.

It is best to order a website and its promotion to IT specialists, and then constantly fill it with high-quality content and relevant offers. Unrestricted network activity by territorial and time frames is the best prerequisite for its profitability.

Other options for smart investments in 2019, according to experts, are:

- investments in PAMM accounts;

- own foreign exchange reserves

- investments in blue chip stocks and bonds;

- but we emphasize that real estate remains the most stable and interesting

These are typical pyramids like the infamous MMM. Crazy profits - up to 3% of profits - only their creators shine here. The lifespan of such a pyramid is from a year to a couple of months.

Another big adventure is online casino. No one has yet managed to win big money in it, but it is quite possible to drain all the capital. The fraudulent scheme of an online game is built on the inability of a gambler to stop in time.

If you do not own yourself, it is better not to have any business with either real or virtual rogues. Don't be tempted by "free cheese": chasing him always ends with the click of the mousetrap door.

5. Conclusion

So, you have learned about the most popular ways of investing during the crisis and got acquainted with the opinions of reputable experts on this matter. Now it's up to you. After all, it is up to you and only you to decide where to invest money (your acquired capital). You also bear the burden of responsibility for the decision you make.

Perhaps the choice of objects for investment at the moment is not as wide as many would like. Moreover, the situation in the country is so unpredictable that all forecasts are very relative. Therefore, you need to keep your eyes open and be able to quickly rebuild. The main thing to understand: a crisis

2016 promises to be a testing year for the Russian economy and for the wallets of all Russians. How to save your money and protect yourself as much as possible?

Gold

Gold, like oil and other commodities, is an antagonist to the dollar. Given the fact that the US Federal Reserve has taken a decisive course towards a gradual increase in the key rate, it is most likely not worth focusing on precious metals this year against the backdrop of some slowdown in the entire global economy. In addition, depersonalized accounts, unlike ordinary deposits, are not insured, and our banking system will face great difficulties. In which case, you will not have to hope for compensation.

mutual funds

At the end of the past year, certain mutual investment funds showed quite decent profits (40% -60% per annum). In particular, this can be said about funds. However, there is absolutely no guarantee that this trend will carry over into 2016. In addition, investing in is always a risky business, and even more so in times of crisis.

Real estate

In 2016, the construction market will also be in a difficult position. Probably ruble prices will reach their "bottom" and stop falling. Within a few years, due to the shortage of square meters, prices can even bounce up by 20-30%, but you need to understand that the planning horizon here is rather uncertain, and the risks have grown significantly. At the same time, dollar prices will continue to fall due to inflation.

Ruble

In 2016, the ruble deposit traditionally will not be able to cover even the amount of inflation, which is very likely to exceed the double-digit value. We should only hope for oil, the cost of which, with a probability of 50%, will begin to rise in the second half of this year. Or it will not start, given all the latest news and the sufficient unpredictability of geopolitical risks.

Dollar

The Fed's increase in the key rate by 0.25% can be considered symbolic. At the same time, it is stated that there may be several such increases, in the amount of up to 1.5%. The main thing here is not so much the figure itself, but the fact of the incredible confidence of the US Federal Reserve in a quite favorable conjuncture for this.

Euro

The European economy continues to be tormented by the crisis. The main sign of this is the negative rates on bank deposits and near-zero growth rates. In 2016, the euro will become cheaper against the dollar, and grow against the ruble.

Recipe

The recipe for saving your money in 2016 is as follows:

- 20% rubles,

- 30% euro,

- 50% dollars.

All this must be placed on deposits in the most reliable banks (top 30), divided into parts not exceeding insurance 1.4 million rubles.

Many financial investors would give millions (and this is not an exaggeration) to turn back the clock and briefly return to last year, when everyone fell asleep at one, and woke up at the moment when the national currency practically depreciated. The financiers who managed to invest their money in the American currency made quite good money on this, but, unfortunately, there were few of them. What to expect today? Analysts told in which currency it is better to keep money in 2016, and it is better to choose bank deposits as a form of storing your financial savings - they have been and remain the most reliable methods of storing finances.

Among financiers-analysts, there is a rule that money must be kept in the form in which it will subsequently be spent. In simple terms, it is most logical for Russians to keep their financial savings in their own currency, because one way or another, they live on the territory of Russia, where just such money goes. However, it is no secret to anyone that the ruble today cannot boast of excessive stability, because its exchange rate is influenced by too many unstable (in a crisis) factors - sanctions, oil prices, constantly growing inflation.

The ruble has lost the confidence of the Russians, but despite all this, many experts, speaking about it in 2016, still advise paying attention to it, because such an investment has certain advantages. If the storage of funds is planned for a relatively short period (up to one year or less), then the point in buying some other currency is simply lost, because the difference in the amount of purchase and sale will nullify all the benefits. Moreover, the interest on ruble deposits is always higher than on any other, therefore, by investing money in a bank in rubles, you can not only count on their preservation, but also on receiving benefits.

Dollars or Euros?

The stability of the American and European currencies, which, as practice shows, to stay at approximately the same level in relation to each other, can only be envied, therefore, thinking about what is the best way to keep money in 2016 in Russia, you should pay special attention to them. attention. As for the dollar, it is, as they say, in a special position and is considered an international currency. Despite the fact that some experts said that the dollar will soon lose its popularity, it remains quite stable, because most people still prefer to keep money in it. In addition, experts generally talked about the strengthening of dollar rates against other international currencies, so keeping your savings in US money can be an excellent investment.

Financiers warn that in 2016 it can “jump” against the ruble in exactly the same way as in the past. But in the end, it still normalizes, so they recommend not to panic and not try to buy and sell dollars at “jumping” rates. Those people who did this last year already realized how wrong they were, because they lost quite a lot of money on their frauds, it is possible that a similar situation will happen again this year, but in the end, all experts say that the dollar will take a fairly stable position.

It is difficult to say exactly what is better to keep money in dollars or euros in 2016, because the European currency is also quite stable and often it is a more profitable way to invest. The economy in the countries of Europe is also not distinguished by a sufficiently stable position, therefore, the euro is “at risk” of falling. Over the past few years, the euro has fallen significantly in price, which clearly does not speak in its favor, but the global financial crisis is to blame, so you cannot blame the European currency for instability - everyone has suffered. However, if you make a choice between the dollar and the euro, then it would still be preferable to buy American money, because according to preliminary forecasts of experts, it is they who will be in demand among international investors. The fact is that debt instruments are denominated in dollars, therefore, banks and investment companies will have to pay with this money, which means they will be in demand. Needless to say, where there is demand, there is also supply?

Is multicurrency deposit a way out?

Considering that it is quite difficult to find an answer to the question of what is the best way to store savings in Russia in 2016, it is worth paying attention to multicurrency bank deposits. Today, more than 40% of Russians use such offers from banks, and, according to experts, this is a fairly profitable investment. Banks offer people to open a multi-currency deposit, which successfully combines several monetary units (so to speak, the classics - rubles, dollars and euros, a whole "cocktail"). The disadvantages of such an investment include the fact that they have rather low interest rates, but they make it possible to instantly convert their investments, which minimizes the risk of losing money on sharp collapses in the foreign exchange market (you just need to carefully monitor all the necessary information).

Where to store?

As for the question of where it is better to keep money in 2016, everything is quite simple here - the bank is the ideal option, probably it is not worth explaining why it is necessary to choose it, but for those who do not understand: banking organizations help not only to save their money, but also increase it at the expense of interest, the amount of which depends on the type of financial deposit, while keeping money at home will not bring a person any benefit. An alternative option can be considered a deposit in bank gold, because it has a fairly stable price, but this method is only suitable for long-term storage of large amounts.