Today, oyster mushrooms are in great consumer demand, as they have good taste and are reasonably priced. Many housewives and famous chefs use this type of mushroom in the process of preparing a variety of dishes. Due to such high consumer demand, some people are thinking about starting a business in this direction. The process of growing oyster mushrooms is quite simple, and if you strictly follow the technology and provide favorable conditions for the mushrooms, you can regularly harvest a rich harvest. To organize their own business, aspiring entrepreneurs need to draw up a business plan for growing these popular mushrooms in Russia.

Before starting to grow oyster mushrooms, each subject entrepreneurial activity should get at least a general idea of this business direction. This mushroom is on the territory Russian Federation began to be actively grown in 2014, when foreign products came under embargo. Thanks to the departure of foreign manufacturers from the domestic market, Russian entrepreneurs have a chance to occupy the vacated niches. Today, there is great consumer demand for oyster mushrooms, and entrepreneurs working in this business area cannot cover the deficit. The absence of fierce competition opens up great prospects for people who decide to start their own business.

Stages of organization

To grow oyster mushrooms, a business entity needs to study technology, which involves four main stages:

- Mycelium (seed material) is purchased.

- The substrate is being prepared.

- Mushrooms are grown.

- Finished products are sold.

Once a plan has been drawn up, growing oyster mushrooms can begin in a specially equipped room. Immediately after planting the mycelium, the business entity must begin searching for clients, since after harvesting it will have only 5 days to sell it.

Search for clients, advertising

Each business entity should strive from the very beginning to form its own customer base, which is recommended to be constantly expanded. It should target the following consumer audience:

- Large and small retail outlets.

- Food markets.

- Restaurants.

- Pizzerias.

- Cafeterias.

- Canteens and other catering establishments.

- Enterprises that specialize in processing mushrooms and producing semi-finished products.

- advertise in all local media;

- order business cards, booklets, leaflets and brochures from the printing house;

- place advertisements on the Internet, on all available portals, etc.

Necessary equipment, choice of material

To grow cultivated mushrooms such as oyster mushrooms, a business entity needs to find premises that will meet established standards. It is desirable that it be located in an ecologically clean area so that the finished product does not contain any harmful substances or heavy metals. A novice entrepreneur can use a barn, hangar, garage or warehouse for these purposes. You don't have to make a purchase right away. You can save a decent amount Money, if you rent out the premises.

In a room whose area should not be less than 20 square meters. m., it is necessary to install a heating, lighting and ventilation system. IN mandatory You should monitor the temperature and humidity levels. You will have to equip a room in which the components used in the process of preparing the substrate will be stored. It is necessary to allocate a place where it will be pasteurized and cut.

To prepare the substrate, a business entity will have to use the following components:

- straw (wheat, barley and rye);

- flax fires;

- corn stalks and cobs;

- To increase productivity, you can add tree bark, shavings and sawdust, as well as chaff.

You can also purchase a ready-made substrate, but in this case there will be no guarantee of its quality. If the manufacturer saves on components, or uses them in the wrong proportion, then the entrepreneur’s mushroom yield may significantly decrease.

A business entity must purchase the following equipment:

| Naming of expenditures | Quantity | Price | total amount |

| Hammer Crusher | 1 PC. | 25,900 rubles | 25,900 rubles |

| Humidifier | 1 PC. | 2,850 rubles | 2,850 rubles |

| Pitchfork | 3 pcs. | 290 rubles | 870 rubles |

| Steam generator | 1 PC. | 28,800 rubles | 28,800 rubles |

| Solution (formalin) | 2 kg. | 47.80 rubles | 95.60 rubles |

| Exhaust fan | 1 PC. | 3,980 rubles | 3,980 rubles |

| Heater | 1 PC. | 6,800 rubles | 6,800 rubles |

| Boxes | 10 pieces. | 92 rubles | 920 rubles |

| Plastic bags | 500 pcs. | 9.85 rubles | 4,925 rubles |

| other expenses | 7,500 rubles | ||

| Containers intended for pasteurization | 2 pcs. | 3,800 rubles | 7,600 rubles |

| Total: | 90,240.60 rubles |

You can hire several employees to work in a greenhouse. They may not have experience in this field, but must have medical records. If the business gradually expands, the staff can be increased by 3-4 units. A business entity needs to hire an accountant who will draw up primary documentation, fill out accounting registers and form tax reporting. If a businessman does not want to pay for services staff accountant, he can enter into an agreement with an outsourcing company, which will provide accounting and legal support for a fee.

Costs and profits

To start a business from scratch, a business entity must incur the following monthly expenses:

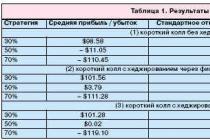

In order to determine the profitability of a mushroom farm, a business entity needs to carry out the following calculations:

- It is planned to plant 150 bags.

- An entrepreneur will collect up to 5 kg of mushrooms from one bag in a month.

- He will sell them at a price of 120 rubles per 1 kg.

- Mushrooms were sold for the amount of 90,000 rubles (5 kg x 100 rubles = 500 rubles x 150 bags).

- The spent substrate was sold for the amount of 1,275 rubles (150 bags x 8.50 rubles).

- In a month you can earn 91,275 rubles.

- Net profit for the month will be: 91,275 – 63,000 = 28,275 rubles.

A business entity will be able to recoup the initial investment in 4-5 months.

Possible income level

If a business entity follows its business plan, then literally after six months of active work it will be able to recoup the initial investment. If he puts in the effort, he can improve the profitability of his mushroom farm. To do this, he is recommended to take the advice of professionals:

- You can increase your income level by gradually raising prices. Initially, in order to attract customers, the business entity lowers its price by several positions, thanks to which it manages to lure most of the buyers from competitors. If they are satisfied with the quality of the finished product, then every month you can increase the cost of a kilogram of mushrooms by 10%.

- To increase income, an entrepreneur may think about expanding his business. To do this, he should build one or more greenhouses.

- You can increase the profitability of a mushroom farm by minimizing monthly costs. For example, a business entity can involve its household members in maintaining the greenhouse. In this case, you won’t have to hire employees or pay them wages. You can also save on payment transport services. If an entrepreneur has a personal car, he can independently deliver finished products to locations.

- To increase the profitability of your business, you can open a mushroom processing workshop. In this case, customers will be able to offer dried, salted, pickled or frozen products.

Registration and registration of business

If people decide to grow oyster mushrooms for subsequent sale, then they need to choose a legal form for their business. In this case, the following options are possible:

- Individual entrepreneur. For state registration You will have to pay a fee of 800 rubles. Fill out and notarize the application and attach it to it payment receipt, copies of all pages of the civil passport and identification code.

- Society with Limited Liability. For state registration, you must fill out an application in the established form. It is accompanied by the Charter, the decision (protocol) of the founder on opening an LLC, a receipt for payment of the state duty (4,000 rubles), copies of the founders’ passports (certified), orders for the appointment of a director and chief accountant, their copies of passports and codes.

- Peasant Farming. State registration is carried out according to the LLC principle, since the KFC is its simplified organizational and legal form.

The collected documents are taken by aspiring businessmen to the Federal Tax Service at the place of registration, since it is tax authority today serves as a state registrar. This can be done in person, or through an official representative, in whose name a power of attorney has been issued and certified at a notary office. Federal law allows you to send the registration documentation package by mail. To do this, you must issue a registered letter with a notification form and a list of attachments.

The documentation received from the businessman will be reviewed by the registrar within 5 working days. If no errors are identified, then an entry will be made about the created business entity in Unified Register. After this, the individual entrepreneur or the head of the LLC will be given an extract from the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs. With this document you must register with tax service and obtain taxpayer status. It is worth noting that business entities in the state registration process can choose a simplified tax regime, otherwise they will automatically be transferred to the general taxation system.

If people decide to grow oyster mushrooms for personal use or for sale to neighbors and friends, then they do not need to obtain the status of a business entity. To sell specialized products in markets, catering establishments and wholesalers, the entrepreneur must have the following documents:

- A certificate that confirms the compliance of grown mushrooms with GOST.

- A protocol confirming that there is no radiation in oyster mushrooms.

- Certificate (phytosanitary).

- A license giving the right to sell food products.

Disadvantages and advantages of this business

Growing oyster mushrooms on an industrial scale is a fairly promising and profitable area. It can be developed both by established business entities who have decided to expand their business, and by people who have just decided to open their own business. According to statistics that are publicly available on the Internet, the profitability of a mushroom farm may well be 40% or more. Every year the turnover of such products in the Russian Federation increases by almost 8% -10%. Besides high profitability The advantages of the mushroom business include the following:

- Oyster mushroom grows very quickly. Under favorable conditions, 1-3 weeks are enough for it to fully ripen. Thanks to this, the business entity will be able to repeatedly collect and sell crops.

- Unlike other areas, the mushroom business does not have such a negative factor as seasonality. Oyster mushroom can be grown all year round, if the necessary conditions are created for this.

- Quite high market prices are set for finished products, which will not change downward in the near future.

- Growing oyster mushrooms should be carried out in accordance with a technology that is quite simple and not too expensive.

Despite the visible advantages of the mushroom business, beginning businesses must take into account all possible risks:

- A rather short shelf life can cause damage to a batch of goods if the buyer refuses it. To minimize this risk, an entrepreneur needs to constantly expand its customer base. Thanks to the availability large quantity potential clients, he will be able, in case of refusal of one buyer, to sell the batch prepared for him to another.

- Low yield. A business entity may encounter this problem if it violates the technology for growing oyster mushrooms or purchases low-quality mycelium. Also, we should not forget about pests and diseases that can completely destroy the crop.

- Breakdown of equipment used in the process of growing mushrooms. In this case, the entrepreneur will have to bear the cost of urgent repairs or purchase a new one. To minimize this risk, experts recommend conducting Maintenance available equipment. In this case, any problems will be identified in a timely manner and immediately corrected.

- We should not forget about the possible increase in competition in the region where the business entity grows mushrooms. In order to maintain his position in the local market, a businessman must also look to neighboring regions.

Useful video

Every business entity who has decided to put oyster mushroom cultivation on stream should listen to the advice of professionals, whose valuable recommendations will help to avoid the most common mistakes:

Growing mushrooms (garden mushrooms) as a business

5 (100%) votes: 1Mushroom farming is a rather specific branch of agricultural production, as it is characterized by a large number of crop rotations per year. Their number can reach up to eight. Therefore, strict adherence to cultivation technology and maintenance of correct temperature and humidity conditions are required. Mushrooms, as products, are characterized by a short shelf life, due to which their natural loss during the production process becomes inevitable.

For purposes accounting Mushroom cultivation belongs to the branch of greenhouse vegetable growing within the framework of crop production in general. Regulatory and methodological support for cost accounting is presented by Methodological Recommendations for accounting of production costs and calculating the cost of products (works, services) in agricultural organizations, approved by Order of the Ministry of Agriculture of Russia dated June 6, 2003 No. 792 (hereinafter referred to as Methodological Recommendations No. 792). Their provisions, however, are not specified in relation to the industry in question. Directly for mushroom growing, Methodological Recommendations No. 792 defines only a list of calculation units.

Synthetic and analytical accounting

Based on a general approach to organizing accounting production costs V agriculture, it can be determined that synthetic accounting for the cultivation of mushrooms is maintained in the generally established manner on account 20 “Main production” subaccount “Crop production”. In the debit of the account, on an accrual basis during the year, costs are accumulated in the context of costing items; in the credit, the output of the main and by-products received is reflected. Analytical accounting is based on the types of mushrooms grown (champignons, oyster mushrooms, fly mushrooms, chanterelles, honey mushrooms, etc.). Within each analytical account, costs are taken into account by their types (costing items).

In accounting, the acceptance of products in the form of grown mushrooms for accounting is reflected in the following accounting entries:

DEBIT 43 CREDIT 20 subaccount “Crop production”

– the main products of the industry – mushrooms – have been taken into account;

DEBIT 10 CREDIT 20 subaccount “Crop production”

– by-products – spent substrate – have been taken into account.

Processing of wild mushrooms purchased from the population by organizations is classified as industrial production for accounting purposes and is accounted for in account 20 “Main production” subaccount “Industrial production”. In general, the methodology for organizing accounting for the subaccount under consideration and accounting for mushroom cultivation are similar. In the debit of account 20, costs are accumulated, and in the credit, the output of finished products is reflected. The result of mushroom processing can be the production of salted, canned and dried mushroom products.

Accounting objects and costing units

The list of costing units and cost accounting objects of the industry is determined by Methodological Recommendations No. 792. When growing mushrooms, the following accounting objects, types of related products and costing units are distinguished. The object of cost accounting is champignons (mushrooms, champignon mycelium). Types of associated products are mushrooms and champignon mycelium. Calculation unit: one centner.

When processing mushrooms, according to Methodological Recommendations No. 792, the following type of cost accounting object, types of related products and costing units are used. The object of cost accounting is the processing of vegetables, fruits and potatoes. Types of related products – canned food; quick-frozen products; pickling, pickling; dried potatoes, vegetables. Calculation units are one thousand conventional cans and one centner.

Costing articles

A farm engaged in the cultivation or processing of mushrooms primarily compiles the nomenclature of costing items.

Growing mushrooms

1. Material costs(resources) used in production, including:

- planting material (mycelium);

- mineral and organic fertilizers;

- plant protection products;

- petroleum products;

- fuel and energy for technological purposes;

- works and services third party organizations.

2. Remuneration (divided by type).

3. Contributions for social needs.

5. Works and services of auxiliary production.

6. Other costs (including natural loss of mushrooms).

7. Costs of organizing production and its maintenance.

8. Expenses for management needs.

Please note: in the structure of production costs, it is necessary to note the predominance of labor costs (since the technology for growing mushrooms is characterized by high labor costs), energy costs, costs for ventilation, heating and water supply of production premises.

Mushroom processing

As a standard nomenclature for costing items when processing mushroom products, the following list of expenses can be recommended, including:

- remuneration of workers servicing the technological process (including deductions for social needs);

- raw materials for processing;

- maintenance of fixed assets (depreciation and Maintenance);

- maintenance and operation of equipment, its depreciation and current repairs;

- works and services (cost of electricity for technological purposes, services of third-party organizations, water supply, transportation costs);

- organization of production and management (attributable to this type products share of general production and general expenses);

- other costs (expenses for containers and packaging of products, losses from defects, expenses through accountable persons, etc.).

Documenting

Growing mushrooms has its own specifics in terms of documenting operations using primary documents.

Specialized form of primary accounting documentation There is no provision for the posting of grown mushrooms and by-products. Therefore, for these purposes it is recommended to use standard forms, contained in the resolution of the State Statistics Committee of Russia dated September 29, 1997 No. 68 “On approval unified forms primary accounting documentation for the accounting of agricultural products and raw materials." For documentation receipt of products may use one of the following forms:

- Diary of receipt of agricultural products (No. SP-14);

- Diary of receipt of greenhouse products (No. SP-15).

The selected form is maintained by the foreman and contains information about the volumes of collected products, indicating the date, place of harvesting and acceptance of the crop, the area from which it was received, the weight and quality of the product. At the end of the working day, the receptionist calculates the totals of product receipts for the day in the diaries.

Cost calculation

The cost of grown mushrooms will be determined as the ratio of the total industry costs minus the cost of the resulting substrate to the total mass of harvested products.

For the purposes of calculating cost, the substrate is assessed based on standard costs for cleaning and removal. In general, the spent substrate is a complete organic fertilizer that can be used in open and protected ground, as well as as roughage in livestock farming.

Example

Costs of an agricultural enterprise engaged in growing champignons for reporting period made up the following indicators:

– wages with accruals – 64,855 rubles;

– raw materials and supplies – 33,380 rubles;

– maintenance of fixed assets – 630 rubles;

– works and services – 7535 rubles;

– organization of production and management – 4586 rubles;

– other costs – 1497 rubles.

The total cost of the enterprise was 112,483 rubles. (64,855 + 33,380 + 630 + 7535 + 4586 + 1497).

During the same reporting period, 200 centners of champignons and 25 centners of substrate with a standard cost of 11,256 rubles were capitalized.

To calculate the cost of 1 quintal of grown champignons, it is necessary to exclude from the total costs the cost of by-products - spent substrate in the amount of 11,256 rubles. Thus, the main product - grown champignons - accounts for 101,227 rubles. actual costs (112,483 – 11,256).

Now let’s determine the cost of 1 centner of grown champignons, which will be equal to 506.14 rubles. per centner (RUB 101,227: 200 c).

Accounting for mushroom cultivation is reflected in the following entries:

DEBIT 43 CREDIT 20 subaccount “Crop production. Growing champignons"

– 101,227 rub. (112,483 – 11,256) – grown champignons were capitalized;

DEBIT 10 CREDIT 20 subaccount “Crop production. Growing champignons"

– 11,256 rub. – the spent substrate is capitalized.

I. Sergeeva,

Associate Professor, Department of Accounting, KF RGAU – Moscow Agricultural Academy named after. K.A. Timiryazeva, Ph.D. n.

We'll tell you how to take into account costs if you grow mushrooms yourself or buy them from the public. Let's look at how to reflect the processing of mushrooms. Let's look at practical examples accounting in mushroom production.

Accounting in mushroom production: costs

In mushroom production there are main and by-products. The main ones include the mushrooms themselves. The company accounts for expenses on them according to the following items:

- planting material;

- mineral and organic fertilizers;

- plant protection products;

- fuel;

- energy;

- works and services;

- salary;

- social security contributions;

- depreciation and repair of fixed assets;

- taxes;

- others;

- general production and general business expenses.

The main products also include canned mushrooms.

The cost consists of the costs of:

- mushrooms that are used as raw materials;

- processing.

A by-product of mushroom production is mycelium. It is valued at its standard value or at its possible sale price. Used as a complete organic fertilizer.

How to account for growing and processing costs

Costs for growing mushrooms are collected in the “Crop Growing” subaccount of account 20. Finished products written off to account 43. Let's look at accounting in mushroom production using an example.

Example 1

In 2016, the farm spent 771,680 rubles. for growing champignons. As a result, we received 112 centners of mushrooms. Expenses for by-products - 14,000 rubles.

The accountant made the following entries:DEBIT 20 subaccount “Crop production” CREDIT 02, 10, 23, 25, 26, 69, 70

— 771,680 rub. — written off the costs of growing champignons;

— 757,680 rub. (771 680 - 14 000) - mushrooms were capitalized;DEBIT 43 CREDIT 20 subaccount “Crop production”

— 14,000 rub. — took into account by-products for sale.The cost of 1 quintal of champignons is 6,765 rubles. ((771,680 rub. - 14,000 rub.) / 112 c).

How to further account for grown mushrooms? It depends on what the farm does with them. If it sells, then the accountant writes off the cost of production from account 43 to account 90. If it processes, then first the mushrooms are transferred from account 43 to account 10 as raw materials. After this, account 20 is written off as expenses to the “Industrial Production” subaccount.

Let's take a closer look at recycling. When a farm freezes or pickles mushrooms, the unit of calculation is the centner. When he wraps it in jars - a thousand conventional jars. The capacity of each is 353.4 cubic meters. cm. For simplicity, this number is rounded to 353 cubic meters. cm, and the net weight is 350 g.

Direct costs are included in the cost of production, while indirect costs will have to be distributed. I’ll show you how to do this with an example.

Example 2

The farm grew champignons. Expenses amounted to 757,680 rubles. After processing, we received 5000 kg of frozen mushrooms, 5000 kg of salted mushrooms and 3420 conventional units. b.

Direct costs:

- for frozen mushrooms - 383,000 rubles;

- salted - 395,000 rubles;

- canned mushrooms - RUB 217,600.

Indirect costs (depreciation, maintenance of premises, etc.) - RUB 366,400.

The market value of 1 kg of frozen mushrooms is 125 rubles, salted mushrooms are 150 rubles, and 1 conventional b. — 225 rub. Total 500 rub. (125 + 150 + 225).

The distribution coefficients will be:

- for frozen mushrooms - 0.25 (125 rubles: 500 rubles);

- salted - 0.3 (150 rubles: 500 rubles);

- canned food - 0.45 (225 rubles: 500 rubles).

Indirect costs were distributed as follows:

- for frozen mushrooms - RUB 91,600. (RUB 366,400 x 0.25);

- salted — 109,920 rub. (RUB 366,400 x 0.3);

- canned food - RUB 164,880. (RUB 366,400 x 0.45).

As a result, the cost is:

- 1 kg of frozen mushrooms - 94.92 rubles. ((383,000 rub. + 91,600 rub.) : 5000 kg);

- 1 kg of salted mushrooms - 100.98 rubles. ((395,000 rub. + 109,920 rub.) / 5000 kg);

- conventional banks - 111.84 rubles. ((RUB 217,600 + RUB 164,880) : UB 3,420).

The accountant wrote:

DEBIT 10 subaccount “raw materials” analytics “mushrooms” CREDIT 43 subaccount “mushrooms”

— 757,680 rub. — mushrooms for processing were taken into account;DEBIT 20 subaccount “Industrial production” CREDIT 10 subaccount “raw materials” analytics “mushrooms”

— 757,680 rub. — transferred the mushrooms to production;DEBIT 20 subaccount “Industrial production” CREDIT 02, 23, 25, 26, 69, 70

— 1,362,000 rub. (383,000 + 395,000 + 217,600 + 366,400) - collected costs;DEBIT 43 subaccount “frozen mushrooms” CREDIT 20 subaccount “Industrial production”

— 474,600 rub. (383,000 + 91,600) — frozen mushrooms were capitalized;DEBIT 43 subaccount “salted mushrooms” CREDIT 20 subaccount “Industrial production”

— 504,920 rub. (395,000 + 109,920) - reflected salted mushrooms;DEBIT 43 subaccount “canned mushrooms” CREDIT 20 subaccount “Industrial production”

— 382,480 rub. (217,600 + 164,880) — taken into account canned mushrooms.

Accounting in mushroom production, if you purchase mushrooms from the population

Employees who are approved by order of the enterprise have the right to purchase mushrooms from the population. The company enters into a liability agreement with them. The accountant gives such employees an advance.

When purchasing, the accountant takes passport data and residential address from the mushroom seller. He enters this information into the procurement act (approved for catering operations). The act is drawn up in two copies. One for the farm, the second for the seller.

The accountant classifies purchased mushrooms as inventories (). The company has the right to include delivery costs in actual cost products. Provided that this option is prescribed in the accounting policy.

Example 3

The employee was given 30,000 rubles on account so that he could purchase forest mushrooms from the population. After some time, the employee submitted an advance report for 29,400 rubles. It was accompanied by a purchase act for 27,000 rubles, an invoice for delivery of products to the warehouse, checks for refueling a car for delivering mushrooms for 2,400 rubles.

The accountant made the following entries:

DEBIT 71 CREDIT 50

— 30,000 rub. - issued money on account;DEBIT 10 subaccount “raw materials” analytics “mushrooms” CREDIT 76

— 27,000 rub. - took into account mushrooms;DEBIT 76 CREDIT 71

— 27,000 rub. — closed settlements with mushroom sellers;DEBIT 23 CREDIT 71

— 2400 rub. — reflected fuel and lubricants;DEBIT 10 subaccount “raw materials” analytics “mushrooms” CREDIT 23

— 2400 rub. — included transportation costs in the price of mushrooms;DEBIT 50 CREDIT 71

— 600 rub. (30,000 - 27,000 - 2,400) - accepted the balance of the accountable amount from the employee.

How to confirm costs

The costs of growing mushrooms are confirmed by primary evidence:

- accounting sheet of labor and work performed ();

- act on the use of mineral, organic and bacterial fertilizers ();

- act of consumption of seeds and planting material ().

The collected mushrooms are reflected in the diary (). The foreman records in it the weight and quality of the mushrooms, the location and area of harvest. At the end of each day, the document is submitted to the accounting department.

To grow mushrooms at home you need little: a good business plan, small investment and suitable premises. Business.ru compiled detailed instructions on creating a mushroom business from scratch with calculations and recommendations.

Growing mushrooms as a small business: overview of the direction

A business project for growing mushrooms can be classified as a low-cost startup. In case of failure, the business can be easily closed without significant losses and just as easily scaled up if the business begins to make a profit.

The business plan should focus on the prospects for mushroom production in Russia, so first, a little information about the state of affairs in the industry. Just 2 years ago, only imported cultivated mushrooms were available on the market. The turning point came in 2017, when, against the background of sanctions and the growth of their own production, domestic farms supplied 30 thousand tons with imports of 26.7.

Experts say that Russian farms capable of producing approximately 4.5 times more products, but everything, naturally, will depend on demand and income of the population.

As with any business, there is a risk of competition with large mushroom growing complexes. But small business has its advantages. Creation large enterprise with a production volume of 5 thousand tons per year, requires more than 2 billion rubles of capital investment, so not every region is provided with industrial production mushrooms Basically, only Central and Volga Regions can boast of this federal districts. The second problem of the large mushroom agricultural complex is the lack of compost required for cultivation: only a seventh of the required amount is prepared in the country, and buying imported goods almost doubles the cost of production.

Thanks to these difficulties in implementing large-scale projects, growing mushrooms at home has a good chance of occupying niches in cities with weak support from large or medium-sized businesses.

More business ideas with minimal investment in 2019 - in the Business article. RU

Mushrooms as a business: equipment, taxes, production and sales plan

Among the difficulties of the mushroom business, it is worth noting that it is imperative to adhere to agricultural practices and maintain temperature and humidity parameters. In addition, a new entrepreneur may have difficulty finding stable distribution channels.

The advantages for small businesses growing mushrooms include low start-up and operating costs, the lack of licensing and other control and regulatory acts. Positive feature is also that production does not depend on the season. Demand is subject to slight seasonality, as it decreases for a short time during the natural mushroom period.

Registration and taxes

Typically, for a mushroom growing business, the legal form chosen is an individual entrepreneur. If an entrepreneur has start-up capital at his disposal to open a medium-sized enterprise, we advise you to immediately register an LLC: this will make it easier to obtain a loan for business development and will allow you to count on subsidies from the state.

The procedure for opening an individual entrepreneur and LLC is traditional; the OKVED code is “Cultivation of mushrooms and mycelium (mycelium)” 12/01/31. You can open an individual entrepreneur yourself or using free help outsourced specialists. The latter is the most convenient and profitable option: you don’t have to waste time preparing documents and going to the tax office; accounting gurus will do everything for you.

For the premises it is necessary to obtain a conclusion from the SES and the fire service. After receiving the products, it will also be necessary to issue a certificate of conformity: it is issued by the SES, the cost is 2-5 thousand rubles.

You can register an individual entrepreneur or LLC for free in the Glavbukh Assistant service

The optimal method of taxation for this type of activity would be the unified agricultural tax (UST). When using it, you can pay only 6% of the difference between income and expenses, whereas with the simplified tax system the entrepreneur pays 15%. The Unified Agricultural Tax has 2 more features: entrepreneurs whose agricultural component of their business is at least 70% have the right to it, and report to the tax office once every six months.

Technology

The simplest project of such a business is the artisanal cultivation of mushrooms in plastic bags filled with compost - straw mixed with humus, sawdust, fallen leaves, and waste from oilseed production. The purchased mycelium is mixed with compost and, while maintaining the desired temperature, humidity, and then light, a harvest is obtained in 6-8 weeks. From one sowing of mycelium, 3 mushroom cuttings are obtained with an interval of 2 weeks.

If there is no money for automation, you can maintain temperature and lighting manually, and control humidity using irrigation. The disadvantage of this approach is that you will be forced to continuously participate in the growing process, and interruptions in work can lead to the destruction of the crop. In addition, only small volumes can be controlled manually. The productivity of this approach is several tens of kilograms per month.

A more advanced plan for growing mushrooms involves the purchase of climate control equipment, lines for filling bags with substrate or ready-made substrate blocks. This significantly reduces labor intensity and allows larger volumes to be processed quickly.

Premises and equipment

For the initial launch of a business project for growing mushrooms, a room without temperature changes, equipped with shelves or racks, is sufficient. This could be a garage, basement, outbuilding. The area does not matter and depends solely on the planned volumes.

Mushrooms are quite sensitive to environmental parameters, so to simplify their control, there is a sufficient amount of equipment: fog generators, devices for maintaining the temperature of compost and ambient air, CO2 content controllers, automated lighting devices.

Sales channels and profitability

Before developing a business plan for growing mushrooms, check whether there are large manufacturers and suppliers of such products in your region. Find out who supplies mushrooms to large stores: the packaging label always contains the name of the manufacturer with the address. If possible, find out purchasing prices in networks and from large buyers.

Possible volumes of distribution channels should be “tested” before starting work. Such channels could be:

Internet sales;

Points at food markets;

Organic and dietary food stores;

Retail chains and non-chain food stores;

Catering enterprises;

Packaging and procurement production (drying, canning);

Wholesale buyers (have contracts with chains, but do not grow products, but buy them from small producers).

The profitability of mushroom production is about 50%, and on average you can expect that a kilogram of grown mushrooms will bring 100 rubles in net income.

Growing champignon and honey mushrooms as a business

Champignons and honey mushrooms are the most common types of mushroom crops in Russia. Champignons today occupy 73% of the market for cultivated mushrooms, so for beginners it is better to choose traditional varieties. You are more likely to encounter high level competition, but their marketing is much easier.

Growing oyster mushrooms and other exotic mushrooms as a business

Oyster mushroom, and even more so exotic types of mushrooms, such as shiitake, enoki and others, occupy a very small niche and the business prospects for growing these species are unclear. Although some experts point out the undervalued and therefore promising potential of non-traditional species. This opinion is based on two premises. First, health activists promote ideas about their healing properties: antioxidant, anti-cancer, cleansing, etc. Secondly, these mushrooms are closer in taste to forest mushrooms: the average Russian consumes 4-8 kg of wild mushrooms per year, and this is an annual volume of up to 1 million tons.

At the same time, such mushrooms are no more complicated in terms of growing technology, but they last longer. marketable condition. Considering that Russians are less familiar with these varieties, it is recommended to introduce them into business gradually after gaining experience and a sufficient pool of distribution channels.

The accounting system in agricultural organizations is regulated by a standard set of regulations. Among them:

- Law dated December 6, 2011 No. 402-FZ, regulating general rules and principles for implementing accounting operations;

- Chart of accounts from Order of the Ministry of Finance dated October 31, 2000 No. 94n, on the basis of which the working chart of accounts of the enterprise is developed and approved;

- a set of accounting provisions;

- Tax Code and other legislative acts.

Features of accounting in agriculture

The organization of accounting at enterprises specializing in the production of agricultural products must be correlated with the specifics of the activities of such companies. At all stages of the technological cycle greatest influence have natural factors:

- the inability to separate production cycles from land resources, their condition and area;

- dependence on living organisms, their health and development;

- seasonality of production due to climatic conditions.

In accounting, land resources are divided by type of land. They are reflected in natural meters (hectares are taken as the unit of measurement). Implemented capital investments V land are shown in accounting transactions in monetary terms.

FOR REFERENCE! Agricultural activity is characterized by the presence of a large set of industries. Each direction of production has its own specifics.

The complexity of organizing an accounting system is due to the need for accounting personnel to have knowledge and skills to work in a certain industry with a narrow specialization. Accounting difficulties are associated with the uneven distribution of the amount of work in different months and the non-standard type of cost division. Costs for keeping animals or growing plants are distributed based on the type of product. From one plant variety or one breed (species) of animal, several types of finished products are obtained, which, at the discretion of the enterprise management, can be used in several ways.

Costs depending on the production period are not tied to calendar year. The expenses incurred by the company in the past period provide the results of its activities in the present. Expenses that are made in current period, will be able to pay off next year after the harvest.

The specifics of accounting are associated not only with the complexity of dividing costs and the variety of production cycles. Additionally, the accountant must organize control of the movement and operation of agricultural machinery and equipment. Accounting activities are reflected in registers by structural units(teams, farms).

Land accounting

The peculiarity of recording the main asset of agricultural enterprises - land - is that it is not subject to depreciation. Land cannot become obsolete physically or morally; it is not subject to wear and tear. If land plots are operated in compliance with technology and established standards, they do not lose their original characteristics. IN in some cases There is an improvement in the quality of land resources.

Land must be used by the organization based on ownership. If it is not there, then a use or lease agreement must be drawn up.

IMPORTANT! Land valuation is carried out at the time of capitalization according to the amount of costs incurred for its acquisition or the amount market price(if the plot was received free of charge). When exchanging an allotment for other assets, its price is equal to the total value of the exchanged objects.

If the land is a contribution to authorized capital, its price can be determined by agreement of the parties. If it is impossible to accurately determine the price range, you need to focus on standard cost indicators.

Accounting of land is carried out in the context of their purpose and stages of operation. Resources that are at the stage of rest and reclamation are shown separately. Analytics should reflect the breakdown of assets by agricultural category. Additional subaccounts take into account protective strips, areas under roads, and public buildings.

FOR REFERENCE! Primary documents for agricultural enterprises differs from standard forms. Specialized forms were approved by Order No. 750 dated May 16, 2003.

Seasonality

The seasonal nature of the activity requires the creation of a special classification system for accounting expenses. They should be represented by assets, deferred costs and current expenses. During forced downtime due to climatic conditions or production specifics, no direct sales costs are generated.

Depreciation charges on assets should be based not on monthly standards, but on the total amount at the end of the season. For example, if the downtime phase lasts 7 months a year, then the depreciation period will be the remaining 5 months in the season. Monthly deductions will be determined by dividing the annual rate by 5.

NOTE! The Tax Code of the Russian Federation does not provide for a seasonal mechanism for calculating depreciation. As a result, between accounting data and tax accounting temporary tax differences appear.

When evaluating products, two types of cost are used: planned and actual. Throughout the year, with a shifted production cycle, accounting transactions show the planned cost indicator. The actual final value is displayed once on the last day of the annual interval. The resulting deviations in the amount of cost should be written off to account 90 (if the products have already been sold by that time) or to account 43 (in relation to goods remaining in warehouses).

When recording agricultural crops, difficulties arise at the stage of dividing the harvested crop into categories with different purposes:

- some of the products can be reserved for use in the upcoming sowing campaign;

- a certain percentage of the harvest can be used to supplement the diet of animals that are being fattened or raised;

- A separate group includes products that will be sold as an independent product.

Typical wiring

The chart of accounts with analytical sub-accounts for recording transactions in the agricultural industry is given in Order of the Ministry of Agriculture dated January 29, 2002 No. 68. This normative document Standard correspondence accounts are provided:

- D08.7 - K60 - the record reflects the fact of the acquisition of adult livestock (productive and working), classified as the main herd.

- D01.4 – K08.7 – purchased livestock is accounted for at the purchase price.

- D11.2 – K01.4 – cattle were culled from the main herd with subsequent fattening.

- D01.5 - K08.8 - this posting shows the incoming batches of perennial young plantings.

- D20.3 - K01.4 - correspondence is relevant for situations when culled animals are not fed for fattening, but are sent to slaughter.

- D08.6 – K11.1 – the fact of transfer of young animals to the main herd is recorded.

- D10.1 – K20.1 – purchased grain is received for its further use in the production of mixed feed.

- D10.1. – K23.7 – the entry reflects the arrival of raw materials in the form of horse hair or wool (after molting).

- Manure and droppings are accounted for as debit 10.2 and credit 20.2.

- Horse manure should be shown in the debit flow of account 10.2 and the credit flow of account 23.7.

- D10.7 (8 or 11) – K40 – capitalization of feed, seed material and equipment that were created by our own production line.

- D91 – K11 – dead animals that were not included in the insurance contract were written off.

Features of tax accounting

For agricultural enterprises tax legislation a special mode is provided. Organizations using it are exempt from paying amounts for and. This tax system involves the abolition of property tax obligations.

REMEMBER! If the founders of the enterprise decide to stay common system taxation, they have the opportunity to take advantage preferential terms on income tax. The tax rate for some categories of agricultural producers is 0% (clause 1.3 of Article 184 of the Tax Code of the Russian Federation).

Agricultural organizations do not have the right to choose at what rate of income tax their activities will be taxed. If an enterprise meets the criteria established by the Tax Code of the Russian Federation for a preferential rate, then the institution is obliged to apply it.

To switch from to unified agricultural tax, you need to contact the service company tax office with notice. When using special mode tax period The annual interval is recognized, the reporting period is considered to be half a year. Organizations must make advance tax payments; the declaration is prepared at the end of the year.

IMPORTANT! If a business entity specializes in the processing of agricultural products, and not in their production, then it cannot apply the Unified Agricultural Tax.

The object of taxation is the income indicator reduced by the expenses incurred by the organization.