Hello, dear traders! Today in the article you will be presented with another simple trading strategy - “Daily Range”. The strategy does not use indicators; to implement it you only need a calculator.

The “Daily Range” strategy can be used on any currency pair; as an example, I will consider it on the EURUSD and GBPUSD pair.

The principle of the strategy is based on the price readings of the previous day. You only need to determine the High, Low and Close (highest high, low and closing price level) of the previous trading day.

I will explain the essence of the strategy in detail using the example of the GBPUSD currency pair:

I am looking at the example on the terminal from the broker Alpari, according to its time (in winter), trading opens at 00:00 and closes at 23:00.

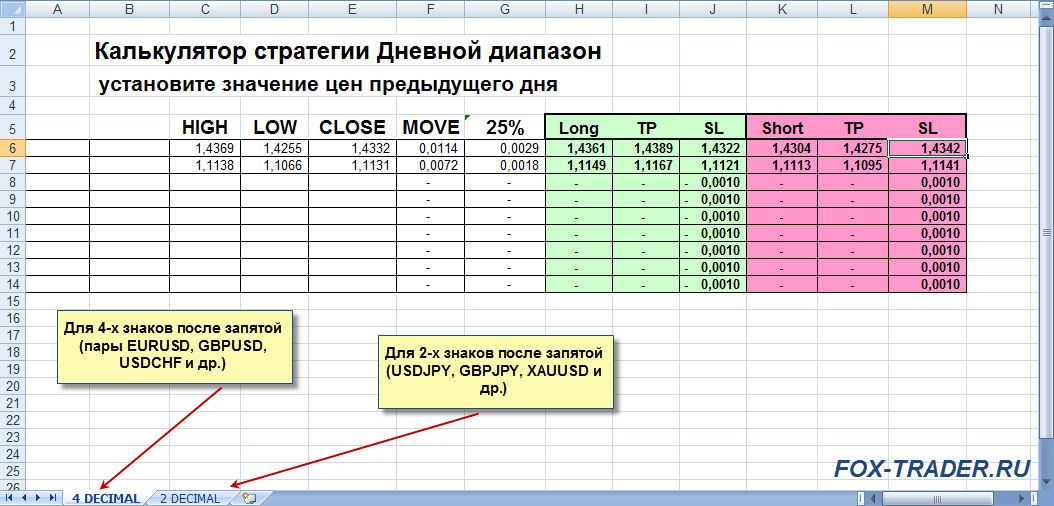

We determine the High, Low and Close of a 24-hour period (trading day 02/18/2016): High was 1.4368, Low was 1.4255, the closing price of the trading day was 1.4332.

The total movement of the pair, the range in which it moved within 24 hours (High – Low) was 114 points.

We set to buy and sell at a distance of 25% of the total move (114 points), deferred from the closing price. 25% of 114 points is approximately 29 points.

Set the Buy Stop at the level of 1.4361 (Close + 29 points).

Sell Stop at level 1.4303 (Close – 29 points).

Take profit is 25% of the previous day's move, that is, also 29 points. The take profit level for Buy Stop is 1.4389, Sell Stop is 1.4274.

Stop loss is placed 10 points above the closing price with a Sell Stop, and 10 points below with a Buy Stop.

When one of the orders is triggered, the second one is deleted.

As you can see, the meaning of the strategy is simple, it is as follows: if the pair moves in one direction at least 50% of the total move of the previous day, then you are in profit.

Let's look at another example, the EURUSD currency pair:

We determine High, Low and Close in trading days on February 19, 2016:

High – 1.1138;

Close – 1.1131;

The total price movement is 72 points, 25% of 72 is 18 points.

We place orders:

Buy Stop – 1.1149 (Close + 18 points);

Sell Stop – 1.1113 (Close – 18 points);

Stop loss level:

for Buy Stop – 1.1121 (Close – 10 points);

for Sell Stop – 1.1141 (Close + 10 points);

The take profit level for Buy Stop is 1.1167, Sell Stop is 1.1095.

The Sell Stop order was triggered and the goal was achieved.

If during the day not one of the pending orders is triggered, at the end of the day we delete the orders. And vice versa, if the order is triggered, but the take profit is not reached during the day, then we leave open position until the next trading day. With the onset of the next day, adjust the stop and take levels based on the analysis of the previous trading day.

To make it easier and faster to work with the strategy, I offer you a calculator (in Excel format) for automatically calculating entry points, take profit and stop loss levels.

Calculator screenshot:

Of course, additional indicators can be used to filter signals. Let's say a moving average with a period of 100, if the price is above it, consider only purchases, below - sales. All in your hands.

There is nothing wrong with wanting to day trade. You just need to keep one thing in mind: your risk on any trade should never exceed 2% of the size. Trading will not lead you to disaster if you manage your risks correctly.

Let's look at one of the best and simplest strategies for day trading.

Trading on the breakout of the opening range is a very popular system that is used as professional traders, and so do amateurs. With its help, you can achieve high accuracy of transactions if you apply the right indicators and strict rules, and also be able to assess the general mood of market participants. This system is only applicable for intraday trading.

It has several varieties and is used by traders all over the world. Some enter a trade after a significant breakout of the opening range, while others prefer to trade as soon as the morning range is broken. The duration of the transaction when working to break through the morning range can vary from 30 minutes to three hours.

Practice shows that the system described below can be used on different markets. This method can be called a combination of scalping and trend trading, so it allows you to take advantage of fast trend movements and make quite a lot of trades.

Trading strategy

Compliance with the rules described below can dramatically increase the percentage of successful transactions. Within the first 30 minutes trading session Any stock forms a certain range. This is called the opening range or morning range. High and Low of this period of time are taken as support and resistance levels.

- We buy when the stock rises above the High opening range.

- We sell when the stock falls below the Low opening range.

This is the general idea, and the specific system is built on the basis of the rules described below. Working under such a system requires strict adherence to all rules of purchase and sale.

General rules of the trading system (applicable for buying and selling)

1) The opening range is formed by the High and Low of the first 30 minutes of trading.

2) A 5-minute chart with 5- and 20-period simple moving averages (EMA) overlaid is used to make decisions.

3) You should only enter at the close of a 5-minute candle outside the opening range.

4) 20-period EMA is one of the key indicators that is used in this system for trend trading. Stop loss is always placed at the 20 EMA to give profits room to run.

5) Confirmation by volume - a breakout candle should always have an increased volume.

6) Auxiliary confirmation - other indicators can be used for additional confirmation. It should be understood that the idea of using additional indicators is to have at least two confirmations to enter a trade. But this condition is not mandatory.

7) Consider support and resistance levels. Don't buy a stock below a resistance level or sell above a support level.

8) Always trade two lots, closing half the position as soon as a small profit appears. The second lot makes it possible to take advantage of the daily trend.

- Before a breakout, the stock must be trading above the 20 EMA.

- Buy when the 5-minute candle closes above the opening range.

- At the moment of breakout, the 5 EMA line should be above the opening range.

Where to keep a stop order

Initial stop loss - Low of the opening range. The trailing stop loss should be moved as the stock moves in your direction and profits are made, lock in 50% of the position and move the stop order to the 20 EMA level. A 5 minute candle closing below the 20 EMA is to exit.

When to take profit

When the 5 minute candle closes below the 20 EMA.

Rules for selling shares

- Before a downside breakout, the stock must trade below the 20 EMA.

- Sell when the 5-minute candle closes below the opening range.

- At the moment of breakout, the 5 EMA line should be below the opening range

Where to keep a stop order

Initial stop loss - High of the opening range. The trailing stop loss should be moved as the stock moves in your direction and profits are made, lock in 50% of the position and move the stop order to the 20 EMA level. A 5 minute candle closing above the 20 EMA is an exit signal.

When to take profit

When the 5 minute candle closes above the 20 EMA.

How to increase the likelihood of success in a transaction

Listed below additional conditions increase the likelihood of success:

- A breakout of the opening range upward occurs above the High of the previous day (for buying).

- A downward breakdown of the opening range occurs below the Low of the previous day (for selling).

- The trade is made in the direction of the trend on a higher time frame (15 or 30 minutes).

- The general market is moving in the direction of the deal.

- A breakout of the opening range occurs after a short consolidation.

When not to trade a morning range breakout

If the opening range is too wide, it is better not to trade this strategy as it will require a very long stop loss. In this case, it is recommended to use other trading systems.

Avoid trading the breakout of the morning range on the day when important news comes out. After the market calms down following the news, trade using other trading systems.

Stay up to date with everyone important events United Traders - subscribe to our

"Morning range" is based on a breakout of the range. Only in our case we're talking about about the corridor that is formed during inactive trading hours. That is, from 00:00 to 6:00 GMT. For trading it is best to use currency pair EURGBP. In addition, select the 4 time frame from M5 to H1 in your MetaTrader terminal.

The essence of this Forex strategy is that you need to place pending orders in equal volumes to break out the range at 6:01 GMT. One order (BUY STOP) is on the upper border of the corridor, the other (SELL STOP) is on the lower border.

After one of the trades is opened, we double the volume of the second order (on the opposite side of the corridor). After this, you need to tighten it, as shown in the figure. The level of 161.8% will be our take profit level.

Stop loss must be placed on the other side of the formed channel. In case both positions are closed by stop loss, trading should be stopped for today. In addition, if no transactions were opened before 17:00 Moscow time, then the orders should be deleted.

Forex trading strategy “Morning range” is built on a breakout of a range, which often forms during inactive trading hours on the Forex market. All traders know that inactive hours on Forex are from 00:00 to 6:00 GMT, it is during this period that the range is formed, subject to the formation of a channel that needs to be broken.

Market: Forex;

Currency pair: EURGBP;

Indicators: flat channel, Fibonacci grid;

Timeframe: M5-H1;

Trading time: 00:00 — 6:00 GMT

Strategy: scalping;

Protective orders: TrallingStop, TakeProfit, StopLoss.

Trading signals trading strategy for EURGBP

At 6:01 (GMT) you need to put pending order for a range breakout BuyStop at the upper border of the formed channel, adding the size of the spread, and pending order SellStop at the lower border of the formed channel, adding the size of the spread for the desired currency pair.

For installation and maintenance you can use trailing stop from 1 point.

Forex Strategy “Morning Range” implies that pending orders should be set in equal volumes. Don’t forget to double the lot size on the opposite side when opening one of the pending orders. After that we will build Fibonacci levels . The level of 161.8% will be the desired level TakeProfit.

Stop loss order We place it on the other side of the formed channel for safety. If the second doubled stop loss order is closed, no more transactions should be opened on that day.

Forex trading strategy “Morning range” implies that if pending orders are not opened before 17:00 (Moscow time), you need to delete these orders. But if the price did not approach the channel boundaries and did not break through at least one of them, then it is permissible to place pending orders a little later. This is in case you did not have the opportunity to be near trading terminal at 6 am GMT.

And if you were unable to enter the market using pending orders, you can conclude a trade deal using market price in the direction of breaking through the range.