The minimum wage is the minimum wage per month, established by the Federal Law "On the minimum wage" dated 06/19/2000 N 82-FZ. Every year, the Federal Law “On Amending Article 1 of the Federal Law “On the Minimum Wage”” appears and establishes the minimum wage for the coming year.

- The minimum wage for 2014 was 5,554 rubles (Federal Law No. 336-FZ of December 2, 2013);

- The minimum wage in 2015 amounted to 5,965 rubles (Federal Law No. 408-FZ dated December 1, 2014);

- The minimum wage for 2016 was 6,204 rubles (Federal Law No. 376-FZ of December 14, 2015), and from July 1, 2016 it will increase to 7,500 rubles;

- The size of the minimum wage in 2017 remained equal to 7,500 rubles, but from July 01, 2017, the minimum wage increased to 7,800 rubles (Federal Law of December 19, 2016 No. 460-FZ);

- The minimum wage at the beginning of 2018 was 9,489 rubles, and later it was increased to 11,163 rubles (Federal Law No. 41-FZ dated March 7, 2018);

- The minimum wage in 2019 amounted to 11,280 rubles (Federal Law No. 481-FZ of December 25, 2018).

- The minimum wage in 2020 is 12,130 rubles (Federal Law No. 463-FZ of December 27, 2019).

Application of the minimum wage

The MOT is used for:

- Regulation of wages. In accordance with the Labor Code of the Russian Federation, the salary of an employee of any organization for a fully worked month cannot be less than the minimum wage.

- Determining the minimum amount of benefits for temporary disability, pregnancy and childbirth.

- the government of the subject of the Russian Federation;

- associations of trade unions;

- associations of employers.

After the agreement is concluded, all employers are invited to join it: the proposal to join the agreement is officially published in the media. If the employer has not submitted a reasoned written refusal within 30 calendar days from the date of the official publication of the offer, it is considered that the employer has acceded to the agreement and is obliged to apply it.

The regional minimum wage must be applied by commercial organizations and entrepreneurs of a constituent entity of the Russian Federation, separate subdivisions located in the constituent entity, state institutions financed from the budgets of the constituent entities of the Russian Federation, and municipal institutions. Federal state, budgetary and autonomous institutions are not required to apply the regional minimum wage.

In addition to the regional minimum wage, allowances and coefficients established in the region are applied. For example, in the Altai Territory, an agreement for 2019-2021 sets a minimum wage of 13,000 rubles. At the same time, a regional coefficient of 15% operates in the region. This means that employers in the Altai Territory do not have the right to set wages below 14,950 rubles (13,000 × 1.15).

New minimum wage from January 1, 2020

From January 1, 2020, the minimum wage has changed in the Russian Federation. The new minimum wage increased to 12,130 rubles. This fact will affect the amount of the minimum allowance for a child under 1.5 years old.

From January 1, 2018, the billing period and average daily earnings for calculating temporary disability benefits have changed. The maximum and minimum amount of sick leave payments have changed.

Calculation of sick leave in 2018

In 2018, the billing period for benefits includes 2016 and 2017.

For 2016, payments within the limits of 718,000 rubles can be taken into account, for 2017 - within

RUB 755,000

Let's calculate the maximum average daily earnings for calculating sick leave in 2018:

The maximum average daily earnings for sick leave calculation in 2018 is: 2017.81 rubles.

From January 1, 2018, the minimum wage is 9489 rubles. The average monthly earnings should be compared with 9489 rubles.

In 2017, the minimum wage was 7800 rubles. Since the minimum wage has been increased, the minimum sick leave benefit in 2018 has become larger.

Let's calculate the average daily earnings:

The maximum average daily earnings for 2018 is: 311.97 rubles.

Reference data for calculating sick leave in 2018. Table.

How to calculate sick leave in 2018

After returning to work after illness, the employee presents a sick leave. The organization is obliged to assign him an allowance within 10 calendar days from the date of application and pay - on the next day set for the payment of wages. According to Article 15 of Law No. 255-FZ.

The benefit is accrued and paid if the employee applies for it no later than six months from the date of entry to work. According to Article 12 of Law No. 255-FZ.

You need to pay the entire period of disability of the employee, including days off and non-working holidays.

In case of illness or domestic injury, the benefit for the first three days of disability is paid to the employee at the expense of the company, and from the fourth day - at the expense of the FSS of the Russian Federation (clause 2, article 3 of the Federal Law of December 29, 2006 No. 255-FZ).

General procedure for calculating sick leave in 2018

To calculate the sick leave, the number of days in a year is always 730. It doesn't matter if we count in a leap year or not. Only for calculating maternity benefits, the number of days may be different.

Calculate the marginal base for the calculation of contributions. For calculation, we take the base values for 2016 and 2017: this is 718,000 rubles. and 755,000 rubles. respectively. In total, this will be:

RUB 1,473,000

Example 3. Calculation of sick leave 2018 from the minimum wage

A new employee has joined the company. Due to the difficult economic situation in his region, he could not find a job for a long time and did not work in 2016 and 2017. After working for about a month, he fell ill. A week later, he brought a sick leave for 5 calendar days.

Since in the billing period (2016-2017) the employee did not receive wages, the accounting department must calculate sick leave benefits based on the minimum wage.

First, we determine the average earnings: 9489 rubles. × 24 months : 730 days = 311.97 rubles

The employee's work experience is 4 years 3 months, so his allowance will be 60% (up to 5 years) of the average earnings.

The calculation of the benefit looks like this: 311.97 × 5 × 60% = 936.91 rubles.

A similar situation in which there is no earnings in the billing period will be for employees who have returned from maternity leave. If there was no earnings, you need to calculate the hospital allowance from the minimum wage, taking into account the length of service.

Example 4. Calculation of sick leave 2018 from the minimum wage with experience

less than 6 months

If the employee's insurance period is less than 6 months, the sick leave allowance cannot exceed the minimum wage for a full calendar month, in accordance with Part 6 of Article 7 of Law No. 255-FZ.

In this case, to calculate the sick leave, you need to calculate and compare: the daily allowance calculated from the employee's earnings and the maximum daily allowance for a particular month, calculated from the minimum wage.

For example, let's calculate the maximum daily allowance for March and February 2018. March has 31 days, February has 28 days.

The maximum daily allowance in February 2018 will be: 9489 rubles. : 28 days = 338.89 rubles.

The maximum daily allowance in March 2018 will be: 9489 rubles. : 31 days =

RUB 306.1

Example 5. Calculation of sick leave if the experience is less than 6 months

On March 20, 2018, he brought a sick leave for the period of illness from March 12 to 18 (7 calendar days).

Earnings for the billing period 2016 - 2017 we do not consider. If an employee has less than 6 months of service, the sick leave benefit cannot be more than the minimum wage for a full calendar month and should be 60% of average earnings.

Therefore, for further calculation of the allowance, we must take the amount of 311.97 rubles. and multiply it by 60%. We get: 311.97 rubles. × 60% = 187.18 rubles.

We calculate the sick leave allowance from the daily allowance calculated from the minimum wage.

The sickness benefit is equal to: 187.18 rubles. × 7 days = 1310.26 rubles.

Just in case. For our own peace of mind, we will verify the amount of accrual for March and the minimum wage. The amount received is 187.18 × 31 = 5802.58 rubles. This amount is less than the minimum wage.

We pay an allowance in the amount of 1310.26 rubles.

Sick pay for part-time work

Part-time work is not uncommon these days. Many enterprises, due to a drop in revenue, a shortage of funds, and also in order to save money, have introduced part-time work. According to a survey conducted on our site in mid-2017, approximately 30% of participants said that they would like to keep staff and introduced part-time work.

If your company has a part-time work regime, sick leave benefits in 2018 should be calculated according to general rules, taking into account several features.

First, it does not matter how many days and / or hours employees work during the week, if the allowance is calculated from actual earnings.

Secondly, to determine the average daily earnings, you need to divide the earnings for the billing period by 730. The figure 730 does not change.

At the same time, the average salary of an employee cannot be less than the minimum wage. If, according to your calculations, you get a figure less than the minimum wage, you still need to take the minimum wage to calculate the sick leave. Then, reduce the average daily wage calculated from the minimum wage in proportion to the length of the working time of such an employee.

This rule can be applied if the part-time work regime was established no later than the day of illness. Retroactively, when an employee is on sick leave, a part-time job cannot be established.

Example 6. Calculation of sick leave if the company has a part-time job

Secretary of the director Marinina I.P. works 4 hours a day, 5 days a week.

She was ill in January. After returning to work, she brought a sick leave sheet for 5 calendar days to the accounting department.

Her earnings in the billing period were:

In 2016 - 50,000 rubles,

In 2017 - 65,000 rubles.

A little more than 5 years of insurance experience.

The average daily earnings from actual payments will be:

(50,000 rubles +65,000 rubles) : 730 days = 157.53 rubles.

Compare with the average daily earnings calculated from the minimum wage - 311.97 rubles. The amount calculated by us is 157.53 rubles. less than the amount calculated from the minimum wage.

We adjust the average daily earnings for the part-time coefficient:

311.97: 8 hours × 4 hours = 155.98 rubles.

Let's calculate the allowance taking into account the experience:

RUB 155.98 × 80% × 5 days = 623.92 rubles.

In 2020, the size of the lump-sum benefit for pregnancy and childbirth (BiR), in accordance with Federal Law No. 81-FZ of May 19, 1995, for women who are in different social status at the time of maternity leave, is calculated from the average salary or can be set in the minimum amount.

→

→

→

→

→

→

Thus, the allowance can be equal to:

- 100% of the average earnings - for working women subject to compulsory insurance in case of disability and maternity;

- 100% of the amount of monetary allowance - for contract servicemen;

- in the minimum fixed amount - in all other cases (including some categories of unemployed - students who were dismissed during the liquidation of the organization, etc.).

The legislative framework that establishes the indicated amounts of the B&R allowance:

- Art. 8 of Federal Law No. 81-FZ of May 19, 1995 "On State Benefits for Citizens with Children";

- Art. 11 of Law No. 255-FZ of December 29, 2006 "On compulsory social insurance in case of temporary disability and in connection with motherhood".

No major changes in calculus there was no maternity benefit compared to previous years, with the exception of the indexation of the minimum fixed amount by 3% from February 1, 2020, annual and.

- The amount of the benefit is calculated from the salary or other type of income, taking into account the district coefficient (if the latter is relevant for the area where the woman leaving the decree lives, and it has not already been taken into account when calculating wages).

- If a woman has combined work for at least two years two employers, then the amount of the allowance is calculated from the salary of each of them. Then, in the antenatal clinic, she must issue two maternity sick leaves to provide for each place of work.

- The payout amount based on the minimum wage(minimum wage), is subject to annual indexation in accordance with the increase in the subsistence level of the able-bodied population on average in Russia (the minimum wage from January 1, 2020 is 12,130 rubles).

Maximum maternity benefit in 2020

The amount of maternity allowance generally depends on the average salary, but if the income is too high limited within certain limits. That is, with an annual salary, for example, of a million rubles, maternity payments will not be charged from this amount, but from a smaller one - from which, according to the law, they can be paid by the employer contributions to insurance funds(PFR, MHIF and FSS).

Attention

Compared to the previous year, in 2020, the maximum limits for maternity benefits increased. This happened because of the new limits on the bases from which mandatory contributions to Social Insurance Fund(FSS).

Benefits begin to accrue only after the woman goes on maternity leave. That is, a pregnant woman will receive it in a smaller amount if she goes on vacation for BiR later than the deadline. The minimum duration of a full vacation in BiR is 140 days(70 days before delivery and 70 after), however, it can increase with multiple or complicated pregnancies - the amount of the lump-sum payment due will increase in proportion to the duration.

- For each day of processing a woman will receive regular salary, so for these days she will not be entitled to maternity payments.

- When leaving on maternity leave from the main job and from a combined position at different times, the allowance will be accrued for a different number of days.

Average earnings for calculating sick leave benefits

According to the established rule, maternity payments are calculated on the basis of average earnings for two previous full calendar years. At the same time, unlike the usual sick leave for temporary disability, the amount of maternity benefit is not affected by the work experience of the employee (provided that it is more than 6 months).

Attention

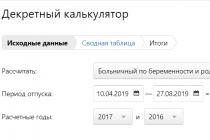

For those who issue a decree in 2020, the settlement years will be 2018 and 2019. When working part-time, the average amount of earnings is taken according to the amounts actually paid.

The average earnings used in the calculation include all types of income of a woman from which contributions to the FSS. To him, in accordance with Art. 9 of the law of July 24, 2009 No. 212-FZ do not include:

- social insurance benefits, including temporary disability payments (sick leave);

- periods of release from work with full or partial pay;

- one-time material assistance paid by the employer to employees in the amount of up to 4,000 rubles. for the billing period;

- other less common types of payments.

When calculating average earnings are taken into account these incomes:

- salary and travel allowance;

- bonuses, fees;

- holiday pay;

- compensation for unused vacation;

- financial assistance from the employer over unaccounted for 4,000 rubles.

Average daily earnings is calculated by dividing the income from which insurance premiums were paid to the FSS for two calendar years by the number of days in this period (in the simplest case - 730 days). The total number of days does not include:

- The periods during which the woman was on sick leave, on leave for BiR and childcare.

- Days when the employee was released from duties with partial or full salary retention, if no social insurance contributions were accrued during this time.

Attention

If during one or both accounting years a woman was on maternity leave or parental leave, then such a calendar period is allowed (but not obligatory) to be replaced by any other. The main thing is that when measuring the amount of payments does not decrease.

The resulting figure is multiplied by the number of days on maternity leave and we get the amount of the benefit in each case. The allowance can be calculated after the end of sick leave(main and, if any, additional), which will indicate the number of days of vacation in BiR.

Decree may last:

- 140 days - base case;

- 156 days - with complications during childbirth;

- 194 days - at the birth of two or more children at the same time.

The marginal base for calculating insurance premiums in 2020 (table)

The average earnings for maternity leave for each billing year cannot exceed the maximum established by law. The size of the latter is base limit, with which in the FSS insurance premiums are charged.

Limit sizes of bases for accrual of maternity leave in 2010-2020. are shown in the table below. For annual salaries in excess of the amounts given, the figures from the table will be used.

Limits of the insurance base for contributions to the FSS for 2010-2020.

| Year | Insurance base, rub. in year |

|---|---|

| 2010 | 415 000 |

| 2011 | 463 000 |

| 2012 | 512 000 |

| 2013 | 568 000 |

| 2014 | 624 000 |

| 2015 | 711 000 |

| 2016 | 718 000 |

| 2017 | 755 000 |

| 2018 | 815 000 |

| 2019 | 865 000 |

| 2020 | 912 000 |

Note: The limit bases for years before 2018 are given for cases where a woman wishes to replace the year in which she was on maternity leave or on leave to care for another child with a different calendar period, and also simply for the purpose of comparison (for illustration).

Attention

If the employee's salary in the billing year exceeds the amount presented in the table, then the employer did not pay contributions to the FSS from any part of the salary in excess of the above limit and, accordingly, it cannot be fully taken into account when calculating benefits.

In fact, the law limits not only the annual total that is taken into account, but also indirectly the actual average daily earnings.

- In general, when calculated in 2020, it cannot exceed the sum of the marginal bases for 2018 and 2019 divided by 730 (the number of days in two ordinary years) or 731 (if one of the two years is a leap year).

- That is, in 2020, the average daily earnings for the previous two years for calculating benefits in the general case cannot be more than 2301.37 rubles.

Maximum maternity benefit in 2020

Based on the formula for calculating benefits and the maximum insurance base, the maximum amount of payments for 140 days of the decree in 2020 will be:

140 days × (815,000 rubles + 865,000 rubles) / 730 days = RUB 322,191.80

Accordingly, with an extended decree (complicated childbirth, multiple pregnancy) and a salary greater than or equal to the insurance base, the employee will be required to:

- for maternity leave 156 days long - 359,013.72 rubles.

- for a vacation lasting 194 days - 446,465.78 rubles.

Attention

This amount paid as a lump sum for the entire period of vacation in BiR. It will be relevant provided that in 2017 and 2018. the woman was not on sick leave or on maternity leave.

An important addition: to the received maximum payout regional coefficients do not apply. That is, for example, both in the Arctic and in the Black Sea region, the maximum allowance will be the same.

Minimum maternity benefit in 2020

In some cases, the B&R benefit is paid at a minimum amount:

- working- according to the minimum wage for each month of the decree, the amount of which is established for each year by federal law;

- unemployed - in the form of a fixed amount established by law.

Women who did not work before the onset of pregnancy and childbirth do not go on maternity leave and cannot count on B&R benefits, even in the minimum amount. The exception is pregnant women with the official status of unemployed (i.e. registered with the Employment Center), dismissed due to the liquidation of the organization a year or less before obtaining the status, as well as some other categories of persons.

When calculating based on the size of the minimum wage

The minimum wage changes periodically (most often once a year) taking into account the increase in the living wage. In 2020, it is 12130 rubles.

For the B&D allowance in the minimum amount according to the minimum wage according to the law they have a right:

- Pregnant women going on maternity leave if they have worked in an organization less than 6 months.

- Women with an average salary below the minimum wage for the past two years (it is noteworthy that in this case, the calculated average earnings are compared with the minimum established for the estimated year of maternity leave, and not for the previous 2 years, so the allowance is calculated according to the minimum wage at the time of its appointment).

Attention

If a woman's earnings for some certain part of the calculation calendar period were below the minimum wage or were absent at all, then during this time the amount is also calculated based on the minimum wage.

Table of minimum wage sizes by years

| Year | Minimum wage, rub. |

|---|---|

| 2013 | 5205 |

| 2014 | 5554 |

| 2015 | 5965 |

| 01.01.2016 — 30.06.2016 | 6204 |

| 01.07.2016 — 30.06.2017 | 7500 |

| 01.07.2017 — 31.12.2017 | 7800 |

| 01.01.2018 — 30.04.2018 | 9489 |

| 01.05.2018 — 31.12.2018 | 11163 |

| 2019 | 11280 |

| 2020 | 12130 |

Note: For individual subjects of the Russian Federation, the size of the minimum wage may differ depending on regional agreements and orders. Increases are also applied to this amount. district coefficients.

Corresponding to the value of the minimum wage = 12130 rubles. minimum maternity allowance per 140 days of maternity leave from January 1, 2020 will be paid in a lump sum RUB 55830.60:

140 days × (12130 rubles × 24 months) / 730 days = RUB 55830.60

- From the above calculation, it can be seen that the minimum benefit is also determined by the average daily earnings for 2 years, equivalent to the current value of the minimum wage. There are no exclusion periods for this.

- If the period of maternity leave falls on the junction of years, then you can postpone maternity leave and move it to the beginning of the new year. This is allowed if the employee sees that in this case the amount of the allowance will be more beneficial for her.

Non-working women during the liquidation of the organization

Women who lost their jobs due to the liquidation of the organization no more than a year before receiving the status of unemployed, can count on benefits in the form of a clearly fixed amount. From February 1, 2020, its size is RUB 675.15 per 1 month.

A payment in the same amount is due to the following categories of women registered with the Employment Center within a year after the termination of work:

- terminated activities as individual entrepreneurs (IP);

- who have lost the status of a lawyer, private notary or other person whose activities are licensed.

In this case, the allowance will be paid in one of the following amounts:

- 3108.0 rub. with sick leave 140 days;

- 3463.2 rubles - at 156 days;

- RUB 4306.8 - at 194 days.

The amount of payment to full-time students

According to the law, women who study full-time in professional, higher educational institutions and scientific organizations can also count on maternity payments on the basis of a relevant certificate from a medical organization. in the amount of the scholarship.

- The allowance is also intended for graduate students of full-time education.

- Payments are accrued when going on academic leave.

The allowance is issued at the place of study and paid from the state budget. The educational institution has no right to refuse to pay a woman. At the same time, students of other forms of education (correspondence) allowance for BiR not allowed.

Conclusion

The amount of maternity pay for those who went on maternity leave in 2020 is generally equal to the average salary or other income (stipends, monetary allowance). The amount of the settlement allowance for BiR for those who went on maternity leave on sick leave for 140 days from 01/01/2020 fluctuates within from 55830.60 to 322191.80 rubles.

In general, the amount of the payment depends on:

- length of stay on sick leave;

- the current minimum wage - for women with a small salary or recently laid off;

- the marginal base for calculating insurance premiums - for those who received high wages.

RedRocketMedia

Bryansk, Ulyanova street, house 4, office 414

Content

Statistics say that 63% of Russian citizens are unemployed or receive a “black” salary, and only 16% of them are officially recognized as unemployed. 54% of the number of people registered with the employment service are women aged 31 to 50 years. In order to reduce tension in the labor market, the government decided to provide unemployed citizens with unemployment benefits in 2018, the maximum amount of which will be 4,900 rubles.

What is unemployment benefit

Citizens who are unable to get a job and are registered with an employment center may apply for financial assistance. Unemployment benefits in 2018 will not be indexed. It decreases after a certain period of time. The size of the unemployment subsidy is affected by the size of the regional rate and the length of service of the specialist.

Representatives of some departments believe that individuals discredit this type of social payments as a phenomenon, because. try to get it as soon as possible. Officials insist on the introduction of a full-fledged retraining system based on employment centers, which would reduce the cost of retraining specialists.

Status of the unemployed and the conditions for obtaining it

Unemployed recognize able-bodied citizens who do not have a permanent income or work. They must first register with the employment service in order to find a suitable vacancy and demonstrate their readiness to start a suitable job. Employees of employment centers sometimes reject requests for financial assistance from people with disabilities, because. confuse the concept of ability to work and ability to work. If a person is able to perform his official duties, then he can, regardless of his state of health.

Legal regulation

According to Article 34 of the Law of the Russian Federation of April 19, 1991 “On Employment of the Population”, all citizens officially recognized as unemployed can receive unemployment benefits in 2018. An individual can apply for a job that will suit him in terms of qualifications, working conditions, health status, transport accessibility. For example, if a citizen received 15,000 rubles at a previous job, then an employee of the labor exchange must select vacancies for him with a salary of at least 9,500 rubles.

Unemployed residents who have lost the right to receive a subsidy may apply for material assistance. You can get it upon retraining in the direction of the employment service or after 36 months from the date of registration of the status of unemployed. Under the law, individuals under the age of 30 can take advantage of retraining benefits. These include compensation for public transport costs, medical expenses (provided with a certificate from the hospital).

Who is eligible to receive

Any citizen of Russia who has reached the age of 16 without permanent or temporary income can register with the labor exchange and register as unemployed. Girls on maternity leave cannot use this right, because. they belong to the temporarily disabled population. A woman will be able to receive the status of unemployed after the child reaches 1.5 years. Unemployment benefits are not paid to the following categories of residents:

- under 16 years of age;

- full-time students;

- pensioners;

- individuals with the status of an individual entrepreneur;

- disabled people classified as incapacitated groups;

- individuals who decide to apply at the place of temporary registration;

- convicted by court decision to corrective labor;

- persons who provided false information about their recognition as unemployed.

Labor exchange payments

The allowance is credited to the account of a citizen on a monthly basis from the moment he received the status of unemployed. Persons who have lost their jobs due to the liquidation of the company, the termination of the activities of the individual entrepreneur or due to the reduction of the staff, cannot use this privilege. According to Article No. 178 of the Labor Code of the Russian Federation (Labor Code of the Russian Federation), such citizens retain an average salary for a job search period of 2 months, and then they will be able to receive a subsidy, like other unemployed people.

Every 14 days, the specialist will receive requests for re-registration. You should respond quickly when you receive them, because. if an individual does not regularly confirm his status, the provision of material assistance is terminated. To resume payments, an unemployed worker will have to fill out an application again and collect the entire package of documents.

Over what period are they paid?

Financial assistance for unemployment begins to accrue from the first day the specialist is recognized as unemployed. The procedure for paying unemployment benefits in 2018 will not undergo any major changes. In case of early retirement, the unemployed person loses the subsidy. A specialist will not be able to become a member of the state program to combat unemployment if he works part-time or has a temporary part-time job.

The subsidy is paid for 2 years. After 7-12 months comes a six-month break. If the specialist has not found a job after this time, he must contact his supervisor from the employment center. After the official appeal, payments will be resumed for 7-8 months, and then again there will be a six-month break. After that, the subsidy will be transferred to the account of an individual for 4-5 months.

How much pay

When calculating the amount of unemployment benefit, three months of earnings at the last place of work are taken into account. In total, before dismissal, an individual is required to work for at least 26 weeks. If a citizen worked part-time, then first the employees of the center recalculate working hours. If the total amount is less than 1040 hours, the specialist is assigned a minimum allowance equal to 850 rubles. The exception is orphans. For the first 6 months they are paid an allowance equal to the level of the average regional salary.

Minimum and maximum size

The amount of payments is determined by the position and length of service of the employee. The maximum unemployment benefit is 4900 rubles, which is 2 times lower than the subsistence minimum. For 3 years, the government has been considering applications to increase the amount of this subsidy, but additional funds from the state budget have not yet been allocated to achieve this goal. The minimum subsidy is 850 rubles. It is installed:

- first-time job seekers and university graduates;

- those who want to find a job after a long break;

- persons who have worked less than 26 weeks in a year;

- specialists who were dismissed by the decision of the trade union for violating labor discipline.

An orphan child is eligible for increased unemployment benefits in 2018. It is equal to the size of the average monthly salary established in the region where the citizen lives. Relevant changes were made to Federal Law No. 89 and come into force on May 1, 2018. Financial support will be provided to the orphan continuously for 6 months. If during this time the specialist does not find a job, then the amount of the allowance is automatically reduced to 850 rubles. The amount of unemployment benefits for the disabled is calculated, as for ordinary specialists.

Payout amount

The amount of unemployment benefits in 2018 directly depends on the salary of a citizen at the previous place of work. At the federal level, its value cannot exceed 4900 r, but in some regions of the country there are regional coefficients. In these regions, unemployment benefits will be higher than those established by law. The subsidy in 2018 will continue to accrue as a percentage of wages if the following conditions have been met:

- a citizen has worked for at least 26 weeks under an employment contract;

- less than 1 year has passed since the dismissal;

- the reason for the loss of work is not the unlawful actions of a citizen (appropriation of property, violation of labor discipline, etc.).

Average earnings are calculated on the basis of information for 3 months provided by the citizen. The resulting amount is multiplied by the regional coefficient. For example, in Buryatia it is 1.3. If the subsidy is equal to 900 rubles, then when multiplied it will increase to 1170 rubles. It happens that the amount of material assistance, according to the calculations of the employees of the employment center, turned out to be 10,000 rubles. An unemployed specialist will not be able to receive a payment of this amount, because. by law, the maximum amount of the subsidy is 4900 r.

The procedure for determining the average daily earnings

Features of the calculation of benefits are described in the decree of the Ministry of Labor of the Russian Federation of 12.08.2003. When determining the average daily earnings, both the basic salary and other types of payments from the employer are taken into account. Remuneration based on the results of one calendar year is calculated not taking into account the full amount, but in the amount of 1/12 for each month of work. When calculating the average salary, they take information for the 90 days preceding the dismissal. When calculating benefits, in addition to salary, take into account:

- bonuses for long service and other labor achievements;

- additional income received due to overtime work;

- bonuses and fees;

- salary in kind.

Subsidies for previously employed persons in the first year

One of the prerequisites for increasing the size of the subsidy is the existence of continuous work experience for a specialist for 12 months until the moment of dismissal. The payment of unemployment benefits in 2018 will not change on this item. The first 3 months the specialist will receive 75% of the average monthly income, and the next 4 months - 60%. After this time period, there is often a six-month break in payments, and then for 5 months the specialist is credited with 45% of his salary.

Grants for the second year

In the second 12-month period, the citizen receives the minimum subsidy multiplied by the district coefficient. For example, in Moscow this figure is 1.7, and the amount of monthly material assistance will be 2890 rubles. At the end of the second year, the citizen will be deprived of the subsidy provided. The total period for granting material assistance may not exceed 24 months, considering 36 calendar months.

Conditions for Moscow

The amount of payments is determined by the average earnings of a citizen for 3 months. In Moscow, unemployment benefits will be increased in 2018, because the regional coefficient here is the highest among all Russian cities. A similar indicator when calculating payments is used by the authorities of St. Petersburg. Moscow unemployed will be able to take advantage of transport benefits. They will additionally be paid 1190 rubles. The maximum amount of social benefits will be 6940 rubles, and the minimum - 2890 rubles.

After applying to the Department of Labor and Social Protection of the Population, a citizen will receive the status of an unemployed person on the 11th day from the date of submission of all documents. For the first 10 days, together with the employees of the employment center, he studies the list of current vacancies. With an unpopular specialty, retraining will be offered to an individual. If in 10 days the search for a place of study or work is not successful, then the citizen is assigned the status of an unemployed person and benefits begin to accrue.

When payments stop

After official employment, a citizen ceases to receive unemployment benefits. Upon registration of the fact of the death of an individual, the payment of material assistance is terminated. If a citizen has not come to the employment center for more than 1 month, then the state will stop transferring money. The Employment Center may refuse to provide unemployment benefits if:

- a citizen is serving a criminal sentence;

- an individual was sentenced to corrective labor;

- when a citizen undergoes formal vocational training or additional education with the payment of a regular cash allowance;

- when an individual provides false information about himself;

- refusal of a citizen from the assistance of state bodies in finding a job.

In what cases are payments temporarily suspended while maintaining the status

When a citizen leaves his place of residence in connection with retraining or advanced training in vocational education institutions, money will not be credited to his account. During conscription and compulsory military service, individuals are not provided with benefits, because. the maintenance of military personnel is paid by the state. The restriction applies to maternity leave. For a period of up to 3 months, payments are suspended if:

- the citizen refused 2 suitable job options during his stay at the labor exchange;

- the individual has refused to be reprofiled or to participate in public works;

- the unemployed person was dismissed from the last place of work for violation of labor discipline and other actions indicated by Article 35 of the Labor Code of the Russian Federation;

- the citizen was expelled from the place of retraining;

- an individual arbitrarily left the training in the direction from the employment center.

How to issue

The first step of any person who decides to obtain the official status of unemployed will be to contact the employment center at the place of his registration. An authorized employee of the department will give the unemployed an application form and a list of documents that must be submitted to receive financial assistance. After receiving all the certificates, an individual can re-apply to an employee of the employment center.

An employee of the department will record the fact of submission of documents, and then offer the citizen several options for work. When looking for vacancies, an employee of the labor exchange should focus on the education, qualifications and work experience of a person. For example, if an engineer is offered a job as a cook, he has the right to refuse such an offer. Often employees are sent for retraining, and then they are looking for suitable vacancies. If all of the above measures did not help with finding a job, then the specialist is assigned the status of unemployed.

Where to go

There are employment centers in every region of Russia. A citizen who wants to officially become unemployed must come there. A specialist working with the unemployed population will give an individual a list of documents that will need to be collected in order to receive benefits. You can become a member of the state program only at the place of permanent registration. If a specialist is registered in Khabarovsk, but is temporarily registered in Moscow, then he must return to his hometown and look for work there.

What documents are required

Registration of the status of the unemployed takes 11 days. An individual who is recognized as unemployed can receive unemployment benefits in 2018. The unemployed can spend money on utility bills or their own food. The decision to register a person as unemployed and to pay monetary compensation is made on the basis of the following documents:

- passports;

- completed application;

- work book or a document that replaces it;

- a diploma of education and other documents confirming the qualifications of a potential employee;

- certificate of average earnings for 3 months from the last place of work;

- SNILS (insurance number of an individual personal account);

- TIN (individual taxpayer number);

- bank account number for money transfer.

Video

Did you find an error in the text? Select it, press Ctrl + Enter and we'll fix it!Discuss

Unemployment benefit in 2018: procedure and amount of payment

Unemployment benefits are entitled to receive only citizens who are officially unemployed, who received such status in accordance with Law No. 1032-1 of 04/19/1991 "On Employment".

In 2019, only:

- able-bodied citizens;

- who have reached the age of 16;

- non-pensioners and full-time students;

- not engaged in entrepreneurial activity;

- not occupying the position of founders of enterprises and firms;

- sentenced to correctional labor or imprisonment.

The amount of the benefit depends on the average earnings of the unemployed for the last 3 months at the last place of work. The average earnings are determined on the basis of the data presented in the certificate from the last place of work. Law No. 1032-1 sets the maximum and minimum unemployment benefits. It is equal to 4900 and 850 rubles, respectively. It can be adjusted by the district coefficient, which is set by the regional authorities depending on the standard of living and the minimum wage in the region.

Moscow has the highest unemployment benefit, as here the Moscow Government makes additional payments. In addition to the minimum and maximum benefits, the authorities of the region “pay extra” for another 850 rubles. In addition, the unemployed are compensated for transportation costs in the amount of 1,190 rubles. Thus, the minimum and maximum unemployment benefits in Moscow are 2,890 and 6,940 rubles, respectively.

The following citizens receive the minimum unemployment benefit:

- first-time job seekers;

- who worked at the last place of work for less than 26 weeks;

- those who want to find a job after a long break (more than 1 year);

- dismissed from the last place of work "under the article";

- who left the place of study, where they were sent from the Employment Center arbitrarily and without good reason.

The applicant receives the status of unemployed on the 11th day from the date of submission of all documents. In the first 10 days, employees of the Employment Center offer him all available vacancies that suit him in terms of qualifications.

If the applicant has an "unpopular" specialty, he will be offered training or retraining. If in 10 days he does not find a suitable job or place of study, then on the 11th day he will receive the status of unemployed and will receive unemployment benefits from that day.

Unemployment benefits in 2018 in the Moscow region

The amount of unemployment benefits in the Moscow region is about the same as in Moscow. The standard of living in the Moscow region is as high as in Moscow. Therefore, the maximum and minimum unemployment benefits here are the same as in Moscow.

The Moscow government pays its unemployed 850 rubles in addition to the maximum and minimum benefits. The authorities of the Moscow region do not make such additional payments. Therefore, the unemployed of the Moscow region receive 4,900 and 850 rubles, respectively. Unemployment benefit depends on the average earnings of the unemployed for the last 3 months. In the first 3 months as unemployed, the applicant will receive 75% of his average earnings, in the next 4 months - 60%, and then - 45%.

The allowance is accrued and paid only for 12 months within 1.5 years. If the unemployed person could not find a job for a year through no fault of his own, then the allowance will be paid for another 1 year. Its size will be equal to the minimum allowance for the region. To maintain the status of unemployed and continue to receive benefits, it is necessary to re-register every 2 weeks at the Employment Center at the place of residence. Otherwise, the payment of benefits may be suspended.

Where to go

In order to start receiving unemployment benefits, you must do the following:

- visit the Employment Center at the place of their permanent registration;

- prepare the necessary documents. Their complete list will be issued by a specialist of the Employment Center;

- complete the relevant application;

- start receiving benefits.

Such actions are called the registration of an unemployed citizen with the Employment Center. This can be done by those citizens who have already reached the age of 16, and who do not have a permanent job, and are not engaged in entrepreneurial or other income-generating activities.

It should be understood that the main goal of the Employment Center is not the payment of benefits to unemployed citizens. The main goal is the employment of the unemployed in the shortest possible time. The payment of benefits is a measure of additional support for unemployed citizens by the state.

You should contact the Employment Center at the place of permanent registration. That is, this means that if an unemployed person has a permanent residence permit in the Republic of Tyva, but lives in the Moscow region, having a temporary registration, that he must go to Tyva and look for work there.

If an unemployed person has been living in another region for many years, has a temporary registration and worked here (documents from the place of work can confirm this), can he register at the place of temporary registration? The unequivocal answer is no! You can only register at the place of permanent registration.

Like many other government agencies, the Employment Center has its own official website. However, it will not work to register using the World Wide Web, since only original documents are needed. On this site you can always see the available vacancies in the Employment Center. Also on this portal you can find out the exact address of the Employment Center, which is "fixed" to the address of the applicant.

What are the deadlines

You can register with the Employment Center at any time. But there are several nuances that must be taken into account:

- if the applicant was dismissed due to staff reduction, then he must register within 2 weeks after dismissal. In this case, he will receive the wages for the third month;

- if the applicant does not do this or finds a job in the nearest time after the dismissal, then he will not receive benefits for the third “unemployed” month.

There are no other nuances. No matter what time the unemployed person arrives and brings documents for registration, he will be recognized as unemployed and will receive benefits. And the amount of benefits depends on whether he previously worked or not.

Conditions required to receive

Not everyone can count on receiving unemployment benefits in Moscow.

The following citizens have the right to register and receive benefits:

- citizens who were fired from their previous job to reduce staff. They need to come to the Employment Center and submit documents within 2 weeks after the dismissal;

- persons who have never worked in their lives, but at the same time have an education;

- citizens who do not work and do not have education;

- pregnant unemployed women;

- people with disabilities.

That is, citizens aged 16 to retirement age who do not have any income, including from entrepreneurial activities, can be recognized as unemployed.

Benefit procedure

In order to receive benefits, you must register with the Employment Center at the place of your permanent registration. But this does not mean that the citizen will start receiving benefits from the very first day, as soon as he applied with the documents. Within the first 10 days from the date of application:

- he will be offered all available vacancies in the employment center. Including temporary, which correspond to his education and work experience;

- if there are no such vacancies, then he will be invited to participate in public works;

- if he does not have an education, or if it is “not popular” at the moment, he will be offered either to go to study again, or to undergo appropriate retraining.

If these measures do not bring a positive result, and the applicant does not find a suitable job, then on the 11th day after applying, he is registered. From that day on, he will receive the official status of unemployed and will receive benefits.

At the same time, one should not forget that a citizen will not be registered, and as a result, will not receive unemployment benefits in Moscow if he:

- Twice in a row he refuses the job offered to him. In this case, the vacancy will correspond to:

- his education;

- his qualifications;

- his work experience;

- his state of health;

- paid not lower than the living wage;

- located in the access zone from the place of registration of the applicant. This is a rather controversial criterion, since Moscow is a very large city, and it takes only a few hours to get from one end to the other. Therefore, this criterion for Moscow is rather “vague”.

- Twice in a row refuse the proposed place of study or place of work if he has no education and has never worked;

- Does not appear at the specified Employment Center within 10 days after the submission of documents for the selection of vacancies for him or places of study and retraining.

- Does not appear at the Employment Center within the predetermined period for registration.

- Intentionally submit false information and documents.

In the presence of such circumstances, a decision will be made to refuse to register this citizen. But 1 month after the decision is made, he can visit the employment center again, submit documents and register. And, therefore, start receiving benefits if they no longer violate the above standards.

Benefit payment procedure

There is a certain procedure for paying unemployment benefits:

- it is calculated as a percentage of average earnings, but cannot be higher than the established maximum - 4,900 rubles for citizens who previously worked. This value has not changed for several years and will remain at the same level in 2018;

- the allowance is paid monthly;

- those citizens who have not previously worked will receive the minimum allowance - 850 rubles.

This value has also not been indexed for several years.

In this case, the unemployed must:

- check in every 2 weeks at the Employment Center;

- consider vacancies offered by the Employment Center. An unemployed person is not obliged to go to an interview for those vacancies that do not suit him, neither by education, nor by skill level. For example, an unemployed person is an engineer of low-voltage systems by education, and he is sent for an interview for a job as a cook in a cold shop;

- if the unemployed person has an “unpopular” profession or education, then he should consider options for retraining for “popular” specialties;

- be aware that the amount of the benefit will not always be the same. In the first 3 months from the moment of registration - 75% of the average monthly earnings (or monetary allowance, if he was previously in military service) of the unemployed. Average earnings are calculated based on wages for the last 3 months from the last month of work. It does not matter how much time has passed since the applicant quit. If the company has already ceased to exist, then you need to submit an extract from the Unified State Register of Legal Entities about this fact;

- in the next 4 months, the amount of the benefit will be 60% of the above calculated amount;

- further - only 45% of the same value.

Unemployment benefit legislation

The main legislative act that regulates the registration of citizens, the payment of unemployment benefits to them and other important points regarding the assignment of the status of an unemployed citizen is the Law of the Russian Federation of 04/19/1991 No. 1032 - 1 "On Employment in the Russian Federation".

The latest amendments to this law were made by Federal Law No. 495-FZ of December 28, 2016. But these changes did not affect the fundamental provisions of the law.

For 2 years now, deputies have been proposing to increase the size of the allowance by region to the subsistence level in this region. But so far such proposals are under discussion and have not yielded any results. The amount of unemployment benefits is still at around 4900 rubles (maximum limit) and 850 rubles (minimum limit).