Consider how you can withdraw cash from your wallet or transfer funds.

Yandex wallet has three statuses:

- anonymous- automatically assigned during registration;

- nominal- available only for citizens of the Russian Federation, significantly expands the number and volume of operations;

- identificational- makes it possible to use the services of the online system to the fullest.

Transfer to a bank card from an anonymous wallet is not available.

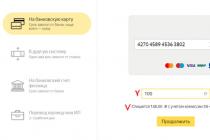

Translation order:

- enter your personal account;

- find the "money transfers" section in the left menu;

- in the "where" field, select - "to a bank card";

- indicate the card number and the transfer amount;

- the final amount, including the commission, will be displayed under the field.

- the system will send a confirmation code to the phone;

- the code is inserted into the field, the operation is completed.

The minimum transfer amount is 100 rubles. The commission for the service is 3% + 45 rubles. The transfer arrives within 1 day.

There are two ways to save some commission

- Banks "Tinkoffbank", "Promsvyazbank" and "Alfa-click" take a commission of 3%, provided that the wallet is identified.

- Savings from each transfer occur when specifying its details instead of the card number. In this case, the money is received within 3 days.

Money transfer can be made to cards: VISA, Master Card, Maestro and MIR.

The percentage of the commission is quite high, with regular transactions the losses are significant. It is more profitable to get a bank card from Yandex, where the account balance in the wallet will be associated with it.

Quick transfer

A quick money transfer is possible when linking a Sberbank card to Yandex:

- in the settings, select the "linked cards" tab;

- enter data;

- make a test payment of 1 rub.

Binding is needed if it is convenient for you to pay on the Internet without replenishing your wallet.

Method 2 - cash via ATM or terminal

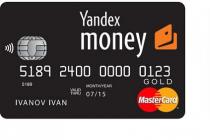

To withdraw money, you will need to get a personal Ya.Card card. It is ordered in your personal account, you need to exit the anonymity mode and provide basic information about yourself.

Yandex map

Yandex map The map shows:

- First Name Last Name;

- number;

- cvc (security code);

- validity.

The cost of production and delivery is 300 rubles, the waiting time is 5 days. Receipt - at the Russian Post office.

Card features:

- has a common balance with the electronic service Yandex. Money;

- operates in Russia and abroad;

- cash out money in the terminal;

- making payments;

- payment for purchases and services.

When withdrawing money through an ATM, a commission of 3% + 15 rubles is charged. Card maintenance for the first 3 years is free. This is the only way to withdraw money from an ATM.

The previously existing possibility of receiving cash without a card at Raiffeisenkombank ATMs has been cancelled.

Method 3 - transfer to another system

Cashing out electronic money using private money services Western Union, CONTACT, Unistream and their competitors. Only owners of wallets with identified status can use payment systems. Registering such a wallet is very simple: just have a Sberbank card and connect a mobile application. Other electronic services require a scan or copy of the passport.

Points of the systems are located in every city of Russia and the CIS countries, money can be received in cash immediately at the box office. Commission 4%, funds are received within 2-3 hours, sometimes one business day.

In your personal account, the fields with options are located next to the "transfers to the bank" field.

Procedure:

- save the phone number, it will receive an SMS with the control number of the transfer;

- fill in a standard form: full name, country of destination, place of payment of the transfer; specify the currency and amount to be received;

- after the commission is calculated, the total amount payable appears;

- click the "send transfer" button.

To receive money at the nearest branch, you need to indicate the number of the transfer, the amount and present your passport.

Method 4 - translate physical. person to a bank account

Yandex wallet makes it possible to send money to your bank account, another account, use virtual money to repay a loan. Funds can be transferred to the accounts of individual entrepreneurs and legal entities.

- In Tinkoffbank, Promsvyazbank, Alfa-click banks, the operation takes several hours, less often - 1 day. In other banks - up to 3 working days.

- The minimum transaction amount is 100 rubles.

The sequence of actions for transferring an individual to a bank account, repaying a loan:

- go to the "money transfers" section;

- in the "methods" field, select: "to a bank account";

- fill out the form: full name, BIC, financial account number,

- name of payment, amount of sending;

- specify the wallet for debiting;

- confirm the transaction.

The process ends with the receipt of an SMS message confirming the operation.

You need to have complete information about the account, carefully check the details. The mistake made will not allow the operation to be carried out.

Method 4 - transfer to an individual entrepreneur or legal entity

To transfer money to the account of a legal entity, you do not need to enter numerous data. The Yandex system will independently find the necessary details by the recipient's TIN.

To replenish the bank account of a legal entity:

- select "transfer to the account of a legal entity";

- enter the TIN, Yandex will find the rest of the details;

A commission of 3% + 15 rubles is charged.

Transfer limits

Each e-wallet has limitations. Limits on operations in Yandex.Money depending on the status of the wallet:

| Operation | Anon. | Nominal | Ident. |

| balance in wallet | 15 000 | 60 000 | 500 000 |

| monthly turnover | 40 000 | 200 000 | 3 000 000 |

| expenditure transactions | 15 000 | 60 000 | 250 000 |

| money transfer | unavailable | 15 000/operation | 400,000/operation |

| daily withdrawal from the Yandex.Money card | 5 000 | 5 000 | 100 000 |

| Payments in foreign stores | unavailable | allowed | allowed |

The Yandex wallet has a function - an accelerated withdrawal of funds, provided by all transaction methods. The client must be an authorized user. After checking, the "accelerated" button appears. The implementation will have large percentage losses, but if you need cash urgently, this is the most convenient option.

Comparison of methods

The people who use e-wallets most often:

- freelancers;

- active buyers in online stores;

- gamers.

Each user prefers one of the ways to withdraw money from the service. Let's compare the advantages and disadvantages of each:

Each method has pros and cons:

- the commission for transferring to a card is slightly higher, but time is saved;

- payment systems are convenient for quick withdrawal of money in any city, but the commission is higher and identification is required;

- The fastest way to withdraw money is with a card, but you need to get it.

How to transfer without commission

Any method of withdrawing savings from Yandex wallet involves the payment of a commission fee. The only possibility of interest-free realization of savings is payment for purchases within the Internet.

Money from the e-wallet can be spent:

- payment of traffic police fines - commission 1%;

- eliminate debts on taxes and penalties - 0%;

- for individual entrepreneurs, contributions to the pension fund, for compulsory medical insurance - 0%;

- utility bills -1%;

- payment for a landline phone, mobile communications, Internet - 0%.

Another most preferred option is to get a personal plastic card of the Yandex system. Having paid once for its production, the subsequent use of the card for 3 years is absolutely free.

Despite the commission charged, using the Yandex.Money system has many advantages:

- uninterrupted operation of the service;

- a variety of ways to withdraw funds;

- the amount of the commission is less than in other electronic services;

- high degree of protection;

- the site is easy to use;

- quick withdrawal of money.

The quality, or rather, the convenience of withdrawing funds from the electronic payment system, is a significant indicator of solidity and friendliness to users of the service. Yandex Money offers its customers a number of ways to cash out funds from a virtual wallet. However, to what extent are they accessible, convenient and do not entail losses?

It is obvious that the convenience of the methods by which funds can be withdrawn from the Yandex wallet can be assessed by the small number of actions performed by the user and the time during which money is received from the virtual account. The second side of the service evaluation is whether you have to pay for withdrawing funds from the wallet. Of course, the most favorable for the user are methods that are not subject to commission or at least with minimal loss of money.

Ways to withdraw money from the wallet

The system offers a whole list of options that you can use to withdraw money from virtual to real. In order to get a complete list of them, you need to log in to the service and go to the "Remove" section.

After clicking the button, the browser will open the “How to withdraw money” selection window, which presents a complete (almost complete) list of options through which you can make a withdrawal. All possibilities can be sorted by region, speed of transferring money, as well as the possibility of making a withdrawal without identification.

You can display the content:

- with a Yandex.Money bank card;

- by transferring them to any payment card;

- by transferring to a bank account;

- by sending through money transfer systems.

Yandex Money card

The Yandex Money system offers the possibility of issuing a real plastic card linked to a virtual wallet account. The service states that the release and delivery of plastic is free of charge and without commission. At the same time, however, a fee for the use (“maintenance”) of plastic is charged, which is:

- 249 rubles for three years when ordering from the Russian Federation;

- 349 - when ordering from other countries.

The advantage of a payment instrument that has a common account with a Yandex wallet is the ability to make purchases and pay for services without any commission. However, it will not be possible to cash out funds without interest.

When using a Yandex Money card, payment is withheld when:

- withdrawing cash from an ATM;

- transferring funds to another card;

- replenishment of LiqPay;

- ordering and replenishing a virtual card from Russian Standard Bank.

The size of the bets is quite large: 3% of the withdrawn amount plus 15 rubles, but not less than 100 rubles.

Transfer to the card

You can withdraw cash by transferring to a bank card of any financial institution. The minimum amount that can be withdrawn is 500 rubles.

As a rule, when withdrawing cash directly from an ATM, there is no commission, however, it is when transferring funds and also amounts to 3% plus 15 rubles.

Through a bank account

To withdraw money to a bank account, after authorization, go to the "Withdraw" tab, and then select the appropriate method:

It should be noted that in each of the methods by which you can withdraw the required amount of money, the payment system takes its own percentage. Commissions range from 2% (but not less than 30 rubles) when transferring to the account of a legal entity or individual entrepreneur in Russia to the standard "3% plus 15 rubles." when repaying loans.

Money transfer systems

Yandex Money offers to withdraw funds through popular money transfer systems:

- Western Union;

- CONTACT;

- RNKO "RIB";

- Idram.

All these services, working with the transfer of both cash and virtual funds, also burden the withdrawal with a commission. Moreover, in this case we are talking about increased interest, since Yandex Money and the translation service also benefit. For example, withdrawing money through CONTACT is subject to:

- 3% - Ya.D;

- 1.5 - 2% and not less than 60 rubles - CONTACT.

Exchange offices

Electronic exchangers allow you to withdraw money from your Yandex wallet to other payment services or bank accounts/cards. At the same time, commissions for such operations due to the great competition between exchangers are really minimal.

For the convenience of users, there are even special rating sites that show real-time rates at which money is withdrawn or transferred.

Thus, the only way that allows you to withdraw amounts from a digital wallet without a commission is to use a proprietary plastic card of the system. At the same time, the essence of the operation does not fully correspond to the concept of “cash withdrawal”, since without losses you can only pay for goods and services, but when cashing out at an ATM, the percentage is still withdrawn.

All other operations are subject to a certain fee, which, as a rule, is 3% + 15 rubles. To avoid excessive payments, you need to carefully monitor how much will be withdrawn from the account during a certain operation. To minimize costs, it is worth contacting a supporter of exchange organizations.

Reading 5 min. Views 5.2k.

Another part of users immediately asks a similar question after registering in the system. Many fear that it will be difficult to do this, and whether it is worth transferring money to these resources if they cannot then be converted into cash. In fact, inside a Yandex.Money account, all operations are done quite simply. Often it is not even required to confirm payment details or have an identified account.

There are several ways to cash out Yandex money and turn poison into paper rubles.

The fear of withdrawing Yandex money is associated with the desire of users to do without paying commissions for the transfer. However, free schemes do not work for a long time. Today, any system takes a commission for transfers, cash withdrawals, and so on. But everyone can spend money without a commission.

Consider the main ways to withdraw funds. Each of them is quite affordable and simple, has its pros and cons.

Transfer using transfer systems - Western Union, Contact, Idram, RONCO "RIB"

The term of enrollment depends on the specific system. The commission is - 3% + 15 rubles. When withdrawing 1000 rubles. Through Contact, a commission of 90 rubles is withheld. And if you identify yourself in the Rapida system online through Contact, then the commission will be 150 rubles. when paying 100 rubles. But you don't always have to pay that much.

To exchange electronic Yandex money for cash, in the "Withdraw" section, select the name of the desired company and click the link. You will need to fill out the form and click the confirmation button for the transfer.

The most common is the Contact system. Wallet owners often withdraw funds through it. Operation behavior instruction:

- visit your personal account, fill out an application and prescribe the amount;

- select the Contact section, then the point where you are going to receive money;

- after 1-3 days, an SMS will be sent to the phone about the transfer;

- take your passport, visit the cashier of the payment system, where you sent the transfer, take the cash.

You do not need to fill out numerous papers before cashing out, submit documents. The commission will be 4-5%. Sometimes the cashier asks for the amount or payment number for insurance.

Points of payment systems can be found in any city in Russia and neighboring countries.

Withdrawal to a plastic card

You can withdraw money to Visa, American Express, Master Card, Maestro cards. On the Yandex website, you can link a card to a Yandex wallet, but this is not necessary.

In the form you need to indicate the bank card number and the amount. Cash withdrawal is possible at an ATM. Money comes to the card in a matter of seconds, and the commission is charged in the amount of 1-3%.

Transfer to a personal bank account

The steps of the operation are:

Go to the website of the bank, fill out an application. After its approval by the banking commission, the money will be credited to the account in a week. Everyone knows how to withdraw cash through a bank.

Thus, you can constantly transfer funds from Yandex.Money and make savings. However, the bank has the right to return funds to the Yandex wallet if it considers it doubtful or the commission that the bank will have to pay will be high.

You can withdraw up to 100 thousand rubles at a time, you can make up to five transfers to different countries of the world per day. Anonymous users will not be able to transfer money in large volumes, they are allowed to withdraw up to 40 thousand rubles per month.

Withdrawal via ATM

The easiest option is how to withdraw money from Yandex and receive the entire amount through the terminal. Yandex grants the right to each user to receive a personal card, which is valid in many countries. With its help, funds can be withdrawn through an ATM. Moreover, you can withdraw money not only in rubles, but even in foreign currency - euros or dollars. It is not much different from banking. "Card with pluses" can be obtained by filling out an application on the official website of the payment system. But there is one condition - the presence of identification.

Top up your mobile phone

In this way, you can withdraw money by visiting the bank or pick up the transfer at the operator's office. You can withdraw funds from Yandex money to your phone in 15 minutes. With only 1% commission. The money transfer limit is 5,000 rubles. in 24 hours. But you can transfer money to your relatives or friends. Fast and inexpensive.

other methods

Until recently, the Yandex electronic payment system worked only on the territory of the Russian Federation, but after revising its own development priorities, most of the CIS countries began to use it. Therefore, the number of people who want to know the answer to the question: How to withdraw money from a Yandex wallet without commission is growing every day.

What to do before withdrawing funds

To withdraw funds, you must change the status of the user, since each new user receives an anonymous identifier that has limited functions. To gain access to the withdrawal of funds and other opportunities, you must pass identification. You can also use official registrars, the number of which is quite large.

Withdrawing money in Yandex requires compliance with certain rules, such as:

- Restriction on the amount of payments.

- A certain interval between ongoing monetary transactions.

- Small commission.

Ways to withdraw money

How to withdraw cash from Yandex wallet? There are quite a few ways to get money from this system, they are all simple and easy to understand. Consider the most popular of them.

Yandex bank card

A detailed study of the instructions for withdrawing Yandex Money using MasterCard explains quite intelligibly how to withdraw money from a Yandex wallet without commission. The main condition is an issued and active card, the sending and production of which is completely free.

To get a card, you need to do the following:

- Log in to the system and go to the "Bank cards" section, then click on the "Issue a card" button.

- Fill out a short questionnaire, indicating the data from the passport;

- Come up with a rather complex and unique password to enter;

- Get a card and complete its activation;

- If you are the owner of a Gold card, the number of which always starts with 5129, then the pin code will be sent to you immediately after activation. If there is no SMS, please contact the 24/7 support service.

For the World card, the first digits of which are 5106, the pin code is created by the user at the time of card activation.

Remember, the pin code for each card can be obtained only once. In case of its loss, the only way to solve the problem is to reissue the card.

Transferring funds to a bank card without linking it to a wallet

Let's answer the question: is it possible to withdraw money from Yandex wallet in cash? This can be done by using bank cards issued worldwide:

- american express.

- Maestro.

- mastercard.

- Visa.

- Visa Electron.

- Diners Club International.

You can withdraw cash from Yandex only when the bank credits them to the card. Its conditions are as follows:

- Commission fee - 3% + payment in the amount of 45 rubles.

- The size of the minimum allowable transfer is 500 rubles, the maximum: for owners of personalized wallets - no more than 15 thousand rubles. for one transfer, for identified clients - up to 75 thousand rubles. No more than 150 thousand rubles per day. Per month - no more than 600 thousand rubles.

In accordance with existing laws, only users who have indicated their data can transfer to a card. It can be done:

- By submitting an application for identification.

- Online, if you have a passport of a citizen of the Russian Federation.

Most users of the Yandex system are interested in how to withdraw cash from Yandex Money? To receive cash, you must have some basic knowledge and the minimum amount allowed for withdrawal. When performing this operation, you must specify your card number, the amount you want to withdraw, and your email address. Immediately after filling in all the above fields, the user is shown the amount to be paid, taking into account all fees and commissions.

The number of allowable transfers to cards of foreign banks per day should not exceed 5 times. You can withdraw money from any ATM in the world. The period of time during which funds will be credited directly depends on who issued the card.

If the bank that issued your plastic card is a member of the well-known MasterCard MoneySend or Visa Payments and Transfers system, then the money you send will reach the recipient within a few minutes. In other cases, the term for receiving money can be from one to six business days.

Bank transfer to the account of an individual

You can withdraw money from your Yandex personal account only after it has been credited to the card. To do this, your account must be linked to the card used, and the verification procedure must also be completed, which consists in identifying the identity of the client. Otherwise, you simply will not be able to withdraw money, since anonymous access to this function is closed.

The system also provides users with the status of "Named", which provides many advantages:

- The maximum allowable limit at a time is 15 thousand rubles, per month - 300 thousand rubles. To transfer a larger amount, the user must be identified.

- A small commission rate is 3% of the transfer amount + 15 rubles.

- Fast receipt of money, taking no more than 3 days, excluding weekends.

- Possibility of money transfer to any user;

- Two additional withdrawal options;

- Possibility of carrying out money transactions in foreign banks.

Most clients of the service simply do not need such a status, since the basic capabilities provided by the system are quite large and diverse.

Remember, money transfers in the system can only be made in rubles, other currencies are not supported.

How to withdraw money from Yandex money without commission

How to withdraw money from Yandex wallet without commission? Today, it is almost impossible to receive money from Yandex without commission fees. Yes, you can pay in stores, without any commissions, but when withdrawing money from an ATM, it will definitely be.

In general, being the owner of an electronic wallet of the system is quite profitable, as it has a convenient and pleasant interface, and also has a high level of protection and confidentiality, which is quite important.

You can cash out by transferring funds to a bank card or account, using the transfer system, using an intermediate payment system, or using the services of money changers/services. All of these methods allow you to withdraw money from a Yandex wallet with a commission. About replenishment here -.

Output options:

Additionally:

To withdraw money from Yandex Money, click the "Withdraw" button next to the account balance. Or you can use the link https://money.yandex.ru/withdraw/.

1. To any card

Only members of the system with a named or identified status can send a transfer. Yandex Money can be transferred to any card of any bank:

- Visa (Classic, Electron)

- master card

- Maestro

But there is such a moment that some banks prohibit making transfers to their cards from poison. Usually these are banks not from the CIS - for example, America and the like. And most likely it will not be possible to transfer to virtual cards and anonymous ones (without the specified owner). Therefore, I recommend sending the first translation minimum amount of 100 rubles to check whether it will reach at all or not.

The transfer commission in any case will be 3% of the transfer amount + 45 rubles. The maximum transfer amount at a time depends on your status in the system: 15,000 rubles per operation for owners of personalized wallets, 75,000 rubles at a time - for identified ones.

In terms of terms, the transfer takes from a few seconds to five working days, depending on the card bank.

Calmly credited funds and non-ruble cards. Her bank will convert the amount.

2. To the Yandex.Money card

As you know, you can get, the account balance of which will be equal to the balance of the wallet in Yandex. Therefore, you can cash out Yandex Money through it at any ATM.

If the card is registered and you have been identified, you can withdraw 10,000 rubles per month without commission. If more - 3% of the amount, but not less than 100 rubles.

3. To a bank account

You can withdraw money from Yandex Money to the account of an individual, legal entity, individual entrepreneur in Russia, as well as to any other account in another country. And then cash them out at the bank. The commission will be 2% of the amount, at least 30 rubles.

The transfer takes 1-3 days, but there is an option to make the transfer faster, within a minute. There is such an opportunity when transferring to Alfa-Bank, Promsvyazbank, Tinkoff Bank. Here, everyone has different conditions, but on average, the commission will be 3%.

4. With the help of transfer systems

It may be convenient for some to cash out Yandex Wallet funds through transfer systems:

- Western Union (instantly, fee depends on destination country)

- RNKO "RIB" (a couple of days, commission 3% + 15 rubles)

- Idram (instantly, commission 3% + 15 rubles)

- Unistream (a couple of days, the commission depends on the country of destination)

5. Through money changers

As I have already written on this site more than once, you can turn to the services of private money changers, who can be found, for example, here:

How to withdraw money from Yandex Money through them? Write to them, and they will tell you everything in detail. Some conditions are written directly on the forum. Choose those who have a lot of reviews and all positive. Don't be fooled by newbies with no reviews, but with tempting courses. Don't take risks.

6. Through exchangers

I advise you to use the online monitoring of exchangers like https://www.bestchange.ru. Choose in the left column what you are changing (that is, Yandex.Money, of course), and in the right - what. There are many options, including cash withdrawal.

The problem is that you cannot select a city in advance in this case, so you will have to open each of the exchangers and see which cities it works with. I must say right away that the larger the city, the more likely it is that there will be the right person there. There will definitely be no problems with Moscow, St. Petersburg and Kiev.

Final table

| Output option | Commission | Withdrawal period |

| to any card | 3% + 45 rubles | from a couple of seconds to 5 slaves. days |

| to Yandex.Money card |

up to 10,000 rubles per month - 0% otherwise - 3%, min 100 rubles |

straightaway |

| to a bank account |

through partner banks - 3% for a legal entity or individual entrepreneur - 2%, min 30 rubles |

through partner banks - immediately otherwise - 3 working days |

| transfer systems (Western Union, etc.) | depends on destination country | from immediately to 3 working days |

| money changers | usually higher than usual | depends on the output method |

| exchangers | usually higher than usual | depends on the output method |

If there are problems

You withdrew money from Yandex Money, but they did not come. What to do? Here is a link to the Yandex Money support service - https://yandex.ru/support/money/issue/resolve.html. But as they themselves recommend, including me, it is better to first contact the support of the bank where you sent the money. More often than not, the problem is on his side. Contact the POI last.

And another moment. Representatives of the service are on social networks, and on some forums. You can write there, but in any case, the answer will be this: "fill out the form at such and such an address." So it makes no sense to waste time communicating with them, it’s better to do it right away.

Found an error in the article? Select it and press CTRL+ENTER