The loan calculator calculates monthly payments, loan interest, commission and insurance payments. A payment schedule is drawn up with an indication of the amounts of payments taken into account. The loan calculator can calculate payments by the annuity or differentiated method. The totals on the right display the amount of the monthly payment, interest overpayment, overpayment including commissions, and the total cost of the loan.

Pay special attention to the Effective Interest Rate, which, taking into account additional commissions and insurances, can be significantly higher than that offered in the loan agreement.

Loan calculator settings

Calculation method

It is possible to calculate the loan and payments, both by the Loan Amount, and by the Purchase Cost and down payment. When calculating a loan based on the Purchase Price, the loan amount is first calculated, and interest and commissions on the initial payment are not charged.

Choice of loan currency

The loan calculator can calculate a loan online in one of 3 currencies: rubles, dollars or euros.

Credit term

By default, the loan term must be entered in months. You can also enter the term in years, but you must change the type of the loan term.

Interest rate

Traditionally, the interest rate is calculated on the basis of interest/year. By changing the settings of the loan calculator, you can calculate payments based on the monthly interest rate.

Payment type

Typically, banks use the annuity method for calculating loan payments (equal monthly payments) to calculate a loan. However, the second option is also possible - differentiated payments (accrual interest on the balance). Using the drop-down menu, select the type of payment calculation you need. For more information about the types and methods of calculation, see the annuity calculator or differentiated payment calculator sections.

Additional settings

Issuance fee

One of the conditions for issuing a loan by many banks is the payment of the Commission upon issuing or for issuing a loan. The loan calculator can include such a fee in the total cost of the loan and, if necessary, break the fee into monthly payments.

Monthly commission

Taken into account in the total cost of the loan and in monthly payments

Insurance

Credit insurance is an additional monthly commission option. As a rule, banks do not include insurance in the monthly payment schedule and charge a similar commission on the basis of an additional agreement. However, the total cost of the loan received can increase significantly. The online loan calculator takes into account the monthly insurance in the total cost of the loan and in the amount of the monthly payment.

Last installment

One of the options for a loan is a loan with a final installment. When calculating such a loan, the monthly payment is lower due to a decrease in payments on the principal debt. However, interest on the last installment is also accrued and taken into account in monthly payments.

date of issue

By default, the current date is used, but you can choose any convenient date. The function is convenient when working with the payment schedule.

First payment date

Initially, the current date is used, for the convenience of working with the payment schedule, select the required one.

The loan calculator calculates monthly payments, loan interest, commission and insurance payments. A payment schedule is drawn up with an indication of the amounts of payments taken into account. The loan calculator can calculate payments by the annuity or differentiated method. The totals on the right display the amount of the monthly payment, interest overpayment, overpayment including commissions, and the total cost of the loan.

Pay special attention to the Effective Interest Rate, which, taking into account additional commissions and insurances, can be significantly higher than that offered in the loan agreement.

Loan calculator settings

Calculation method

It is possible to calculate the loan and payments, both by the Loan Amount, and by the Purchase Cost and down payment. When calculating a loan based on the Purchase Price, the loan amount is first calculated, and interest and commissions on the initial payment are not charged.

Choice of loan currency

The loan calculator can calculate a loan online in one of 3 currencies: rubles, dollars or euros.

Credit term

By default, the loan term must be entered in months. You can also enter the term in years, but you must change the type of the loan term.

Interest rate

Traditionally, the interest rate is calculated on the basis of interest/year. By changing the settings of the loan calculator, you can calculate payments based on the monthly interest rate.

Payment type

Typically, banks use the annuity method for calculating loan payments (equal monthly payments) to calculate a loan. However, the second option is also possible - differentiated payments (accrual interest on the balance). Using the drop-down menu, select the type of payment calculation you need. For more information about the types and methods of calculation, see the annuity calculator or differentiated payment calculator sections.

Additional settings

Issuance fee

One of the conditions for issuing a loan by many banks is the payment of the Commission upon issuing or for issuing a loan. The loan calculator can include such a fee in the total cost of the loan and, if necessary, break the fee into monthly payments.

Monthly commission

Taken into account in the total cost of the loan and in monthly payments

Insurance

Credit insurance is an additional monthly commission option. As a rule, banks do not include insurance in the monthly payment schedule and charge a similar commission on the basis of an additional agreement. However, the total cost of the loan received can increase significantly. The online loan calculator takes into account the monthly insurance in the total cost of the loan and in the amount of the monthly payment.

Last installment

One of the options for a loan is a loan with a final installment. When calculating such a loan, the monthly payment is lower due to a decrease in payments on the principal debt. However, interest on the last installment is also accrued and taken into account in monthly payments.

date of issue

By default, the current date is used, but you can choose any convenient date. The function is convenient when working with the payment schedule.

First payment date

Initially, the current date is used, for the convenience of working with the payment schedule, select the required one.

A consumer loan is a loan that you take out for various consumption needs. For example, you want to buy a TV in a store or a washing machine, or go on vacation.

Buying a tour from an operator is a purchase of a service. Those. you consume a service and take out a consumer loan.

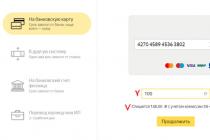

The consumer loan calculator is designed to calculate cash loans, taking into account commissions and insurance.

Commissions and insurance are introduced through early payments.

Calculation options

The calculator allows you to simply calculate the loan - enter the amount, rate, term and click calculation.

The second option is the calculation of early repayment. You set the loan details and the dates and amounts of the early repayments. If you want to understand how much you will repay if you deposit a certain loan amount each month, we recommend using the forecast calculator

See Also:

It will allow you to understand how quickly you will close the loan.

How to compare two loans

Before obtaining a bank loan, it will not be superfluous to calculate the overpayment on the loan. It is best to compare the offers of several banks and choose the best one. The calculator on this page can be used for this. However, you will have to open another page with a calculator to compare 2 different loans. Especially for comparing loans and early repayment schemes, we have made a loan comparison calculator

See also:

It will allow you to understand which early repayment scheme to choose - to reduce the term or the amount of the payment. It will also help you choose the best loan option.

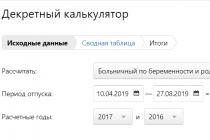

How to calculate a loan using a calculator

There are 2 loan options

The first is a preliminary calculation when you want to borrow cash. For this calculation, the date of the first payment is not needed. It can be left as default. It does not affect the monthly payment.

Loan amount - it is specified in the loan agreement and is taken without taking into account the down payment for a product or service.

Interest rate - the nominal rate on the loan, excluding commissions and insurance. Taken from the loan agreement. You can enter 3 decimal places.

Expressed without dividing by one hundred.

Term - an integer number of months for which the loan is taken. If you have 2 years, for example, then you need to enter 24 months

The second option is the calculation of the existing loan

The next field is the date of the first payment. This parameter is already important when you took out a loan

For a loan taken, the calculation by date is important. That is, when plotting the schedule, the date of the next payment is indicated - the number of the day in the month.

Date-based calculation is important for early repayments. The date of early payment of funds determines in which month the new reduced payment will be.

How to use the calculator?

After entering the required data above, you need to click on the calculation button.

After pressing it, the following options are possible

- Data entry errors. Please note that dates must be entered through a dot in the format dd.mm.yyyy. Amounts are entered in through a dot, the rate can have 3 decimal places

- There was a successful settlement of the loan. Set up a payment schedule. Loan overpayment calculated

Read also:

If the calculation is successful, you can start adding early repayments. In the form on the right - adding early repayment - you need to enter the date, type and amount and click add. There will be an automatic recalculation of the loan schedule and other parameters. The total overpayment will change.

In the case of full early repayment, after this payment, there will be zeros in the schedule, regardless of whether the amount or term was reduced.

If you added a repayment with a change in the term, there will be fewer lines in the chart compared to the initial version.

Repayment with a change in the amount will reduce the annuity payment on the loan. The number of lines in the payment schedule will remain the same.

If you added a change in the interest rate, the payment schedule for the new interest will be recalculated from the moment when this change took place. The payment may increase or decrease depending on whether the rate was reduced or increased.

Export data to Excel

After the calculation, you can save the results on your computer. To do this, click on the link "Get Excel file". An Excel 2003 file will be generated and a "Download File" link will appear. You need to click on this link and the file will be saved to you. You can print the file and return to it at any time.

When calculating the loan, the link to this file disappears and you will need to generate the Excel file again.

I recommend bookmarking the calculator for ease of use in the future.

Popular questions and answers

How to calculate the interest per annum on a loan? Percentage per annum is not considered. The annual loan rate is determined by the bank based on your income, credit history and other scoring parameters. Interest on the loan is calculated every day, but they must be paid every month. If you want to know the rate per month, you need to divide the annual rate by 12. Similarly, if per day, then multiply by 365 (366) If you want to calculate the interest for each month of using the loan, then you need to multiply the rate per day by the number of days in the month and on the balance of the debt at the beginning of the month.

Loan payment schedule

The portal offers the following services:

- deposit

- mortgage

- credit

- car loan

You can use a special calculator without paying.

How to calculate interest on our service

Using our special loan calculator, you can calculate the amount of monthly payments and the amount of overpayment on the loan, according to personal information about a particular borrower, taking into account his wishes, by entering into the program:

- a suitable amount for the initial payment;

- for how long the loan is taken;

- the applied rate in percent;

- borrower's income;

- whether the borrower can provide collateral.

Having entered the necessary information in all columns, the program itself will select a possible loan within a few minutes and automatically calculate the amount of the upcoming monthly payment online and determine what the overpayment will be.

Performs an approximate calculation, since it does not take into account how many days a month has.

A more precise payment schedule, applicable rates and the amount of overpayment can be set individually for the client directly at the bank.

How to calculate your monthly payment using an online loan calculator

All potential borrowers are primarily concerned with the question of how much money he will have to take from his family every month so as not to stray from the schedule for making regular payments. You can calculate this amount on our online loan calculator based on:

- the interest rate applied by the bank;

- the amount of the loan issued;

- selected payment type.

You can make this calculation right now using the services of our website.

Our bank calculator will calculate the loan in one click. Just specify the parameters of the required you are interested in. loan and the program will make a preliminary calculation in an automated mode. The monthly payment schedule will be generated under the form and will contain a table of payments divided into principal and interest.

Bank calculator for calculating a consumer loan in cash

Before registering a consumer, many citizens are interested in the conditions under which lending takes place. How much will I have to pay per month? How much will I pay for the entire term? What is the percentage of overpayment on a future cash loan? These are common questions people are looking for answers online in 2019 and will be looking for in 2020, 2021 and beyond. Our experts have developed a universal loan calculator that works completely online, which will help you answer them.

We will describe in detail how to independently work correctly with this calculation program.

What can this calculator calculate?

Correctly calculating a loan does not require special knowledge. Our program is designed in such a way that it will be easy to use for both average individuals and pensioners. Previously, you can set 4 parameters in the form:

- Amount of money loan(200000, 500000, 800000 or whatever). By moving the slider, the maximum amount will be 15,000,000 rubles, but you can enter any arbitrary number.

- Loan terms, which can also be absolutely anything - a year, 2 years, 3 years, 4 years, 5 years, 7 years, but the slider is set within 6-180 months.

- Interest rate loans. We set 8.9% as the minimum value, and 49.9% as the maximum. But you can also put the number that is convenient for you - 15 per annum, 18 per annum, 16 per annum or 20 per annum.

- And the last - payment type. If you plan to pay the loan in equal payments (annuity), then select the "Equal" tab. If you want the amount of the monthly payment to become smaller over time, then set the active tab "Reducing" (differentiated).

Having set these conditions, you just have to click on the "Calculate" button. Mathematical formulas in online mode will instantly provide you with data on the following parameters:

- The amount of the monthly payment, in rubles.

- The amount of the original loan.

- Full cost (initial + interest).

- Total overpayment (interest in rubles).

- Overpayment ratio, in percent.

Usually, after a preliminary calculation, visitors talk about the calculator on social networks, and also put a rating. According to it, other people see how convenient and useful our program is to use. And reviews help to form a common opinion about the functionality and convenience of the calculator.

Drawing up a payment schedule or how to calculate loan payments

To solve this issue, you also do not need to have specialized skills. After receiving the initial data, a table will open under the form, which will reflect an approximate payment schedule for a future short-term or long-term loan. The following data will be presented on a monthly basis:

- month number;

- exact date of payment;

- the amount of the monthly payment (principal debt together with interest);

- the amount of the principal debt in the payment;

- the amount of interest in the payment;

- balance on the loan after payment of the payment.

Under the payment table there will be a final line in which the total cost and overpayment on the loan are accumulated. You will understand how much to pay for a loan according to the selected terms of borrowing money. The data presented will also be sufficient to evaluate prepayments.

Choosing the right cash loan

After you calculate the amount of debt yourself, you will have access to a block with the most popular loan offers. The site team tried to collect in one place the products of many banks in Russia. The convenient location of the information will help you submit applications to several banking institutions and, after receiving approval, take money from any bank branch.

We hope you found our bank calculator useful!