Statistical reporting micro-enterprises is a minimal obligation of organizations with micro-enterprise status to report to the statistical authorities. One of these reports, submitted at the end of the year, is called “MP-micro Form”: this article will tell you who should submit this report and in what time frame.

Statistical reporting applies to absolutely all organizations, regardless of their size. Some reports need to be submitted regularly, in particular accounting results for the year, and some - after certain period and only to those respondents who were included in the Rosstat sample. Such a report is the MP-micro form, approved by the Order of Rosstat dated November 2, 2018 No. 654. The report is called “Information on the main indicators of micro-enterprise activity” and is annual. Let's consider its features in more detail.

Form MP-micro: who is required to take

This report is intended solely for legal entities that are categorized as microenterprises. These are the organizations that in 2018:

- no more than 15 employees worked;

- annual income from management entrepreneurial activity amounted to no more than 120 million rubles;

- the share of participation of state entities, public and religious organizations and foundations did not exceed a total of 25%;

- the share of participation of other companies (including foreign ones) did not exceed 49% in total.

Excess limit values within 3 calendar years in a row leads to the loss of status.

If the firm fits these parameters, it is necessary to check whether it fell into the sample of statistical observation. This can be done using a special service on the Rosstat website. It is enough for an organization to enter all its data in the proposed form (name, OKPO, TIN or OGRN) and receive information about all reports to statistics that must be submitted in 2019. In addition, Rosstat authorities notify the respondents in the sample in advance of the need to report. Rosstat sends such written notifications to the addresses of companies known to it.

MP-micro: deadlines 2019

In 2019, the due date for the MP-micro report for 2018 falls on February 5th. There are no reschedules as it is Tuesday. It is this date that appears in the Order of Rosstat as the last day for fulfilling the obligation to report. Being late carries a heavy fine.

Features and order of filling

Filling out the MP-micro is not at all difficult, it is in the form of a questionnaire. In the header, as usual, you must write the details and name of the organization, as well as its postal address.

Next, in MP-micro comes section 1, in which you need to answer only one question: does the company apply a simplified taxation system. There are obviously two possible answers: “yes” and “no”. Check the box next to the correct option.

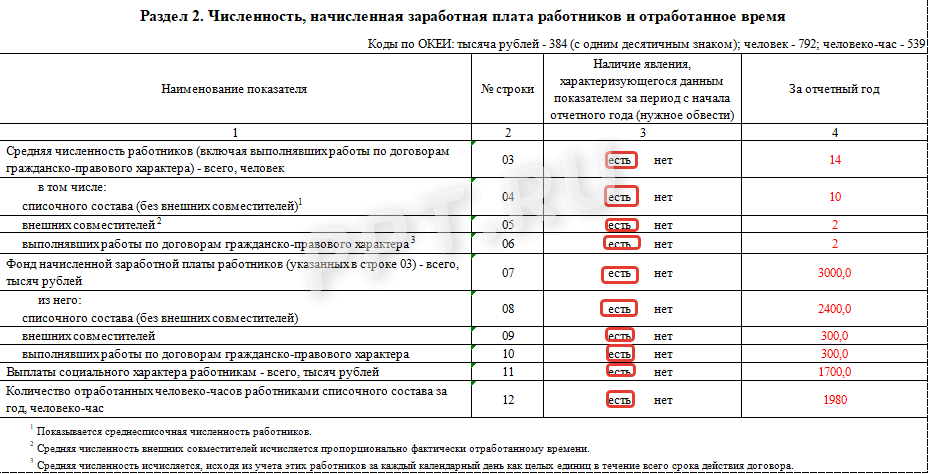

The second section in the MP-micro form is more voluminous. It is intended for information about the number and wages workers. To complete it, you need to calculate average headcount, as well as indicate the number of external part-time workers and persons who work under civil law contracts. By the same principle, it is necessary to divide the wage fund. At the end, you need to provide information about social benefits employees, as well as indicate the number of man-hours worked.

The third section is small and is called "General economic indicators". You need to fill in information about the shipment of goods, the performance of work and services. Also in the same section, you need to inform the statistics agency about investments in fixed assets. All data must be given in rubles, and VAT and excises must be deducted from the cost.

The fourth section of the MP-micro form is intended for firms that are engaged in wholesale and retail and are catering establishments. It should indicate whether or not there are such turnovers, as well as indicate their volume for reporting period.

The final, fifth section of the MP-micro report must be completed by organizations if they have drivers on their staff and they use any freight or passenger transport for their needs. Even one car obliges the accountant to complete this section.

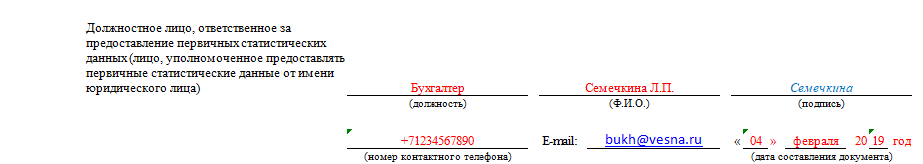

At the end, the report must be signed by the accountant who filled it out. You also need to put down the date of filling and indicate your email and phone number.

What reports are submitted to the statistics of microenterprises in 2019

In addition to information about the activities of MP-micro organizations, the smallest companies and individual entrepreneurs are required to send other forms to Rosstat:

- balance sheet and form No. 2 (may be in a simplified version) - until 03/31/2019;

- form No. MP (micro)-nature “Information on the production of products by a micro-enterprise” for firms that manufacture products, mining, manufacturing industries, companies that produce and distribute electricity, gas and water, logging, and also engaged in fishing - until 25.01 .2019 (Order of Rosstat dated July 27, 2018 No. 461);

- annual form No. 1-IP "Information on the activities of an individual entrepreneur" exclusively for individual entrepreneurs - until 03/02/2019.

In addition, other statistical documents may be added depending on the industry in which the firm operates and its field of activity.

Responsibility for failure

Large fines apply for violation of deadlines or ignoring the obligation to submit statistical reports. They are provided article 13.19 of the Code of Administrative Offenses of the Russian Federation, and their size is:

- for officials - from 10,000 to 20,000 rubles;

- for organizations - from 20,000 to 70,000 rubles.

A repeated violation will cost significantly more, the fine rises to 50,000 rubles for officials, and up to 150,000 rubles for legal entities. The statistics agency may be held liable within two months from the date of the violation.

Reporting is a way of summarizing data in specialized forms, which is inherent, first of all, accounting. Basically, it is necessary to reflect the final results that the company has achieved for any period, its financial position, quantitative characteristics of activity, cash flows and other indicators.

Regulations and base

Statistical reporting is one of the types of documentation that is submitted to the state statistics bodies. Its forms are established at the legislative level.

The reliability of the information provided is confirmed by the signatures of officials in the forms, which become legal documents required to be submitted.

Legal entities are required to provide statistical reporting. This is established by Federal Law No. 282-FZ of November 29, 2007 and Decree of the Government of the Russian Federation No. 620 of August 18, 2008.

All forms submitted to the statistical authorities have approved form. They can be installed federal Service state statistics and the Ministry of Finance Russian Federation. The latter regulates the forms that are used to summarize financial indicators.

The basis on which the statistical reporting is formed is the accounting in the company, that is, the statistical data is formed from the information contained in primary documentation. It is difficult to overestimate the importance of statistics, so the law provides for liability for misrepresentation of transmitted information and failure to meet deadlines.

Statistical reporting in our country is divided into two types: general and branch. The first one seems to be legal entities, and the second - only those that are related to certain industries, for example, Agriculture, metallurgy, etc.

Which companies should submit

Federal law establishes that statistical reports must be transmitted the following respondents:

- legal entities;

- state and municipal authorities;

- foreign companies that have their own within the Russian Federation;

- individual entrepreneurs;

- small businesses.

Most individual entrepreneurs have signs of small enterprises, therefore, when submitting reports, they must be guided by the rules established for the latter. In accordance with these rules, a simpler procedure for submitting statistical reports is provided for them (Federal Law No. 209-FZ of July 24, 2007).

So, a company or individual entrepreneur is recognized as small in 2018 if there is the following signs:

- the average number of employees in 2017 did not exceed 100 people;

- annual revenue excluding for the same period did not exceed 800 million rubles;

- the share of participation of other companies that are not recognized as small or medium, as well as foreign companies is no more than 49%;

- the share of participation of the state or municipalities, charitable foundations, public and religious associations is no more than 25%.

If the annual revenue was less than 120 million rubles, and the number of employees in 2017 was less than 15 people, then such a company is recognized as a micro-enterprise.

The above signs are evaluated by the Federal tax office RF, according to the results, it introduces or excludes the company from the corresponding unified registry, which is posted on her website nalog.ru.

AT federal law No. 209-FZ of July 24, 2007, it was established that a complete statistical audit is carried out every 5 years; in the rest of the period, statistical reporting is submitted only by those small enterprises that, according to certain criteria, were chosen by Rosstat of the Russian Federation.

The fact that the company was included in the sample, Rosstat must inform its management by sending a letter with the corresponding requirement, which must be accompanied by reporting forms and rules for filling it out. However, companies can check this information independently on the website of the State Statistics Committee of the Russian Federation www.gks.ru.

All companies that are required by law to keep accounting records at the end of the year must pass financial statements. One copy of this report must be submitted to the state statistics authority.

All companies that are required by law to keep accounting records at the end of the year must pass financial statements. One copy of this report must be submitted to the state statistics authority.

This rule is specified in Federal Law No. 402-FZ. Deadline set to March 31, 2019. Individual entrepreneurs may not submit financial statements, tk. the law allows them not to keep accounting records.

You can clarify information on the Rosstat sample for a particular enterprise on the website of this department, as well as by receiving a corresponding request by mail. Most often, statistical authorities require delivery the following reporting forms:

- PM- This form of reporting is submitted by small enterprises. The reporting period for it is a quarter. The PM form must be submitted by the 29th next month after the end of the quarter, that is, for the last quarter of 2018, reports must be submitted before January 29, 2019. Micro-enterprises do not fill out this form.

- PM-prom- is a monthly report, set for small businesses. Microenterprises do not represent the PM-prom form. This report must be submitted by the 4th day of the month following the reporting month.

- 1-IP- this form is submitted by individual entrepreneurs, if they are not engaged in the production of agricultural products. This report is prepared for submission once a year until March 2nd.

- 1-IP (trade)- present individual entrepreneurs employed in retail trade and rendering household services citizens. This report is submitted once a year until October 17th.

For micro-enterprises, their own form of statistical reporting MP (micro) has been established. She summarizes the information calendar year and must be submitted by February 5th.

All required forms must be submitted in duplicate. First transmitted to the statistical authorities, and the second with marks of acceptance - remains in company.

Today, reports can be submitted in person to the territorial body of statistics, by registered mail or in in electronic format. And electronic reporting can be transferred in two ways: through an electronic document management system or directly on the website of the territorial body of Rosstat, if such a technical possibility is organized (at present, only in a few regions). These options are only available if available.

If the accounts are transmitted by registered mail or electronically, then the date of submission is the date of dispatch, which is confirmed by the relevant receipts.

A responsibility

In case of violation of the deadlines, according to Article 13.19 of the Code of Administrative Offenses of the Russian Federation, administrative liability and fines are provided. The head of the company can pay from 10,000 to 20,000 rubles, and legal entities - from 20,000 to 70,000 rubles.

If the company allows repeated violation of the deadlines, then the fine for the head of the company is set in the amount of from 30,000 to 50,000 rubles, and for businesses from 100,000 to 150,000 rubles. The same penalties apply for non-submission of statistical reports.

Learn the features of reporting by small businesses in this video.

In order for an organization to be classified as a micro-enterprise, its performance indicators must meet certain criteria (Article 4 209-FZ of July 24, 2007):

- the number should be no more than 15 employees;

- operating income should not exceed 120 million rubles.

What reports are submitted to the statistics of microenterprises in 2019

The activities of small businesses (including micro-enterprises) are subject to continuous statistical monitoring once every five years. The last such observation was in 2016 based on the results of activities for 2015.

In the interim periods, micro-business entities are only subject to selective observation once a year. Its rules are established by the Decree of the Government of February 16, 2008 No. 79.

A complete list of statistical reporting for micro-organizations consists of 18 forms. The vast majority of them are associated with specific activities. Main form: MP (micro); who is required to submit a report, we will understand below.

To understand whether an organization was included in the sample or not, you should refer to the special resource of Rosstat statreg.gks.ru. On the page that opens, by filling in the company data, you can get a list of statistical forms to be submitted. Some regional offices Rosstat publishes a list of organizations included in the sample on their websites. For example, a list of selected organizations in St. Petersburg and Leningrad region can be found on the Petrostat page in the section Reporting → Statistical reporting → List of reporting economic entities.

MP (micro) deadlines 2019

The statistical form we are considering was approved by order of Rosstat dated August 21, 2017 No. 541. It also contains a brief explanation of how to fill it out.

Blank MP (micro)

The date for the submission of the MP (micro) report is set for February 5. Late submission of the form may result in penalties. According to article 13.19 of the Code of Administrative Offenses of the Russian Federation, a fine for a company for failing to submit statistical reports can range from 20,000 to 70,000 rubles.

There are situations when statistical authorities request reporting, despite the fact that when a request is made to the statreg.gks.ru resource, it is not reflected in the list. In order to avoid penalties, we recommend that you save a screenshot of the page. If the report was not named in the list to be submitted on the resource and the company was not notified in writing by Rosstat about the need to submit the report, penalties are not applied.

Also, statistical authorities may request the completion of the MP (micro) form - nature. It contains information about the products manufactured, is filled in quantitative terms and must be submitted before January 25 of the year following the reporting one.

Form MP (micro) - nature

Sample report filling

The detailed Instructions of Rosstat on filling out the MP (micro) form were approved by Order No. 723 dated 11/07/2017.

The report is filled out according to the basic data of the micro-enterprise and consists of a title page and five sections. On title page fill in information about the organization. The sections of the report provide information about:

- taxation system;

- number and wage fund;

- the amount of revenue;

- the amount of investment in fixed assets;

- about cargo transportation.

The form is provided by all organizations that were included in the sample observation, including those that did not operate or were declared bankrupt, if there is no decision in relation to them arbitration court about liquidation.

Non-operating micro-enterprises submit reports with zero values of cost indicators.

If the microorganization is not included in the list, then a report in the form of 1-mp (micro) for 2017 is not submitted to the state statistics authorities.

Other forms of state statistical reporting applicable to microorganizations, based on the types of activities carried out economic activity are presented in the correct order.

| Reporting on 1-MP ANNUAL Report on the financial and economic activities of a small organization |

|

| Who represents? | Small organizations - commercial organizations with an average number of employees for the calendar year preceding the reporting one, from 16 to 100 people inclusive. |

| The report is not submitted: |

|

| Presentation type: | Reports are submitted in the form of an electronic document using |

The PM form (quarterly) must be submitted to the territorial statistical bodies based on the results of the quarter - by the 29th day of the month following the corresponding quarter, by those legal entities that:

- are classified as small enterprises;

- were included in the Rosstat sample.

Small businesses are firms that:

- employs from 15 to 100 people (subclause “a”, clause 2, part 1.1, article 4 of the law “On the development of small and medium-sized businesses” dated July 24, 2007 No. 209-FZ);

- annual revenue is up to 800 million rubles. (clause 1 of the Decree of the Government of the Russian Federation of 04.04.2016 No. 265).

Rosstat collects data on small businesses as part of quarterly sample observations - forming representative samples of enterprises (clause 3, article 5 of Law No. 209-FZ). The lists of firms included in the sample are usually published on the websites of the department's territorial offices.

However, the information on this site is not always correct. More about this - in the material “Attention: the Rosstat service with a list of reporting forms can be misleading!” .

Starting from the reporting for the 1st quarter of 2018, a form approved by the order of Rosstat dated August 21, 2017 No. 541 is used to submit the PM form to statistics. The document must be drawn up in accordance with general guidelines for filling, approved by the same order. Consider the main features of filling out the PM form in statistics according to the instructions in 2019.

Read more about the penalty for non-submission of statistical reports. “Not submitting statistical reports has become more expensive” .

Instructions for filling out the quarterly form of PM in statistics (how to fill out the document, what to look for)

The considered form consists of 3 sections.

Section 1 is a questionnaire that reflects the fact of application / non-application of the simplified tax system.

Section 2 reflects indicators on the number of staff of the company, as well as on the salary of employees. The reporting entity shall indicate in the form:

- information about the payroll: qualitative (including the allocation of ordinary employees, external part-time workers and external contractors under contracts) and quantitative;

- the size of the fund of the average accrued salary with its distribution among the main 3 types of employees with the additional allocation of other non-listed persons;

- the amount of social payments, also broken down by the main 3 types of employees, with an additional allocation of other non-listed persons;

- the number of hours worked during the reporting period by employees on the payroll.

In sec. 3 forms reflected basic economic indicators firms for the period (excluding VAT, excises and other mandatory transfers):

- goods, services and works independently produced by the company;

- goods sold produced by third parties;

- catering products, independently produced by the company;

- expenses for the purchase of products for resale;

- investment in new and imported fixed assets;

- internal spending on research and technological development;

- the value of resold properties and the cost of their acquisition.

The PM form includes indicators for the entire company as a legal entity (that is, the document includes figures that summarize the indicators for all divisions).

The document is signed by the head of the company or a responsible officer who has the authority to submit data to Rosstat. A person can be vested with the appropriate authority by a separate order of the company's management. The contact details of the responsible person are indicated next to the signature.

Results

Legal entities belonging to the category of small enterprises - in accordance with the criteria, statutory No. 209-FZ, as well as those included in the Rosstat sample, must report to the department in the PM form at the end of the quarter. Its current form was approved by order of Rosstat dated August 21, 2017 No. 541. This form contains information about the company's staff, employee salaries, company turnover, that is, the main economic indicators of the company's activities.