First of all, you need to make sure that the company is registered in in due course and conducts activities. This can be done in many ways.

Check TIN

Make sure that the supplier's TIN is not a random set of numbers, but a real digital code that belongs to the company offering the deal.

It is very easy to check this, since the TIN has its own algorithm, and a fake number, most likely, will not match it. You can recognize an error in the TIN in any program for preparing information about the income of individuals by entering the number in the "TIN of the employer" field. If the number does not satisfy the algorithm, an error message will appear.

At the same time, you can establish the authenticity of the TIN and its belonging to a particular company on the website of the Federal Tax Service or using the counterparty verification service.

Request a copy of the state registration certificate (or an entry sheet in the Unified State Register of Legal Entities)

The state registration certificate confirms that the counterparty exists as a legal entity and is registered as a taxpayer. From January 1, 2017, when registering legal entities and individual entrepreneurs instead of a certificate of state registration, a record sheet of the desired register is issued - ERGUL or EGRIP. Thus, the entry sheet is a document confirming the fact of making an entry in the Unified State Register of Legal Entities or EGRIP.

In accordance with clause 13 of the Rules for maintaining the Unified State Register of Legal Entities, the record sheet state register included in the registry legal entity. In accordance with clause 19 of the Rules for Maintaining the USRIP, the entry sheet of the state register is included in the registration file of an individual entrepreneur.

Get an extract from the Unified State Register of Legal Entities / EGRIP

A fresh extract from the Unified State Register of Legal Entities confirms that the counterparty is registered and has not been deregistered at the time of its receipt. In addition, by extract from the Unified State Register of Legal Entities you can check the details specified by counterparties in contracts and other documents.

An extract can be requested directly from a potential partner or using the FTS service.

Balance allows you to do several at once important findings about company:

- First, he confirms that the company is reporting.

- Secondly, it allows you to establish whether the organization conducted economic activities.

- Thirdly, from accounting you can learn about the "portfolio" of funds that the company has. If a firm has near-zero asset value, significant debentures and authorized capital 10,000 rubles is a reason to think about whether it is worth giving such a company, for example, trade credit. Turnovers that are too low compared to the amount of the proposed transaction may also indicate that the supplier hides part of the income. In this case, it is better to refuse the transaction.

Data-driven financial statements easy to compose the financial analysis, which will show the dynamics of the company's activities and allow you to evaluate it financial stability. In the service on the company card, you can find links to financial statements and mini-financial analysis, which will allow you to immediately see key points in book forms without the need to learn a large and complex financial report by company.

Information about legal entities that have tax debts and/or do not represent tax reporting more than a year, can also be obtained on the website of the Federal Tax Service.

Additional analytics

It is necessary to verify the integrity of the counterparty and collect evidence that you have carried out the necessary verification. Why is it important? In the event of a lawsuit, this will confirm that your company has shown .

From the point of view of the tax authorities (), the company did not show due diligence if she doesn't have:

- personal contacts of the management in the counterparty company when discussing the terms of supply and when signing contracts;

- documentary confirmation of the authority of the head of the counterparty company, copies of a document proving his identity;

- information about the actual location of the counterparty, as well as the location of warehouse, production, retail space;

- information about the method of obtaining information about the counterparty (advertising, recommendations of partners, official website, etc.);

- information about state registration counterparty in the Unified State Register of Legal Entities;

- information on whether the counterparty has the necessary license (if the transaction is concluded within the framework of a licensed activity), a certificate of admission to a certain type of work, issued self-regulatory organization;

- information about other market participants of similar goods, works, services, including those who offer lower prices.

Company information

Bulk registration address

A mass address is one of the signs of one-day firms. At the end of 2017, the Ministry of Finance issued a warning that if there is confirmed information about the inaccuracy of the information provided about the address of the legal entity, the registration authority has the right to refuse registration. According to the document, the facts of including information about the mass registration address are the basis for verifying the reliability of data in the Unified State Register of Legal Entities. Thus, by registering companies at a mass address, a legal entity or individual entrepreneur risks being denied registration.

But the tightening of control over mass addresses applies not only to new businesses, but also to already registered companies: the tax office sends letters to companies that need to provide reliable information about their address to the registration authority. It will not be possible to ignore the notification of the tax authorities: if the address is not confirmed, the submitted documents do not correspond to reliability, then an entry is made in the Unified State Register of Legal Entities about incorrect information about the address, which may lead to the organization being excluded from the register, according to. It is all the more dangerous to enter into contracts with counterparties registered at mass addresses.

How to check the "mass character" of the address? Firstly, a service is available on the website of the Federal Tax Service that checks the address entered by the user with a list of mass addresses. Secondly, it shows which companies are registered at the same address as the counterparty of interest to the user, service. In a number of cases, such a “neighborhood”, even if we are not talking about mass registration, may turn out to be significant.

The actual location of the counterparty

In itself, the discrepancy between the actual and legal address does not characterize the counterparty in any way. According to the Federal Tax Service, almost 80% Russian companies are not located at the legal address specified during registration. But the tax office recommends checking actual place finding a counterparty along with other data.

Such information can be obtained by visiting the legal or actual address of the prospective partner. This will allow not only to clarify whether the counterparty's office is actually located there, but also to look at the premises, production or retail space, and talk with employees and neighbors in the office building. Such a visit can be especially productive if it is done incognito, under the guise of a buyer or potential partner.

In Contour.Focus, you can view the panorama of buildings and surroundings for the specified legal entity in one click. This option is called .

The feasibility of the terms of the contract for the counterparty

There must be clear evidence that the counterparty has real opportunity fulfill the terms of the contract. First of all, the time spent on the delivery or production of goods, the performance of work or the provision of services is taken into account.

Violations of tax laws

The taxpayer has the right to request from the tax authorities information on the payment of taxes by counterparties. At the same time, it does not matter whether the inspection will respond to the company's request. The Code does not establish an obligation tax authorities provide taxpayers, at their request, with information on the fulfillment of obligations by counterparties, provided by law about taxes and fees, or about their violations of the law ().

As arbitration practice shows, the very fact of applying to the tax office with a request to assist in checking the integrity of counterparties testifies to the company's due diligence.

In order for the fact of contacting the inspection to be recorded, the request should be sent by registered mail with a return receipt (you have one copy of the inventory and the returned notification) or submit a request personally to the office tax office(in this case, a copy of the request with a mark of acceptance remains on hand).

Arbitration cases

"Black list" on the website of the Federal Tax Service

This is a register of disqualified persons. Disqualification is an administrative punishment, which consists in depriving individual certain rights, in particular, the right to hold senior positions in the executive management body of a legal entity, to be a member of the board of directors (supervisory board), to exercise entrepreneurial activity for the management of a legal entity.

The grounds for disqualification may be intentional or fictitious bankruptcy, concealment of property or property obligations, falsification of accounting and other accounting documents, etc.

To avoid cooperation with companies whose head was disqualified, it is enough to check a potential partner through a special service on the website of the Federal Tax Service. The search is carried out by the name of the legal entity and PSRN.

By the end of 2018, the Federal Tax Service launched the Transparent Business service in test mode, which can be used to collect comprehensive information about a taxpayer - an organization and exercise due diligence.

If you enter data about the TIN, PSRN or company name in the search, the following information will appear:

- the date of state registration and the main state registration number of the legal entity, the method of formation of the legal entity and the name of the registering authority;

- information about the registration of the organization in the tax authority;

- state of the legal entity;

- address of the legal entity and information about the address of mass registration;

- OKVED;

- the size of the authorized capital;

- inaccurate data about the head of the company, the management of the activities of many other legal entities;

- category of the subject of small and medium business.

You should pay attention to the triangle sign, which may appear in the section as a warning. This means that the information requires special attention.

Powers of the person signing the documents

The Ministry of Finance recommends that when checking counterparties, obtain documentary evidence of the authority of the head (his representative). If the documents are signed by a representative of the company, a power of attorney or other document authorizing this or that person to sign documents on behalf of the company must be obtained from the counterparty.

The Ministry of Finance also recommends that taxpayers request identification documents from the head of the counterparty company. This will confirm that the documents are signed by the person who has the authority to do so. In addition, there may be cases when the counterparty is registered on a lost or stolen passport. You can find this out on the FMS website.

Transaction Information

Confirmation of personal contacts when concluding a transaction

The lack of personal contacts during the conclusion of the transaction may indicate that the taxpayer did not exercise due diligence. The collected data on the circumstances of the conclusion of the contract with the counterparty (who participated in the negotiations, who released the goods, etc.) will help to prove the opposite.

Verification of transaction documents

This procedure avoids not only the claims of the tax authorities, but also possible litigation.

- check the address indicated in the documents of the counterparty, in particular, in invoices;

- make sure that the supplier's documents do not contain logical contradictions and comply with the Tax Code of the Russian Federation and other laws;

- compare the signatures of employees on documents in order to exclude the situation when different signatures are put on behalf of one person (it is better to exclude such documents so that the Federal Tax Service does not claim that they are fictitious).

This list of "filters" is not exhaustive. There are other ways to be careful in choosing a counterparty and get the most complete information about it.

Net assets - formula for calculating the balance sheet 2018-2019years approved by the Ministry of Finance of Russia. How to calculate the net assets of a company? What conclusions can be drawn by analyzing the value of net assets companies? How often should net assets be calculated? You will find answers to these questions in our article.

General concept of net assets

Performance evaluation and successful work planning modern companies impossible without analysis economic indicators. One of the most important values among such indicators is the value of net assets (NA).

The value of net assets is the difference between the value of all assets of the organization (property, land, Money etc.) and the sum of all its obligations (debt on payment of taxes and payments to the budget, loans, etc.). To put it simply, net assets are those funds of the company that will remain after repayment of debts to creditors.

Calculation of net assets in without fail is made once a year and is reflected in the annual financial statements in line 3600 of section 3 of the Statement of changes in equity. It is also done, if necessary, to obtain information about the current financial situation, pay interim dividends or the actual value of the share to the participant.

How to calculate the net asset value of the balance sheet 2018-2019 (formula)

To find out, let's turn to the order of the Ministry of Finance of Russia dated August 28, 2014 No. 84n, which provides the procedure for calculating them.

It is valid for companies of the following forms of ownership:

- joint-stock companies (public and non-public);

- societies with limited liability;

- state and municipal unitary enterprises;

- cooperatives (production and housing accumulative);

- business partnerships.

According to Order No. 84n, to calculate the company's net assets, the value of liabilities must be deducted from the value of assets. For this, the formula is used:

CHA \u003d (VAO + OJSC - ZU - ZVA) - (TO + KO - DBP),

NA - net assets;

VAO - outside current assets organizations;

OJSC - current assets of the organization;

ZU - the debt of the founders to the organization for filling shares in the authorized capital;

ZVA - the debt formed during the redemption of own shares;

DO - long-term obligations;

KO - short-term liabilities;

DBP - deferred income (in the form of state aid and gratuitous receipt of property).

To calculate net assets, you can also use the data contained in the company's balance sheet. To calculate the value of net assets on the balance sheet, the formula can be modified:

CHA \u003d (line 1600 - memory) - (line 1400 + line 1500 - DBP).

Read more about the values given in this formula in the article. "Net assets - what is it in the balance sheet (nuances)?" .

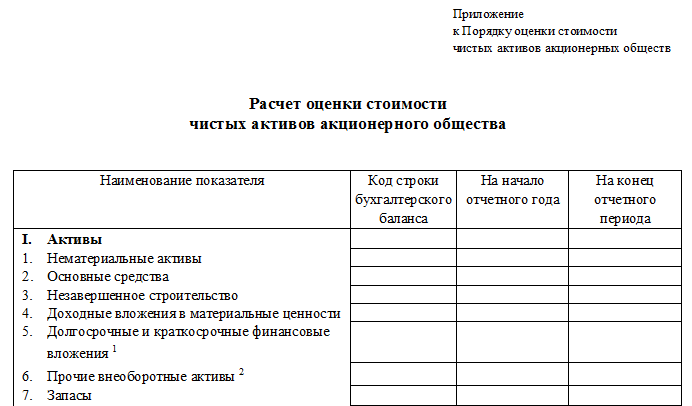

Please note that it is not enough just to make a calculation on a calculator, it must also be completed. And approved form currently not. Companies must develop the 2018-2019 net assets calculation form on their own and approve it as an attachment to accounting policy. However, before the issuance of Order No. 84n of the Ministry of Finance dated August 28, 2014, the form given in the appendix to Order No. 10 of the Ministry of Finance of the Russian Federation and the Federal Commission for Securities of Russia dated January 29, 2003 No. 03-6 / pz was used to calculate net assets. The form of this form lists all those indicators that are required to calculate net assets now, therefore, we consider it acceptable to use it (after its approval in the accounting policy of the organization).

You can download this form from our website:

Net Asset Value Analysis

It is easy to conclude that when analyzing net assets, the output should be positive. Negative will indicate that the company is unprofitable and with a high degree of probability in the near future may become completely insolvent, that is, insolvent. An exception can only be a recently opened company, since during its existence the invested funds did not have time to justify themselves and did not bring income for objective reasons. Thus, the dynamics of the calculation of net assets is one of the key indicators of the company's financial condition.

Note that in the calculation and evaluation of net assets, the authorized capital of the company plays an important role. If the amount of net assets exceeds the value of the authorized capital, this indicates the well-being of the company. If net assets at some stage become less than the amount authorized capital, this indicates the opposite: the organization operates at a loss.

What consequences await the company if net assets are less than the authorized capital, read.

We repeat: this situation is acceptable only for the 1st year of the company's operation. However, if after this period the situation does not change in positive side, the management of the company is obliged to reduce the size of the authorized capital to the amount of net assets. If this figure is equal to the minimum established by law indicators or less than them, the issue of closing the enterprise should be raised (clause 4, article 30 of the law "On LLC" dated February 8, 1998 No. 14-FZ).

Read more about the consequences of negative NA values in the material "What are the implications of negative net assets?" .

Results

The value of net assets is one of key indicators the financial viability of the organization. The higher it is, the more successful the organization and the more attractive it is for investment. Only an organization with high net assets can guarantee the interests of its creditors. That is why it is necessary to be very careful in assessing the value of a company's net assets.

The company's net assets are those own funds companies that will remain with her after she pays off all creditors. That is, it is the difference between the assets of the company and its liabilities, taking into account small adjustments. Another way to determine net assets is to take the total of section III of the balance sheet Capital and Reserves and also adjust it by some amounts. That is, net assets are the capital of the LLC.

Calculation of net assets according to the balance sheet

The value of net assets is determined according to the balance sheet data according to the formula (clause 2, article 30 of the Law of 08.02.98 N 14-FZ; Procedure approved by Order of the Ministry of Finance of 08.28.2014 No. 84n):

This formula clearly shows that equity and net assets are essentially the same thing.

Or you can use the following formula for calculating net assets on the balance sheet:

The calculation of net assets in 2018 is made according to the same formulas.

Net assets: accounting line

The amount of net assets is reflected in the financial statements in Section 3 "Net Assets" of the Statement of Changes in Equity.

If net assets are less than authorized capital

If your company's net assets have become less than the authorized capital, then you are obliged to reduce the authorized capital to the level of net assets and register such a decrease in the Unified State Register of Legal Entities (). That is, at least after the preparation of the annual financial statements, it is necessary to compare the authorized capital and net assets.

Also, there is a rule. If the LLC decides to pay dividends to the participants, but as a result of accrual of dividends, the net asset value will become less than required, then it is impossible to accrue dividends in the planned amount. It is necessary to reduce the profit distributed to dividends to a value at which the above ratio will be fulfilled.

At the same time, no liability for violation of the requirement on the ratio of authorized capital and net assets has been established.

Negative net assets

If the net assets have become less than the size of the minimum authorized capital (10,000 rubles) or the net assets have generally gone negative, then the LLC is subject to liquidation (clause 3 of article 20 of the Law of 08.02.98 N 14-FZ).

Net asset valuation

tax service also analyzes the financial statements of companies and selects those with net assets less than the authorized capital. After all, negative or just small net assets are the result of a large loss in the current or past periods. After that, the head of the company is invited to a commission at the IFTS, where he is invited to increase net assets to the desired level.

Increase in net assets

There are several ways to increase net assets:

- carry out a revaluation of property (fixed assets and intangible assets) (clause 15 PBU 6/01);

- check accounts payable (perhaps some debts have expired limitation period);

- receive assistance from members of the company (contribution to the property of the LLC).

Use your balance to check financial position company at a specific point in time by looking at how it balances assets, liabilities, and equity. The basic balance equation is as follows: Assets = Liabilities + Equity

- Assets. Remember that assets add value to a business. The quality of asset management can be determined by evaluating how they are distributed between cash, receivables, short-term and long term investment, stocks, fixed assets, facilities, land plots, buildings. In doing so, you will be able to understand whether the business is able to maintain and grow its operations, or it will close.

- Commitments. Obligations are everything borrowed funds companies. Borrowing is one way to get financial resources to maintain operations. The liabilities section will also inform you about the amount of debt to suppliers and contractors, on bills payable and on other types of accounts payable. It is often the case (in certain situations, of course) that a high leverage can be a sign that a company is in trouble and unable to sustain its own operations.

- Capital. Capital represents the company's own funds. It is the main source of funds to support the operations of the business. When reviewing the equity section, look at the number of ordinary and preferred shares. By sections of capital you will be able to assess the real value of the business from the point of view of its owners. An impressive amount of equity can serve as an indicator of a business's ability to continue operating and grow. The opposite situation indicates the presence of problems and the likelihood of curtailing the business.

Use the cash flow statement to understand the cash flows for reporting period. There are two methods of preparing a cash flow statement: direct and indirect.

- The direct method in a generalized form represents the receipt and use of funds in the reporting period.

- The indirect method involves adjusting net profit transactions that affected it but did not affect the amount of cash.

Check the statement of shareholders' equity for more detailed information on the changes in the equity section of the balance sheet during the reporting period. You will be able to get acquainted with how many shares are allowed to be issued, how many of them are actually issued. In this report, you can see the changes that have taken place by article. ordinary shares, preferred shares, additional capital and retained earnings.

Definition

Net assets- this is the value determined by subtracting from the amount of the organization's assets, the amount of its liabilities. Net assets is the amount that will remain to the founders (shareholders) of the organization after the sale of all its assets and the repayment of all debts.

The net asset indicator is one of the few financial indicators, the calculation of which is unambiguously determined by the legislation of the Russian Federation. The procedure for calculating net assets was approved by the Order of the Ministry of Finance of Russia dated August 28, 2014 N 84n "On Approval of the Procedure for Determining the Cost of Net Assets". This procedure is applied by joint-stock companies, limited liability companies, state unitary enterprises, municipal unitary enterprises, production cooperatives, housing savings cooperatives, business partnerships.

Calculation (formula)

The calculation comes down to determining the difference between assets and liabilities (liabilities), which are defined as follows.

The composition of assets accepted for calculation includes all assets of the organization, with the exception of accounts receivable founders (participants, shareholders, owners, members) on contributions (contributions) to the authorized capital (authorized fund, unit trust, share capital), for payment of shares.

The composition of liabilities accepted for calculation includes all liabilities, except deferred income. But not all deferred income, but those that recognized by the organization in connection with the receipt state aid, as well as in connection with gratuitous receipt property. These incomes are actually own capital organizations, therefore, for the purposes of calculating the value of net assets, they are excluded from the current liabilities section of the balance sheet (line 1530).

Those. formula for calculating net assets by balance sheet enterprises are as follows:

Net assets \u003d (line 1600 - memory) - (line 1400 + line 1500 - DBP)

where ZU is the debt of the founders on contributions to the authorized capital (it is not separately allocated in the Balance sheet and is reflected in short-term receivables);

DBP - deferred income recognized by the organization in connection with the receipt of state assistance, as well as in connection with the gratuitous receipt of property.

An alternative way to calculate net asset value giving exactly the same result as the formula above would be:

Net assets \u003d str. 1300 - memory + DBP

Normal value

The indicator of net assets, known in Western practice as net assets or net worth - key indicator activities of any commercial organization. The organization's net assets must be at least positive. Negative net assets are a sign of the insolvency of the organization, indicating that the company is completely dependent on creditors and does not have its own funds.

Net assets should not only be positive, but also exceed the authorized capital of the organization. This means that in the course of its activities, the organization not only did not waste the funds originally contributed by the owner, but also ensured their growth. Net assets less than the authorized capital are allowed only in the first year of operation of newly created enterprises. In subsequent years, if net assets become less than the authorized capital, civil Code and legislation on joint-stock companies requires the authorized capital to be reduced to the value of net assets. If the organization's authorized capital is already at a minimum level, the question of its further existence is raised.

net asset method

In valuation activities, the net asset method is used as one of the methods for assessing the value of a business. With this method, the appraiser uses data on the net assets of the organization according to the financial statements, previously adjusted based on their own estimated values market value property and liabilities.