This section contains a glossary in the same wording as on the website of the Ministry of Economics.

CAPM

Capital asset pricing model.

CAPM = Risk Free Rate + Beta× market premium+ risk premiums (for small companies, company-specific).

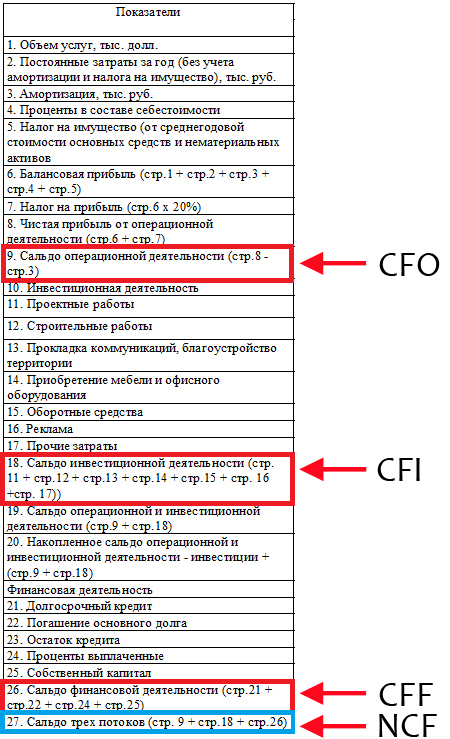

CFF

Cash flow from financial activities(Cash from financing activities).

CFF = Flow from share issuance - Share repurchases + New borrowings - Loan repayments - Dividend payments (simplified)

CFI

Cash flow from investment activity(Cash from investing activities).

CFI = Sales Flow financial assets and OS - Investments in OS - Purchase of financial assets (simplified)

CFO

Cash from operating activities.

CFO = net cash flow from operations after taxes and interest = net income + depreciation - change in working capital (simplified)

EBIT

Earnings before interest and tax.

EBIT = Revenue - Cost of sales - Selling and administrative expenses

EBITDA

Earnings before interest, tax, depreciation and amortization.

EBITDA = EBIT + Depreciation

EPS

Net income per share (Earnings per share).

EPS = (Net profit - Dividends on preference shares) / Weighted average ordinary shares in circulation

EV/EBITDA

Business enterprise value to Earnings before interest, tax, depreciation and amortization.

Multiplier market value invested capital to earnings before interest, income tax and depreciation

EV/Sales

EV / Revenue (Enterprise value to Sales).

Multiplier of the market value of invested capital to revenue

EV/Inventory

Multiplier of the ratio of the market value of the business to the volume of reserves in physical terms.

IRR

Internal rate of return (Internal rate of return).

NOPAT

Net operating profit after taxes (Net operating profit after tax).

NOPAT = EBIT*(1-Income Tax)

NPV

Net Present Value.

Click on the picture to enlarge

P/BV

Price to Book Value Multiple. Market Value Ratio Multiplier equity to the book value of equity, Price / Book value own capital.

P/E

Price to Earnings Multiple. Multiplier of the market value of equity to net profit, Price / net profit.

ROE

Return on equity (Return on Equity).

ROE = (Net Profit) / (Equity)

ROE = (Net profit) / ( Total assets) × (Total assets) / (Equity)

ROA

Return on Assets.

ROA = (Net Profit) / (Total Assets)

risk free rate

risk free rate. The interest rate of return that an investor can receive on his capital when investing in the most liquid assets, characterized by the absence or minimum possible risk non-return of invested funds.

Beta asset i

measure of risk. Covariance of asset i with the market portfolio/Dispersion of the market portfolio.

Beta leverless

Beta without leverage, beta without taking into account financial leverage, debt-free beta (Beta unlevered).

Beta Leverless = Beta Lever /

Beta lever

Leverage beta, leveraged beta, debt beta (Beta (re)levered).

Levered Beta = Leverless Beta ×

Gross profit

The difference between revenue and cost products sold or services.

Interdependent Assets

contributory assets. Assets (tangible and intangible) involved in the formation of cash flow.

Cash flow on invested capital

Cash flow to the firm, Cash flow for all invested capital (Free cash flows to firm (FCFF)).

FCFF = EBIT*(1-Tax Rate) + Depreciation - Capital expenditures- Change in non-monetary working capital.

FCFF = CFO – Capital cost + Interest expense*(1-tax rate)

Cash flow to equity

Free cash flows to equity (FCFE).

FCFE = Net Income + Depreciation - Capital Costs - Change in Non-Cash Working Capital + ( New debt- Amortization)

Discounting at the end of the period

Click on the picture to enlarge

Discounting at the beginning of the period

Click on the picture to enlarge

Mid-period discounting

Click on the picture to enlarge

Discount multiplier (discount factor)

Discount coefficient. The coefficient by which the value of future cash flow is multiplied to give its present value.

Interval multipliers

income multipliers.

Absolute liquidity ratio

Coefficient absolute liquidity= (cash + short-term financial investments) / Short-term liabilities.

Customer base churn rate

Retirement rate (Сhurn rate).

The share of clients leaving the client base for the period (to the total number of clients at the beginning of the period).

Retirement rate = Number of units retired during the period / Number of active units at the beginning of the period

Coverage ratio

Current liquidity ratio, total liquidity ratio, total coverage ratio.

Coverage Ratio = Current Assets / Current Liabilities

Licensor

The party transferring the right to use the object of the license to the licensee in accordance with the license agreement.

Licensee

A party in a license agreement that acquires from the right holder (Licensor) a limited right to use the results of intellectual activity and means of individualization equated to them.

Discounted cash flow method

The discounted cash flow method is based on the assumption that the value of the business (enterprise) is equal to the present value of future cash flows that will be received in the face of changing income streams.

Cost = The sum of the current values of the cash flows of the forecast period + present value post-forecast cash flow

Income capitalization method

The income capitalization method is based on the premise that the value of the business (enterprise) is equal to the present value of future income that will be received under conditions of a stable income stream.

Cost = Income / Capitalization Rate

Salvage value method

Net proceeds received after the sale of the organization's assets, taking into account the repayment of existing debt and costs associated with the sale of assets and the termination of the activity of the organization conducting business.

Capital market(s) method

Based on share prices of similar companies open type in the world stock markets.

Adjusted Net Asset Method

Within the method net assets value is defined as the difference between the market value of assets and liabilities.

Method of comparable transactions

Deal method. Based on information about the sale of blocks of shares or the company as a whole (mergers / acquisitions).

Royalty exemption method

Based on the analysis of the income stream in the case of a license agreement.

Cost advantage method

Based on the analysis of the amount of cost savings resulting from the use of intangible assets.

excess returns method

Excess profits to the enterprise bring unrecorded on the balance sheet intangible assets providing profitability above the industry average.

Replacement cost method (IA)

Accounting for the cost of creating intangible assets at replacement cost.

Replacement cost method (IA)

Accounting for the cost of creating intangible assets at the cost of reproduction.

Gordon Model

The Gordon model is used to evaluate a firm that is in a steady state.

The cost calculation is based on the capitalization of income in the last year of the forecast period or in the first year of the post-forecast period.

As a rule, the equality of the amount of capital investments and depreciation is observed when constructing the cash flow

Instant multipliers

balance multipliers.

Asset turnover

Asset turnover ratio \u003d Revenue / Average annual value of assets (value of assets at the end of the period)

Operating profit

Revenue from sales.

Profit from the main (ordinary) activity, equal to the difference between revenue and expenses for the main activity (the latter includes direct and operating expenses); difference between gross profit and operating expenses

Control Award

Control premium. The value of the advantage associated with owning a controlling stake

Equity risk premium

Equity risk premium

Profit before tax

Profit before tax = EBIT - Finance costs

Profitability of sales

Sales margin.

Return on sales = Profit from sales / Revenue

Return on sales based on net profit

Net profitability (Net income margin).

Return on sales based on net profit = Net profit/Revenue

Market capitalization

Market capitalization (MC).

The market value of all outstanding shares of the company, calculated on the basis of quotations

Market value of invested capital

business enterprise value.

Click on the picture to enlarge

Market value of equity

equity value.

Discount for lack of liquidity

Discount for the lack of liquidity. The amount by which the value is reduced to reflect the lack of liquidity of the subject property.

Discount for the non-controlling nature of the package

DLOC (Discount for Lack of Control).

DLOC = 1 - (1 / (1 + Control Bonus))

Own working capital

Net working capital.

Working Capital Equity = Accounts Receivable + Inventory - Accounts payable

Weighted average cost of capital

Cost of invested capital (WACC).

WACC = Cost of Equity × [Equity /(Debt + Equity)] + Cost of Debt × [Debt /(Debt + Equity)] × (1 - Income Tax Rate)

Discount rate

discount rate. The interest rate used to bring projected cash flows (income and expenses) down to a given point in time, such as the valuation date.

The cost of debt

The cost of borrowed capital. Cost of debt

Cost of equity

Cost of equity.

Returns that investors expect from equity investments

Terminal cost

Terminal Value (TV). Reversion, post-forecast cost.

The cost of cash flow in the post-forecast period

Terminal period

Post-forecast period (Terminal period).

The period following the last forecast period when the company's activity stabilizes

terminal stream

Cash flow in the post-forecast period (Terminal Cash Flow).

Working capital cycle

Turnover period (Working capital cycle).

Turnover ratio accounts receivable= Revenue / Average balance of receivables (value of receivables at the end of the period)

Inventory Turnover Ratio = Cost/Average Inventory (end-of-period inventory)

Accounts payable turnover ratio \u003d Cost / Average balance of accounts payable (value of accounts payable at the end of the period)

Turnover in days = 365 (360) / Turnover ratio

Net profit

Net income = Profit before tax - Income tax

Net assets

The amount determined by subtracting from the amount of the organization's assets, the amount of its liabilities.

According to the order of the Ministry of Finance of Russia dated August 28, 2014 No. 84n "On approval of the procedure for determining the value of net assets"

net debt

net debt.

Net debt = Long-term and current liabilities - Cash and cash equivalents,

The cash flow to equity is generated by the equity of the enterprise. At the same time, the actual value of equity capital is presented in section III "Capital and reserves" balance sheet enterprises. Therefore, discounting cash flow to equity allows you to evaluate the value of the business in terms of equity.

The actual cash flows of the enterprise are reflected in the annual Statement of Money". However, to evaluate the business, it is necessary to calculate the expected future cash flows for each year of the forecast period. For this, it can be used, based on the forecast of cash flows for the operating, investment, financial activities of the company being valued according to the logic of the "Cash Flow Statement". The direct method of calculating cash flows is more commonly used in fundamental analysis, often used in business valuation.

Cash flow to equity, calculated by the indirect method, = + depreciation accrued for the period + increase in long-term debt for the period - increase in own working capital for the period - capital investments for the period – reduction of long-term debt for the period.

Net profit as a balance of income and expenses of the assessed enterprise roughly reflects the cash flow from the main operating activities of the enterprise. Depreciation deductions as a non-cash element of costs in the process of calculating the cash flow are added to profit, since their accrual is not accompanied by an outflow of cash.

The increase in own working capital is necessary for the expansion of the main activity, the acquisition of current assets of the enterprise (raw materials, materials, etc.) and requires an outflow of funds. The growth of own working capital is understood as an increase in those of its elements, in which own working capital and funds directed to their replenishment turned out to be connected.

The calculation of cash flow to equity also takes into account cash inflows and outflows from financial and investment activities:

- an increase in long-term debt is added, resulting in an inflow of cash,

- deducted are reductions in long-term debt and capital expenditures that result in cash outflows.

At the same time, the movement of short-term debt in the above methodology for determining the cash flow is not taken into account, since it is considered that its turnover is within the turnover of the enterprise's funds that took place within the period (year) under consideration.

The main goal of any business is to make a profit. In the future, the profit indicator is reflected in a special tax report on financial results- it is he who indicates how effective the work of the enterprise is. However, in reality, profit only partially reflects the results of the company's work and may not at all give an idea of how much money the business actually earns. Full information on this issue can only be found in the cash flow statement.

Net profit cannot reflect the funds received in real terms - the amounts on paper and the company's bank account are two different things. For the most part, the data in the report is not always factual and is often purely nominal. For example, revaluation exchange rate difference or depreciation does not bring real money, and funds for the goods sold appear as profit, even if the money has not yet actually been received from the buyer of the goods.

It is also important that the company spends part of its profits to finance current activities, namely the construction of new factory buildings, workshops, outlets- in individual cases these costs are much higher than net profit companies. As a result of all this, the overall picture can be quite favorable and the company can be quite successful in terms of net profit - but in fact the company will suffer serious losses and not receive the profit that is indicated on paper.

Free cash flow helps to correctly assess the company's profitability and assess the real level of earnings (and also better assess the possibilities of a future investor). Cash flow can be defined as the funds available to a company after all due expenses have been paid, or as funds that can be withdrawn from a business without harming the latter. You can get data for calculating cash flows from the company's report under RAS or IFRS.

Types of cash flows

There are three types of cash flows, and each option has its own characteristics and calculation procedure. Free cash flow is:

from operating activities - shows the amount of money that the company receives from the main activity. This indicator includes: depreciation (with a minus sign, although funds are not actually spent), changes in accounts receivable and credit debt, as well as inventory - and in addition other liabilities and assets, if any. The result is usually displayed in the column "Net cash from core / operating activities". Legend: Cash Flow from operating activities, CFO or Operating Cash Flow, OCF. In addition, the same value is also simply referred to as Cash Flow;

from investment activity - illustrates the cash flow aimed at the development and maintenance of current activities. For example, this includes the modernization / purchase of equipment, workshops or buildings - therefore, for example, banks usually do not have this item. In English, this column is usually called Capital Expenditures (capital expenditures, CAPEX), and investments can include not only investments “in themselves”, but also be aimed at buying assets of other companies, such as stocks or bonds. Referred to as Cash Flows from investing activities, CFI;

from financial activity - allows you to analyze the turnover of financial receipts for all operations, such as receiving or returning debt, paying dividends, issuing or repurchasing shares. Those. this column reflects the conduct of business by the company. A negative value for debts (Net Borrowings) means their repayment by the company, a negative value for shares (Sale/Purchase of Stock) means they are bought. Both characterize the company in a good way. In foreign reporting: Cash Flows from financing activities, CFF

Separately, you can stop at promotions. How is their value determined? Through three components: depending on their number, the company's real profit and market sentiment in relation to it. Additional issue shares leads to a drop in the price of each of them, since there are more shares, and the company's results during the issuance most likely did not change or changed slightly. And vice versa - if the company buys back its shares, then their value will be distributed among the new (smaller) number of securities and the price of each of them will rise. Conventionally, if there were 100,000 shares at a price of $50 each and the company bought back 10,000, then the remaining 90,000 shares should be worth approximately $55.5. But the market is the market - revaluation may not occur immediately or by other amounts (for example, an article in a major publication about a company's similar policy can cause its shares to grow by tens of percent).

The debt situation is ambiguous. On the one hand, it is good when a company reduces its debt. On the other hand, properly spent credit funds can take the company to a new level - the main thing is that there are not too many debts. For example, at famous company Magnit, which has been growing strongly for several years in a row, free cash flow turned positive only in 2014. The reason is development through loans. Perhaps, during the study, it is worth choosing for yourself some kind of maximum debt limit, when the risks of bankruptcy begin to outweigh the risk of successful development.

When summing all three indicators, a net cash flow . Those. is the difference between the inflow (inflow) of money into the company and their outflow (expenditure) in certain period. If a we are talking about negative free cash flow, it is indicated in brackets and indicates that the company is losing money, not earning it. At the same time, to clarify the dynamics, it is better to compare the company's annual rather than quarterly indicators in order to avoid the seasonal factor.

How are cash flows used to value companies?

To form an impression of a company, it is not necessary to count Net Cash Flow. The amount of free cash flow also allows you to evaluate the business using two approaches:

based on the value of the company, taking into account own and borrowed (loan) capital;

including only equity capital.

In the first case, all cash flows reproduced by existing sources of borrowed or borrowed funds are discounted. own funds. In this case, the discount rate is taken as the cost of capital involved (WACC).

The second option provides for the calculation of the value of not the entire company, but only a small part of it - equity. For this purpose, the equity of the FCFE is discounted after all debts of the company have been paid. Let's consider these approaches in more detail.

Free cash flow to equity - FCFE

FCFE (free cash flow to equity) is a designation of the amount of money left from the profit received after paying taxes, all debts and expenses for the operating activities of the enterprise. The calculation of the indicator is carried out taking into account the net profit of the enterprise (Net Income), depreciation is added to this figure. After that, capital costs (arising in connection with the modernization and / or purchase of new equipment) are deducted. The final formula for calculating the indicator, determined after the payment of loans and loans, is as follows:

FCFE = Net cash flow from operating activities – Capital expenditures – Loan repayments + New loan origination

Free cash flow of the firm - FCFF

FCFF (free cash flow to firm) refers to the funds that remain after the payment tax amounts and the deduction of capital expenditures, but before interest payments and common debt. To calculate the indicator, you must use the formula:

FCFF = Net cash flow from operating activities - Capital expenditures

Therefore, FCFF, unlike FCFE, is calculated without taking into account all loans and loans issued. This is what is usually meant by free cash flow (Free Cash Flow, FCF). As we have noted, cash flows may well be negative.

Cash flow calculation example

In order to independently calculate cash flows for a company, you need to use its financial statements. For example, Gazprom has it here: http://www.gazprom.ru/investors. We follow the link and select the sub-item “all reporting” at the bottom of the page, where you can see reports from 1998. We find desired year(let it be 2016) and go to the section “Consolidated financial statements IFRS. Below is an excerpt from the report:

1. Calculate the free cash flow to capital.

FCFE = 1,571,323 - 1,369,052 - 653,092 - 110,291 + 548,623 + 124,783 = 112,294 million rubles remained at the disposal of the company after paying taxes, all debts and capital expenditures (expenses).

2. Determine the free cash flow of the firm.

FCFF = 1,571,323 - 1,369,052 = 202,271 million rubles - this indicator shows the amount net of taxes and capital expenditures, but before interest and total debt payments are made.

P.S. When American companies all data can usually be found at https://finance.yahoo.com. For example, here is the data of Yahoo itself in the Financials tab:

Conclusion

AT general view cash flow can be understood as available funds companies and calculate it both with and without debt and loan capital. A company's positive cash flow indicates profitable business, especially if it grows from year to year. Nevertheless, any growth cannot be infinite and rests against natural limitations. In turn, even stable companies (Lenta, Magnit) can have negative cash flow - it is usually based on large loans and capital expenditures, which, if properly used, can, however, provide significant future profits.

Dividing the company's market capitalization by the firm's free cash flow yields P/FCF ratio . Capitalization (Market Cap) is easy to find on yahoo or morningstar. A value less than 20 usually indicates good business, although any indicator should be compared with competitors and, if possible, with the industry as a whole.

Let's analyze the types of cash flows of an enterprise: the economic meaning of indicators - net cash flow (NCF) and free cash flow, their construction formula and practical examples calculation.

Net cash flow. economic sense

Net cash flow (EnglishNetCashflow,Netvalue,NCF, present value) - is key indicator investment analysis and shows the difference between positive and negative cash flow for a selected period of time. This indicator determines financial condition enterprise and the ability of the enterprise to increase its value and investment attractiveness. Net cash flow is the sum of the cash flow from the operating, financial and investment activities of the enterprise.

Consumers of net cash flow indicator

Net cash flow is used by investors, owners and creditors to evaluate the effectiveness of investing in an investment project/enterprise. The value of the net cash flow indicator is used in assessing the value of an enterprise or an investment project. Since investment projects can have a long implementation period, all future cash flows lead to the value at the present time (discounted), resulting in the NPV indicator ( Netpresentvalue). If the project is short-term, then discounting can be neglected when calculating the cost of the project based on cash flows.

Estimation of NCF values

The higher the value of the net cash flow, the more investment attractive the project is in the eyes of the investor and creditor.

Formula for calculating net cash flow

Consider two formulas for calculating net cash flow. So net cash flow is calculated as the sum of all cash flows and outflows of the enterprise. And the general formula can be represented as:

NCF - net cash flow;

CI (Cash inflow) - incoming cash flow, which has a positive sign;

CO (cash outflow) - outgoing cash flow with a negative sign;

n is the number of cash flow evaluation periods.

Let us write in more detail the net cash flow by type of activity of the enterprise; as a result, the formula will take the following form:

![]() where:

where:

NCF - net cash flow;

CFO - cash flow from operating activities;

CFF - cash flow from financing activities;

Example calculation of net cash flow

Let's analyze in practice an example of calculating net cash flow. The figure below shows the way in which cash flows from operating, financial and investment activities are generated.

Types of cash flows of the enterprise

All cash flows of an enterprise that form a net cash flow can be divided into several groups. So, depending on the purpose of use by the appraiser, the following types of cash flows of the enterprise are distinguished:

- FCFF is the free cash flow of the firm (assets). Used in valuation models by investors and lenders;

- FCFE stands for free cash flow from equity. It is used in models of valuation by shareholders and owners of the enterprise.

Free cash flow of the firm and capital FCFF, FCFE

A. Damodaran distinguishes two types of free cash flows of an enterprise:

- The firm's free cash flow (FreeCashflowtofirm,FCFF,FCF) is the cash flow of the enterprise from its operating activities, excluding investments in fixed assets. The free cash flow of a firm is often referred to simply as free cash flow, i.e. FCF=FCFF. This type cash flow shows how much money the company has left after investing in capital assets. This flow is created by the assets of the enterprise and therefore in practice it is called free cash flow from assets. FCFF is used by the company's investors.

- Free cash flow to equity (FreeCashflowtoequity,FCFE) is the cash flow of the enterprise only from the equity of the enterprise. This cash flow is usually used by the shareholders of the company.

A firm's free cash flow (FCFF) is used to assess enterprise value, while free cash flow to equity (FCFE) is used to assess shareholder value. The main difference is that the FCFF measures all cash flows from both equity and debt, while the FCFE measures cash flows from equity only.

The formula for calculating the free cash flow of a firm (FCFF)

EBIT ( Earnings Before Interest and Taxes) – earnings before taxes and interest;

СNWC ( Change in Net Working Capital) - change in working capital, money spent on the acquisition of new assets;

Capital Expenditure) .

J. English (2001) offers a variation of the free cash flow formula for a firm, which looks like this:

CFO ( CAshFlow from Operations)- cash flow from the operating activities of the enterprise;

Interest expensive - interest expenses;

Tax - interest rate income tax;

CFI - cash flow from investing activities.

The formula for calculating free cash flow from capital (FCFE)

The formula for estimating the free cash flow of capital is as follows:

N.I. ( Net Income) is the net profit of the enterprise;

DA - depreciation of tangible and intangible assets;

∆WCR is net capital cost, also called Capex ( Capital Expenditure);

Investment - the amount of investments made;

Net borrowing is the difference between repaid and received loans.

The use of cash flows in various methods for evaluating an investment project

Cash flows are used in investment analysis for rate various indicators project efficiency. Consider the main three groups of methods that are based on any type of cash flows (CF):

- Statistical estimation methods investment projects

- Payback period of the investment project (PP,paybackperiod)

- Profitability of the investment project (ARR, Accounting Rate of Return)

- current value ( n.v.,Netvalue)

- Dynamic methods for evaluating investment projects

- Net present value (NPV,Netpresentvalue)

- Internal rate of return ( IRR, Internal Rate of Return)

- profitability index (PI, Profitability index)

- Annuity equivalent (NUS, Net Uniform Series)

- net rate of return ( NRR, Net Rate of Return)

- Net future value ( nfv,NetFuturevalue)

- Discounted payback period (DPP,Discountedpayback period)

- Methods taking into account discounting and reinvestment

- Modified net rate of return ( MNPV, Modified Net Rate of Return)

- Modified rate of return ( MIRR, Modified Internal Rate of Return)

- Modified net present value ( MNPV,modifiedpresentvalue)

In all these models for evaluating the effectiveness of the project, cash flows are based on which conclusions are drawn about the degree of project effectiveness. As a rule, investors use the free cash flows of the firm (assets) to estimate these ratios. The inclusion of free cash flows from equity in the formulas for calculating the equity allows for an emphasis on assessing the attractiveness of the project/enterprise for shareholders.

Summary

In this article, we examined the economic meaning of net cash flow (NCF), showed that this indicator allows us to judge the degree investment attractiveness project. We considered various approaches in calculating free cash flows, which allows us to focus on the assessment, both for investors and shareholders of the enterprise. Increase the accuracy of investment project evaluation, Ivan Zhdanov was with you.

FCFE is the amount of money left over from profits after taxes, debt payments, and expenses to maintain and develop a company's operations. The calculation of free cash flow to equity FCFE starts with the company's net income (Net Income), the value is taken from the income statement.

To it is added depreciation, depletion and amortization (Depreciation, depletion and amortization) from the income statement or from the cash flow statement, since in fact this expense exists only on paper, and in reality no money is paid.

Further, capital expenditures are subtracted - these are the costs of servicing current activities, upgrading and purchasing equipment, building new facilities, and so on. CAPEX is taken from the investment activity report.

Something the company invests in short-term assets - for this, the change in the amount of working capital (Net working capital) is calculated. If working capital increases, cash flow decreases. Working capital is defined as the difference between current (current) assets and short-term (current) liabilities. In this case, it is necessary to use non-monetary working capital, that is, to adjust the amount of current assets by the amount of cash and cash equivalents.

For a more conservative estimate, non-cash working capital is calculated as (Inventory + Accounts Receivable - Accounts Payable last year) - (Inventory + Accounts Receivable - Accounts Payable of the previous year), figures are taken from the balance sheet.

In addition to paying off old debts, the company attracts new ones, which also affects the amount of cash flow, so it is necessary to calculate the difference between payments on old debts and receipt of new loans (net borrowings), the figures are taken from the financial performance report.

General formula calculation of free cash flow to equity has the form:

FCFE = Net Income + Depreciation - Capital Costs +/- Change in Working Capital - Loan Repayments + New Borrowings

However, depreciation is not the only "paper" expense that reduces profits, there may be others. Therefore, another formula can be used using cash flow from operations, which already includes net income, adjustment for non-cash transactions (including depreciation), and changes in working capital.

FCFE = Net cash flow from operating activities - Capital expenditures - Repayment of loans + Obtaining new loans

13. Classification of cash flows in accordance with IFRS-7 and RAS No. 23.

The cash flow statement should contain information about the cash flows for reporting period broken down into flows from operating, investing or financing activities.

An entity presents cash flows from operating, investing or financing activities in the form that best suits the nature of its business. Classification by type of activity provides information that allows users to evaluate the impact of this activity on financial position enterprise and the amount of its cash and cash equivalents. This information can also be used to assess the relationship between these activities.

The same transaction may include cash flows classified differently. For example, when the cash payment on a loan includes both interest and principal, the interest portion may be classified as an operating activity and the principal portion may be classified as a financing activity.

Operating activities

The amount of operating cash flows is a key indicator of the extent to which an entity's operations generate sufficient cash to repay loans, maintain the entity's operating capacity, pay dividends, and make new investments without recourse to external sources financing. Information about specific components of cash flows from operating activities for previous periods when combined with other information, it is useful in predicting future cash flows from operating activities.

Cash flows from operating activities are predominantly related to the main income-generating activities of the entity. Thus, they are generally the result of transactions and other events included in the determination of profit or loss. Examples of cash flows from operating activities are.