How and where is it better to open an individual investment account (IIA) in 2019?

Many prominent entrepreneurs have repeatedly spoken out about such a useful thing as long-term investments. So, Warren Buffett, who heads Berkshire Hathaway, constantly talks about this in his regular letters to the company's shareholders. This is what John Bogle, the legendary founder of the Vanguard Group, says.

For a non-specialist, this is essential, since he is especially at risk of losing funds on the exchange if he starts to engage in intraday transactions on it.

The Russians have an excellent tool, which is an individual investment account. This is hosted by a brokerage service - which, in turn, helps an individual (subject to certain restrictions on the part of the latter) to make serious profits due to tax benefits.

The domestic market saw such a mechanism for the first time in 2015, the reason for this was the update of the legislation on the share market, along with updates in Tax Code countries.

Important to know about IIS

An account can only be created by a private trader, both with a brokerage company and directly with a bank. Of the requirements - taxation on the territory of the Russian Federation (presence in the country from 183 days a year). At the same time, there is a rule: one account - one individual.

Which brokerage company is best to open an investment account? Check out the rating best brokers Russia in 2017.

The account itself is not limited in time, but in order for tax benefits to be applied, it is necessary to meet the minimum investment period, the value of which is 3 years and which starts from the date of signing the contract.

The account is allowed only in rubles, and within 12 months it can be replenished in the amount of no more than 1 million rubles, although until 06/18/17 the limit was 400 thousand rubles. It is not necessary to replenish the IIS additionally annually. However, it is unacceptable to withdraw part of the funds back.

You should also be aware of banking and brokerage commissions for working with securities.

IIS tools

At the same time, any investment options are possible that are applicable to the leading Russian trading floors Moscow and St. Petersburg. It:

- shares of Russian and foreign enterprises;

- bonds of municipalities, corporations, sovereign;

- currency;

- shares of mutual funds;

- derivative methods (option, futures trading, etc.).

It should be noted that some brokers and banking institutions do not allow working with a number of instruments, issuers, etc. Full list Supported investment methods can be obtained from the broker.

IIS and tax deduction

The main plus of the account is the return of part of the investment, which ultimately increases profitability. Moreover, 2 types of tax preferences are provided for IIS owners.

Deductionfor a fee

In this situation, an individual is provided with a 13% refund of the amount that was credited in the previous year, however, its largest amount is limited to 130,000 rubles.

Important: the deduction is possible when the investor has declared profit for past period(i.e. there was a tax payment), and the maximum refund cannot be more than the tax amount.

If less than 3 years have passed since the opening of the IIA, its replenishment, application for a refund and its subsequent receipt, the law obliges the investor to return the funds to the state.

If the investor closes the account, then 13% tax will be withheld from the profits received.

Deductionon income

Such a deduction exempts an individual from taxation on personal income tax form from the amount of all income credited in the course of IIS operations. The law provides for the application of a deduction without the obligatory possession of other taxable income.

An individual can count on such a return only after 3 years from the date of creation of the IIS. If it is closed before 3 years from the moment of its formation, the state will withhold personal income tax in the amount of 13%, similar to the brokerage account scheme.

It is important to take into account all the nuances and details of investment when choosing the type of deduction, including the method of investment and tax rate at a profit. Say, personal income tax does not apply to payments on coupons and domestic government bonds. In the case of the purchase of OFZ, for example, you can get a refund on the contribution.

Getting a tax deduction

If a we are talking on the deduction for replenishment (contributions), the investor applies to the tax office in the year following the one in which the replenishment was made. In this case, it is necessary to confirm the contributions with the 3-NDFL declaration, attaching the following documents to it:

- delivery confirmation last year's profit with a tax rate of 13% (say, a certificate 2-personal income tax from the organization in which the individual works);

- confirmation of the creation of the IIS and the transfer of funds to it (can be provided by a broker);

- return request, for this you will need to specify Bank details.

If a deduction for income is implied, then an individual must, upon termination of the contract, give the bank or broker a certificate from the tax office stating that there are no cases of receiving deductions for replenishment.

The bank, therefore (or the broker), will not be able to pay out the money with the withholding of 13% personal income tax.

Hello dear readers of my blog! Today we will continue the topic of investing and we will study the benefits of investing in IIS. The main thing that attracts investors to IIS is tax incentives which allows you to get a good additional income. True, there are a number of details in this case that novice investors do not pay attention to at first. Today we will figure out where it is better to open an individual investment account, according to what criteria to choose a company, and consider several the best offers on the market.

Understanding terminology

In terms of what an individual investment account is, it has a lot in common with a regular brokerage account, it just has tax benefits. Anyone can open it not only a resident of the Russian Federation.

Allocate 2 types of IIS depending on how the investor receives a tax benefit:

- type A- in him tax is compensated, which the investor paid from his income for a certain time period. The principle of operation is more convenient to disassemble with an example. Suppose your wage is 25,000 rubles, for the year a tax of 39,000 is paid on this income (rate 13%). When investing in IIS, this amount is compensated to you. It should be borne in mind that the maximum amount of investment per year from which you can receive a deduction is 400 000 rubles, so the income is limited to 52,000 rubles. Wherein total amount, which can be deposited on IIS, is limited 1,000,000 rubles/year.

- type B- the difference from the previous one is that the investor does not enjoy a tax deduction, that is, no one compensates for the taxes paid to him. On the other hand, when the account is closed, the profit is not taxed. So if you actively reinvest during the account (this topic is devoted to), then it makes sense to choose this particular type of account. When it closes, be sure to provide reference that the investor did not use the tax deduction.

On an account of type A, no one forbids receiving additional income from working on the stock market, but in this case, with additional income you have to pay 13% in the form of tax. In order to maximize the benefits of Type I IIS, it is desirable to invest regularly. As to whether what type of account is preferable, then there is no universal answer. It all depends on specific investor and the style of his work. If active work is expected in the stock market, and the expected income will exceed 100% of the invested amount, then it makes sense to use IIS type B.

Investment account insurance

Question safety of funds when investing, it is always particularly acute. If you are worried about IIS - whether your contribution is insured by the state or not, then I have to upset you, deposit insurance is not provided. Right now in State Duma are considering options for insuring IIS accounts, but the timing of the adoption of the law and the amount to be insured are this moment not known.

Since 2015, the procedure has been greatly simplified, so that you can even open IIS remotely. This has led to an increase in the number open accounts of this kind lately. IIS can be opened on one's own through public services. The process takes a lot A couple of minutes.

Where is the best place to open an IIS?

You can open IIS:

- at the broker;

- from a bank with a brokerage license;

- at management company.

The practice of opening investment accounts in the world

IIS is not special offer For Russia. This practice is widespread in the world, working conditions differ, as well as the maximum possible investment amounts. For example, in England you can open ISA(individual savings accounts), moreover, you can invest in them up to £ 15,000. AT USA there are similar retirement accounts ( IRA), in Canada – RRSP, that is, registered pension savings plans. Investment risks are low This explains the popularity of IIS among the population.

What to look for when choosing

The choice can be difficult to make, especially if you have never dealt with investment accounts before. In the question of where it is better to open an IIS, consider the following factors:

- are you going invest immediately or some time after opening an account. If you plan to do this not at the time of opening an account, but later, then immediately cross out the management companies from the list of applicants. You must immediately deposit a certain amount in them on the IIS;

- possibility to open an account online. For example, VTB 24 does not provide such an opportunity, so if there is no branch in your city, it automatically drops out of the applicants;

- minimum amount limit;

- turnover commission;

- monthly fee;

- quality of technical support. Highly important point especially for beginners. Employees should not "float" in matters of investment. From this point of view, BCS is beyond competition - support works on high level and the chance of running into a newcomer is extremely small;

- what markets are available for IIS. It all depends on the preferences of the investor, companies have different attitudes to this issue. For example, there are no restrictions in Finam, but Promsvyazbank does not provide an opportunity to work with the foreign exchange and derivatives markets for IIS;

- offered products and conditions of work on them. There are very large differences in these parameters. Some brokers are suitable for investors with small capital, while others, on the contrary, are more focused on investors with amounts close to the maximum. For example, VTB 24 offers for deposits from 300,000 rubles the opportunity to use auto-following strategies through a broker, and the broker Opening- twice as many strategies for deposits from 50,000 rubles.

Next, I prepared a small review of the best in my opinion proposals for opening IIS. Not only working conditions were taken into account, but also feedback from contributors. This will help you save time upon independent study of the conditions provided by the companies.

Finam

The broker makes it possible to open an IIS online. In this case, the investor gets the opportunity to work on stock, urgent and currency markets, it is possible to trade on the St. Petersburg and Moscow stock exchanges. Funds are credited to single account, from which the investor gets access to several trading platforms at once.

You can start investing now from 5000 rubles, however, it is difficult to count on a serious income with such an amount, besides trading operations will be blocked until the amount of funds on the account exceeds 30 000 rubles. So it is for this amount that I recommend focusing at least. The site has a small online calculator. By entering the estimated investment amounts, you can get a recommendation on what is more profitable - to get tax deduction or exempt income from taxes.

At the moment, the commission is the same for any turnover up to 1 million rubles and amounts to 0.0354%. There is autofollow strategies The return depends on the degree of risk.

Commission

A little more about commissions:

- stock section MOEX– with a turnover of up to 1 million rubles, the commission is equal to 0,0354% ;

- currency section– with a turnover of up to 1 million rubles 0,0332% ;

- urgent section ( futures and options) – $0.45 per contract;

- US stock market– with a turnover of up to $17,000, the commission is 0,0354% .

The management company is also represented on the market. Finam management". Here, the lower threshold for investing in IIS is already from 300,000 rubles.

Funds are credited to the account without a commission from the company, it is possible early closure of IIS without penalty from the broker. In this case, the deduction from investment income is 10%.

BCS

Offers to open an IIS and invest from 300,000 rubles. You can work with the stock, derivatives and currency markets, there is access to the Moscow Exchange, but there is no access to SPBEXCHANGE. You can open IIS, as in the case of Finam, online. Available margin lending at 14.5% for sales and 17.5% for longs.

Commission depends on turnover and ranges from 0.0354% for turnovers up to 1 million rubles to 0.0177% for turnovers over 15 million rubles. It cannot be less than 35.4 rubles for 1 transaction. You can choose a tariff option without this restriction, but in this case you will have to work with large percentages. First month valid preferential offer, within which the commission is equal to 0.0177%, regardless of the turnover achieved. There are other options - a comparison of tariffs can be done on the broker's website, but BCS Start is optimal for IIS.

Of the interesting proposals, I note the possibility investing in notes(ruble and currency). The yield on them ranges from 12.5% to 14.5% per annum, respectively. You can invest in OFZ portfolio or in bond portfolio, the yield in this case will be slightly lower.

To work, use the web version of Quick or the version of the terminal for mobile devices.

Zerich

The broker makes it possible to open an IIS online. Offered 2 types of investment in IIS:

- « Reliability of the state". The minimum investment threshold is 30,000 rubles, the investor receives a 13% tax deduction + approximately 10% return on investment in bonds. This tariff assumes the investment of funds in OFZ, the income of 10% is indicated on the website as an indicative value, in reality it may be higher. Maximum amount investment per year - 1 million rubles.

- « Currency stability". The investor receives the same 13% tax deduction + up to 9.5% income in foreign currency. In this case, the invested funds are directed to Eurobonds. Threshold for investment from 100,000 rubles.

Commissions

There is no separate tariff for IIS, within the framework of the tariff " Universal» commissions are as follows:

- for stock market – 0.055% of the transaction volume;

- for the foreign exchange market– 0.03% of the transaction volume;

- futures market- 0.85 rubles for 1 contract;

- available margin lending, the percentage is calculated according to the formula 9% + market rate, for valuable papers 15%.

One of the tariff requirements Universal» - investments from 100,000 rubles. There are other tariff options, for example, " negotiable”, there is no requirement for the size of the deposit at all. But the commissions are also higher, for example, in the foreign exchange market, you will have to pay from 0.075%. This broker has a well-implemented, so if you are thinking about starting to work in the stock market on your own, then pay attention to him.

Opening

It stands out from the others because there is no minimum required amount for investing in IIS. After opening and replenishing an account, an investor gets full access to the stock, derivatives and currency markets, and can work on MOEX. SPBEXCHANGE not available.

stands out separate tariff for individual investment accounts. Briefly about working conditions and commissions:

- stocks and bonds– from 0.04 rubles per transaction or 0.057% of its volume;

- Eurobonds on MOEX- 0.04 rubles or 0.015%;

- currency market – 1 ruble per trade or 0.035%;

- available margin lending at 13% for sales and 18.4% for purchases;

- work is being done through QUIK, the cost of monthly access is 250 rubles. This amount is not charged from those clients whose balance in the company is equal to or exceeds 50,000 rubles.

I note that tariffs are given for self-managed IIS. There is another type of tariff called Model Portfolio (IMS), is aimed at those who are going to use the services of analysts, and not trade on their own. In principle, if you are new to the market and do not even know, then it is better to stay on it.

Management company "Opening"

Access to the IIS is also provided by the management company OOO UK OTKRITIE, do not confuse it with a broker of the same name. There is no way to open an account online, besides You can invest only amounts from 50,000 rubles. The fee from investment income is up to 15%.

The opening offers several interesting finished products:

- there are options structured products with capital protection, will need to invest from 250 000 rubles;

- can use one of the strategies with a minimum level of investment from 50 000 rubles. Work with them is realized through the management company;

- I have an opportunity trade according to recommendations. In this case, notifications about which bonds to buy on IIS come in the form of an SMS message to the client's number or to his email.

Unlike brokers, who almost compete with their management companies, Otkritie actively cooperates with it. This is evidenced by the fact that the products are implemented through it.

VTB

VTB is inferior to the companies mentioned above in a number of indicators:

- here there is no way to open the IIS remotely;

- the client gets access only to the stock and derivatives markets . The Moscow and St. Petersburg stock exchanges, as well as the foreign exchange market, remain inaccessible;

- commissions are higher than those of competitors.

We will dwell on the commissions separately - for the tariff " professional standard»:

- with a turnover of 10 million rubles – 0,02124%;

- 5-10 million rubles – 0,02596%;

- 1-5 million rubles – 0,0295%;

- up to 1 million rubles – 0,0472%.

If you select " Investor standard”, then the commission does not depend on the turnover and is fixed 0,0413% . Of the interesting proposals, I can only mention a few autofollowing strategies. Work with them is organized through a broker, while you need to have at least 300,000 rubles on your account. Signals will be issued only for shares of Russian companies traded on MOEX.

Terms of margin lending– 13% for short positions and 16.8% for longs. Additionally, the bank charges 0.2% commission, this commission is deducted at the end trading session. In general, if you plan to trade on one's own, then it is not the best choice broker for IIS. "Opening" from this point of view looks much better.

Alfa Capital

IIS is opened through the management company. This option is interesting because the company ranks first in terms of the number of opened individual investment accounts (among management companies). Another argument in its favor is the maximum amount of investor funds managed by the company.

Now working conditions with IIS:

- you can open an account online, without fussing with public services, and even more so without a personal visit to the company's office;

- You can invest from 10,000 rubles;

- there is 3 reliable work strategies. Funds are invested in OFZ, shares and corporate bonds. Moreover, statistics on them have been kept since 2015, that is, from the very time when everyone could afford IIS;

- service is not the best– you will have to pay a total of 4% (2% per annum + 2% of the invested amount).

In principle, everything is simple and clear in Alfa Capital Management Company. The most important - reliability, from this point of view, it can be attributed to the leaders. If you are thinking about where it is more profitable to open an IIS in terms of reliability, then it is definitely worth a closer look.

Strategies for working with individual investment accounts

You can simply invest the funds allocated for this purpose and simply forget about them for 3 years. But in order to make the most efficient use of money, it is better to work on the strategy. It will bring maximum financial return.

I will briefly describe several strategies for working with IIS.

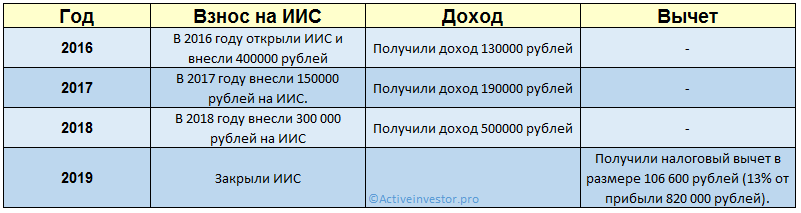

- Reducing investment time. Remember that money cannot be withdrawn within 3 years, otherwise we will not receive a tax deduction, and a number of companies may also write off a penalty for early account closure. But there is loophole, allowing to reduce the period during which the money will be unavailable. To do this, you need an IIS of type A (that is, open with a broker). The account is opened, but the money does not immediately start there. For example, they opened it in January 2017, then in December 2018 (almost 2 years after the opening) they introduced 400,000 rubles there, and in March 2019 the state will reimburse 52,000 rubles. At the end of 2019, we again enter 400,000 rubles, get a tax deduction in 2020 and close the account. Eventually money freeze time reduced.

- Selection of a broker that withdraws profits from coupons and dividends to a bank account, card, or another account with the same company. In this case, you can try to earn money by buying securities with high dividends. Truth, the risk rises sharply.

- IIS for relatives. If there is a lot of money, then we take all family members, and open IIS for each. We deposit funds and receive a tax deduction.

- Reinvestment- the tax deduction is immediately deposited into a regular account, and trading is carried out.

- Long-term operation of IMS. Until the account is closed, no one will charge income tax. So you can not close the account and work in peace.

- You can regularly deposit small amounts and invest in OFZs and stocks. A decent amount will come up in a few years.

Whatever strategy you choose, choose your broker carefully. My small IIS rating will help with this.

General issues

In this section, I will briefly try to answer most common questions related to IIS:

- Investment term? From 3 years.

- Is it possible to early closing of an account? Yes, but the tax deduction or exemption of income from tax is canceled.

- Is it possible to have multiple IIS?? No, one person can only have 1 account.

- How much can you invest? Up to 400,000 rubles, this is the maximum for which the deduction will apply. Despite this, remember that you can deposit up to 1,000,000 rubles per year into the account.

- When can I invest? If the contract is concluded with a broker, then this can be done immediately after opening an account. It is beneficial to open an IIS so that there is always an opportunity to invest free money in it. The three-year period is counted from the date of conclusion of the contract.

- How to open IIS? Online. If this function is not available, then when visiting the broker's office / MC.

- What is the difference between a UK and a broker? The contract with the management company is about trust management, and with the broker - about brokerage services.

- Is it possible to transfer IIS from one broker to another? Yes, it's possible.

Summary

If you look, for a number of reasons, IIS is more profitable than a simple bank deposit. In the bank, your money will bring you income no more than that specified in the contract, and when working with IIS there is a real chance to get more.

So my advice to you is to choose a broker (preferably from among those considered) and open an IIS. It will not need to be replenished immediately, but when free money appears, you can invest it and reduce the freezing time. Remember - the best time to invest is December, the tax deduction will need to be issued before April 30 of the next year for the previous year.

This is where I propose to end. short review individual investment accounts. Ask all questions in the comments and do not forget to subscribe to my blog updates. I promise there will be many more interesting things.

If you find a mistake in the text, please highlight a piece of text and click Ctrl+Enter. Thanks for helping my blog get better!

The Individual Investment Account is perhaps one of the few really good things that our government has done for the private investor and the development of the investment industry.

Why is this type of investment so attractive? IIS provides an opportunity to receive tax benefits by investing in the stock market. Abroad, for example, in the USA, Great Britain and other countries, such accounts have existed for a long time. For Russians, the opportunity to open individual investment accounts has appeared recently - since 2015. At the moment, this tool is already used by about 180 thousand investors.

What is an individual investment account?

IIS is a special type of account on which you can purchase securities and which entitles you to receive a tax deduction or preferential taxation investment income. It can be opened with a broker or management company.

But this method of investing has a number of features and limitations:

- To receive the benefit, an investment account must be opened for at least 3 years. Maximum term work is not limited.

- You can close the account at any time before the end of three years and withdraw the money and profits, but you will lose your tax benefits. Therefore, in order not to lose the right to a deduction, the money in the account must be kept for at least three years. Partial withdrawal of funds without closing the IIS is also not provided.

- The three-year countdown starts from the date the account was opened.

- An individual can open only one investment account.

- The maximum amount that can be deposited on IIS during the year is limited to 400,000 rubles per year ( update: since 2017, the value has been increased to 1 million rubles). Minimum amount for opening and replenishment is not installed. At the same time, opening an account does not oblige you to immediately deposit money into it (except for the case when an IIS is opened in a management company as part of trust management). Money can be deposited later at any time. Contributions can be made all at once or in increments such as monthly or yearly. It's not limited in any way. The main thing is that the amount of your contributions for the year does not exceed maximum limit. The account can be replenished only with money and only in rubles.

- On IIS you can get investment income by purchasing various financial instruments: stocks, bonds, eurobonds, futures, options, as well as currency. As part of the opening of IIS in the Criminal Code, trust management is available. Financial instruments that are traded on foreign exchanges cannot be bought. List of available financial instruments may differ depending on the broker.

- It is not necessary to purchase any securities. You can deposit money and leave it "lying" on the account. The right to receive a deduction does not disappear.

- Funds and securities on IIS, as well as on a brokerage account, are not insured by the DIA.

Tax deductions for IIS

The main advantage of individual investment accounts is the possibility for the investor to receive tax deductions. There are two types of deductions to choose from: contributions and income.

Deduction on contributions to an individual investment account

The essence of this tax deduction is that the investor gets the right to return the paid personal income tax in the amount of 13% of the amount deposited on the IIS. However, when maximum value contribution of 1 million rubles, the amount of the tax deduction applies only to amounts up to 400,000 rubles. This type is suitable only for those who have official income and pay income tax individuals.

The amount of the deduction is calculated according to following formula: Annual fee * 13%. The maximum amount of the contribution to the account for the year is 1 million rubles. But the amount covered tax break, is limited to 400 tr, so the deduction cannot exceed 52,000 rubles.

On the other hand, the amount of the deduction is limited to the paid personal income tax. If the amount of tax paid by the investor for the year was 45,000 rubles, then only 45,000, and not 52,000, can be returned, even if all 400,000 rubles have been deposited into the account. The "unspent" deduction is not carried over to the next tax periods.

The deduction can only be received for the year in which the contributions were made.

Money can only be received next year. That is, if you opened an IIS and deposited money in 2016, then you can submit documents and receive a deduction only in 2017. At the same time, personal income tax is returned, which was paid in the year of the contribution, that is, for 2016.

When closing an IIA after three years, the income received is taxed at 13% as on a regular brokerage account. If you received a tax deduction, and then closed the IIA before three years, the taxes will have to be returned to the budget, taking into account penalties and fines.

Income deduction

This type of deduction exempts the investor from paying tax on income received on IIA. Unlike the first type, in this case the amount of the deduction is not limited. This type of deduction is suitable for those who do not have official income, which means they do not pay personal income tax.

The deduction is expressed in the fact that when you close an IIA, your broker or management company, which are tax agents, does not withhold taxes from you on income received from investments. Also, this type of deduction is suitable for those who receive high income from IIA trading, and the economic benefit from the tax exemption is greater than from the contribution deductions.

How and where to open an IIS?

An individual investment account can be opened with a broker or management company. At the moment, quite a lot of participants offer their clients to open such an account.

Opening an IIS with a broker

By opening an account with a broker, the investor gets access to financial instruments traded on the stock exchange: stocks, bonds, currencies, derivatives, ETFs. Sberbank, Finam, Otkritie, and BCS are leading among brokers in terms of the number of open IIS.

Opening an account with a broker is no more difficult than opening an account with a bank. To do this, just contact the office of the company with a passport and sign Required documents. Some brokers provide the ability to remotely open IIS, for this you need to have account site "Gosuslugi". In this case, you do not need to visit the office.

When choosing a broker, there are several important parameters to consider:

- reliability and size of the broker;

- convenience of working with a broker;

- the minimum amount to open an account;

- access to exchanges (Moscow, St. Petersburg) and exchange sections (stock, derivatives, currency);

- tariff plan: amount of commission per transaction, subscription fee for servicing a brokerage account and depo account, payment for trading terminals;

- other commissions (for depositing/withdrawing funds, submitting bonds to an offer, etc.).

You can read more about choosing a broker for investment. And in this article I will just give comparison table tariffs of the first four brokers by the number of open IIS.

In addition, I will say that these are not the most favorable rates on the market. You can find brokers with better conditions.

In addition, I will say that these are not the most favorable rates on the market. You can find brokers with better conditions.

Opening an IIS in a management company

About the opening investment account in the management company must be told separately. Opening an IIS in the Criminal Code provides for the conclusion of an agreement trust management, within the framework of which the legislation prohibits the acquisition of mutual funds of the management company that has an IIA. And the company is unlikely to buy funds from someone else's management company. Therefore, in fact, some kind of trust management strategy remains the only tool.

Now management companies offer many different strategies. But before you give money to the remote control, you need to understand well what is being offered to you and at what price. DO is not the cheapest way to invest, both in terms of fees and entry threshold. The competence and integrity of the manager will also be difficult to verify.

What type of IIS to choose?

The choice of the type of IIS depends on many factors, but first of all - on your personal situation. For example, if you do not have official income from which you pay personal income tax, or their amount is minimal, then the choice is obvious - IIS with a deduction for income (of the second type).

But if you have official income and the personal income tax paid is significant, then there is something to think about. The benefit from using one or another type of deduction depends mainly on two factors: time and profitability.

I will give a couple of examples. We invest 400,000 a year and get the maximum tax deduction. Yield 10% per annum. What type of IIS will be more profitable? For this I will use my calculator. The calculator shows that under such conditions, the use of the first type of deduction is more profitable for an investment period of up to 13 years. If more, it is better to choose the second one.

Now let's take a yield of 15%. In this case, the second type of IIS becomes more profitable much earlier - in the 9th year of investment.

It can be seen that as income increases, the tax deduction for income that exceeds the fixed contribution deduction increases. Therefore, the longer the investment period and the expected profitability, the more profitable the second type of IIS becomes.

In total, the first type is better for those who:

- has official income and pays significant personal income tax

- conservative investors who prefer

- whose investment horizon is up to 7-10 years.

The second type is better suited for those who:

- has no official income and does not pay personal income tax, or it is negligible;

- plans that his profit from trading will exceed the amount of the deduction for contributions;

- has a long investment horizon of 7-10 years or more.

Luckily, you don't have to choose the type of deduction right away. This can be done in the third year after opening the account. But the combination of two deductions at the same time is impossible. If you received a deduction for contributions, you will no longer receive a deduction for income.

How to get a tax deduction for IIS?

The procedure for obtaining a tax deduction depends on the type of deduction chosen.

For getting contribution deduction

- Obtain a document confirming the receipt of income taxable at a rate of 13% - a 2-NDFL certificate from your tax agent (for example, an employer).

- Prepare documents confirming the opening of IIS (a copy of the agreement with the broker on opening an investment account) and payment documents confirming the transfer of funds ( payment order, broker report on crediting funds).

- Fill out the declaration 3-NDFL.

- Submit an application for a tax refund.

- Submit a 3-NDFL declaration along with the above documents and an application to the tax office at the place of registration.

The declaration can be submitted to the tax office on paper or in in electronic format.

The declaration can be submitted to the tax office on paper or in in electronic format.

To fill out the 3-NDFL declaration, you can download the form template from the FTS website nalog.ru for the appropriate taxable period, print it out and fill it out by hand.

A printed declaration in paper form and copies of documents must be submitted to the tax office. This can be done by appearing there in person, by sending a letter by mail or through an authorized representative.

But it is much easier to send the declaration along with the documents electronically. To fill out the declaration, you can use the "Declaration" program and upload a ready-made file in xml format from it.

The second option is to fill out a declaration in personal account taxpayer on the website of the Federal Tax Service.

There is a myth that 3-personal income tax must be submitted to the tax office strictly before April 30. This rule only applies if you declare your income for last year. In case of sending a return declaration income tax, this can be done within three years after you paid it.

After sending, you must wait for the verification of your documents by the tax office (up to 3 months). In case of success cash transferred to your bank account.

When filling out and sending the 3-NDFL declaration and documents, you may encounter various difficulties and questions, especially if you have never done this before. To make it easier for you to cope with this task, use the step by step. It details all the steps that you need to go through in order to receive a tax deduction for contributions to an individual investment account.

To get a tax income deduction you need to do the following:

- Before closing the IIS (not earlier than three years), request tax office a certificate stating that you did not use the tax deduction for contributions during the entire period of the contract.

- Provide this certificate to your broker or MC. When you close the IIS, your tax agent will not withhold income tax from you.

What else do you need to know about an individual investment account?

- To receive a tax deduction as early as next year, you can deposit money until December 31 current year inclusive.

- IIS can be opened now, even if you do not plan to replenish it in the next few years. The account can remain empty indefinitely. But the countdown of three years will begin from the moment the contract is signed.

- Securities purchased on an individual investment account are not subject to the tax benefit of long-term holding of securities.

- You can return personal income tax paid not only on wages. Any tax on personal income paid at a rate of 13%, such as property tax, on securities or on real estate rentals, is refundable. The exception is dividends.

- IIS can be transferred to another broker. To do this, a new account is opened with a new broker and securities are transferred to it (the new broker must be notified of open IIS). You have 30 days to transfer your account.

- For the entire period of the account, income tax is not charged. This happens only when IIS is closed (with the exception of receiving a deduction for income).

- and coupons corporate bonds purchased on IIS are taxed at 13%. Coupons of state, municipal and sub-federal bonds are not taxed.

- Management companies cannot invest more than 15% of the account funds in a bank deposit.

- Dividends and coupons come to IIS by default. This does not count as a top-up. Some brokers allow the client to choose to be credited to a bank account. Thus, you can "withdraw" part of the funds despite the ban.

Features of work

Since it is not possible to deposit money into an investment account immediately, various options arise. Below are four various options by the time of opening the IIS and making contributions.

By opening an account in December, and depositing money before the end of the year, next year you can get 52,000 rubles. If you delay and deposit money a month later, in January 2017, the deduction will have to wait about 1.5 years.

It is not prohibited by law to deposit money into last month third year of the contract. Therefore, in a month you can close the IIS, get the money back plus a tax deduction. The profitability of such an operation will be 26% per annum.

In summary, an individual investment account is a great tool for those who want to increase their savings by investing in the stock market and are ready to invest money for several years.

In summary, an individual investment account is a great tool for those who want to increase their savings by investing in the stock market and are ready to invest money for several years.

In order to attract investments for the prosperity of the stock market, in 2015 was established special kind IIS accounts. The system has a number of its advantages and nuances, but not everyone knows what it is and how to use this account.

What is IIS and how does it work

Many do not understand what an individual investment account is. IIS is a brokerage type of account that allows you to invest money in the market through bonds, futures, mutual funds, or entrust this business to a management company. Opening an account is available to every citizen. To do this, you need to contact the broker or investment company. To date, such a service is provided even banking organizations.

Many do not understand what an individual investment account is. IIS is a brokerage type of account that allows you to invest money in the market through bonds, futures, mutual funds, or entrust this business to a management company. Opening an account is available to every citizen. To do this, you need to contact the broker or investment company. To date, such a service is provided even banking organizations.

But do not confuse a regular brokerage account with an IIS, since there are a number of differences between them:

- It is not possible to open multiple IIS. You can only transfer an account from one company to another

- You can deposit no more than 400,000 rubles per year on IIS. Only ruble equivalent is allowed

- To receive tax deductions, opening an IIS is allowed only for a period of at least three years.

If a citizen has official employment and has his own savings, then you need to directly think about how to start investing. Finishing three years, the profitability of the investment account can reach up to 100%. First of all, you need to choose the right brokerage company that will ensure the reliability and safety of deposits:

- By contacting the organization to open an account, you can independently participate in your own investments financial resources. A special order is formed, which is carried out by an intermediate link (called an intermediary). On behalf of the intermediary, he will invest in those organizations that the account holder deems necessary. It can be FINAM, KIT Finance, Otkritie or Sberbank

- Where the investment will be made and in what project depends on the management company, but with the permission of the account holder. The investor transfers his monetary assets for use to an intermediary. His participation is reduced only to deciding what risks and losses the account holder may incur

- To organize and open an account in commercial bank or a specialized brokerage company, it is necessary to conclude a formal agreement (agreement) with him. Prepare required package documents and submit to tax authority. The package of documents consists of the following: a certified contract with the company, a certificate from the account opening, bank details with full name organizations, an application for tax credit compensation.

Many investors are wondering how much profit can be earned on IIS. Profitability depends little on their actions. In practice, most investors are forced to leave financial assets through trust management. They do not make an independent decision on what investments and in what projects the money will be invested. A reward of 13% can only be received if the investor deposits money into the account for three years.

Income depends on the increase in the value of investments, but with these indicators often increases the risk. In this situation, the investor decides on his own where to invest his assets: in risky projects and get the maximum profit, or take care of his own safety and choose less profitable ones. investment projects.

The second option involves the receipt of income with subsequent exemption from income tax.

Minimum term operation of the account is equivalent to three years. Upon its completion, it is not necessary to close the account or withdraw financial assets. Its functioning continues and brings profitability. It is possible to organize funded part pensions.

Advantages of IIS

IIS has the following advantages:

- By investing Russian rubles, each investor can receive 13% of the deposit amount every three years. If the IIS continues to work for three years, then 4.3% is due per year

- With the help of IIS, you can make any transactions with bonds and promotional packages, which is impossible when opening bank account. If the investor does right choice and invest in securities, the value of which will gradually increase, then you can count on making a profit, more than from a bank account

- If the depositor works officially, then he has the right to refund income tax in the amount of 13%. As a rule, the amount of the tax deduction is no more than 52,000 rubles annually.

Thinking about what is better IIS or a brokerage account, you should analyze the disadvantages of an individual inversion account.

Disadvantages of an Individual Investment Account

However, IIS is not without the following nuances:

- Financial assets, deposited to the IIS account do not have insurance, compared with bank deposit

- It is not recommended to withdraw monetary assets for three years, otherwise all payments and tax refunds will be canceled

- The maximum contribution amount per year is no more than 1,000,000 rubles (after adopted amendment). In this case, the tax deduction will still be calculated from the amount of 400,000 rubles. It is advisable to divide the amount by the annual replenishment so that it exceeds 400,000 rubles.

Where is the best place to open an IIS

Based on information received from the Moscow Exchange, about 200,000 IIS accounts are opened in the following companies:

| Name | Opportunities to open online | Minimum deposit, rub | Payment per month, rub | Commission from turnover, in % |

| Sberbank | No | 0 | 150 | 0,16 |

| Finam | there is | 5000 | 177 | 0,03 |

| Opening | 0 | 200 | 0,04 |

To protect yourself from unnecessary risks, it is recommended to open IIS accounts only in trusted brokerage companies, which occupy top places in the list stock exchanges. Since the market is just starting to develop actively, there are companies involved in fraudulent activities in this area.

IIS is modern way multiplying your own savings. On Russian territory brokerage market is just beginning its development, so every year the number of management companies increases exponentially, but it is recommended that contracts be concluded only with those companies that have previously received a license.

Video “Tricks of using an individual investment account (IIA) - Andrey Vanin”

By continuing to use our site, you consent to the processing of cookies, user data (location information, device type, ip-address) in order to operate the site, conduct retargeting and conduct statistical research and reviews. If you do not want to use cookies, please change your browser settings.

VTB Bank (PJSC) (VTB Bank). General license Bank of Russia No. 1000. License professional participant securities market for brokerage activities No. 040–06492–100000, issued on March 25, 2003

Furtherlegal information

1. The content of the site and any pages of the site (the "Site") is for informational purposes only. The site is not and should not be considered as an offer by VTB Bank to buy or sell any financial instruments or provide services to any person. The information on the Site cannot be considered as a recommendation for investing funds, as well as guarantees or promises in the future of the return on investment.

No provisions of the information or materials presented on the Site are and should not be considered as individual investment recommendations and / or the intention of VTB Bank to provide investment advisory services, except on the basis of agreements concluded between the Bank and customers. VTB Bank cannot guarantee that the financial instruments, products and services described on the Site are suitable for all persons who have become familiar with such materials and / or correspond to their investment profile. The financial instruments mentioned in the information materials of the Site may also be intended exclusively for qualified investors. VTB Bank is not responsible for the financial or other consequences that may arise as a result of your decisions regarding financial instruments, products and services presented in the information materials.

Before using any service or purchasing a financial instrument or investment product, You must independently assess the economic risks and benefits of the service and / or product, the tax, legal, accounting consequences of concluding a transaction when using a particular service, or before purchasing a particular financial instrument or investment product, your willingness and ability to accept such risks. Upon acceptance investment decisions You should not rely on the opinions expressed on the Site, but should make your own analysis financial position the issuer and all risks associated with investing in financial instruments.

Neither past experience nor financial success other persons does not guarantee or guarantee that the same results will be obtained in the future. The value or income of any investment mentioned on the Site may change and/or be affected by changes in market conditions, including interest rates.

VTB Bank does not guarantee the return on investment, investment activity or financial instruments. Before making an investment, you must carefully read the conditions and / or documents that govern the procedure for their implementation. Before purchasing financial instruments, you should carefully read the terms of their circulation.

2. None of the financial instruments, products or services mentioned on the Site are offered for sale or sold in any jurisdiction where such activity would be contrary to securities laws or other local laws, and legal acts or oblige VTB Bank to comply with the registration requirement in such jurisdiction. In particular, we would like to inform you that a number of states have introduced a regime of restrictive measures that prohibit residents of the respective states from acquiring (assisting in acquiring) debt instruments issued by VTB Bank. VTB Bank invites you to make sure that you have the right to invest in the financial instruments, products or services mentioned in the information materials. Thus, VTB Bank cannot be held liable in any form if you violate the prohibitions applicable to you in any jurisdiction.

3. All numerical and calculated data on the Site are given without any obligation and solely as an example of financial parameters.

4. This Site does not constitute or is intended to provide legal, accounting, investment or tax advisory services, and therefore no reliance should be placed on the contents of the Site in this regard.

5. VTB Bank makes reasonable efforts to obtain information from reliable, in its opinion, sources. At the same time, VTB Bank does not make any representations that the information or estimates contained in the information material posted on the Site are reliable, accurate or complete. Any information presented in the materials of the Site may be changed at any time without prior notice. Any information and estimates provided on the Site are not the terms of any transaction, including a potential one.

6. VTB Bank draws the attention of Investors who are individuals to the fact that the funds transferred VTB Bank as part of brokerage services, does not apply federal law from 23.12.2003. No. 177-FZ "On insurance of deposits of individuals in banks Russian Federation».

7. VTB Bank hereby informs you of the possible existence of a conflict of interest when offering the financial instruments considered on the Site. A conflict of interest arises in the following cases: (i) VTB Bank is an issuer of one or more financial instruments in question (a beneficiary of the distribution of financial instruments) and a member of the VTB Bank group of persons (hereinafter referred to as the group member) simultaneously provides brokerage and/or trust management services (ii) a group member represents the interests of several persons simultaneously when providing them with brokerage, advisory or other services and/or (iii) a group member has its own interest in making transactions with a financial instrument and simultaneously provides brokerage, advisory services and/or (iv) a member group, acting in the interests of third parties or the interests of another member of the group, maintains prices, demand, supply and (or) trading volume in securities and other financial instruments, acting, inter alia, as a market maker. Moreover, group members can and will continue to be in contractual relations to provide brokerage, depositary and other professional services with persons other than investors, provided that (i) group members may obtain information of interest to investors, and group members shall not be under any obligation to investors to disclose such information or use it in the performance of its obligations; (ii) the conditions for the provision of services and the amount of remuneration of group members for the provision of such services to third parties may differ from the conditions and amount of remuneration provided for investors. When resolving emerging conflicts of interest, VTB Bank is guided by the interests of its clients. More detailed information on the measures taken by VTB Bank in relation to conflicts of interest can be found in the Bank's Policy on managing conflicts of interest posted on the Website.

8. Any logos, other than the logos of VTB Bank, if any are given in the materials of the Site, are used solely for informational purposes, are not intended to mislead customers about the nature and specifics of the services provided by VTB Bank, or to obtain additional benefit through the use of such logos, as well as the promotion of goods or services of the copyright holders of such logos, or damage to their business reputation.

9. The terms and provisions contained in the materials of the Site should be interpreted solely in the context of the relevant transactions and transactions and / or securities and / or financial instruments and may not fully comply with the meanings defined by the legislation of the Russian Federation or other applicable legislation.

10. VTB Bank does not guarantee that the operation of the Site or any content will be uninterrupted or error-free, that defects will be corrected, or that the servers from which this information is provided will be protected from viruses, Trojan horses, worms, software bombs or similar items and processes or other harmful ingredients.

11. Any expressions of opinions, estimates and forecasts on the site are the opinions of the authors as of the date of writing. They do not necessarily reflect the views of VTB Bank and are subject to change at any time without prior notice.

VTB Bank is not liable for any losses (direct or indirect), including real damages and lost profits, arising from the use of information on the Site, for the inability to use the Site or any products, services or content purchased, received or stored on the Site .

These materials are intended for distribution only in the Russian Federation and are not intended for distribution in other countries, including the United Kingdom, the European Union, the United States and Singapore, and also, although in the Russian Federation, citizens and residents of these countries. VTB Bank (PJSC) does not offer Financial services and financial products to citizens and residents of the countries of the European Union. collapse